Earnings summaries and quarterly performance for FIRST NATIONAL CORP /VA/.

Executive leadership at FIRST NATIONAL CORP /VA/.

Board of directors at FIRST NATIONAL CORP /VA/.

BB

Boyce Brannock

Detailed

Director

EH

Elizabeth H. Cottrell

Detailed

Chair of the Board

EM

Emily Marlow Beck

Detailed

Director

GE

George Edwin Holt, III

Detailed

Director

GF

Gerald F. Smith, Jr.

Detailed

Vice Chairman and Secretary

JR

James R. Wilkins, III

Detailed

Director

JC

Jason C. Aikens

Detailed

Director

KP

Kirtesh Patel

Detailed

Director

ND

Norman D. Wagstaff, Jr.

Detailed

Director

TT

Toni T. Lee-Andrews

Detailed

Director

WM

W. Michael Funk

Detailed

Director

WS

William S. Wilkinson

Detailed

Director

Research analysts covering FIRST NATIONAL CORP /VA/.

Recent press releases and 8-K filings for FXNC.

First National Bank Alaska announces unaudited results for fourth quarter 2025

FXNC

Earnings

Dividends

Revenue Acceleration/Inflection

- First National Bank Alaska reported net income of $20.1 million for the fourth quarter of 2025, slightly up from $20.0 million in the same period of 2024, contributing to a record annual net income of $77.5 million for 2025.

- Total assets reached $5.1 billion as of December 31, 2025, an increase of $102.2 million compared to the same period in 2024, driven by record annual loan growth with total loans at $2.7 billion.

- Key profitability metrics improved, with Return on Assets (ROA) increasing to 1.53% and Net Interest Margin (NIM) rising to 3.82% as of December 31, 2025, compared to 1.22% and 3.12% respectively in the prior year.

- The bank demonstrated strong operational efficiency with an efficiency ratio of 49.86% as of December 31, 2025, down from 53.51% in the prior year.

