Earnings summaries and quarterly performance for DYNEX CAPITAL.

Executive leadership at DYNEX CAPITAL.

Board of directors at DYNEX CAPITAL.

Research analysts who have asked questions during DYNEX CAPITAL earnings calls.

Bose George

Keefe, Bruyette & Woods

7 questions for DX

Also covers: ACT, AGM, AGNC +25 more

Eric Hagen

BTIG

7 questions for DX

Also covers: AGNC, AOMR, ARR +21 more

TC

Trevor Cranston

Citizens JMP

7 questions for DX

Also covers: AGNC, ARR, CIM +10 more

JS

Jason Stewart

Janney Montgomery Scott LLC

5 questions for DX

Also covers: AGNC, AJX, AOMR +12 more

DH

Douglas Harter

UBS

4 questions for DX

Also covers: ACRE, ACT, AGNC +42 more

JW

Jason Weaver

Unaffiliated Analyst

4 questions for DX

Also covers: AGNC, ARR, BRSP +15 more

DH

Doug Harter

UBS Group AG

3 questions for DX

Also covers: ARCC, ARR, BETR +15 more

Recent press releases and 8-K filings for DX.

Dynex Capital Amends Distribution Agreement to Increase Shares Available for Sale

DX

- Dynex Capital, Inc. entered into Amendment No. 8 to its Distribution Agreement on January 27, 2026, which increases the number of shares of Common Stock available for sale.

- The amendment increased the shares available by 60,000,000 shares of Common Stock, bringing the new total to 221,292,973 shares.

- As of January 27, 2026, 67,354,187 shares of Common Stock remain available for issuance under the amended agreement.

- The company continues to offer and sell shares through sales agents including BTIG, LLC, Citizens JMP Securities, LLC, JonesTrading Institutional Services LLC, J.P. Morgan Securities LLC, Keefe, Bruyette & Woods, Inc., RBC Capital Markets, LLC, UBS Securities LLC, and Wells Fargo Securities, LLC.

- Janney Montgomery Scott LLC is no longer a party to the Distribution Agreement as of January 27, 2026.

Jan 27, 2026, 2:09 PM

Dynex Reports Strong 2025 Performance, Significant Capital Growth, and Key Executive Appointments

