Earnings summaries and quarterly performance for FIRSTSUN CAPITAL BANCORP.

Executive leadership at FIRSTSUN CAPITAL BANCORP.

Neal E. Arnold

Chief Executive Officer and President; Chief Operating Officer (FirstSun)

Jennifer L. Norris

Executive Vice President and Chief Credit Officer; Chief Operating Officer (Sunflower Bank)

Laura J. Frazier

Executive Vice President and Chief Administrative Officer

Mollie H. Carter

Executive Chair

Robert A. Cafera, Jr.

Senior Executive Vice President and Chief Financial Officer

Board of directors at FIRSTSUN CAPITAL BANCORP.

Research analysts who have asked questions during FIRSTSUN CAPITAL BANCORP earnings calls.

Matthew Clark

Piper Sandler

8 questions for FSUN

Matt Olney

Stephens Inc.

7 questions for FSUN

Michael Rose

Raymond James Financial, Inc.

7 questions for FSUN

Woody Lay

Keefe, Bruyette & Woods (KBW)

7 questions for FSUN

Timothy Mitchell

Raymond James

1 question for FSUN

Wood Lay

Keefe, Bruyette & Woods

1 question for FSUN

Recent press releases and 8-K filings for FSUN.

- FirstSun Capital Bancorp held a special meeting of stockholders on February 27, 2026, where a quorum representing over 89% of outstanding shares was present.

- Stockholders approved the proposal to adopt the Agreement and Plan of Merger, dated October 27, 2025, with First Foundation Inc., which will result in First Foundation merging into FirstSun.

- Additionally, stockholders approved an amendment to FirstSun's certificate of incorporation to increase the number of authorized shares of common stock and to create a class of non-voting common stock.

- FirstSun Capital Bancorp held a special meeting of stockholders on February 27, 2026, where a quorum was present with over 89% of outstanding shares represented.

- Stockholders approved the Agreement and Plan of Merger, dated October 27, 2025, under which First Foundation Inc. will merge with and into FirstSun.

- In conjunction with the merger, stockholders also approved an amendment to increase the number of authorized shares of FirstSun common stock and the creation of a new class of non-voting common stock.

- All key proposals related to the merger and share structure amendments were approved, leading to the withdrawal of the adjournment proposal.

- FirstSun Capital Bancorp held a special meeting of stockholders on February 27, 2026, to vote on proposals related to its merger with First Foundation Inc..

- Stockholders approved the Agreement and Plan of Merger with First Foundation Inc., under which First Foundation will merge into FirstSun.

- Additionally, stockholders approved an amendment to increase the number of authorized shares of FirstSun common stock and the creation of a class of non-voting common stock for issuance in connection with the merger.

- FirstSun Capital Bancorp and First Foundation Inc. jointly announced receipt of regulatory approval from the Office of the Comptroller of the Currency for the merger of their bank subsidiaries, Sunflower Bank, N.A. and First Foundation Bank.

- The completion of the merger of First Foundation with FirstSun remains subject to regulatory approval from the Board of Governors of the Federal Reserve System and stockholder approvals at meetings scheduled for February 27, 2026.

- The merger is currently expected to be completed early in the second quarter of 2026.

- As of December 31, 2025, FirstSun had total consolidated assets of $8.5 billion.

- Halper Sadeh LLC, an investor rights law firm, is investigating FirstSun Capital Bancorp (FSUN) for potential violations of federal securities laws and/or breaches of fiduciary duties to shareholders concerning its merger with First Foundation Inc..

- Upon completion of the proposed transaction, FirstSun shareholders are projected to own 59.5% of the combined company.

- The firm suggests that insiders may receive substantial financial benefits not available to ordinary shareholders, and the proposed transaction terms could limit superior competing offers.

- FirstSun Capital Bancorp and First Foundation Inc. entered into Amendment No. 1 to their Merger Agreement on February 6, 2026, modifying terms related to the non-voting common stock.

