Earnings summaries and quarterly performance for Embecta.

Research analysts who have asked questions during Embecta earnings calls.

Marie Thibault

BTIG

7 questions for EMBC

Also covers: ABT, ARAY, ATRC +15 more

AP

Anthony Petrone

Mizuho Group

4 questions for EMBC

Also covers: ADMA, ALC, AXGN +24 more

Kallum Titchmarsh

Morgan Stanley

3 questions for EMBC

Also covers: ATEC, AXNX, INSP +7 more

Michael Polark

Wolfe Research

3 questions for EMBC

Also covers: BBNX, BSX, DXCM +13 more

Ryan Schiller

Wolfe Research

3 questions for EMBC

GS

Grace Shawn

Bank of America Securities

2 questions for EMBC

Mike Polark

Wolfe Research, LLC

2 questions for EMBC

Also covers: BBNX, BSX, DXCM +6 more

Travis Steed

Bank of America

2 questions for EMBC

Also covers: ABT, AXNX, BAX +24 more

GM

Gracia Mahoney

Bank of America

1 question for EMBC

Sam Eiber

BTIG, LLC

1 question for EMBC

Also covers: AIRS, APYX, EOLS +8 more

Recent press releases and 8-K filings for EMBC.

Embecta Reports Q1 2026 Results and Reaffirms FY 2026 Guidance

EMBC

Earnings

Guidance Update

New Projects/Investments

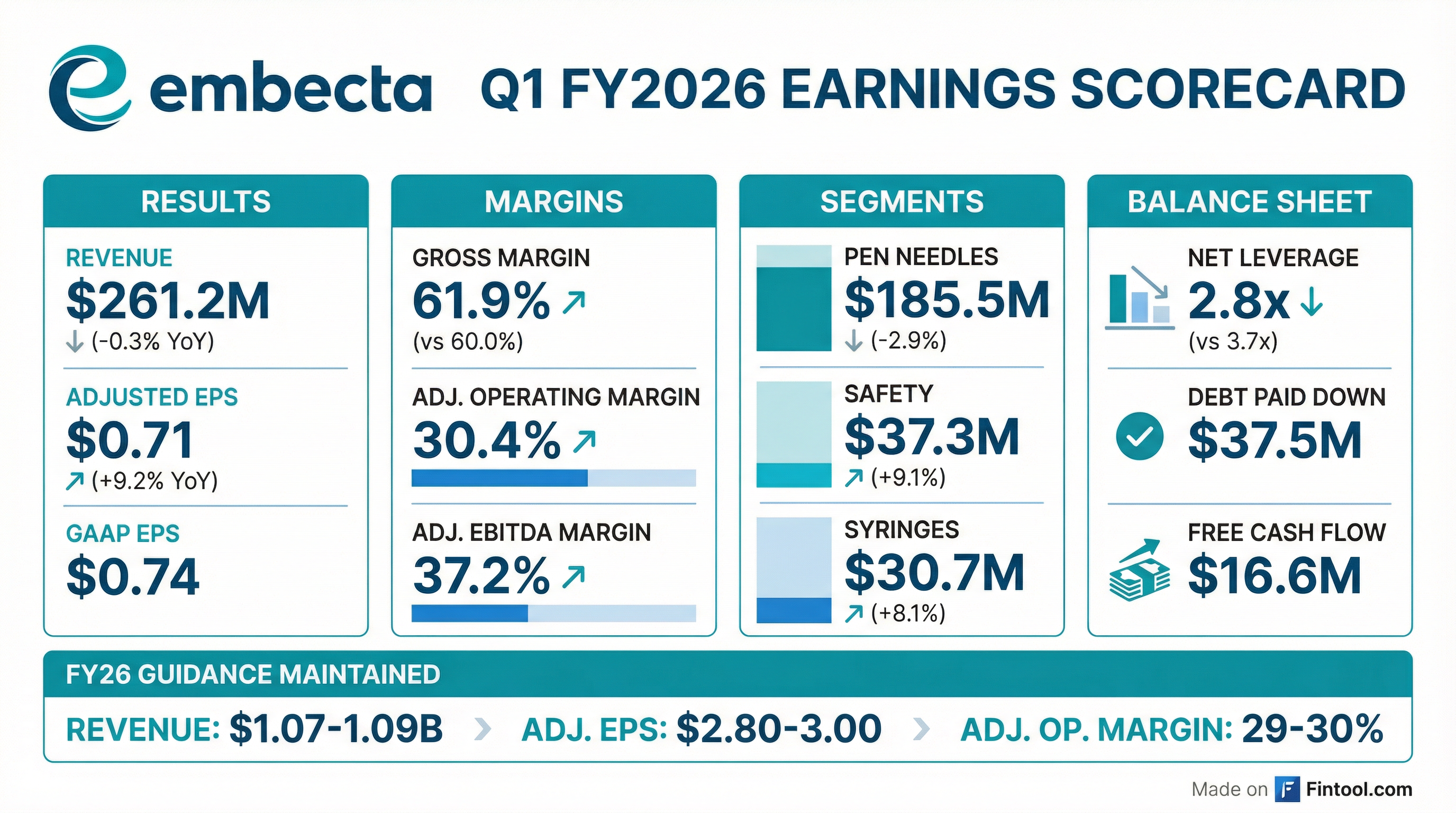

- Embecta reported Q1 2026 revenue of $261 million, reflecting a 0.3% decline year-over-year on an as-reported basis, or a 2% decline on an adjusted constant currency basis, which was largely in line with expectations.

- Adjusted diluted earnings per share for Q1 2026 was $0.71, an increase from $0.65 in the prior year period, primarily driven by a reduction in interest expense and a lower adjusted tax rate.

- The company reaffirmed its full fiscal year 2026 guidance for revenue, adjusted operating margin, and adjusted diluted EPS, but now anticipates being closer to the lower end of these ranges due to incremental U.S. pricing headwinds, partially offset by an improved international outlook.

- In Q1 2026, Embecta generated approximately $17 million in free cash flow and repaid approximately $38 million of outstanding debt, reducing its last 12 months net leverage to approximately 2.8 times.

