Earnings summaries and quarterly performance for EQUIFAX.

Executive leadership at EQUIFAX.

Mark W. Begor

Chief Executive Officer

Chad M. Borton

Executive Vice President, President, Workforce Solutions

Jamil Farshchi

Executive Vice President, Chief Technology Officer and Chief Information Security Officer

John W. Gamble, Jr.

Executive Vice President, Chief Financial Officer and Chief Operations Officer

Julia A. Houston

Executive Vice President and Chief Legal Officer

Patricio Remon

President, Equifax International

Board of directors at EQUIFAX.

Audrey Boone Tillman

Director

Barbara A. Larson

Director

G. Thomas Hough

Director

John A. McKinley

Director

Karen L. Fichuk

Director

Mark L. Feidler

Independent Chairman of the Board

Melissa D. Smith

Director

Robert D. Marcus

Director

Scott A. McGregor

Director

Research analysts who have asked questions during EQUIFAX earnings calls.

Kelsey Zhu

Autonomous Research

8 questions for EFX

Scott Wurtzel

Wolfe Research

8 questions for EFX

Toni Kaplan

Morgan Stanley

8 questions for EFX

Andrew Steinerman

JPMorgan Chase & Co.

7 questions for EFX

Craig Huber

Huber Research Partners

7 questions for EFX

Kevin McVeigh

Credit Suisse Group AG

7 questions for EFX

Faiza Alwy

Deutsche Bank

6 questions for EFX

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

6 questions for EFX

Andrew Nicholas

William Blair & Company

5 questions for EFX

Arthur Truslove

Citi

5 questions for EFX

Jason Haas

Wells Fargo

5 questions for EFX

Kyle Peterson

Needham & Company

5 questions for EFX

Simon Clinch

Redburn Atlantic

5 questions for EFX

Jeff Meuler

Robert W. Baird & Co.

4 questions for EFX

Jeffrey Meuler

Robert W. Baird & Co. Incorporated

4 questions for EFX

Surinder Thind

Jefferies Financial Group

4 questions for EFX

Ashish Sabadra

RBC Capital Markets

3 questions for EFX

George Tong

Goldman Sachs

3 questions for EFX

Keen Fai Tong

Goldman Sachs Group Inc.

3 questions for EFX

Manav Patnaik

Barclays

3 questions for EFX

Matthew O'Neill

Financial Technology Partners

3 questions for EFX

Ryan Griffin

BMO Capital Markets

3 questions for EFX

Aaron MacNeil

TD Cowen

2 questions for EFX

Brendan Lynch

Barclays

2 questions for EFX

David Bother

RBC Capital Markets

2 questions for EFX

David Paige

RBC Capital Markets

2 questions for EFX

Jimmy

Wells Fargo & Company

2 questions for EFX

John Gibson

BMO Capital Markets

2 questions for EFX

Owen Lau

Oppenheimer & Co. Inc.

2 questions for EFX

Rayna Kumar

Oppenheimer & Co. Inc.

2 questions for EFX

Simon Alistair Clinch

Redburn Atlantic

2 questions for EFX

Tim Monachello

ATB Capital Markets

2 questions for EFX

Zach Lasich

FT Partners

2 questions for EFX

Andrew Stein

FT Partners

1 question for EFX

Brandon Barron

Needham & Company, LLC

1 question for EFX

Brendan Popson

Barclays

1 question for EFX

David Paige Papadogonas

RBC Capital Markets

1 question for EFX

Joshua Dennerlein

BofA Securities

1 question for EFX

Kwun Sum Lau

Oppenheimer

1 question for EFX

Recent press releases and 8-K filings for EFX.

- Enerflex reported Q4 revenue of $627 million, up from $561 million in Q4 2024, and adjusted EBITDA of $123 million.

- Signed a definitive agreement to divest the majority of its APAC operations to INNIO, expected to close in H2 2026, to sharpen focus on North America, Latin America, and the Middle East.

- Engineered Systems backlog was $1.1 billion at December 31, 2025, with Q4 bookings of $377 million and a book-to-bill ratio of 1.1x.

- Generated a record $141 million of free cash flow in Q4, reduced net debt to $501 million (bank-adjusted net debt/EBITDA ~1x).

- Provided 2026 organic capex guidance of $175–195 million (including $90–100 million growth capital) and continues its NCIB for share repurchases through March 2026.

- Total U.S. consumer debt reached $18.20 trillion by December 2025, with annual growth accelerating versus December 2023 and 2024.

- Delinquencies remain elevated: 5.7% of consumers were 60+ days past due in Q4 2025, down from a 6.8% peak in Q3 2025 but still above pre-pandemic norms.

- Bankcard balances rose to $1.12 trillion (+4.1% YoY) while 60+ day bankcard delinquency eased to 3.03% (from 3.16%).

