Earnings summaries and quarterly performance for Gen Digital.

Executive leadership at Gen Digital.

Board of directors at Gen Digital.

Research analysts who have asked questions during Gen Digital earnings calls.

Saket Kalia

Barclays Capital

9 questions for GEN

Roger Boyd

UBS

8 questions for GEN

Dan Bergstrom

RBC Capital Markets

6 questions for GEN

Andrew Nowinski

Wells Fargo

5 questions for GEN

Tomer Zilberman

Bank of America

5 questions for GEN

Joseph Gallo

Jefferies & Company Inc.

4 questions for GEN

Meta Marshall

Morgan Stanley

4 questions for GEN

Robert Coolbrith

Evercore ISI

4 questions for GEN

Hamza Fodderwala

Morgan Stanley

2 questions for GEN

Matt Hedberg

RBC

2 questions for GEN

Robert Ottenstein

Evercore ISI

2 questions for GEN

Matthew Hedberg

RBC Capital Markets

1 question for GEN

Peter Levine

Evercore ISI

1 question for GEN

Recent press releases and 8-K filings for GEN.

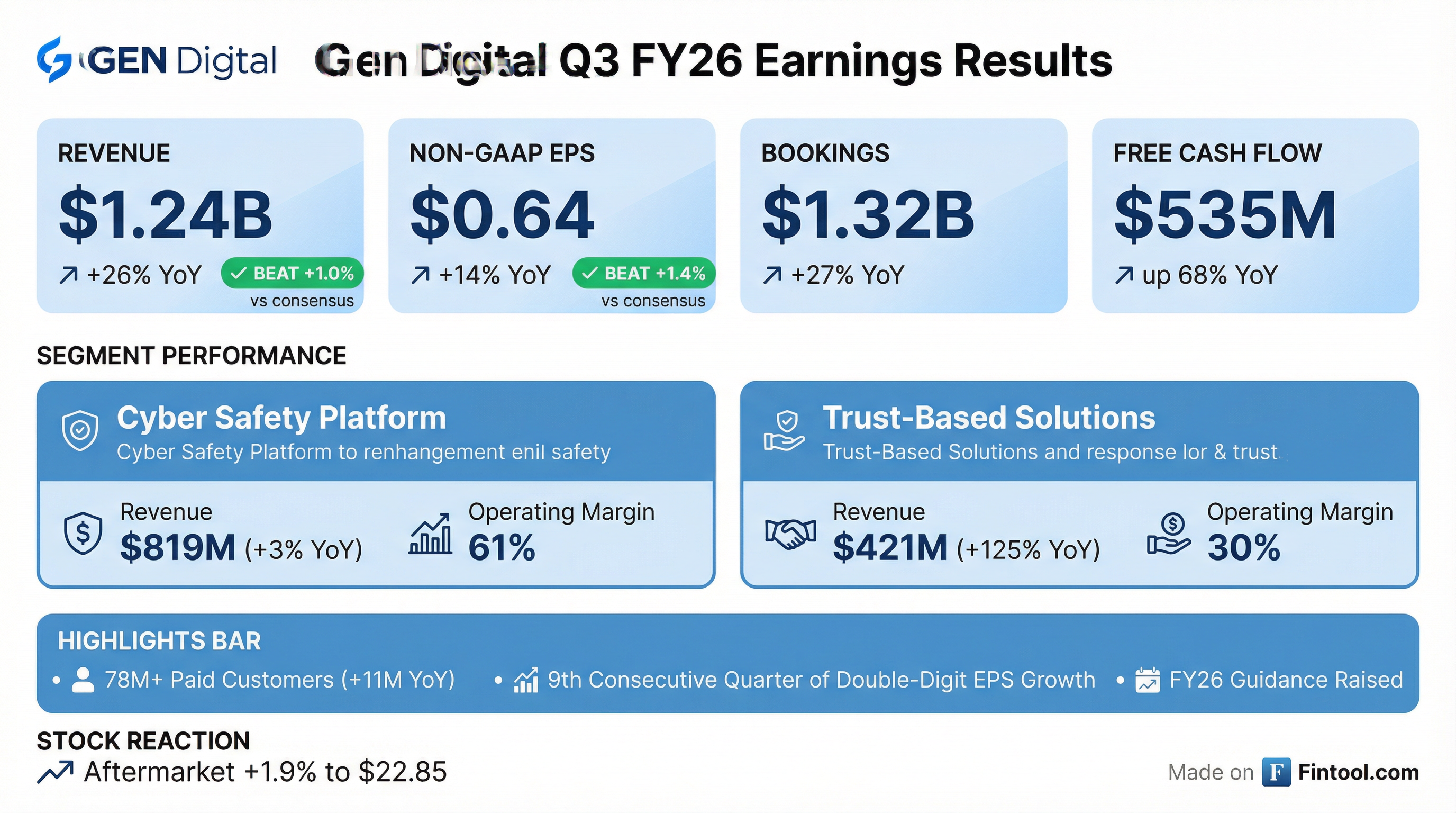

- Strong financial performance with $1.3 billion bookings (+27% yoy), $1.2 billion revenue (+26% yoy), non-GAAP EPS of $0.64 (+14% yoy) and a 51% operating margin.

- Segment growth: Cyber safety bookings +5% and revenue +3% (61% op margin); trust-based solutions bookings +23% and revenue +22% pro forma, driven by nearly 40% revenue growth at MoneyLion.

- Platform & product innovation: Introduced beta Agent Trust Hub and Norton Neo safe AI browser, and launched MoneyOne financial subscription in closed beta.

- Robust cash flow & returns: Generated $535 million free cash flow; deployed $300 million to share repurchases, $300 million to debt repayment, paid $77 million in dividends, reducing net leverage to 3.1× EBITDA.

- Bookings grew 27% Y/Y to $1,319 M; Revenue rose 26% Y/Y to $1,240 M; EPS reached $0.64 (+14% Y/Y)

- Cyber Safety Platform revenue of $819 M (+3% Y/Y) with a 61% operating margin; Trust-Based Solutions revenue jumped 125% Y/Y to $421 M

- Paid customers increased 11% Y/Y to 78 M; Direct revenue up 18% Y/Y to $1,025 M; Partner revenue up 87% Y/Y to $215 M