- Strategic initiatives are progressing, including the completion of the stand-up phase, brand transition, strengthening Medicare Part D access, and advancing the GLP-1 strategy with generic launches anticipated in markets such as Canada, Brazil, China, and India starting in calendar year 2026.

Feb 5, 2026, 1:00 PM

embecta Announces Q1 FY 2026 Results and Reaffirms FY 2026 Guidance

EMBC

Earnings

Guidance Update

- For Q1 FY 2026, embecta reported revenue of $261.2 million, a 0.3% decrease compared to the prior year period, with GAAP net income of $44.1 million and GAAP earnings per diluted share of $0.74.

- The company advanced its brand transition program in International markets, expecting substantial completion by the end of calendar year 2026, and strengthened its U.S. Medicare business by contracting with an additional Medicare Part D payer.

- embecta paid down approximately $37.5 million of term loan B during the fiscal first quarter, remaining on track to reduce gross debt by approximately $150 million during FY 2026, and ended the quarter with a net leverage of ~2.8x.

- The company reaffirmed its FY 2026 financial guidance, projecting reported revenue between $1,071 million and $1,093 million and adjusted earnings per diluted share between $2.80 and $3.00.

Feb 5, 2026, 1:00 PM

Embecta Reports Q1 2026 Results, Reaffirms FY 2026 Guidance at Lower End

EMBC

Earnings

Guidance Update

New Projects/Investments

- Embecta reported Q1 2026 revenue of approximately $261 million, reflecting a 0.3% decline year-over-year on an as-reported basis, or a 2% decline on an adjusted constant currency basis. This was driven by a 7.6% decline in U.S. revenue (adjusted constant currency) and a 4.6% increase in international revenue (adjusted constant currency).

- For Q1 2026, adjusted diluted earnings per share were $0.71, up from $0.65 in the prior year, with an adjusted gross margin of 62.6% and adjusted operating margin of 30.4%.

- The company reaffirmed its fiscal year 2026 guidance ranges for revenue, adjusted operating margin, and adjusted diluted EPS, but now expects to be closer to the lower end of these ranges. This is attributed to incremental U.S. pricing headwinds, partially offset by an improved outlook for the international business.

