Earnings summaries and quarterly performance for FLEX.

Executive leadership at FLEX.

Revathi Advaithi

Chief Executive Officer

Daniel J. Wendler

Chief Accounting Officer

Hooi Tan

Chief Operating Officer

Kevin Krumm

Chief Financial Officer

Michael P. Hartung

President, Chief Commercial Officer

Scott Offer

Executive Vice President and General Counsel

Board of directors at FLEX.

Charles K. Stevens, III

Director

Erin L. McSweeney

Director

John D. Harris II

Director

Lay Koon Tan

Director

Maryrose Sylvester

Director

Michael E. Hurlston

Director

Patrick J. Ward

Director

William D. Watkins

Independent Chair of the Board

Research analysts who have asked questions during FLEX earnings calls.

Ruplu Bhattacharya

Bank of America

8 questions for FLEX

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for FLEX

Mark Delaney

The Goldman Sachs Group, Inc.

7 questions for FLEX

Steven Fox

Fox Research

7 questions for FLEX

Jacob Moore

Sidoti & Company, LLC

4 questions for FLEX

Steve Barger

KeyBanc Capital Markets Inc.

3 questions for FLEX

George Wang

Barclays PLC

2 questions for FLEX

Tim Long

Barclays

2 questions for FLEX

Christian Zyla

KeyBanc Capital Markets

1 question for FLEX

Dong Wang

Nomura Instinet

1 question for FLEX

Recent press releases and 8-K filings for FLEX.

