Earnings summaries and quarterly performance for EZCORP.

Research analysts who have asked questions during EZCORP earnings calls.

Brian McNamara

Canaccord Genuity - Global Capital Markets

8 questions for EZPW

Also covers: CENT, COOK, DRVN +11 more

KJ

Kyle Joseph

Jefferies

7 questions for EZPW

Also covers: AFRM, CACC, CRMT +14 more

AS

Andrew Scutt

ROTH Capital Partners

6 questions for EZPW

Also covers: AMRK, BLBD, CPIG +3 more

RS

Raj Sharma

Texas Capital Bank

6 questions for EZPW

Also covers: APEI, ASPU, CXW +4 more

JH

John Hecht

Jefferies

3 questions for EZPW

Also covers: AFRM, ARCC, BFH +23 more

DS

David Scharf

Citizens Capital Markets and Advisory

2 questions for EZPW

Also covers: AFRM, ECPG, ENVA +11 more

JW

Jonathan Weitz

Jefferies

2 questions for EZPW

ZO

Zach Oster

Citizens Capital Markets

2 questions for EZPW

Also covers: ECPG, RM

AH

Alex Howell

Stephens Inc.

1 question for EZPW

CI

Craig Irwin

ROTH Capital Partners

1 question for EZPW

Also covers: AMRC, ANDE, ASYS +26 more

Recent press releases and 8-K filings for EZPW.

EZCORP Reports Record Q1 2026 Revenue and Earnings, Expands Footprint with Key Acquisitions

EZPW

Earnings

M&A

New Projects/Investments

- EZCORP achieved one of its strongest quarters in history for Q1 2026, reporting record revenue of $374.5 million, up 17%, and significant earnings growth, including a 36% increase in Adjusted EBITDA to $70.3 million and a 34% rise in diluted EPS to $0.55.

- The company completed two significant acquisitions subsequent to quarter-end: a majority interest in Simple Management Group (SMG) on January 2nd, adding 105 stores across 12 countries for approximately $64 million, and El Bufalo Pawn on January 12th, adding 12 stores in Texas for $27.5 million.

- These transactions expanded EZCORP's global footprint to 1,500 pawn stores across 16 countries, marking a significant milestone and creating a platform for future domestic and international expansion.

- Management noted a highly favorable pawn demand environment driven by challenged consumer credit conditions for lower and middle-income households, and expects favorable Q2 momentum from the tax refund season and elevated gold prices supporting scrap contributions.

- EZCORP's capital allocation strategy prioritizes building scale through M&A and organic growth, with an active M&A pipeline, particularly in Mexico and other Latin American countries, while maintaining a fiscally conservative balance sheet.

2 days ago

EZCORP Reports Record Q1 2026 Revenue and PLO, Completes Key Acquisitions

EZPW

Earnings

M&A

Guidance Update

- EZCORP delivered one of its strongest quarters in history for Q1 2026, with record revenue and Pawn Loan Outstandings (PLO), driving over 35% growth in both net income and EBITDA. Total revenues increased 17% to $374.5 million, and diluted EPS rose 34% to $0.55.

- Subsequent to quarter-end, EZCORP completed two significant acquisitions: a majority interest in Simple Management Group (SMG) on January 2nd, expanding its presence into 11 new countries, and El Bufalo Pawn on January 12th, adding 12 stores in Texas. These deals increased EZCORP's total store count to 1,500 across 16 countries.

- The company anticipates favorable Q2 momentum due to strong pawn demand, tax refund season, and elevated gold prices, which are expected to support scrap gross profit margins for about two more quarters. EZCORP plans to continue disciplined capital deployment, focusing on growth through M&A and organic expansion, and will re-evaluate its share buyback program, supported by $465.9 million in unrestricted cash.

2 days ago

EZCORP Reports Record Q1 2026 Revenue and Earnings, Expands Footprint with Key Acquisitions

EZPW

Earnings

M&A

Guidance Update

- EZCORP delivered one of its strongest quarters in history for Q1 2026, with record total revenues of $374.5 million, up 17%, and diluted EPS improving 34% to $0.55. Adjusted EBITDA rose 36% to $70.3 million.