- Auto loan and lease balances totaled $1.685 trillion (+1% YoY); severe auto delinquency ticked up to 1.61% and write-offs fell to 25.9 bps; outstanding lease balances climbed 7.6% to $95.8 billion.

- Student loan balances declined 1.4% YoY to $1.33 trillion, with the severe delinquency rate stabilizing at 16.39%.

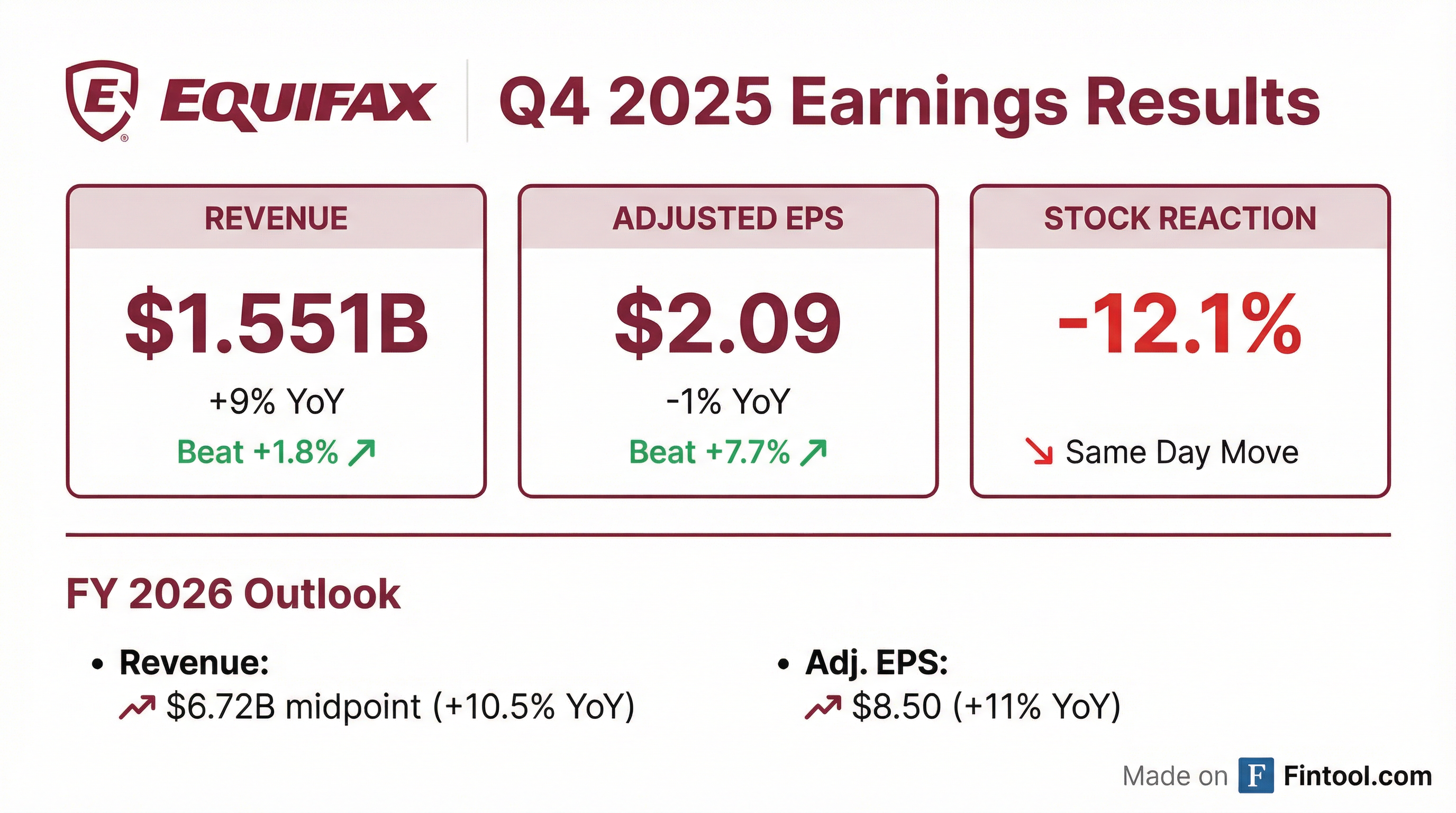

- Equifax reported Q4 revenue of $1.551 billion, up 9% year-over-year, topping estimates; adjusted EPS was $2.09 (beat) while GAAP EPS of $1.44 missed.

- Strong segment performance: 20% U.S. Mortgage revenue growth, 12% U.S. Information Solutions growth (including 33% Mortgage), and 5% local-currency international growth.

- Free cash flow margin improved to 22%, and the company returned $561 million to shareholders, including $500 million for repurchasing 2.3 million shares under its $3 billion buyback program.

- Management guided Q1 revenue of $1.60–$1.63 billion and 2026 revenue of $6.72 billion with adjusted EPS of $8.50, citing headwinds in U.S. mortgage and hiring markets.

