Earnings summaries and quarterly performance for Gen Digital.

Executive leadership at Gen Digital.

Board of directors at Gen Digital.

Research analysts who have asked questions during Gen Digital earnings calls.

Saket Kalia

Barclays Capital

9 questions for GEN

Roger Boyd

UBS

8 questions for GEN

Dan Bergstrom

RBC Capital Markets

6 questions for GEN

Andrew Nowinski

Wells Fargo

5 questions for GEN

Tomer Zilberman

Bank of America

5 questions for GEN

Joseph Gallo

Jefferies & Company Inc.

4 questions for GEN

Meta Marshall

Morgan Stanley

4 questions for GEN

Robert Coolbrith

Evercore ISI

4 questions for GEN

Hamza Fodderwala

Morgan Stanley

2 questions for GEN

Matt Hedberg

RBC

2 questions for GEN

Robert Ottenstein

Evercore ISI

2 questions for GEN

Matthew Hedberg

RBC Capital Markets

1 question for GEN

Peter Levine

Evercore ISI

1 question for GEN

Recent press releases and 8-K filings for GEN.

- Gen Digital’s MoneyLion acquisition is expanding its financial-wellness platform, with MoneyLion revenues growing 40–50% year-over-year and bank-account connections up 15% in the last quarter as part of cross-sell to Gen’s 200 million users.

- The company is repositioning as an AI-first, agent-centric business, equipping its 5,000 engineers with AI tools to compress prototyping cycles from months to 72 hours and enhance real-time consumer feedback.

- Cyber Safety delivered 61% margins last quarter, while Trust-Based Solutions hold 30% margins; MoneyLion’s segment margin has improved from 15% to 20% through operational efficiencies.

- Management maintains a disciplined M&A approach, prioritizing high-ROIC tuck-ins (e.g., MoneyLion) and balancing organic innovation with opportunistic share buybacks at attractive valuations.

- The partner channel has already hit its $500 million annual revenue target, driven by employee-benefit and telco partnerships that expand global reach with zero CAC to existing users.

- Gen’s MoneyLion acquisition is driving the expansion into financial wellness, with MoneyLion growing at 40%–50% and Cyber Safety users’ bank-account connections up 15% in the latest quarter.

- The company is shifting to an AI-first model—moving from device to user to agent—and now prototypes new features in 72 hours, accelerating product development and real-time consumer feedback.

- Engine by Gen powers a white-label financial marketplace, enabling end-to-end services (e.g., insurance renewals) via partnerships including Equifax, and expanding the ecosystem without building products in-house.

- Gen maintains robust profitability with Cyber Safety margins above 60%, trust-based solutions around 30%, and has lifted MoneyLion margins from 15% to over 20%, while driving double-digit marketing and operational efficiencies.

- A diversified partner channel (employee benefits, telcos, affiliates) has delivered $500 million in annual pro-partner revenue, extending global reach with zero customer-acquisition cost.

- Gen’s Cyber Safety platform reaches 200 M active users and 500 M endpoints, while MoneyLion is growing 40–50% post‐acquisition with bank‐account connections up 15% in the latest quarter.

- The company is transitioning to an AI‐first model—equipping ~5,000 employees with AI tools to prototype solutions in 72 hours, aiming to make AI agents safe and user-friendly.

- Trust-based segment margins are robust: Cyber Safety at 61%, MoneyLion margins improved from 15% to >20%, supported by >$2 B of annual unlevered free cash flow for reinvestment or share buybacks.

- Go-to-market channels, including employee benefits, telcos, and the Engine marketplace, drive diversified growth and cross-sell, achieving $500 M in partner revenue.

- Gen Digital’s acquisition of MoneyLion a year ago is now scaling at 40–50% YoY, leveraging its 200 million active-user base for zero-CAC cross-sell and achieving a 15% increase in connected bank accounts.

- The company is executing an AI-first transformation, shifting from device- to agent-based security, equipping 5,000 engineers with AI tools to deliver new prototypes in 72 hours versus months.

- Its Trust-Based Solutions segment, anchored by MoneyLion, is growing 40–50%, with the PFM Early Wage Access business up 40% QoQ, overall segment margins improving from 15% to >20%, and PFM retention at 60%.

- Gen Digital maintains cybersecurity margins >60%, pursues disciplined capital allocation through high-ROIC M&A, and is prepared for opportunistic share buybacks around $21.

