Earnings summaries and quarterly performance for AUTOMATIC DATA PROCESSING.

Executive leadership at AUTOMATIC DATA PROCESSING.

Maria Black

President and Chief Executive Officer

Brian Michaud

Executive Vice President, Smart Compliance Solutions & Human Resources Outsourcing

Joseph DeSilva

Executive Vice President, North America and Chief of Operations

Michael A. Bonarti

Chief Administrative Officer

Peter J. Hadley

Chief Financial Officer

Sreeni Kutam

President, Global Product & Innovation

Board of directors at AUTOMATIC DATA PROCESSING.

Carlos A. Rodriguez

Director

David V. Goeckeler

Director

Francine S. Katsoudas

Director

Karen S. Lynch

Director

Linnie M. Haynesworth

Director

Nazzic S. Keene

Director

Peter Bisson

Director

Robert H. Swan

Director

Sandra S. Wijnberg

Director

Scott F. Powers

Director

Thomas J. Lynch

Non-Executive Chair of the Board

Research analysts who have asked questions during AUTOMATIC DATA PROCESSING earnings calls.

Dan Dolev

Mizuho Financial Group

8 questions for ADP

Kartik Mehta

Northcoast Research

8 questions for ADP

Mark Marcon

Baird

8 questions for ADP

Tien-tsin Huang

JPMorgan Chase & Co.

8 questions for ADP

Bryan Bergin

TD Cowen

6 questions for ADP

Ramsey El-Assal

Barclays

6 questions for ADP

Samad Samana

Jefferies

6 questions for ADP

Daniel Jester

BMO Capital Markets

5 questions for ADP

James Faucette

Morgan Stanley

5 questions for ADP

Kevin McVeigh

Credit Suisse Group AG

5 questions for ADP

Scott Wurtzel

Wolfe Research

5 questions for ADP

Ashish Sabadra

RBC Capital Markets

4 questions for ADP

Bryan Keane

Deutsche Bank

4 questions for ADP

Jason Kupferberg

Bank of America

3 questions for ADP

Zachary Gunn

Financial Technology Partners

3 questions for ADP

David Paige

RBC Capital Markets

2 questions for ADP

Peter Christiansen

Citigroup Inc.

2 questions for ADP

Caroline Latta

Bank of America

1 question for ADP

David Paige Papadogonas

RBC Capital Markets

1 question for ADP

Jared Levine

TD Cowen

1 question for ADP

Kathy Chan

Wells Fargo Securities

1 question for ADP

Michael Infante

Morgan Stanley

1 question for ADP

Zachary Ajzenman

TD Cowen

1 question for ADP

Recent press releases and 8-K filings for ADP.

- ADP reported that U.S. private-sector payrolls rose by 63,000 in February 2026, topping forecasts of around 50,000, with January’s gain revised down to 11,000.

- Job gains were concentrated in education and health services (+58,000) and construction (+19,000), while professional and business services shed 30,000 jobs and manufacturing fell by 5,000.

- Wage growth for job-stayers held steady at 4.5%, while the pay premium for job-switchers slowed to 6.3%, the lowest level on record.

- February’s increase was the largest monthly gain since July 2025.

- Private employers added 63,000 jobs in February, the strongest monthly gain since July 2025, driven by construction and education/health services.

- Annual pay for job-stayers rose 4.5% year-over-year, while pay growth for job-changers slowed to 6.3%.

- January’s job gain was revised down to 11,000 from 22,000.

- On March 2, 2026, ADP introduced a new destination within its ADP Marketplace offering AI agents to automate HR workflows and multistep tasks across the employee lifecycle.

- The curated AI agents, provided by partners including Absorb, Aquera, G-P, Built, Employ, Praisidio, Salary.com, Tapcheck, MakeShift, Payactiv, and Quantum Workplace, address challenges in talent acquisition, compliance, and workforce insights.

- All partner solutions adhere to ADP Marketplace’s responsible AI principles—human oversight, monitoring, explainability, and bias mitigation—aligned with ADP’s own standards.

- The AI agents are now available to ADP’s clients, enabling proactive, integrated tools that anticipate needs and act in real time to simplify HR, payroll, talent, and workforce operations.