DX

Earnings

Management Change

New Projects/Investments

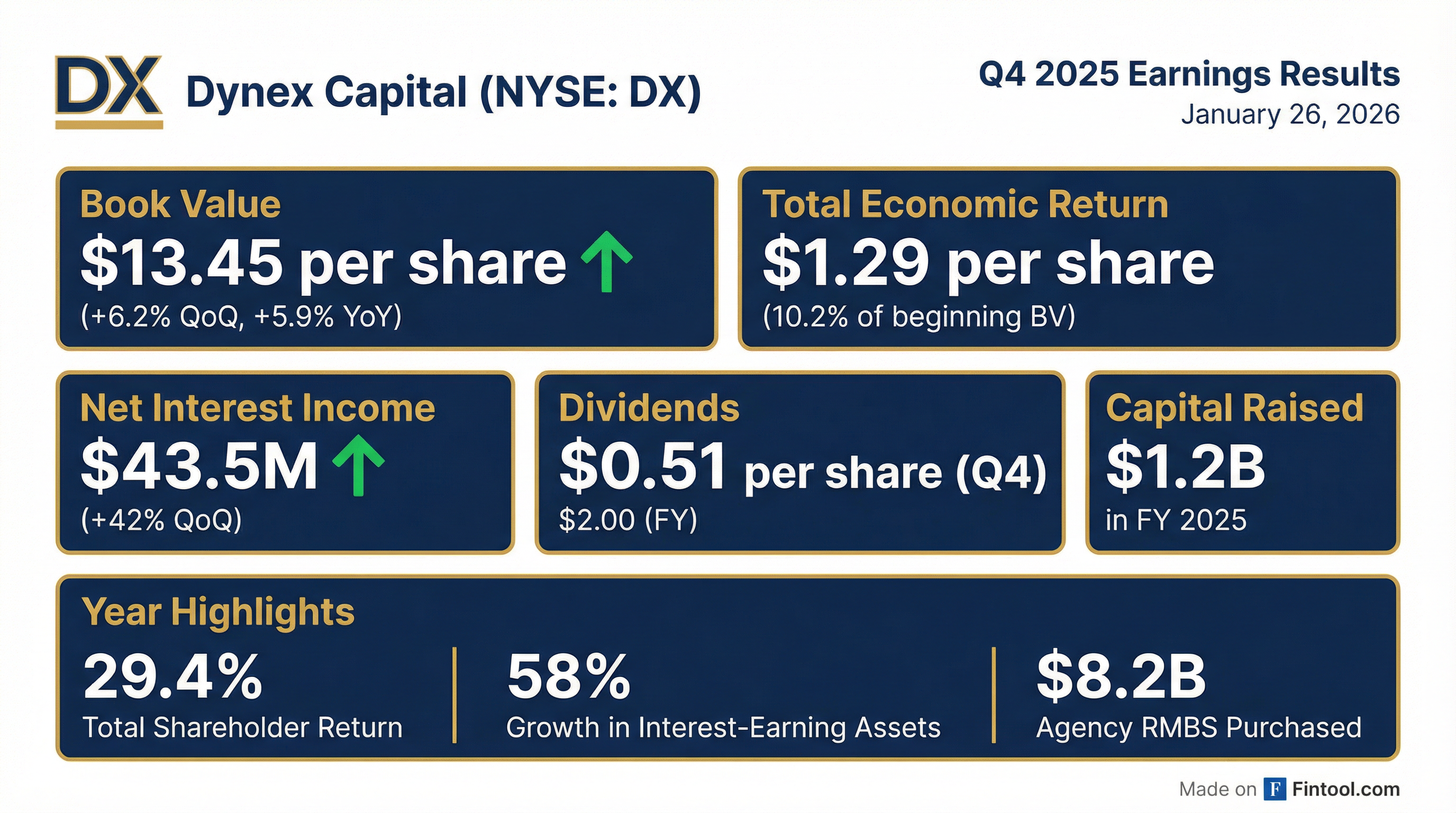

- Dynex delivered a 29.4% total shareholder return and a 21.7% portfolio total economic return for 2025, with a 10.2% total economic return in Q4 2025.

- The company's total equity market capitalization reached $3 billion by the end of last week (early January 2026), having nearly tripled in size over the past 13 months.

- Dynex raised over $1 billion in capital during 2025 and nearly $350 million in early January 2026, growing its mortgage-backed securities portfolio to $19.4 billion by year-end 2025 and approximately $22 billion currently.

- Meagan Bennett was appointed as the new Chief Operating Officer, and Rob Culligan expanded his role as Chief Financial Officer.

- The company maintained a strong liquidity position of $1.4 billion in cash and unencumbered securities at the end of Q4 2025, with leverage at 7.3x total equity.

Jan 26, 2026, 3:00 PM

Dynex Capital Reports Strong 2025 Performance and Strategic Growth

DX

Earnings

Guidance Update

New Projects/Investments

- Dynex Capital reported a total economic return of 10.2% for Q4 2025 and 21.7% for the full year 2025, marking the highest TER this decade. For the year, book value increased $0.75, and $2 of dividends per common share were declared.

- The company significantly expanded its capital base and portfolio, raising and investing over $1 billion in 2025 and an additional $350 million in early January 2026. The TBA and mortgage-backed securities portfolio grew from $9.8 billion at the start of 2025 to $19.4 billion by year-end 2025, currently standing at approximately $22 billion.

- Management highlighted the positive impact of government policy, specifically the Trump administration's announcement to increase GSE retained portfolios by $200 billion, which provides a technical tailwind for MBS spreads and limits downside risk. Current hedged ROEs are in the mid-teens with leverage around 7x, with potential for mid- to high teens at low 8s leverage, representing a carry return without additional spread tightening.

- General and administrative expenses as a percentage of total equity decreased from 2.9% at the close of 2024 to 2.1% at the close of 2025.

Jan 26, 2026, 3:00 PM

Dynex Announces Strong Q4 2025 Results and Portfolio Highlights

DX

Earnings

Dividends

New Projects/Investments

- Dynex reported comprehensive income per common share of $1.22 and a Total Economic Return of 10.2% for Q4 2025.

- The company's portfolio fair value stood at $19.4 billion as of December 31, 2025, with approximately 93% invested in Agency RMBS.

- Dynex declared a Q4 2025 dividend of $0.51 per common share, representing an annualized dividend yield of 14.6%.

- The company maintained strong liquidity with $1.4 billion in cash and unencumbered assets, equivalent to 58% of equity, as of December 31, 2025.

- Economic Net Interest Income for Q4 2025 was $51.1 million, an increase from $44.9 million in Q3 2025.

Jan 26, 2026, 3:00 PM

Dynex Capital, Inc. Announces Q4 and Full Year 2025 Results

DX

'Earnings'

'Dividends'

'Management Change'

- Dynex Capital, Inc. reported a total economic return of $1.29 per common share for the fourth quarter of 2025 and $2.75 per common share for the full year 2025.

- The company's book value per common share increased to $13.45 as of December 31, 2025, compared to $12.67 as of September 30, 2025.

- Dividends declared were $0.51 per common share for the fourth quarter of 2025, bringing the full year 2025 total to $2.00 per common share.

- Dynex Capital raised $393 million in equity capital during the fourth quarter of 2025 through at-the-market issuances, contributing to a total of $1.2 billion for the full year 2025, net of issuance costs.