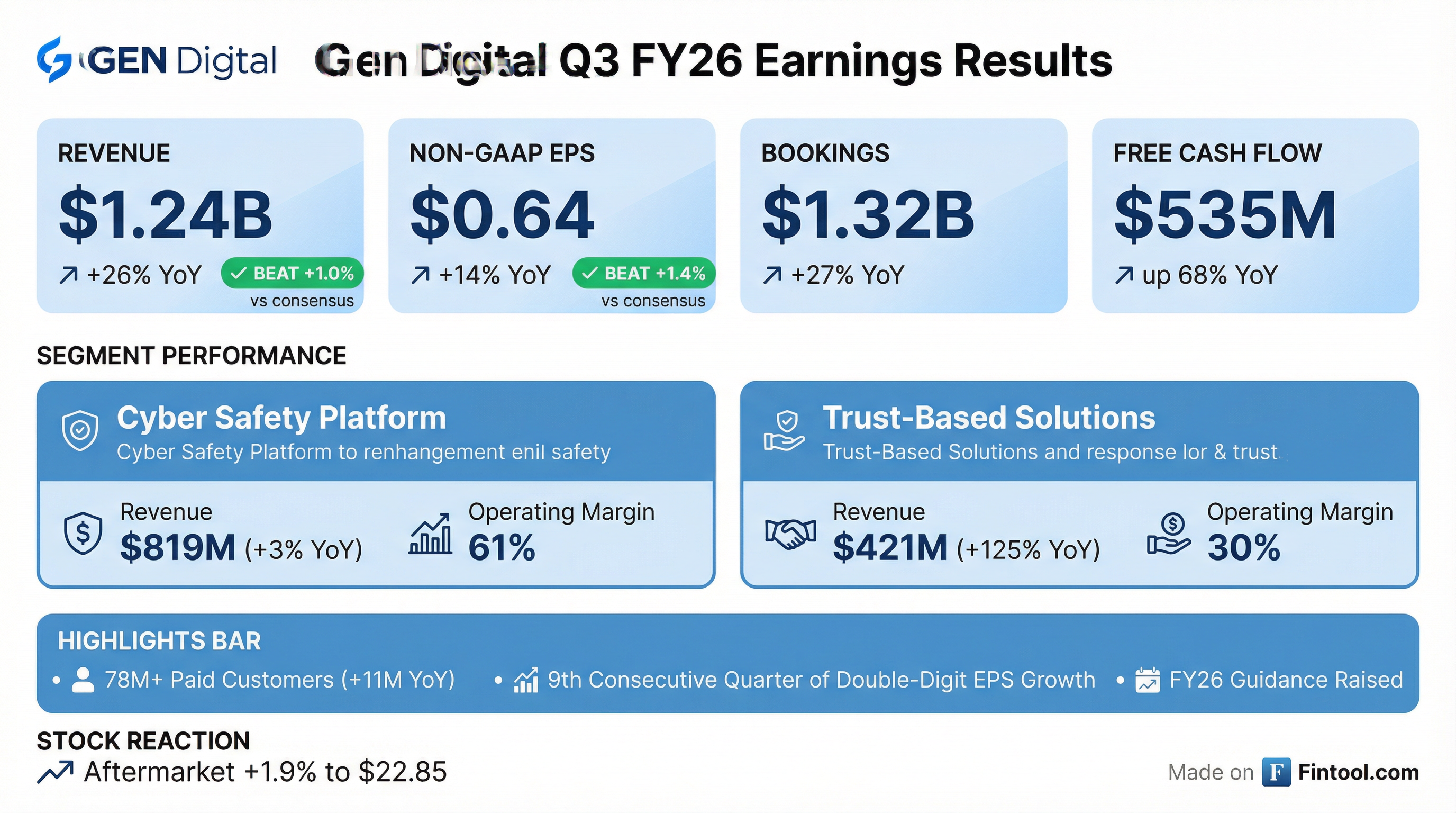

- Strong financial performance with $1.3 billion bookings (+27% yoy), $1.2 billion revenue (+26% yoy), non-GAAP EPS of $0.64 (+14% yoy) and a 51% operating margin.

- Segment growth: Cyber safety bookings +5% and revenue +3% (61% op margin); trust-based solutions bookings +23% and revenue +22% pro forma, driven by nearly 40% revenue growth at MoneyLion.