- The company significantly expanded its global footprint by closing two acquisitions subsequent to quarter-end: a majority interest in Simple Management Group (SMG) for approximately $64 million on January 2nd, and El Bufalo Pawn for $27.5 million on January 12th. These transactions increase EZCORP's total to 1,500 pawn stores across 16 countries.

- Pawn Loan Outstandings (PLO) increased 12% to $307.3 million, and merchandise sales climbed 10% to $205.2 million, with merchandise margin expanding 230 basis points to 37%. Scrap margins also significantly expanded from 23% to 34% due to elevated gold prices.

- Management expects favorable Q2 momentum driven by the tax refund season and continued elevated gold prices, and maintains an active M&A pipeline in the US and Latin America, prioritizing scale and growth while re-evaluating its share buyback program.

2 days ago

EZCORP Reports Strong Q1 Fiscal 2026 Results and Announces Strategic Acquisitions

EZPW

Earnings

M&A

New Projects/Investments

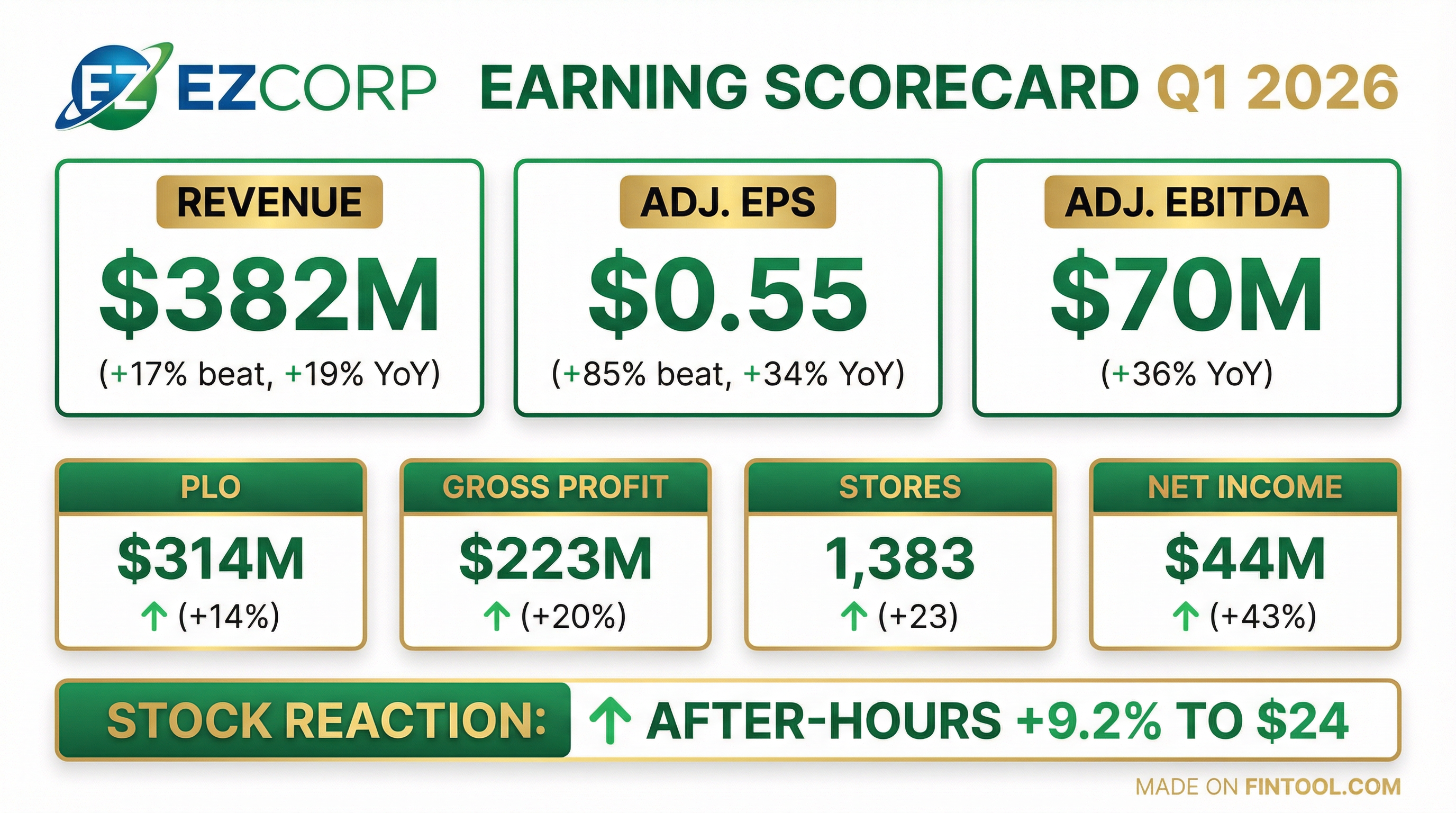

- EZCORP reported strong financial results for the first quarter ended December 31, 2025, with net income increasing 43% to $44.3 million and diluted earnings per share rising 38% to $0.55.

- Total revenues grew 19% to $382.0 million and gross profit increased 20% to $223.0 million for Q1 fiscal 2026.

- Pawn loans outstanding (PLO) increased 14% to $314.4 million.

- Subsequent to the quarter end, EZCORP expanded its footprint by acquiring an 87.7% controlling interest in Founders One, adding 105 stores across 12 countries, and completing the acquisition of 12 pawn stores in Texas for $27.5 million.

3 days ago

EZCORP Reports Strong First Quarter Fiscal 2026 Results and Strategic Acquisitions

EZPW

Earnings

M&A

Revenue Acceleration/Inflection

- EZCORP reported strong first quarter fiscal 2026 results, with net income increasing 43% to $44.3 million and diluted earnings per share (EPS) rising 38% to $0.55 for the quarter ended December 31, 2025.

