Earnings summaries and quarterly performance for COVENANT LOGISTICS GROUP.

Executive leadership at COVENANT LOGISTICS GROUP.

David R. Parker

Chief Executive Officer

Dustin Koehl

Chief Operating Officer

Joey Ballard

Executive Vice President, People & Safety

Matisse Long

Chief Accounting Officer

Paul Bunn

President

Tripp Grant

Executive Vice President and Chief Financial Officer

Board of directors at COVENANT LOGISTICS GROUP.

Research analysts who have asked questions during COVENANT LOGISTICS GROUP earnings calls.

Jeffrey Kauffman

Vertical Research Partners

8 questions for CVLG

Scott Group

Wolfe Research

7 questions for CVLG

Jason Seidl

TD Cowen

6 questions for CVLG

Daniel Imbro

Stephens Inc.

4 questions for CVLG

Dan Moore

B. Riley Securities

3 questions for CVLG

Michael Vermut

Newland Capital

2 questions for CVLG

Reed Saiya

Stephens

2 questions for CVLG

Reed Say

Stephens

2 questions for CVLG

David Floyd

Chattanooga Times Free Press, Inc

1 question for CVLG

Elliot Alper

TD Cowen

1 question for CVLG

Recent press releases and 8-K filings for CVLG.

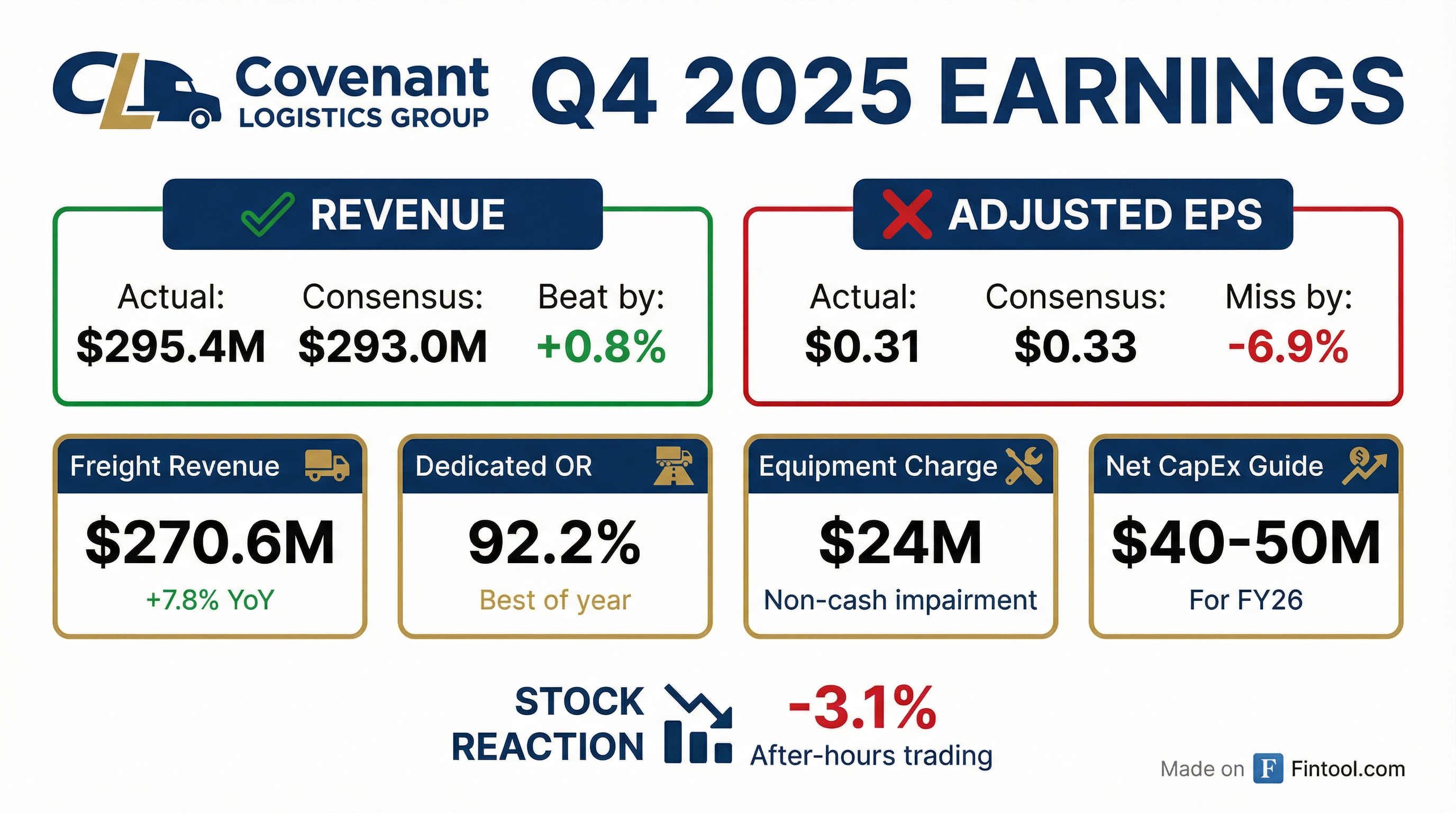

- Covenant Logistics Group reported a 7.8% increase in consolidated freight revenue to $270.6 million for Q4 2025, but consolidated adjusted operating income shrank by 39.4% to $10.9 million.