Feb 4, 2026, 12:15 AM

First National Corporation Reports Record Q4 and Annual 2025 Earnings

FXNC

Earnings

Dividends

Asset Quality

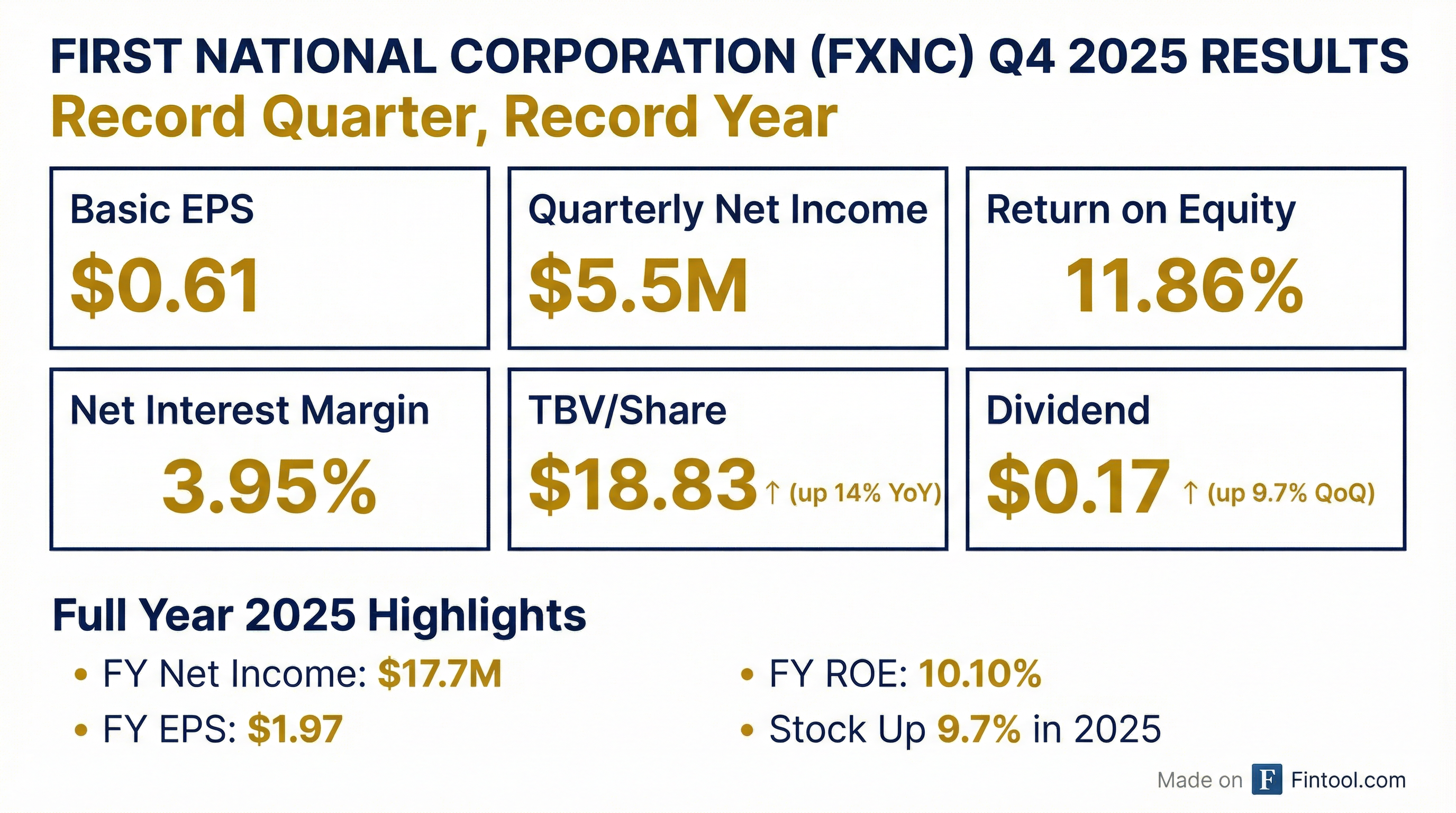

- First National Corporation reported record fourth quarter and annual 2025 earnings, with consolidated net income of $5.5 million and basic and diluted earnings per common share of $0.61 for Q4 2025, and $17.7 million and $1.97 (basic) / $1.96 (diluted) respectively for the full year 2025.

- The company's profitability metrics improved, with a return on average assets of 1.06% and a return on average equity of 11.86% for Q4 2025, alongside a net interest margin (FTE) of 3.95%, which increased from 3.84% in the prior quarter.

- Asset quality significantly improved, as non-performing assets (NPAs) declined to 0.32% of total loans on December 31, 2025, down from 0.40% in the previous quarter and 0.48% a year prior.

- Shareholder returns were boosted by an increased quarterly dividend of $0.17 per common share in Q4 2025, representing a 9.7% increase from the prior quarter, and a 14% growth in tangible book value per share to $18.83 at year-end 2025.

- The company achieved loan growth of $16.3 million in Q4 2025, reflecting a 4.6% annualized growth rate.

Jan 29, 2026, 3:20 PM

First National Corporation Reports Record Fourth Quarter and Annual 2025 Earnings

FXNC

Earnings

Dividends

M&A

- First National Corporation reported consolidated net income of $5.5 million and basic earnings per common share of $0.61 for the fourth quarter of 2025.

- For the full year ended December 31, 2025, the company achieved record consolidated earnings of $17.7 million and basic earnings per common share of $1.97.

- The company increased its quarterly dividend by 9.7% in the fourth quarter of 2025 and grew its tangible book value per share by 14% for the year, reaching $18.83 at December 31, 2025.

- Asset quality improved, with non-performing assets declining to 0.32% of total loans on December 31, 2025.

Jan 29, 2026, 1:30 PM

Fancamp Exploration Ltd. Achieves ECOLOGO Certification and Reports 2025 Strategic Progress

FXNC

New Projects/Investments

Share Buyback

- Fancamp Exploration Ltd. (Fancamp) has been awarded ECOLOGO® Certification for Responsible Development for Mineral Exploration Industry by UL Solutions, confirming its commitment to best practices in environmental, social, and commercial areas.