- In Q1 2026, Embecta generated approximately $17 million in free cash flow and repaid approximately $38 million of outstanding debt, reducing its last 12 months net leverage to approximately 2.8 times. For fiscal year 2026, the company expects to repay approximately $150 million in debt and generate between $180 million and $200 million in free cash flow, though closer to the low end of that range.

- Strategic progress includes over 95% of U.S. and Canadian revenue transitioning to the Embecta brand and advancements in the GLP-1 strategy, with over one-third of pharmaceutical partners having selected Embecta as a supplier and initial generic GLP-1 launches anticipated in markets like Canada, Brazil, China, and India starting in calendar year 2026.

Feb 5, 2026, 1:00 PM

Embecta Reports Q1 2026 Results and Reaffirms FY 2026 Guidance

EMBC

Earnings

Guidance Update

New Projects/Investments

- Embecta reported Q1 2026 revenue of $261 million, a 0.3% decline year-over-year on an as-reported basis, and adjusted diluted EPS of $0.71.

- The company reaffirmed its fiscal year 2026 guidance for revenue, adjusted operating margin, and adjusted diluted EPS, but now expects to be closer to the lower end of these ranges due to incremental U.S. pricing headwinds.

- International revenue increased by 4.6% on an adjusted constant currency basis, driven by strength in EMEA and Latin America, partially offsetting a 7.6% decline in U.S. revenue for Q1 2026.

- Embecta generated $17 million in free cash flow and repaid $38 million of outstanding debt during Q1 2026, reducing its net leverage level to approximately 2.8 times.

- The company continues to advance its GLP-1 strategy, collaborating with over 30 pharmaceutical partners and anticipating initial generic GLP-1 launches in several international markets starting calendar year 2026, maintaining confidence in the $100 million-plus revenue opportunity by 2033.

Feb 5, 2026, 1:00 PM

Embecta Corp. Reports Q1 Fiscal 2026 Financial Results and Maintains Full-Year Guidance

EMBC

Earnings

Guidance Update

Dividends

- Embecta Corp. reported revenues of $261.2 million for the first quarter of fiscal year 2026, a 0.3% decrease compared to the prior year period, with net income of $44.1 million and diluted earnings per share of $0.74.

- The company maintained its previously provided Fiscal Year 2026 guidance, expecting reported revenues between $1,071 million and $1,093 million and adjusted earnings per diluted share between $2.80 and $3.00.

- During the first quarter of fiscal year 2026, Embecta reduced its outstanding debt by approximately $37.5 million.

- A quarterly cash dividend of $0.15 per share was announced, payable on March 17, 2026.

Feb 5, 2026, 11:54 AM

embecta Discusses Strategic Transformation, Debt Reduction, and Growth Initiatives

EMBC

New Projects/Investments

Product Launch

Revenue Acceleration/Inflection

- embecta, a diabetes injection supplies leader, reported approximately $1.1 billion in revenue and $180 million+ in free cash for its last fiscal year, with a 38% adjusted EBITDA margin.

- The company is undergoing a strategic transformation to become a broad-based medical supplies company, shifting from a prior insulin infusion pump program.

- Financial flexibility has improved significantly, with $185 million of debt paid down in fiscal 2025, reducing net leverage from almost 4x to under 3x. The company expects to reach the low- to mid-2x range by the end of this year (fiscal 2026).

- Key growth initiatives include developing market-appropriate pen needles and syringes for new markets and pursuing GLP-1 opportunities expected to generate over $100 million in revenue by 2033. The brand transition to embecta is 95% complete in the U.S. and Canada and is targeted to be materially done in key markets by calendar year 2026.

Jan 14, 2026, 10:15 PM

Embecta Discusses Strategic Transformation and Financial Performance at J.P. Morgan Healthcare Conference

EMBC

New Projects/Investments

M&A

Demand Weakening

- Embecta, a leader in diabetes injection supplies, reported $1 billion in revenue and $415 million in adjusted EBITDA for its last fiscal year, highlighting its stable and profitable business model.

