Earnings summaries and quarterly performance for EAGLE FINANCIAL SERVICES.

Executive leadership at EAGLE FINANCIAL SERVICES.

Board of directors at EAGLE FINANCIAL SERVICES.

CC

Cary C. Nelson

Detailed

Director

DC

Douglas C. Rinker

Detailed

Director

EH

Edward Hill, III

Detailed

Director

JD

John D. Stokely, Jr.

Detailed

Director

JR

John R. Milleson

Detailed

Director

MB

Mary Bruce Glaize

Detailed

Director

RW

Robert W. Smalley, Jr.

Detailed

Director

SM

Scott M. Hamberger

Detailed

Director

TC

Tatiana C. Matthews

Detailed

Director

Research analysts covering EAGLE FINANCIAL SERVICES.

Recent press releases and 8-K filings for EFSI.

Eagle Financial Services Reports Q4 2025 Results with Solid Profitability and Loan Growth

EFSI

Earnings

New Projects/Investments

M&A

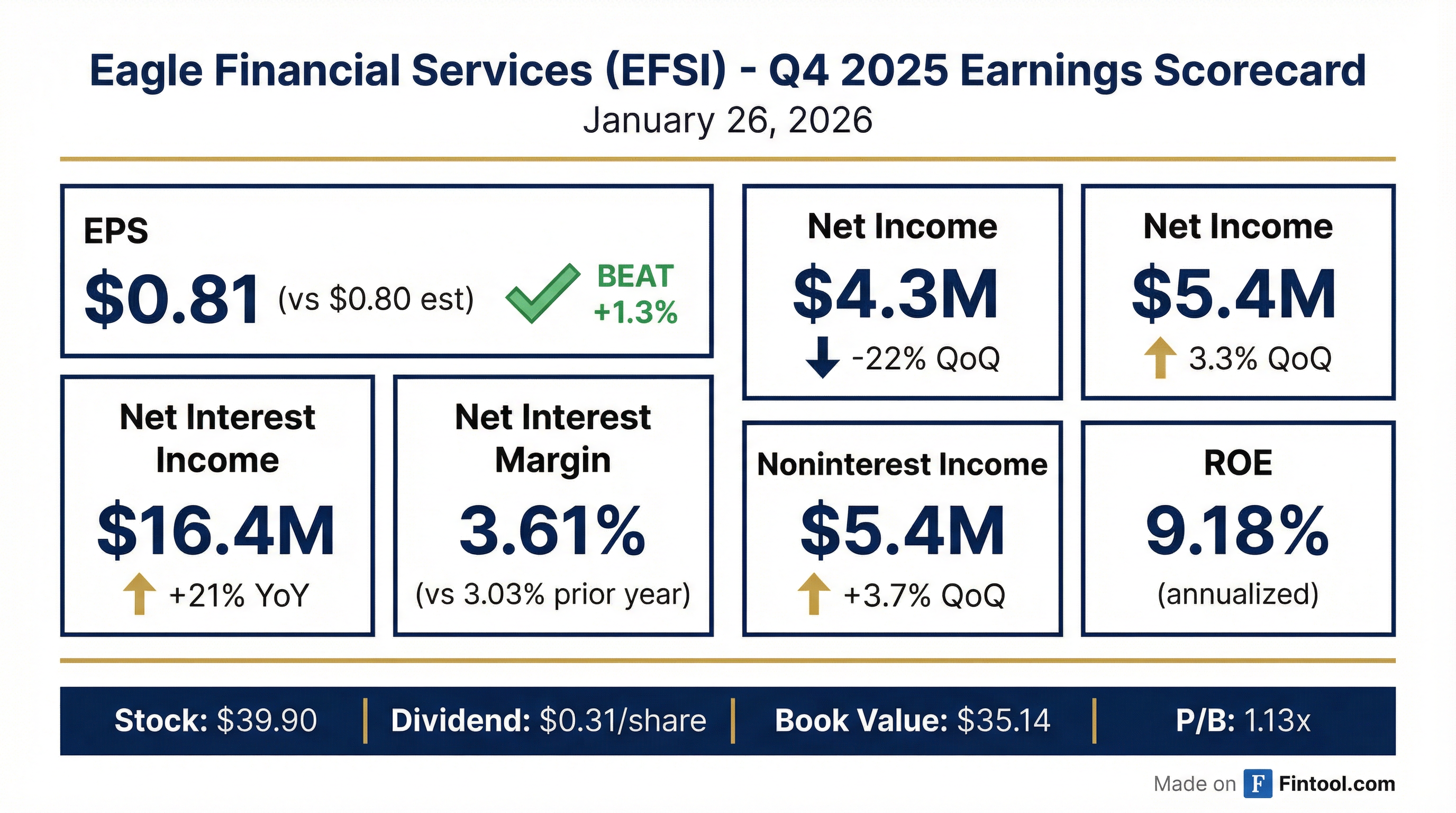

- Eagle Financial Services reported net income of $4.3 million, or $0.81 per diluted share, for Q4 2025, with an annualized return on average assets of 0.91% and an annualized return on average equity of 9.18%.