- Operating cash flow of $541 M and free cash flow of $535 M; ~$0.7 B allocated to share repurchases, debt paydown, and dividends

- Raised FY26 non-GAAP guidance to $4.955–4.975 B revenue (+26% Y/Y) and $2.54–2.56 EPS (+14–15% Y/Y)

- Gen Digital reported Q3 bookings of $1.3 billion (+27% YoY, +10% pro forma) and revenue of $1.2 billion (+26% YoY, +8% pro forma).

- Operating income was $629 million, for a 51% operating margin; net income was $394 million and diluted EPS was $0.64 (+14% YoY).

- Generated $541 million in operating cash flow and $535 million in free cash flow, exited with $619 million cash (>$2.1 billion liquidity) and net leverage of 3.1× EBITDA.

- Returned nearly $700 million to shareholders: $300 million for share repurchases (11 million shares), $300 million debt repayment, and $77 million dividend; Q4 dividend at $0.125 per share.

- Raised FY 2026 guidance: revenue to $4.955–4.975 billion and non-GAAP EPS to $2.54–2.56; Q4 revenue of $1.24–1.26 billion and EPS of $0.64–0.66.

- Delivered $1.3 billion in bookings (+27% YoY) and $1.2 billion in revenue (+26% YoY); non-GAAP EPS of $0.64 (+14% YoY) and $535 million free cash flow in Q3 2026.

- Cyber safety segment bookings grew 5% with revenue up 3% and 61% operating margin; trust-based solutions saw MoneyLion revenue rise 40%, with pro forma segment bookings +23%.

- Paid customer base reached 78 million users, up 1 million sequentially, reinforcing broad subscription adoption.

- Raised full-year 2026 guidance to $4.955 billion–$4.975 billion in revenue and $2.54–$2.56 in non-GAAP EPS; Q4 guidance set at $1.24 billion–$1.26 billion revenue and $0.64–$0.66 EPS.

- Returned capital via $300 million share repurchases, $300 million debt paydown, and a $0.125 per-share quarterly dividend; net leverage improved to 3.1× EBITDA.

- Gen Digital reported Q3 FY26 GAAP revenue of $1.24 billion (up 26%), operating income of $433 million (up 16%), and diluted EPS of $0.31 (up 22%).

