Earnings summaries and quarterly performance for GLADSTONE INVESTMENT CORPORATION\DE.

Executive leadership at GLADSTONE INVESTMENT CORPORATION\DE.

Board of directors at GLADSTONE INVESTMENT CORPORATION\DE.

Research analysts who have asked questions during GLADSTONE INVESTMENT CORPORATION\DE earnings calls.

Mickey Schleien

Ladenburg Thalmann

5 questions for GAIN

Christopher Nolan

Ladenburg Thalmann

2 questions for GAIN

Erik Zwick

Lucid Capital Markets

2 questions for GAIN

Justin (on behalf of Alex Scott)

Barclays

2 questions for GAIN

Bryce Rowe

B. Riley Securities

1 question for GAIN

Matthew Hewitt

Craig-Hallum Capital Group LLC

1 question for GAIN

Matthew Hurwit

Jefferies

1 question for GAIN

Sean-Paul Adams

Not Provided in Transcript

1 question for GAIN

Recent press releases and 8-K filings for GAIN.

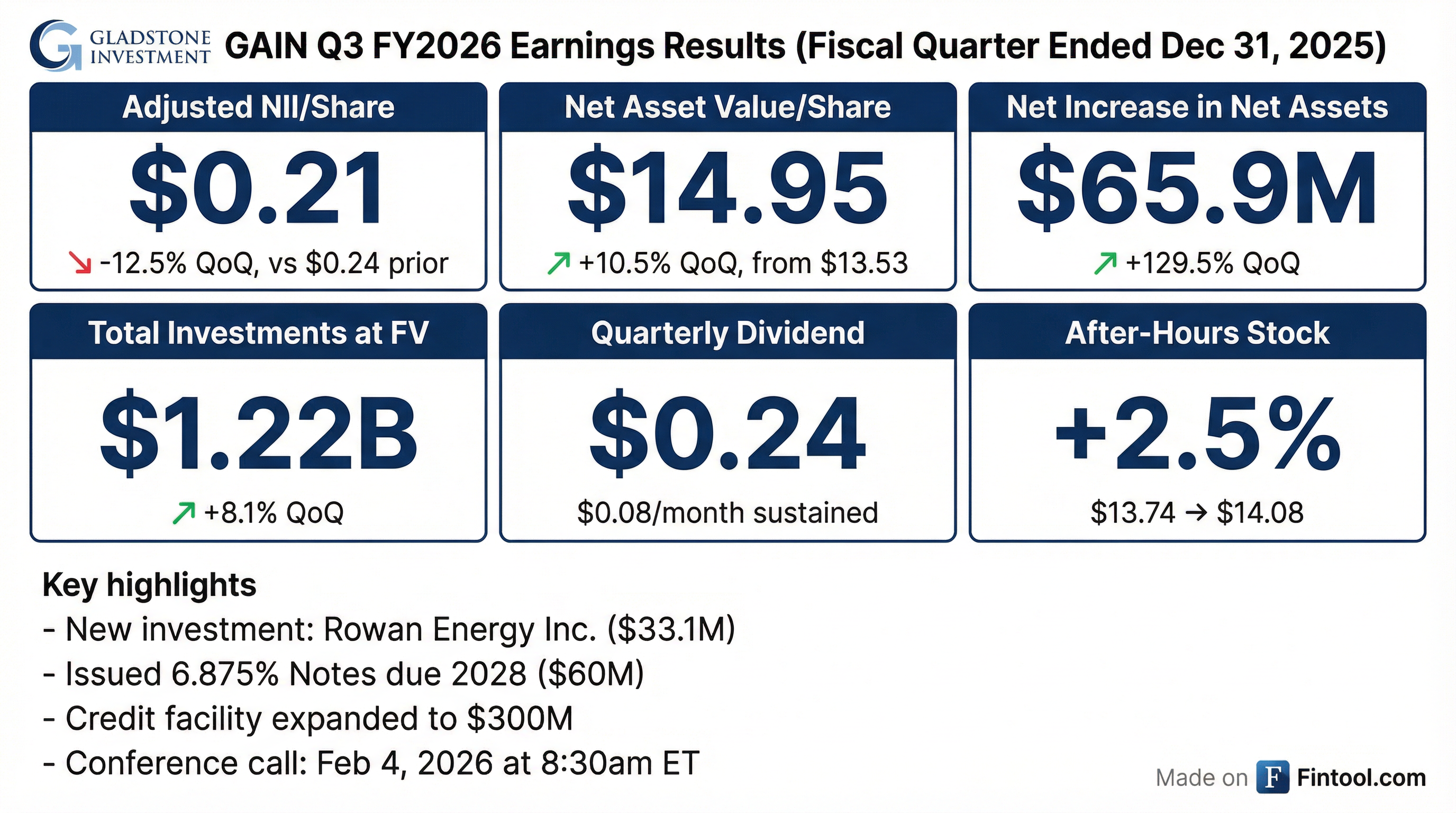

- Gladstone Investment reported adjusted net investment income (NII) of $0.21 per share and total assets of $1.2 billion for the third quarter of fiscal year 2026, ending December 31, 2025.