- This certification represents the first comprehensive third-party validation for Canadian Mineral Exploration Companies, confirming Fancamp's disciplined environmental and social stewardship.

- In 2025, Fancamp initiated a strategic refocus, including the spin-out of core exploration assets into Goldera Exploration Ltd., and launched a Normal-Course Issuer Bid to repurchase up to 5% of its shares.

- The company's stock increased 100% during 2025, indicating strong market support for its strategic progress.

Jan 13, 2026, 12:45 PM

First National Corporation Increases Quarterly Cash Dividends

FXNC

Dividends

- First National Corporation (FXNC) announced a quarterly cash dividend of $0.17 per share.

- This dividend reflects a 9.7% increase from the previous quarterly payment of $0.155 per share.

- The dividend is scheduled to be paid on December 12, 2025, to shareholders of record as of November 28, 2025.

- The company has increased its annual cash dividend payout every year for the past ten years.

Nov 13, 2025, 3:00 PM

First National Bank Alaska Announces Q3 2025 Results

FXNC

Earnings

Dividends

Revenue Acceleration/Inflection

- First National Bank Alaska reported net income of $21.4 million and $6.75 per share for the third quarter of 2025, an increase from $18.0 million and $5.68 per share for the same period in 2024.

- Total assets increased to $5.2 billion as of September 30, 2025, representing a year-to-date increase of $246.2 million. Total loans reached $2.6 billion as of September 30, 2025, an increase of $145.1 million compared to September 30, 2024.

- The bank's Return on Assets increased to 1.53% and Return on Equity improved to 14.13% as of September 30, 2025. Net interest margin also rose to 3.76% through September 30, 2025, compared to 3.04% for the same period in 2024.

- Shareholders' equity reached $567.7 million as of September 30, 2025, up from $527.9 million a year prior, with book value per share increasing to $179.27.

Nov 4, 2025, 11:12 PM

First National Corporation Reports Record Third Quarter 2025 Earnings

FXNC

Earnings

M&A

Dividends

- First National Corporation reported record earnings of $5.55 million for the third quarter of 2025, with basic and diluted earnings per common share of $0.62. This represents an 11% increase from the previous quarter and a 72% increase from one year prior.

- The company's profitability ratios improved, with return on average assets at 1.09% and return on average equity at 12.43% for Q3 2025.

- Net loans held for investment increased 44.5% to $1.419 billion and total deposits grew 44.4% to $1.810 billion from one year prior, primarily due to the Touchstone acquisition.

- Asset quality improved, with non-performing assets declining to 0.28% of total assets as of September 30, 2025.

Oct 30, 2025, 5:10 PM

First National Corporation Reports Record Third Quarter 2025 Earnings

FXNC

Earnings

Dividends

M&A

- First National Corporation reported record earnings of $5.55 million and basic and diluted earnings per common share of $0.62 for the third quarter ended September 30, 2025. This represents an 11% increase in EPS from the previous period and a 72% increase from one year prior.

- The company achieved a return on average assets of 1.09% and a return on average equity of 12.43% for Q3 2025. The net interest margin (FTE) was 3.84%, up 12.2% from one year prior.

- Net loans held for investment grew to $1.419 billion, an increase of 44.5% from one year prior, and total deposits reached $1.810 billion, up 44.4% from one year prior, as of September 30, 2025, partly attributed to the Touchstone acquisition.

- Asset quality improved, with non-performing assets declining to 0.28% of total assets on September 30, 2025, compared to 0.33% in the previous period and 0.41% one year prior.

- The company maintained a strong capital position, reporting a total risk-based capital ratio of 15.15% and a tangible book value per share of $18.26 as of September 30, 2025. A cash dividend of $0.155 per common share was declared and paid during the quarter.

Oct 30, 2025, 11:30 AM

Quarterly earnings call transcripts for FIRST NATIONAL CORP /VA/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more