- The company's net indebtedness increased by $76.9 million to $296.6 million as of December 31, 2025, resulting in an adjusted leverage ratio of approximately 2.3 times and a debt-to-capital ratio of 42.3%.

- In Q4 2025, Covenant Logistics acquired a small truckload brokerage company, Star Logistics Solutions, which is expected to be accretive to earnings during the first half of 2026. The company also plans for a modestly smaller fleet by the end of 2026 with $40 million-$50 million of net CapEx for the year, following an equipment impairment charge.

- Management is optimistic about improving freight fundamentals in 2026, anticipating low to mid-single-digit rate increases in Q1 and Q2 2026 for its expedited and dedicated fleets. The long-term goal is to achieve Expedited operating ratios in the 80s and Dedicated operating ratios of 88-90.

- Covenant Logistics Group reported Q4 2025 consolidated freight revenue increased by 7.8% to $270.6 million, while adjusted operating income shrank by 39.4% to $10.9 million.

- The company completed the acquisition of Star Logistics Solutions in Q4 2025, a small truckload brokerage company expected to be accretive to earnings in the first half of 2026.

- Net indebtedness increased to $296.6 million by December 31, 2025, resulting in an adjusted leverage ratio of approximately 2.3 times and a debt-to-capital ratio of 42.3%. Management anticipates the leverage ratio will improve sequentially starting in Q1 2026.

- For 2026, CVLG plans a modestly smaller fleet with $40 million-$50 million in net CapEx, aiming to reduce balance sheet leverage and improve return on capital. The freight market shows improving fundamentals, with early January revenue trends up and low to mid-single-digit rate increases secured for Q1 2026.

- Covenant Logistics Group reported Q4 2025 consolidated freight revenue increased by 7.8% to $270.6 million, while adjusted operating income decreased by 39.4% to $10.9 million.

- The company acquired Star Logistics Solutions, a small truckload brokerage company, in Q4 2025, which is expected to be accretive to earnings in the first half of 2026.

- Net indebtedness increased by $76.9 million to $296.6 million as of December 31, 2025, resulting in an adjusted leverage ratio of approximately 2.3 times. For 2026, the company expects a modestly smaller fleet and $40 million-$50 million of net CapEx to reduce leverage and improve return on capital.

- Management is optimistic about improving freight fundamentals in 2026, noting rising spot rates, increased bid activity, and securing low to mid-single-digit rate increases, with improvements anticipated later in the year.

- Covenant Logistics Group reported a net loss of $18.257 million or ($0.73) per diluted share for Q4 2025, primarily driven by $19.4 million in non-cash impairment charges and elevated insurance expense. Adjusted net income for the quarter was $8.032 million or $0.31 per diluted share. For the full year 2025, net income was $7.239 million or $0.27 per diluted share, with adjusted net income of $41.252 million or $1.53 per diluted share.

- Total revenue for Q4 2025 increased by 6.5% to $295.374 million compared to Q4 2024, and full-year 2025 total revenue increased by 2.9% to $1,164.472 million.

- The company's net indebtedness increased by $76.7 million to $296.3 million at December 31, 2025, with the net indebtedness to total capitalization rising to 42.3% from 33.4% at December 31, 2024. This increase was primarily due to $46.3 million in acquisition-related payments and $36.2 million in stock repurchases.

- Covenant Logistics Group acquired the assets of an approximately $130 million revenue truckload brokerage business, now operating as "Star Logistics Solutions," to expand its logistics platform. The company plans to moderately reduce its total truckload fleet and delever its balance sheet in 2026, with expected net capital equipment expenditures of $40 million to $50 million.

- Covenant Logistics Group reported a net loss of $(18.257) million or $(0.73) per diluted share for the fourth quarter ended December 31, 2025, primarily due to $19.4 million in non-cash impairment charges and $11.6 million in large claims settlement costs.

- Excluding these charges, the company's adjusted net income was $8.032 million, resulting in adjusted earnings of $0.31 per diluted share for Q4 2025, on total revenue of $295.374 million.