- Total revenues grew 19% to $382.0 million, and gross profit increased 20% to $223.0 million.

- Pawn loans outstanding (PLO) increased 14% to $314.4 million.

- Subsequent to quarter-end, EZCORP completed two significant acquisitions: an 87.7% controlling interest in Founders One (SMG) on January 2, 2026, adding 105 stores, and 12 pawn stores in Texas for $27.5 million on January 12, 2026.

- These acquisitions expand EZCORP's operational footprint to 1,500 pawn stores across 16 countries.

3 days ago

EZCORP Acquires Controlling Interest in Founders One, LLC

EZPW

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- EZCORP, Inc. (EZPW) acquired a controlling interest in Founders One, LLC on January 2, 2026, expanding its operations by 105 pawn stores across 12 countries.

- The transaction involved converting $45 million of preferred equity and $10 million of notes receivable into common equity, an additional $9.4 million cash contribution, and providing a $156.4 million senior secured debt facility for SMG at 13% per annum.

- EZCORP now holds an 87.7% majority interest in Founders, which controls SMG, and will consolidate SMG's financial results, anticipating a meaningful contribution to earnings.

- Founders reported unaudited revenue of $127 million and gross profit of $66 million for the nine months ended September 30, 2025, and revenue of $147 million and gross profit of $79 million for fiscal year 2024.

Jan 5, 2026, 1:01 PM

EZCORP Acquires Controlling Interest in Founders One, LLC

EZPW

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- EZCORP acquired a controlling interest in Founders One, LLC on January 2, 2026, expanding its operations by 105 pawn stores across 12 countries and increasing its total store count to 1,488 across 16 countries.

- The acquisition involved converting $45 million of existing preferred equity and $10 million of notes receivable to common equity, contributing an additional $9.4 million in cash, and providing a $156.4 million senior secured debt facility to SMG.