- Q3 non-GAAP results included bookings of $1.319 billion (up 27%), non-GAAP operating income of $629 million (up 9%), and non-GAAP EPS of $0.64 (up 14%).

- The company raised Q4 FY26 revenue guidance to $1.24–1.26 billion and EPS guidance to $0.64–0.66; FY26 revenue is now expected at $4.955–4.975 billion and EPS at $2.54–2.56.

- Declared a quarterly cash dividend of $0.125 per share, payable March 11, 2026, to shareholders of record as of February 16, 2026.

- Gen Digital reported Q3 FY26 GAAP revenue of $1.24 billion, operating income of $433 million and diluted EPS of $0.31, up 26%, 16% and 22% year-over-year, respectively.

- The company generated year-to-date operating cash flow of $1.066 billion, up 43%, and non-GAAP free cash flow of $1.047 billion, up 42%.

- Gen raised its FY26 non-GAAP revenue guidance to $4.955 billion–$4.975 billion (from $4.920 billion–$4.970 billion) and EPS guidance to $2.54–$2.56, and expects Q4 revenue of $1.24 billion–$1.26 billion with EPS of $0.64–$0.66.

- The board approved a quarterly dividend of $0.125 per share payable March 11, 2026, and returned nearly $700 million of capital to shareholders during the quarter.

- Gen Digital and Equifax announced an expanded strategic partnership to integrate Equifax’s differentiated consumer financial and fraud data with Gen’s AI-powered Engine platform, enhancing identity protection and financial wellness solutions.

- Gen will leverage Equifax data to strengthen offerings across its brands—including Norton, Avast, LifeLock, and MoneyLion—by improving AI-driven portfolio insights.

- Equifax will adopt Gen’s Engine platform to deliver personalized financial product recommendations to myEquifax customers in the U.S..

- Gen’s consumer brands serve nearly 500 million users in over 150 countries, while Equifax employs approximately 15,000 employees across 24 countries.

- Gen launched the Gen Agent Trust Hub, a security platform for safer autonomous AI agent adoption in response to rising risks in the AI Agentic Era.

- Gen Threat Labs found over 18,000 OpenClaw instances exposed to the internet and nearly 15% of skills containing malicious instructions, highlighting urgent security gaps.

- The hub includes a free AI Skills Scanner to detect hidden threats in agent skills and an AI Skills Marketplace of rigorously vetted skills to ensure safe deployments.

- Gen Digital is the leader in consumer cybersafety with 77 million paid customers and 200 million active users across Norton, Avast, LifeLock and Moneyline.

- In Q2, bookings and revenue grew 25–27%, marking eight consecutive quarters of double-digit EPS growth and 4–5% core business growth over four quarters; Moneyline rose nearly 50% in H1.

- The Moneyline acquisition (closed six months ago) combines PFM tools (~60% of segment) and the Engine marketplace (~40%), with the marketplace growing over 50% for three consecutive quarters.

- Moneyline’s operating margin improved from 14–15% pre-acquisition to 20–22%, while Gen Digital generated $200 million of incremental H1 revenue and plans balanced capital allocation—including share buybacks and debt paydown—supporting its 12–15% EPS growth target.

- Gen Digital, provider of consumer cybersafety solutions (brands Norton, Avast, LifeLock), serves 77 million paid customers and 200 million active users, and has expanded into embedded financial wellness via the Moneyline acquisition in June 2025.

- In Q2 FY2025, Gen reported 25–27% year-over-year bookings and revenue growth, marking its eighth consecutive quarter of double-digit EPS growth; core business achieved 4–5% organic growth for four straight quarters despite Moneyline integration.

- Moneyline’s PFM platform and embedded marketplace (“Engine”) have grown over 50% for three consecutive quarters, with the marketplace now representing 60% of its revenue mix; Gen aims to leverage its 77 million customer base for cross-selling.

- Gen expects Moneyline to exit 2025 growing ~30% annually, with continued core growth, strong free cash flow, integration synergies (operating margin improving from ~15% to 20–22%), and opportunistic share buybacks; note an $85 million revenue benefit from an extra fiscal week in FY2025.

Quarterly earnings call transcripts for Gen Digital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more