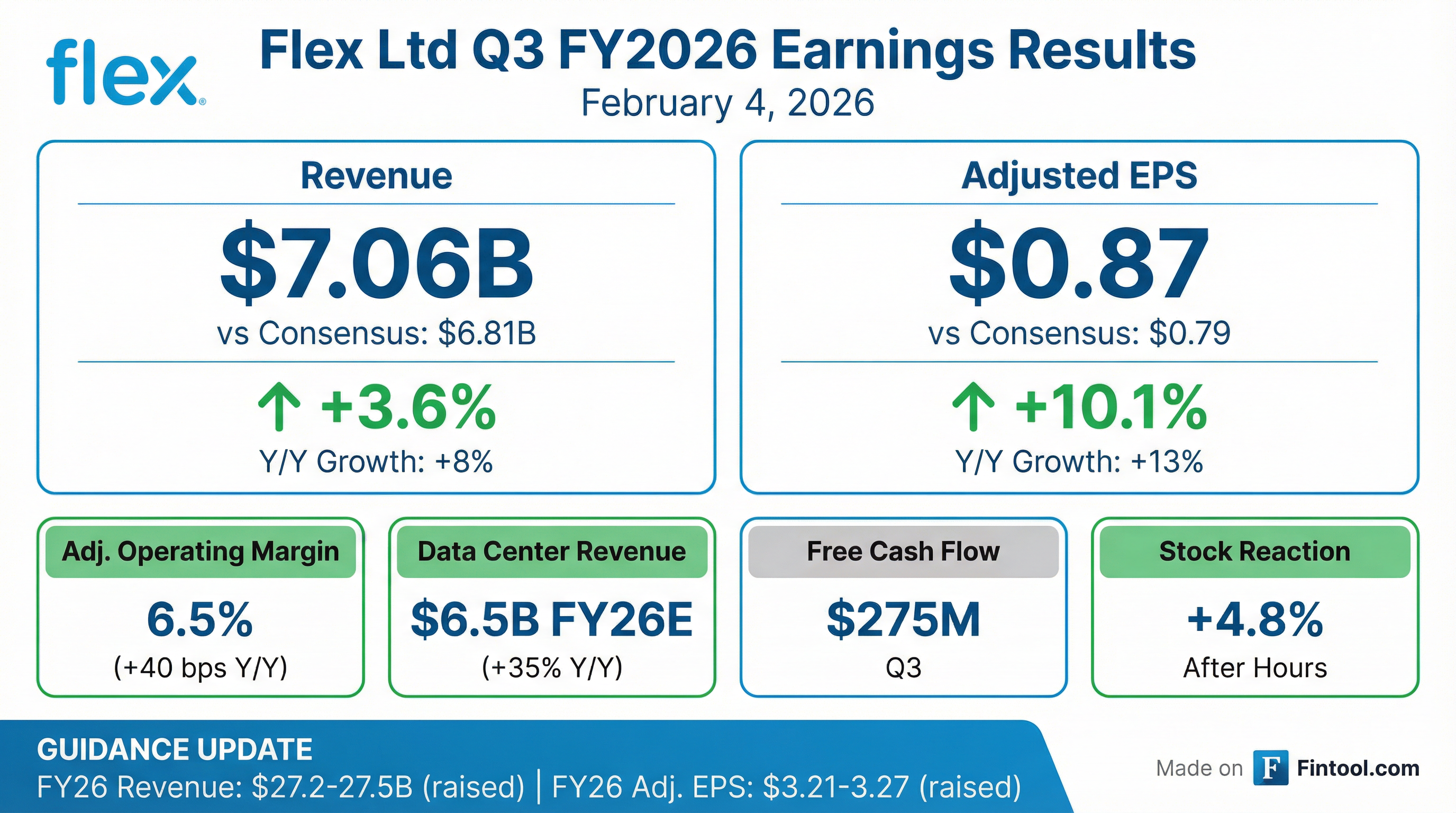

- Flex reported strong Q3 FY2026 results, with revenue of $7.1 billion, an 8% increase year-over-year, and a record adjusted operating margin of 6.5%.

- Adjusted EPS reached a record $0.87, up 13% year-over-year.

- The company raised its full-year FY2026 guidance, now expecting revenue between $27.2 billion and $27.5 billion and adjusted EPS between $3.21 and $3.27 per share.

- Growth was primarily driven by data centers, with continued investments in power and compute capacity for AI programs, and the company repurchased approximately $200 million of stock in the quarter.

- FLEX reported Q3 FY26 revenue of $7.1 billion and adjusted earnings per share of $0.87.

- The company achieved an adjusted operating margin of 6.5%, marking its fifth consecutive quarter with margins at 6.0% or higher.

- FLEX is experiencing continued momentum in its data center portfolio, advancing next-generation AI power, compute, and cooling solutions, with total data center revenue projected to be $6.5 billion for FY26E, up 35% year-over-year.

- The company increased its FY26 guidance for revenue to $27.2 - $27.5 billion, adjusted operating margin to 6.3%, and adjusted earnings per share to $3.21 - $3.27.

- Flex reported strong Q3 fiscal 2026 results, with revenue of $7.1 billion, an 8% increase year-over-year, and record adjusted EPS of $0.87, up 13% year-over-year.

- The company achieved a record adjusted operating margin of 6.5% in Q3 2026, reflecting a 40 basis point improvement year-over-year due to disciplined cost management and a shift towards higher-value products and services.

- For fiscal year 2026, Flex updated its guidance, projecting revenue between $27.2 billion and $27.5 billion and adjusted EPS between $3.21 and $3.27 per share, with both midpoints increasing from prior guidance.

- Growth was primarily driven by strong performance in data centers, Health Solutions, and Core Industrial, while consumer-related end markets showed softness.

- Flex repurchased approximately $200 million of stock in Q3 2026 and maintained its full-year guidance of 80%+ free cash flow conversion.

- Flex delivered an exceptional third quarter of fiscal 2026, with revenue reaching $7.1 billion, an 8% increase year-over-year, and adjusted EPS of $0.87, up 13%. The adjusted operating margin was 6.5%, marking a 40 basis point improvement year-over-year.

- The company raised its full-year fiscal 2026 guidance, now expecting revenue between $27.2 billion and $27.5 billion and adjusted EPS between $3.21 and $3.27 per share.

- Growth was primarily driven by continued strong performance in data center, industrial, and health solutions businesses, with data center growth specifically fueled by rapidly expanding compute and AI workloads.

- Flex repurchased approximately $200 million of stock, equating to about 3.3 million shares, during the quarter.

- Strategic investments are focused on expanding capacity in both power and compute, particularly for AI-related programs, with embedded power experiencing significant technological shifts.

- Flex reported strong third quarter fiscal 2026 results, with net sales of $7.1 billion, an 8% increase year-over-year, exceeding its guidance.

- For the quarter ended December 31, 2025, the company achieved a record adjusted EPS of $0.87 and a record adjusted operating margin of 6.5%.