- The company's net asset value (NAV) increased to $14.95 per share from $13.53 per share in the prior quarter, primarily driven by $1.77 per share of net unrealized appreciation.

- GAIN maintained its monthly distribution to shareholders of $0.08 per share and reported an estimated spillover of approximately $22.9 million, or $0.58 per share, as of December 31, 2025.

- Strategic debt management included redeeming $74.8 million of 8% notes and issuing $60 million of 6.875% notes, reducing the interest burden by 110 basis points, and expanding its credit facility to a total commitment level of $300 million.

- The company invested approximately $163 million in 4 new portfolio companies during the first nine months of fiscal year 2026 and continues to have a healthy pipeline for new acquisitions.

- For the third quarter of fiscal year 2026, Gladstone Investment (GAIN) reported adjusted net investment income (NII) of $0.21 per share, while experiencing a GAAP net investment loss of $6.5 million primarily due to a $9.9 million increase in capital gains-based incentive fees.

- The company's net asset value (NAV) increased to $14.95 per share as of December 31, 2025, up from $13.53 per share in the prior quarter, driven by $70.2 million in unrealized appreciation of its investment portfolio.

- Total assets grew to approximately $1.2 billion, and GAIN invested $163 million in four new portfolio companies during the first nine months of fiscal year 2026.

- GAIN maintained its monthly distribution to shareholders of $0.08 per share and reported an estimated spillover of $22.9 million, or $0.58 per share, as of December 31, 2025, with expectations for supplemental distributions to continue.

- The company strengthened its balance sheet by redeeming $74.8 million of 8% notes and issuing $60 million of 6.875% notes, which reduced its interest burden, and expanded its credit facility to a total commitment level of $300 million.

- Gladstone Investment Corporation reported a net investment loss of $(6.5) million, or $(0.16) per weighted-average common share, for the quarter ended December 31, 2025, primarily due to an increase in total expenses, net, driven by $9.9 million in accruals for capital gains-based incentive fees.

- Net asset value per common share increased to $14.95 as of December 31, 2025, up from $13.53 as of September 30, 2025, largely due to $70.2 million in net unrealized appreciation of investments.

- The company paid $0.08 per common share distribution in October, November, and December 2025, and declared $0.08 per common share for January, February, and March 2026.

- Financing activities included issuing $60.0 million of 6.875% Notes due 2028 and increasing the credit facility from $270.0 million to $300.0 million. The company also invested $33.1 million in a new portfolio company, Rowan Energy Inc..

- Gladstone Investment Corporation (GAIN) reported adjusted net investment income of $0.24 per share for the second quarter of fiscal year 2026, which was sufficient to cover its monthly distributions to shareholders.

- Total assets increased by $90 million from the prior quarter to $1.1 billion, and Net Asset Value (NAV) per share rose to $13.53 from $12.99.

- The company invested approximately $130 million in three new portfolio companies during the first six months of fiscal year 2026 and maintains a healthy pipeline for new acquisitions.

- Liquidity remains strong with $174 million in availability under its credit facility and an asset coverage ratio of 193% as of September 30, 2025.

- GAIN successfully restructured its investment in JR Hobbs, reducing the number of portfolio companies on non-accrual status from four to three, with non-accrual investments now representing 3.9% of the total portfolio at cost.

- Gladstone Investment Corporation reported net investment income of $4.3 million ($0.11 per weighted-average common share) for the second fiscal quarter ended September 30, 2025, a decrease from the prior quarter, while Adjusted net investment income per weighted-average common share remained stable at $0.24 for both quarters.

- Net asset value per common share increased to $13.53 as of September 30, 2025, up from $12.99 as of June 30, 2025, primarily driven by $54.5 million in net unrealized appreciation of investments.

- During the quarter ended September 30, 2025, the company invested $67.6 million in Global GRAB Technologies, Inc. and recognized a $29.9 million realized loss from the restructuring of a loan with J.R. Hobbs Co. - Atlanta, LLC.

- The company paid $0.08 per common share in monthly distributions for July, August, and September 2025, and declared the same amount for October, November, and December 2025.

Quarterly earnings call transcripts for GLADSTONE INVESTMENT CORPORATION\DE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more