- Q4 revenue rose 9% y/y, generating Adj EPS $2.09, $0.06 above October guidance; Adj EBITDA margin 32.8%

- FY 2025 revenue reached $6.075 B (+7%), Adj EPS $7.65 (+5%), Free Cash Flow $1.13 B (+40%), with cash conversion 120%

- Returned $561 M to shareholders in Q4 via $500 M buybacks and $61 M dividends; $1.2 B returned in 2025

- 2026 guidance: revenue $6.66–6.78 B (+9.6–11.6%), Adj EPS $8.30–8.70 (+8.5–13.7%), Adj EBITDA margin 31.3–31.8%

- Revenue rose 9% to $1.551 B, exceeding October guidance by $30 M, driven by strong workforce solutions and USIS mortgage performance.

- EBITDA of $508 M with a 32.8% margin, and EPS of $2.09, $0.06 above the midpoint of guidance.

- Free cash flow of $1.13 B with 120% conversion; $1.2 B returned to shareholders in 2025, including $927 M in share repurchases and $233 M in dividends.

- 2026 guidance calls for 10.6% reported revenue growth (10% constant currency; 7% ex-FICO), 10% EBITDA growth to $2.12 B, EPS of $8.50, and over $1 B free cash flow.

- 2025 full-year results: Revenue of $6.075 B (up 7% reported & organic constant currency), EPS of $7.65, and free cash flow of $1.13 B, all above guidance and within the 7–10% long-term revenue growth framework.

- Segment performance: Workforce Solutions revenue +6% with 51.5% EBITDA margin (Q4 +9%); USIS revenue +10% with margins up 70 bp; International constant-$ revenue +6% with ~100 bp margin expansion; cloud migration on track for mid-2026 completion.

- Innovation & product rollouts: Achieved a record 15% new-product vitality (~$900 M revenue) powered by 90% cloud-native operations and AI; launched Twin Indicator income & employment data solution in mortgage, auto, and card markets.

- 2026 guidance: Revenue expected +10.6% reported (+10% CC) with EPS of $8.50 (+11%) and ≥100% free cash flow conversion; ex-FICO growth ~7% with EBITDA margin expansion of 75 bp, while FICO mortgage royalties will rise to ~6% of revenue, weighing on reported margins.

- Full-year 2025 revenue of $6.075 billion, EPS of $7.65, and free cash flow of $1.13 billion; revenue +7% organic on constant currency basis.

- Q4 2025 EBITDA was $508 million (32.8% margin) and EPS was $2.09; returned $561 million to shareholders, including $500 million in share repurchases.

- 2026 guidance: total revenue +10.6% (reported) / +10% (constant currency) with ex-FICO growth of ~7%; EBITDA of $2.12 billion (+10%) and EPS of $8.50; free cash flow >$1 billion.

- FICO mortgage score royalties pass-through will rise from ~3% to ~6% of revenue in 2026, reducing reported EBITDA margins by >200 bps, while ex-FICO margins are expected to expand by 75 bps.

- Equifax reported fourth-quarter 2025 revenue of $1.551 billion, up 9% year-over-year, and diluted EPS of $1.44 versus $1.39 in Q4 2024.

- Full-year 2025 revenue totaled $6.075 billion, up 7%, with diluted EPS of $5.32 versus $4.84 in 2024.

- By segment in Q4, Workforce Solutions revenue grew 9% to $652.2 million, U.S. Information Solutions (USIS) grew 12% to $526.9 million, and International grew 7% to $371.5 million.

- The company returned $561 million of cash to shareholders in Q4, including a $500 million share repurchase (2.3 million shares) under its $3 billion buyback program.

- For full-year 2026, Equifax expects revenue of $6.72 billion at the midpoint (≈10.5% growth) and Adjusted EPS of $8.50, assuming a modest downturn in U.S. mortgage markets.

- Equifax delivered $1.551 billion in fourth-quarter revenue, up 9% year-over-year and $30 million above guidance midpoint.

- U.S. Mortgage revenue grew 20%, Workforce Solutions revenue rose 9%, USIS revenue increased 12%, and International revenue was up 7% in Q4.

- Returned $561 million to shareholders in the quarter, including repurchasing 2.3 million shares for $500 million.

- Generated $1.13 billion in free cash flow for full-year 2025, a 40% increase from the prior year.

- Issued 2026 guidance for $6.72 billion in revenue (≈10.5% growth) and $8.50 adjusted EPS.

- Equifax introduced Income Confirm, a new product that integrates verified employment and income data from The Work Number with its consumer credit report.

- Income Confirm delivers applicants’ current job status and calculated annual income, enabling lenders to better assess risk and expedite approvals.

- The offering supports both decisioning and credit line assignment stages, helping lenders optimize initial credit lines based on true ability to pay.

- Provided data points include employee name/SSN, employer name, employment status, and annualized income.

Quarterly earnings call transcripts for EQUIFAX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more