- The company announced leadership changes, with Rob Colligan taking on an expanded Chief Financial Officer role and Meakin Bennett appointed as the new Chief Operating Officer.

Jan 26, 2026, 1:01 PM

Dynex Capital, Inc. Announces Strong Q4 and Full Year 2025 Results with Significant Capital Growth and Leadership Changes

DX

Earnings

Management Change

Dividends

- Financial Performance: Dynex Capital, Inc. reported a total economic return of $1.29 per common share for Q4 2025 and $2.75 per common share for the full year 2025, with book value per common share reaching $13.45 as of December 31, 2025.

- Earnings and Dividends: The company posted net income of $1.17 per common share for Q4 2025 and $2.49 per common share for the full year 2025, declaring dividends of $0.51 per common share for Q4 2025 and $2.00 for the full year 2025.

- Capital and Investment Growth: Dynex Capital raised $1.2 billion in equity capital for the full year 2025, including $393 million in Q4 2025. The company also purchased $8.2 billion in Agency RMBS and $1.2 billion in Agency CMBS during 2025.

- Leadership and Strategic Update: The company achieved a 29.4% total shareholder return for 2025 and nearly tripled its market capitalization over the last 13 months. It also expanded its executive team by separating the CFO and COO roles, with Rob Colligan as CFO and Meakin Bennett appointed as the new Chief Operating Officer.

Jan 26, 2026, 1:00 PM

DX Reports Strong Q3 2025 Earnings

DX

Earnings

Revenue Acceleration/Inflection

- DX reported net income to common shareholders of $147,561 thousand, or $1.09 per common share, for Q3 2025, a significant improvement from a net loss of ($16,286) thousand, or ($0.14) per common share, in Q2 2025. This was driven by interest income of $149,679 thousand and net unrealized gains on investments of $142,469 thousand in Q3 2025.

- As of September 30, 2025, the company maintained a strong liquidity position with $1.1 billion in cash and unencumbered assets, representing 55% of equity.

- The portfolio primarily consists of Agency RMBS, totaling $14,957,405 thousand in par value as of September 30, 2025, with a weighted average market yield of 5.03%. Management noted that mortgage spreads remain historically wide, offering opportunities for significant hedged carry, and anticipates a Fed bias to cut rates at least once in 4Q25.

Oct 20, 2025, 2:00 PM

Dynex Capital Inc. Reports Q3 2025 Results and Strategic Updates

DX

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Dynex Capital Inc. delivered 20% year-to-date shareholder returns and a 10.3% total economic return for Q3 2025.

- The company raised $254 million in new common equity capital in Q3 2025, bringing the year-to-date total to $776 million, and expanded its portfolio by 10% since Q2 2025.

- Net interest income continues to trend upward, with over $130 million in portfolio gains during Q3 2025, and quarter-end liquidity stood at over $1 billion.

- Estimated book value per share was $12.71 as of last Friday's close, with ROEs in agency RMBS remaining in the high teens net of hedging costs.

Oct 20, 2025, 2:00 PM

Dynex Capital Reports Strong Q3 2025 Performance and Growth

DX

Earnings

New Projects/Investments

Dividends

- Dynex Capital reported strong financial performance, with year-to-date shareholder returns of 20% and a total economic return of 10.3% for Q3 2025 and 11.5% year-to-date.

- The company's common equity market cap has grown to above $1.8 billion, supported by $254 million in new common equity capital raised in Q3 2025, contributing to a $776 million year-to-date total.

- The portfolio has grown over 50% since the beginning of the year, with net interest income trending upward and over $130 million of gains on the portfolio in Q3 2025.

- Liquidity at quarter end stood at over $1 billion, representing over 50% of total equity, and the estimated book value quarter-to-date is $1,271 net of the dividend accrual.

- The company continues to see attractive opportunities in Agency RMBS, with ROEs remaining in the high teens net of hedging costs, and is opening a new office in New York City.

Oct 20, 2025, 2:00 PM

Dynex Capital, Inc. Announces Third Quarter 2025 Results

DX

Earnings

Dividends

New Projects/Investments

- Dynex Capital, Inc. reported a total economic return of $1.23 per common share, or 10.3% of beginning book value, for the third quarter of 2025.

- The company's book value per common share was $12.67 as of September 30, 2025.

- For the third quarter of 2025, Dynex Capital achieved net income of $1.09 per common share and comprehensive income of $1.20 per common share.

- Dynex Capital raised $254 million in equity capital, net of issuance costs, through at-the-market (ATM) common stock issuances.

- The company purchased $2.4 billion in Agency RMBS and $464 million in Agency CMBS during the quarter, maintaining liquidity of over $1 billion as of September 30, 2025.

Oct 20, 2025, 12:00 PM

Quarterly earnings call transcripts for DYNEX CAPITAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more