- The company achieved $13.1 million in net loan growth during Q4 2025, primarily driven by commercial real estate and C&I lending, despite a $10.3 million reduction in the marine portfolio.

- Non-performing assets remained stable, ending 2025 at $14.6 million, or 0.77% of total assets.

- The efficiency ratio for Q4 2025 was 70.3%, an increase from 64.1% in the prior quarter, mainly due to lower net interest income and higher operating expenses, though it is anticipated to move slightly below 70% in 2026.

- The company is engaging in conversations with potential bank partners for mergers and acquisitions, while also focusing on organic growth with a loan pipeline up over $100 million compared to January 2025.

Jan 27, 2026, 3:00 PM

Eagle Financial Services Reports Q4 2025 Earnings

EFSI

Earnings

Guidance Update

New Projects/Investments

- Eagle Financial Services (EFSI) reported net income of $4.3 million and diluted EPS of $0.81 for Q4 2025, with an annualized return on average assets of 0.91% and return on average equity of 9.18%.

- The company achieved $13.1 million in net loan growth in Q4 2025, primarily from commercial real estate and C&I lending, contributing to a net interest margin increase to 3.61%. Non-interest income also grew to $5.4 million, with wealth management fees up 25% to $2.3 million.

- Non-performing assets were $14.6 million, or 0.77% of total assets, at year-end. The efficiency ratio for the quarter was 70.3%, with management anticipating it to move slightly below 70% in 2026.

- For 2026, EFSI expects wealth management fees and gain on sale revenue to remain consistent with 2025 levels, and its loan pipeline is up over $100 million compared to January 2025. The company also continues to engage in conversations with potential bank partners for mergers and acquisitions.

Jan 27, 2026, 3:00 PM

Eagle Financial Services Reports Q4 2025 Results

EFSI

Earnings

Guidance Update

M&A

- Eagle Financial Services reported net income of $4.3 million and $0.81 per diluted share for the fourth quarter of 2025, a decrease from $5.6 million in net income in the third quarter.

- The company achieved an annualized return on average assets of 0.91% and an annualized return on average equity of 9.18% for Q4 2025. The efficiency ratio was 70.3% in the fourth quarter, up from 64.1% in the third quarter, but is anticipated to move slightly below 70% in 2026.

- Net loan growth was $13.1 million in Q4 2025, driven by commercial real estate and C&I lending. Non-performing assets stood at $14.6 million, or 0.77% of total assets, at the end of 2025.

- Net interest income decreased to $16.4 million in Q4 2025, while net interest margin increased to 3.61%. Non-interest income totaled $5.4 million, with wealth management fees increasing 25% from the third quarter to $2.3 million.

Jan 27, 2026, 3:00 PM

Eagle Financial Services, Inc. Announces Fourth Quarter 2025 Financial Results

EFSI

Earnings

Dividends

- Eagle Financial Services, Inc. reported consolidated net income of $4.334 million and diluted earnings per share of $0.81 for the fourth quarter of 2025. This marks a decrease from $5.584 million net income and $1.04 diluted EPS in the third quarter of 2025.

- The company's net interest margin increased to 3.61% in Q4 2025, up from 3.58% in Q3 2025 and 3.03% in Q4 2024. Annualized return on average assets was 0.91% and annualized return on average equity was 9.18% for Q4 2025.

- Total consolidated assets decreased by $43.8 million to $1.89 billion at December 31, 2025, primarily due to a decrease in cash and cash equivalents. Total deposits also decreased to $1.61 billion from $1.66 billion in the prior quarter.

- The Board of Directors declared a quarterly common stock cash dividend of $0.31 per common share, payable on February 13, 2026, to shareholders of record on February 2, 2026.

- CEO Brandon Lorey stated that 2025 was a pivotal year, marked by a successful capital raise, strategic balance sheet repositioning, and uplist to NASDAQ, which have significantly strengthened the balance sheet and improved the forward earnings profile.

Jan 26, 2026, 9:50 PM

Eagle Financial Services, Inc. Announces Fourth Quarter 2025 Financial Results

EFSI

Earnings

New Projects/Investments

- Eagle Financial Services, Inc. reported net income of $4.334 million and basic and diluted earnings per share of $0.81 for the fourth quarter ended December 31, 2025.

- The company's net interest margin increased to 3.61% for Q4 2025, up from 3.58% in Q3 2025 and 3.03% in Q4 2024.

- Total deposits decreased to $1.61 billion as of December 31, 2025, from $1.66 billion at September 30, 2025, primarily due to $74.4 million of specific large deposits leaving the bank.

- Total net loans increased to $1.46 billion at December 31, 2025, from $1.45 billion at September 30, 2025.

- President and CEO Brandon Lorey stated that 2025 was a pivotal year, marked by a successful capital raise, strategic balance sheet repositioning, and uplist to NASDAQ, which strengthened the balance sheet and improved the forward earnings profile.

Jan 26, 2026, 9:44 PM

Quarterly earnings call transcripts for EAGLE FINANCIAL SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more