- Flex raised its full-year fiscal 2026 guidance, now projecting net sales between $27.2 billion and $27.5 billion and adjusted EPS between $3.21 and $3.27.

- For the fourth quarter of fiscal 2026, the company forecasts net sales of $6.75 billion to $7.05 billion and adjusted EPS of $0.83 to $0.89.

- Flex reported net sales of $7.1 billion, an 8% increase versus the prior year, and adjusted EPS of $0.87 for the third quarter ended December 31, 2025, both exceeding guidance.

- The company achieved a record adjusted operating margin of 6.5% for Q3 FY2026, marking its fifth consecutive quarter with an adjusted operating margin of 6% or greater.

- Flex raised its full-year fiscal 2026 guidance for net sales to $27.2 billion to $27.5 billion, adjusted operating margin to 6.3%, and adjusted EPS to $3.21 to $3.27.

- Agendia announced that its MammaPrint + BluePrint genomic assays are now recognized in the updated NCCN Clinical Practice Guidelines in Oncology to guide personalized anthracycline use in HR+/HER2- early-stage breast cancer patients.

- This update is based on a three-year analysis of outcomes from 1261 HR+/HER2- EBC patients from the prospective, real-world FLEX Study.

- The analysis found that patients with MammaPrint High Risk 2 + BluePrint Luminal B tumors are most likely to benefit from anthracycline-based therapy, showing an absolute benefit of 10.7% in three-year invasive disease-free survival (IDFS) compared to those treated with TC.

- In contrast, patients with High Risk 1 tumors did not show a significant benefit from anthracycline treatment.

- Flex's data center business, encompassing cloud and power solutions, is a primary growth engine, achieving approximately 50% growth last fiscal year and projected 35% plus growth this year. This segment also drives margin expansion, with cloud margins above Flex average and power products in the mid-teens.

- The company has significantly improved its operating margins, reaching approximately 6% in the last four quarters, a year ahead of its May 2024 target, and anticipates further margin expansion, with the data center business being a key contributor.

- Flex is addressing critical data center challenges in power, heat, and scale through innovations such as modular critical power solutions, development of 800-volt architectures (including a partnership with NVIDIA), and proprietary JetCool technology for advanced chip cooling.

- Beyond data centers, Flex is pursuing growth in digital infrastructure, automation, medical devices (e.g., continuous glucose monitors, GLP-1 opportunities), and automotive (centralized compute platforms for software-defined vehicles and power platforms).

- Flex's data center business, which includes cloud and power segments, grew 50% in the last fiscal year and is projected to grow 35%+ this year. This segment is a significant contributor to margin expansion, with cloud business margins exceeding the company average and power products achieving mid-teen margins.

- The company has successfully improved its operating margins, reaching approximately 6% in the last four quarters, which is a year ahead of its May 2024 target, and anticipates further margin expansion beyond this level.

- Flex is strategically addressing power, heat, and scale challenges in data centers through innovations such as modular critical power solutions, enabling one-megawatt racks on 800-volt architectures (including a partnership with NVIDIA), and proprietary JetCool technology for targeted chip cooling.

- The company leverages its vertically integrated rack integration capabilities and its role in manufacturing complex accelerator hardware for custom ASICs, utilizing its EMS, products, and services strategy to achieve higher margins.

- Beyond data centers, Flex is pursuing growth opportunities in digital infrastructure (high-speed networking, satellite communications), industrial automation, medical devices (e.g., continuous glucose monitors), and long-term automotive trends such as software-defined vehicles and power platforms.

- Flex Ltd. is a contract manufacturing company with approximately $26 billion in revenue.

- The company's AI data center utility space accounts for 25% of its business and is growing at 35%, with projected revenue of $6.5 billion for fiscal year 2025.

- Flex has significantly improved its operating margin from 3% to 6% over the past seven years, with expectations for continued expansion driven by mix shift towards high-growth areas like data centers and AI-driven productivity enhancements.

- Strategic acquisitions, such as Crown Technical Systems for utility presence and power pods, and JetCool for liquid cooling, are expanding Flex's integrated data center solutions.

- The company is experiencing substantial benefits from AI CapEx investments, with its data center business showing rapid growth and significant capacity investments in North America and Europe.

Quarterly earnings call transcripts for FLEX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more