- U.S. private employers added an average of 10,250 jobs per week for the four weeks ending January 31, 2026, marking the third consecutive week of strengthening job gains.

- Estimates are based on ADP’s seasonally adjusted NER Pulse four-week moving average, using high-frequency payroll data and subject to revision as new data are added.

- The NER Pulse releases weekly with a two-week data lag; the next report is scheduled for February 24, 2026.

- Private sector employment increased by 22,000 jobs in January, led by education and health services (+74,000) while manufacturing lost 8,000 positions.

- 2025 private sector job growth totaled 398,000, down from 771,000 in 2024, reflecting continued slowdown in hiring.

- Median annual pay for job-stayers rose 4.5% year-over-year in January; job-changers' pay growth eased to 6.4% from 6.6%.

- ADP reported 22,000 U.S. private-sector jobs added in January, below the 45,000 economists’ forecast and down from 37,000 in December.

- Education and health services led gains with 74,000 jobs, while professional & business services lost 57,000 and manufacturing fell 8,000.

- Annual pay grew 4.5% year-over-year as private hires slowed to 398,000 in 2025 versus 771,000 in 2024.

- Markets reacted with about a $300 billion selloff, reflecting a “low-hire, low-fire” labor outlook.

- ADP introduced AI Assist agents, leveraging advanced intelligence to streamline HR and payroll workflows.

- The persona-based agents cater to employees, managers, HR, and payroll practitioners, built on ADP’s global data platform covering 1.1 million clients and 42 million wage earners across 140 countries.

- Key features include automated payroll variance audits, proactive tax ID gap identification, personalized policy guidance, and custom analytics-driven reports and talent actions via natural language.

- The solution draws on 75+ years of workforce data to deliver AI-driven insights while upholding security and compliance standards.