- EZCORP now holds an 87.7% interest in Founders, which controls 85.1% of SMG, and will consolidate SMG's financial results, expecting immediate earnings accretion.

- Founders reported unaudited revenue of $127 million and gross profit of $66 million for the nine months ended September 30, 2025. For the full year 2024, revenue was $147 million and gross profit was $79 million, showing growth of approximately 34% and 29% respectively, compared to fiscal 2023.

Jan 5, 2026, 1:00 PM

EZCORP Reports Record Fiscal Year 2025 Revenue and Profit Growth

EZPW

Earnings

Revenue Acceleration/Inflection

M&A

- EZCORP achieved record revenue of $1.3 billion for fiscal year 2025, marking a 12% increase year over year. Adjusted EBITDA grew 26% to $191.2 million, with net income surging 30% to $110.7 million.

- For the fourth quarter of 2025, adjusted EBITDA increased 33% to $47.9 million, and the EBITDA margin expanded 210 basis points to 14.3%.

- The company's store count reached 1,360 stores at fiscal year-end 2025, after adding 24 stores in Q4 through Denovo openings and acquisitions. Post-fiscal year-end, EZCORP acquired an additional 17 stores and entered an agreement for 12 more Texas locations.

- Pawn Loan Outstanding (PLO) reached a record $303.9 million, an 11% increase year over year. The cash position materially increased to $469.5 million, reflecting a $300 million senior notes offering completed in March 2025.

- Digital initiatives are gaining significant traction, with EZ Plus Rewards membership growing 26% to 6.9 million members and website traffic increasing 49% to 2.6 million visits in the quarter.

Nov 14, 2025, 2:00 PM

EZCORP Reports Record Fiscal Year 2025 Financial Results and Continued Growth

EZPW

Earnings

Revenue Acceleration/Inflection

M&A

- EZCORP reported record fiscal year 2025 results, with revenue reaching $1.3 billion, up 12% year over year, and adjusted EBITDA increasing 26% to $191.2 million. Net income surged 30% to $110.7 million.

- The company's store count grew to 1,360 by fiscal year-end 2025, including 24 stores added in Q4 2025 through de novo openings and acquisitions, with further acquisitions planned post-year-end.

- Earning assets increased 18% to $549.1 million in Q4 2025, driven by an 11% rise in Pawn Loan Outstandings (PLO) to $303.9 million and a 28% increase in inventory to $245.2 million.

- Digital initiatives are showing strong traction, with EZ+ Rewards membership up 26% to 6.9 million members and U.S. online payments growing 42% year-over-year to $34 million.

- Management noted that while a rising gold price provided a tailwind for scrap gross profit, the business model is resilient and adaptable to gold price fluctuations, with expectations for scrap margins to normalize in fiscal year 2026.

Nov 14, 2025, 2:00 PM

EZCORP Reports Record Fiscal Year 2025 Financial Results and Strategic Growth

EZPW

Earnings

M&A

New Projects/Investments

- EZCORP reported a transformative Fiscal Year 2025, achieving record revenue of $1.3 billion, up 12% year-over-year, and adjusted EBITDA of $191.2 million, a 26% increase. Net income surged 30% to $110.7 million.

- The company expanded its store base to 1,360 stores at year-end, adding 24 stores in Q4 2025 through Denovo openings and acquisitions, with further acquisitions post-fiscal year-end.

- Earning assets grew 18% to $549.1 million, driven by an 11% increase in record PLO to $303.9 million. The cash position increased to $469.5 million following a $300 million senior notes offering.

- Digital transformation initiatives are gaining traction, with EZ Plus Rewards membership up 26% to 6.9 million members and U.S. online payments growing 42% year-over-year to $34 million. Management anticipates a sequential increase in total expenses and a decline in scrap sales gross profit after Q1 FY 2026, while the M&A pipeline remains active.

Nov 14, 2025, 2:00 PM

Quarterly earnings call transcripts for EZCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more