- The company recently acquired the assets of an approximately $130 million revenue truckload brokerage business, now operating as "Star Logistics Solutions," to expand its logistics platform and gain exposure to consumer retail and disaster relief sectors.

- For 2026, Covenant Logistics Group plans to reallocate capital, exit unprofitable business relationships, moderately reduce its truckload fleet, improve free cash flow, and deleverage its balance sheet.

- Covenant Logistics (CVLG) has transformed into a diversified logistics company operating through Expedited, Dedicated, Managed Freight, and Warehousing segments, plus a 49% owned equipment leasing joint venture. This diversification has helped it navigate the current challenging freight market.

- The company is currently operating in a "trough of troughs" freight down cycle, which has lasted 40 months, significantly longer than the historical average of 18 months. Despite this, CVLG reported $0.44 per share in Q3 earnings and is generating cash.

- CVLG's strategy focuses on niche, specialized services and aims to shift towards a 50% asset-based and 50% asset-light business model (currently 65% asset-based). Key asset-light segments include Warehousing, which has a $110 million revenue run rate and 10% operating margin, and Managed Freight.

- The company maintains a strong balance sheet with approximately two times EBITDA leverage and $300 million in net debt, and actively pursues shareholder returns through accretive M&A, share repurchases, and dividends.

- Covenant Logistics (CVLG) has transformed into a diversified logistics company, operating through expedited, dedicated, managed freight, and warehousing segments. The company aims to achieve a long-term balance of 50% asset-based and 50% asset-light business, a shift from its current 65% asset-based model.

- Despite navigating a 40-month freight down cycle, Covenant Logistics reported $0.44 earnings per share in Q3 and continues to generate cash, outperforming many industry peers.

- The company's strategy emphasizes shareholder return through accretive M&A, share repurchases, and dividends. It maintains a balance sheet leverage of approximately two times EBITDA with $300 million in net debt, and is comfortable with leverage up to 2.5 times for strategic opportunities.

- Recent strategic acquisitions include a poultry business and an ammunition/explosives hauling business for the Department of Defense, contributing to specialized offerings. Additionally, an equity method investment in Tell, an equipment leasing company, provides $8-11 million in annual dividends.

- Q3 2025 financial results for Covenant Logistics Group showed consolidated freight revenue increased by 4% to $268.9 million, but consolidated adjusted operating income shrank by 22.5% to $15 million, primarily due to margin compression in asset-based truckload operations.

- Net indebtedness increased by $48.6 million to $268.3 million as of September 30, 2025, leading to an adjusted leverage ratio of approximately 2.1 times and a debt-to-capital ratio of 38.8%.

- Management expects Q4 2025 to be challenging due to a soft freight market, increased claims accruals, and impacts from the U.S. government shutdown and customer bankruptcies.

- Despite short-term headwinds, the CEO expressed strong optimism for the next two to three years, driven by government policies accelerating capacity exit, anticipated interest rate reductions, and early signs of rate increases (2.5% to 4%) and bid activity up 17% since August.

- Covenant Logistics Group reported a 4% increase in consolidated freight revenue to $268.9 million for Q3 2025, but consolidated adjusted operating income shrank by 22.5% to $15 million due to margin compression from an inflationary cost environment, high claims, and unproductive equipment.

- The company anticipates a challenging Q4 2025 due to a soft freight market and specific headwinds, including the U.S. government shutdown's impact on Department of Defense freight. Despite short-term challenges, management is optimistic about a longer-term freight market recovery driven by accelerated capacity exits from government policies on non-domiciled drivers and ELD enforcement.

- Management noted a significant reduction in new carrier entries, with weekly MC number declines of 50-100, and over 400 in the last reported week, indicating tightening capacity. Net indebtedness increased by $48.6 million to $268.3 million as of September 30, 2025, leading to an adjusted leverage ratio of 2.1x.

- Covenant Logistics Group reported diluted earnings per share of $0.35 and Adjusted earnings per share of $0.44 for the third quarter ended September 30, 2025, which are lower than $0.47 and $0.54, respectively, in the prior year quarter.

- Total revenue for Q3 2025 increased 3.1% to $296.889 million, up from $287.885 million in Q3 2024.

- The company's net indebtedness increased by $48.7 million to approximately $268.3 million as of September 30, 2025, primarily due to acquisition-related payments of $19.2 million and repurchasing approximately $36.2 million of common stock.

- Management expects Adjusted EPS for Q4 2025 to be sequentially lower than Q3 2025, citing factors such as lower profits from their minority investment in Transport Enterprise Leasing (TEL) due to customer bankruptcies, the impact of the U.S. government shutdown, and the loss of a large Managed Freight customer.

Quarterly earnings call transcripts for COVENANT LOGISTICS GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more