- The amendment removes the previous restriction that prevented holders of non-voting common stock from converting shares into common stock if it would result in owning more than 4.99% of FirstSun's voting securities.

- Conversion of non-voting common stock into common stock is now permitted at the holder's election if a "Diluting Action" by FirstSun reduces the holder's percentage ownership of voting securities, provided the conversion does not lead to a greater percentage of voting securities than held immediately prior to the action.

- The amendment does not alter the merger consideration, exchange ratio, voting mechanics, or any other economic terms of the Merger Agreement.

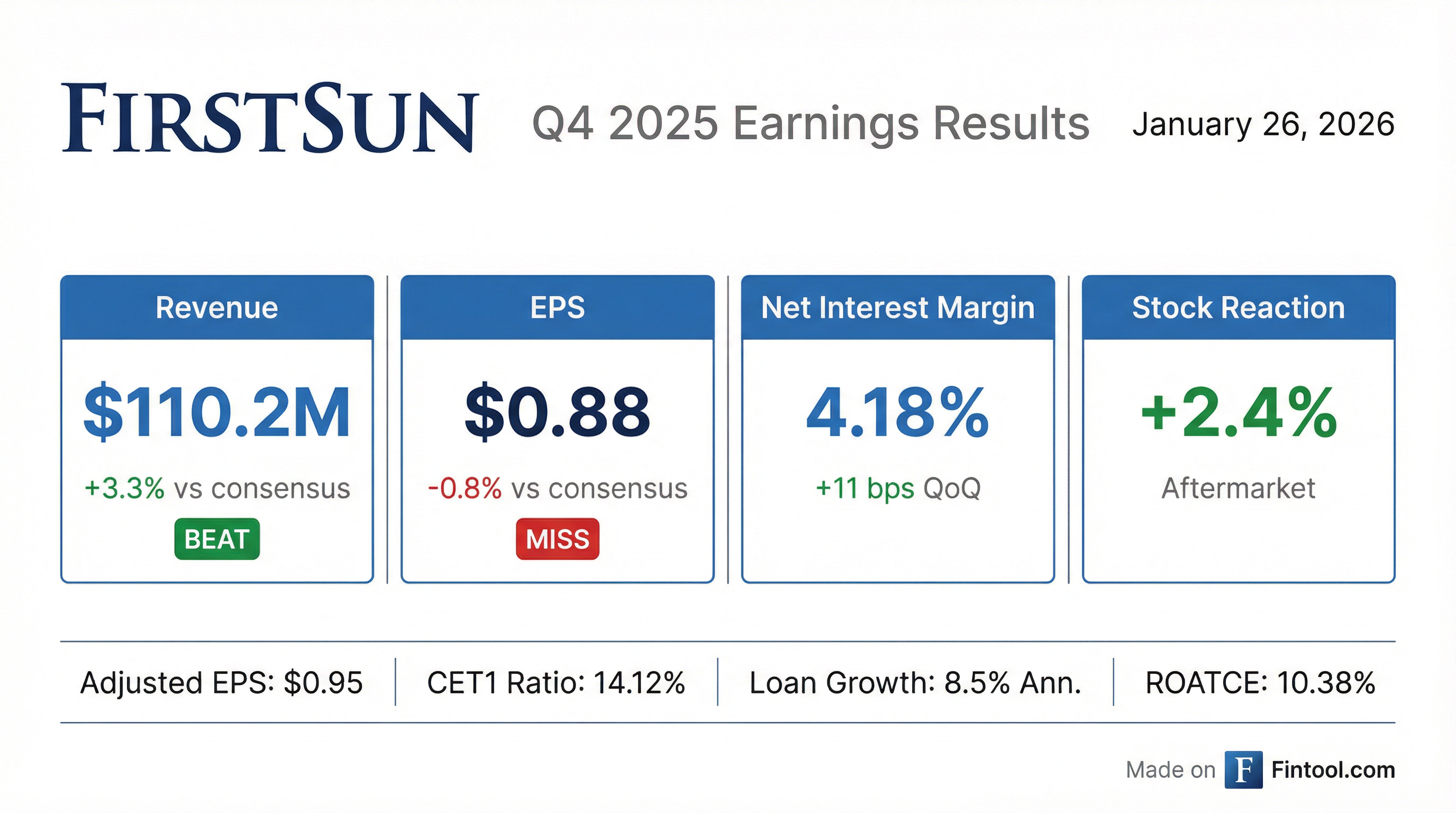

- FirstSun Capital Bancorp reported strong Q4 2025 results, with adjusted diluted EPS of $0.95 and an adjusted ROA of 1.27%, driven by 10.8% annualized revenue growth and a net interest margin of 4.18%.

- For the full year 2025, the company achieved 7% net interest income growth and 13% non-interest revenue growth, contributing to $11.5 million of positive adjusted operating leverage.

- The company provided a standalone outlook for 2026, projecting mid-single digit growth in loans, deposits, and net interest income, with non-interest revenue growth in the low double-digit to low teens range, and a stable net interest margin.

- FirstSun is progressing with its pending merger with First Foundation, having filed a definitive joint proxy statement on January 15, 2026, and expects the combined entity's loan-to-deposit ratio to be in the mid-80s range.

- FSUN reported net income of $24.8 million and diluted EPS of $0.88 for Q4 2025.

- For the full year 2025, total revenue increased by 8.4% to $419.3 million, and diluted EPS grew by 29.0% over 2024 to $3.47.

- The company maintained a strong Net Interest Margin (NIM) of 4.18% in Q4 2025 and ended the year with robust capital ratios, including a CET1 ratio of 14.12% and a Total Capital Ratio of 15.73%.

- FSUN provided a positive outlook for 2026, projecting mid-single-digit growth rates for average loans, average deposits, and net interest income, along with low double-digit to low teens growth for noninterest income, assuming two Fed 25bps rate cuts and stable NIM.