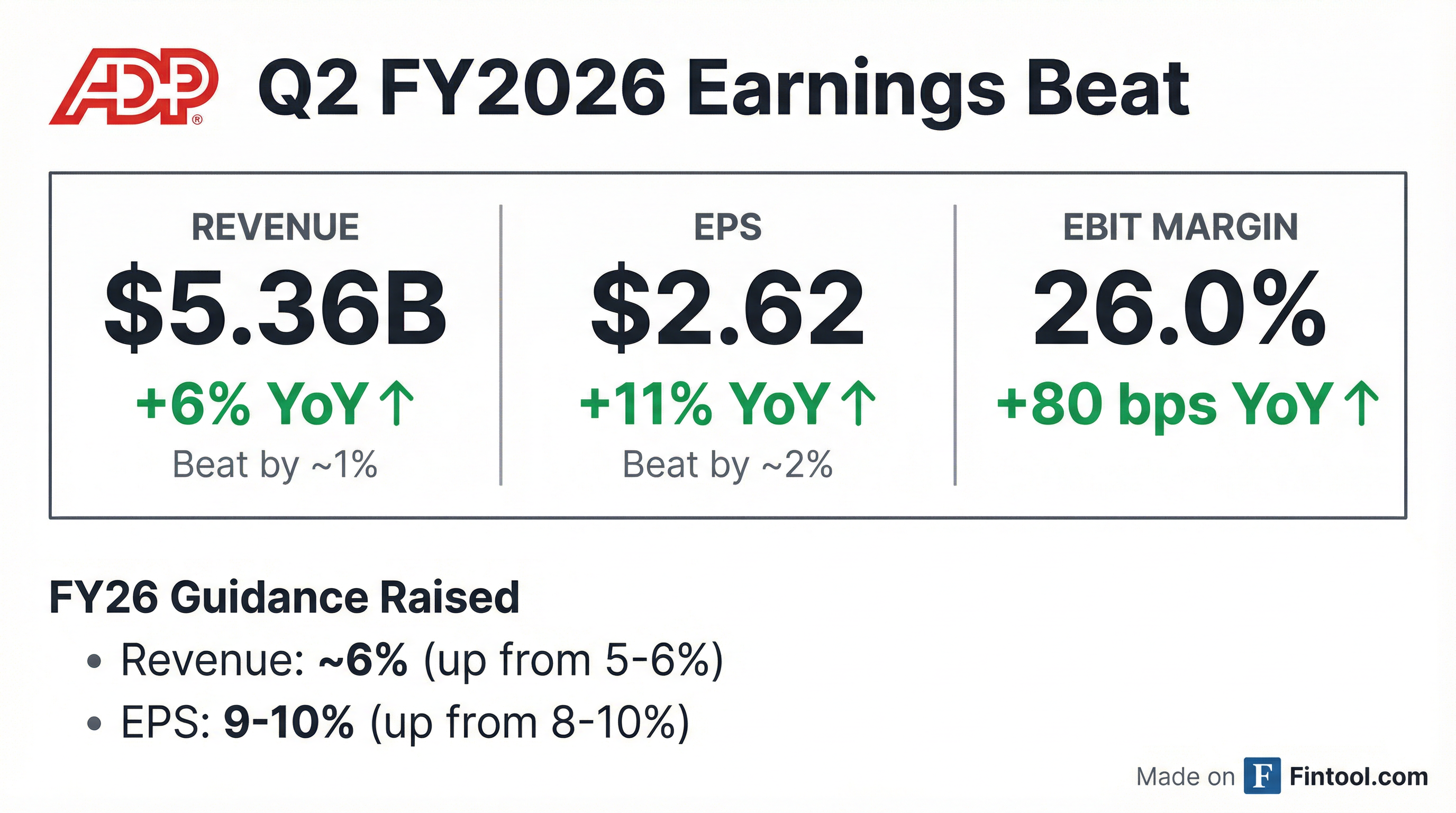

- ADP delivered 6% revenue growth, 80 bps adjusted EBIT margin expansion, and 11% adjusted EPS growth, driven by broad-based new business bookings and record client satisfaction.

- The company raised its fiscal 2026 outlook, now targeting 6% consolidated revenue growth, 50–70 bps EBIT margin expansion, and 9–10% adjusted EPS growth, and authorized a $6 billion share repurchase alongside a 10% dividend increase.

- Strategic investments advanced with strong traction of Workforce Now Next Gen and ADP Lyric HCM, integration of the Workforce Suite, launch of AI-powered ADP Assist agents, and embedding Fiserv’s CashFlow Central into RUN to boost its ecosystem.

- PEO revenue grew 6% (3% ex-pass-throughs) with 2% average worksite employee growth, while ADP’s international operations served over 70,000 clients and won a 75,000-employee European bank contract.

- In Q2, 6% revenue growth, 80 bps of Adjusted EBIT margin expansion, and 11% Adjusted EPS growth were delivered.

- Employer Services revenue rose 6% (5% organic) with pays per control growth of 1% and modest retention decline; PEO revenue grew 6% (3% ex-pass-throughs) and average worksite employees grew 2%.

- Fiscal 2026 guidance was raised: consolidated revenue growth ~6%, Adjusted EPS growth 9–10%, and board authorization of $6 billion share buyback alongside a 10% dividend increase.

- Strategic momentum included broad-based ES new bookings, first mid-market sale of Workforce Now Next Gen, large ADP Lyric wins, launch of ADP WorkForce Suite, and rollout of AI-powered ADP Assist agents.

- Consolidated revenue grew 6% with 80 bps adjusted EBIT margin expansion and 11% adjusted EPS growth; raised full-year revenue growth outlook to ~6%, adjusted EBIT margin up 50–70 bps, and adjusted EPS growth to 9–10%.

- Employer Services revenue rose 6% reported (5% organic), with new business bookings growth maintained at 4–7%, retention modestly down, and pays per control up ~1%; PEO revenue grew 6% (3% ex zero-margin) with average worksite employee growth at 2% and full-year PEO revenue guide of 5–7% (3–5% ex pass-throughs).

- Highlighted HCM technology traction: first Workforce Now Next Gen sale to a >1,000-employee client, strong ADP Lyric enterprise bookings with >70% new logos and two wins >20,000 employees, launch of ADP Workforce Suite and AI-driven ADP Assist agents; introduced Save for Retirement pooled employer plan and won a 75,000-employee European bank.

- Approved $6 billion share repurchase authorization and 10% dividend increase, underscoring commitment to return excess cash.

Fintool News

In-depth analysis and coverage of AUTOMATIC DATA PROCESSING.

Quarterly earnings call transcripts for AUTOMATIC DATA PROCESSING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more