- The company is strategically transforming into a broader medical supplies and drug delivery company, pursuing initiatives such as a brand transition (95% complete in U.S. and Canada) , developing market-appropriate products , and capitalizing on GLP-1 opportunities projected to generate over $100 million in revenue by 2033.

- Embecta significantly reduced its debt by $185 million in fiscal 2025, lowering net leverage from almost four to under three, and targets low to mid-2x by the end of the current year to enable opportunistic M&A and address cannula cost pressures by exploring alternate suppliers for risk mitigation and improved economics.

- China operations faced a two-point decline in total company revenue year-over-year in 2025 due to local brand preference and intensified price competition, with lesser headwinds anticipated in 2026.

Jan 14, 2026, 10:15 PM

Embecta Discusses FY 2025 Performance, Strategic Transformation, and Growth Initiatives

EMBC

New Projects/Investments

Revenue Acceleration/Inflection

Demand Weakening

- Embecta reported FY 2025 revenue of approximately $1 billion, with a 38% adjusted EBITDA margin and over $180 million in free cash. The company significantly reduced its debt, paying down almost $185 million in fiscal 2025, bringing net leverage from nearly four to under three by the end of fiscal 2025, with a target of low to mid-2x by the end of 2026.

- The company is transforming into a broader medical supplies and drug delivery company, with 95% of its U.S. and Canada revenue (60% of total revenue) already converted to the Embecta brand, and global brand transition expected to be materially complete by calendar year 2026.

- New growth initiatives include developing market-appropriate pen needles and syringes for affordable markets, and pursuing a GLP-1 opportunity projected to generate over $100 million in revenue by 2033. Generic GLP-1 launches are anticipated in Brazil, Canada, China, and India in calendar year 2026.

- While the core pen needle business remains resilient, the company experienced a two-point decline in total company revenue year-over-year in 2025 versus 2024 due to a shift towards local Chinese brands and intensified price competition in China. Embecta has introduced a low-cost product and expects some headwinds in China in 2026, but to a lesser extent.

Jan 14, 2026, 10:15 PM

embecta Provides FY 2025 Financial Estimates and Outlines Strategic Growth Initiatives

EMBC

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- embecta, a leading producer of diabetes injection supplies, projects approximately $1.1 billion in adjusted revenues and $415 million in adjusted EBITDA for fiscal year 2025, with pen needles and safety products accounting for about 85% of total adjusted revenues.

- The company significantly reduced its net leverage to 2.9x at the end of fiscal year 2025, down from 3.8x in fiscal year 2024, by paying down approximately $184.5 million of debt.

- embecta is pursuing growth by expanding its product portfolio, with GLP-1 opportunities potentially driving over $100 million in revenue by 2033, and anticipates B2B partner launches in Canada, Brazil, China, and India in 2026.

- The company is also strengthening its core business through a global brand transition expected to be substantially complete by the end of calendar year 2026 and developing market-appropriate pen needles and syringes.

Jan 14, 2026, 10:15 PM

EMBC Reports Q4 and Full Year 2025 Results, Provides FY 2026 Guidance

EMBC

Earnings

Guidance Update

New Projects/Investments

- For Q4 FY 2025, EMBC reported adjusted revenue of $263.3 million, a 10.4% decrease on an adjusted constant currency basis compared to the prior year period, with adjusted earnings per diluted share of $0.50.

- For the full fiscal year 2025, the company achieved adjusted revenue of $1,079.7 million, a 3.9% decrease on an adjusted constant currency basis, and adjusted earnings per diluted share of $2.95.

- EMBC significantly improved its financial flexibility by paying down ~$184 million of term loan B during fiscal year 2025, exceeding its original debt reduction target, and generated strong free cash flow of ~$182 million for the fiscal year.

- The company advanced its GLP-1 strategy with new contracts and purchase orders to co-package embecta pen needles, with generic GLP-1 launches expected to begin in select markets in calendar year 2026.

- For FY 2026, EMBC provided guidance for reported revenue between $1,071 million and $1,093 million and adjusted earnings per diluted share between $2.80 and $3.00.

Nov 25, 2025, 1:00 PM

Quarterly earnings call transcripts for Embecta.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more