- FirstSun Capital Bancorp reported adjusted diluted EPS of $0.95 and adjusted net income of $26.9 million for Q4 2025, with revenue growth up 10.8% annualized and net interest margin at a strong 4.18%.

- For the full year 2025, the company achieved 7% net interest income growth and 13% non-interest revenue growth over 2024.

- The company expects mid-single digit net interest income growth and a stable net interest margin for 2026 on a standalone basis, alongside low double-digit to low teens non-interest revenue growth.

- Asset quality in Q4 2025 showed an allowance for credit losses as a percentage of loans at 1.27%, and the full-year charge-off ratio was 43 basis points, primarily driven by two loans.

- Progress continues on the pending merger with First Foundation, with a definitive joint proxy statement filed on January 15th, 2026, and teams are making strides in integration planning and balance sheet optimization.

- FirstSun Capital Bancorp reported strong Q4 2025 adjusted net income of $26.9 million and adjusted diluted EPS of $0.95, alongside an adjusted return on assets of 1.27%.

- The company achieved 10.8% annualized revenue growth and a net interest margin of 4.18% in Q4 2025, while full-year 2025 saw 7% net interest income growth and 13% non-interest revenue growth.

- For the full year 2025, loans grew by almost 5% and total deposits increased by approximately 6.5%, with a year-end loan-to-deposit ratio of 93.9%. The capital position strengthened, with TBV per share improving by 11.5% to $37.83 and a CET1 ratio of 14.12%.

- FirstSun provided a 2026 outlook (standalone basis), projecting mid-single digit growth in average balance loans and deposits, mid-single digit net interest income growth with stable NIM, and low double-digit to low teens non-interest revenue growth. The pending merger with First Foundation is progressing, with a definitive joint proxy statement filed on January 15, 2026.

Quarterly earnings call transcripts for FIRSTSUN CAPITAL BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more