- Platform & product innovation: Introduced beta Agent Trust Hub and Norton Neo safe AI browser, and launched MoneyOne financial subscription in closed beta.

- Robust cash flow & returns: Generated $535 million free cash flow; deployed $300 million to share repurchases, $300 million to debt repayment, paid $77 million in dividends, reducing net leverage to 3.1× EBITDA.

- Bookings grew 27% Y/Y to $1,319 M; Revenue rose 26% Y/Y to $1,240 M; EPS reached $0.64 (+14% Y/Y)

- Cyber Safety Platform revenue of $819 M (+3% Y/Y) with a 61% operating margin; Trust-Based Solutions revenue jumped 125% Y/Y to $421 M

- Paid customers increased 11% Y/Y to 78 M; Direct revenue up 18% Y/Y to $1,025 M; Partner revenue up 87% Y/Y to $215 M

- Operating cash flow of $541 M and free cash flow of $535 M; ~$0.7 B allocated to share repurchases, debt paydown, and dividends

- Raised FY26 non-GAAP guidance to $4.955–4.975 B revenue (+26% Y/Y) and $2.54–2.56 EPS (+14–15% Y/Y)

- Gen Digital reported Q3 bookings of $1.3 billion (+27% YoY, +10% pro forma) and revenue of $1.2 billion (+26% YoY, +8% pro forma).

- Operating income was $629 million, for a 51% operating margin; net income was $394 million and diluted EPS was $0.64 (+14% YoY).

- Generated $541 million in operating cash flow and $535 million in free cash flow, exited with $619 million cash (>$2.1 billion liquidity) and net leverage of 3.1× EBITDA.

- Returned nearly $700 million to shareholders: $300 million for share repurchases (11 million shares), $300 million debt repayment, and $77 million dividend; Q4 dividend at $0.125 per share.

- Raised FY 2026 guidance: revenue to $4.955–4.975 billion and non-GAAP EPS to $2.54–2.56; Q4 revenue of $1.24–1.26 billion and EPS of $0.64–0.66.

- Delivered $1.3 billion in bookings (+27% YoY) and $1.2 billion in revenue (+26% YoY); non-GAAP EPS of $0.64 (+14% YoY) and $535 million free cash flow in Q3 2026.

- Cyber safety segment bookings grew 5% with revenue up 3% and 61% operating margin; trust-based solutions saw MoneyLion revenue rise 40%, with pro forma segment bookings +23%.

- Paid customer base reached 78 million users, up 1 million sequentially, reinforcing broad subscription adoption.

- Raised full-year 2026 guidance to $4.955 billion–$4.975 billion in revenue and $2.54–$2.56 in non-GAAP EPS; Q4 guidance set at $1.24 billion–$1.26 billion revenue and $0.64–$0.66 EPS.

- Returned capital via $300 million share repurchases, $300 million debt paydown, and a $0.125 per-share quarterly dividend; net leverage improved to 3.1× EBITDA.

- Gen Digital reported Q3 FY26 GAAP revenue of $1.24 billion (up 26%), operating income of $433 million (up 16%), and diluted EPS of $0.31 (up 22%).

- Q3 non-GAAP results included bookings of $1.319 billion (up 27%), non-GAAP operating income of $629 million (up 9%), and non-GAAP EPS of $0.64 (up 14%).

- The company raised Q4 FY26 revenue guidance to $1.24–1.26 billion and EPS guidance to $0.64–0.66; FY26 revenue is now expected at $4.955–4.975 billion and EPS at $2.54–2.56.

- Declared a quarterly cash dividend of $0.125 per share, payable March 11, 2026, to shareholders of record as of February 16, 2026.

- Gen Digital reported Q3 FY26 GAAP revenue of $1.24 billion, operating income of $433 million and diluted EPS of $0.31, up 26%, 16% and 22% year-over-year, respectively.

- The company generated year-to-date operating cash flow of $1.066 billion, up 43%, and non-GAAP free cash flow of $1.047 billion, up 42%.

- Gen raised its FY26 non-GAAP revenue guidance to $4.955 billion–$4.975 billion (from $4.920 billion–$4.970 billion) and EPS guidance to $2.54–$2.56, and expects Q4 revenue of $1.24 billion–$1.26 billion with EPS of $0.64–$0.66.

- The board approved a quarterly dividend of $0.125 per share payable March 11, 2026, and returned nearly $700 million of capital to shareholders during the quarter.

Quarterly earnings call transcripts for Gen Digital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more