Earnings summaries and quarterly performance for FAIR ISAAC.

Executive leadership at FAIR ISAAC.

Board of directors at FAIR ISAAC.

Research analysts who have asked questions during FAIR ISAAC earnings calls.

Jason Haas

Wells Fargo

9 questions for FICO

Surinder Thind

Jefferies Financial Group

9 questions for FICO

Ashish Sabadra

RBC Capital Markets

8 questions for FICO

Manav Patnaik

Barclays

8 questions for FICO

Scott Wurtzel

Wolfe Research

8 questions for FICO

Faiza Alwy

Deutsche Bank

7 questions for FICO

Kevin McVeigh

Credit Suisse Group AG

7 questions for FICO

Kyle Peterson

Needham & Company

7 questions for FICO

Owen Lau

Oppenheimer & Co. Inc.

6 questions for FICO

Craig Huber

Huber Research Partners

5 questions for FICO

Ryan Griffin

BMO Capital Markets

5 questions for FICO

Alexander Hess

JPMorgan Chase & Co.

4 questions for FICO

George Tong

Goldman Sachs

3 questions for FICO

Jeff Meuler

Robert W. Baird & Co.

3 questions for FICO

Keen Fai Tong

Goldman Sachs Group Inc.

3 questions for FICO

Matthew O'Neill

Financial Technology Partners

3 questions for FICO

Simon Alistair Clinch

Redburn Atlantic

3 questions for FICO

Simon Clinch

Redburn Atlantic

3 questions for FICO

Guru Ariel

Oppenheimer

2 questions for FICO

Jeffrey Miller

Baird

2 questions for FICO

Joshua Dennerlein

BofA Securities

2 questions for FICO

Rayna Kumar

Oppenheimer & Co. Inc.

2 questions for FICO

Stephen Polk

Robert W. Baird & Co. Incorporated

2 questions for FICO

Alexander EM Hess

JPMorgan Chase & Co.

1 question for FICO

Andrew Stein

FT Partners

1 question for FICO

David Paige

RBC Capital Markets

1 question for FICO

Faisal

Goldman Sachs

1 question for FICO

Jeffrey Meuler

Robert W. Baird & Co. Incorporated

1 question for FICO

John Mazzoni

Seaport Research Partners

1 question for FICO

Kevin McVay

UBS

1 question for FICO

Kwun Sum Lau

Oppenheimer

1 question for FICO

Sami Nasir

Goldman Sachs

1 question for FICO

Sammy Zhang

Goldman Sachs

1 question for FICO

Recent press releases and 8-K filings for FICO.

- FICO’s Board approved a new stock repurchase program to acquire up to $1.5 billion of common stock.

- The open-ended program allows repurchases in the open market and in negotiated transactions.

- This program succeeds a prior repurchase plan that ran from June 2025 until February 2026.

- December spending rose by 5.6% month-on-month to £830, though it remained 3.5% below December 2024 levels.

- Average active balances hit a record £1,950, up 1.7% from November and 4.8% year-on-year.

- The share of balance paid stabilized at 33.4%, a 0.1% monthly increase but 6.8% lower than a year earlier.

- Delinquency rates climbed, with accounts missing one payment up 6.4% month-on-month and those missing three payments up 3.7% month-on-month and 4.9% year-on-year.

- Fair Isaac reports that over 40 lenders have joined the FICO® Score 10T Adopter Program for non-conforming mortgage loans, driven by community lenders serving underserved markets.

- The program’s early adopters include TLC Community Credit Union, Magnolia Bank, William Raveis Mortgage, Nation One Mortgage, and others.

- Spring EQ became the first HELOC lender to implement FICO® Score 10T, demonstrating its applicability across home-equity products.

- FICO estimates Score 10T can deliver up to 5% more loan approvals or a 17% reduction in delinquencies, with no extra fee for dual processing alongside the Classic FICO Score.

- FICO’s Mortgage and Capital Markets team will support lenders in maximizing Score 10T benefits to expand sustainable homeownership.

- Average UK credit card spending rose 2.6% month-on-month to £785, but remained 2.4% below November 2024 levels.

- Average active balances climbed 0.8% month-on-month to £1,915, up 5% year-on-year.

- Payment rates dropped to 33.4%, the lowest since 2021, down 2.8% month-on-month and 7.4% year-on-year.

- Accounts over their credit limit increased 6.4% month-on-month and 5.9% year-on-year, signaling rising cardholder stress.

- The share of customers using cards for cash declined 12.3% month-on-month and 15.2% year-on-year.

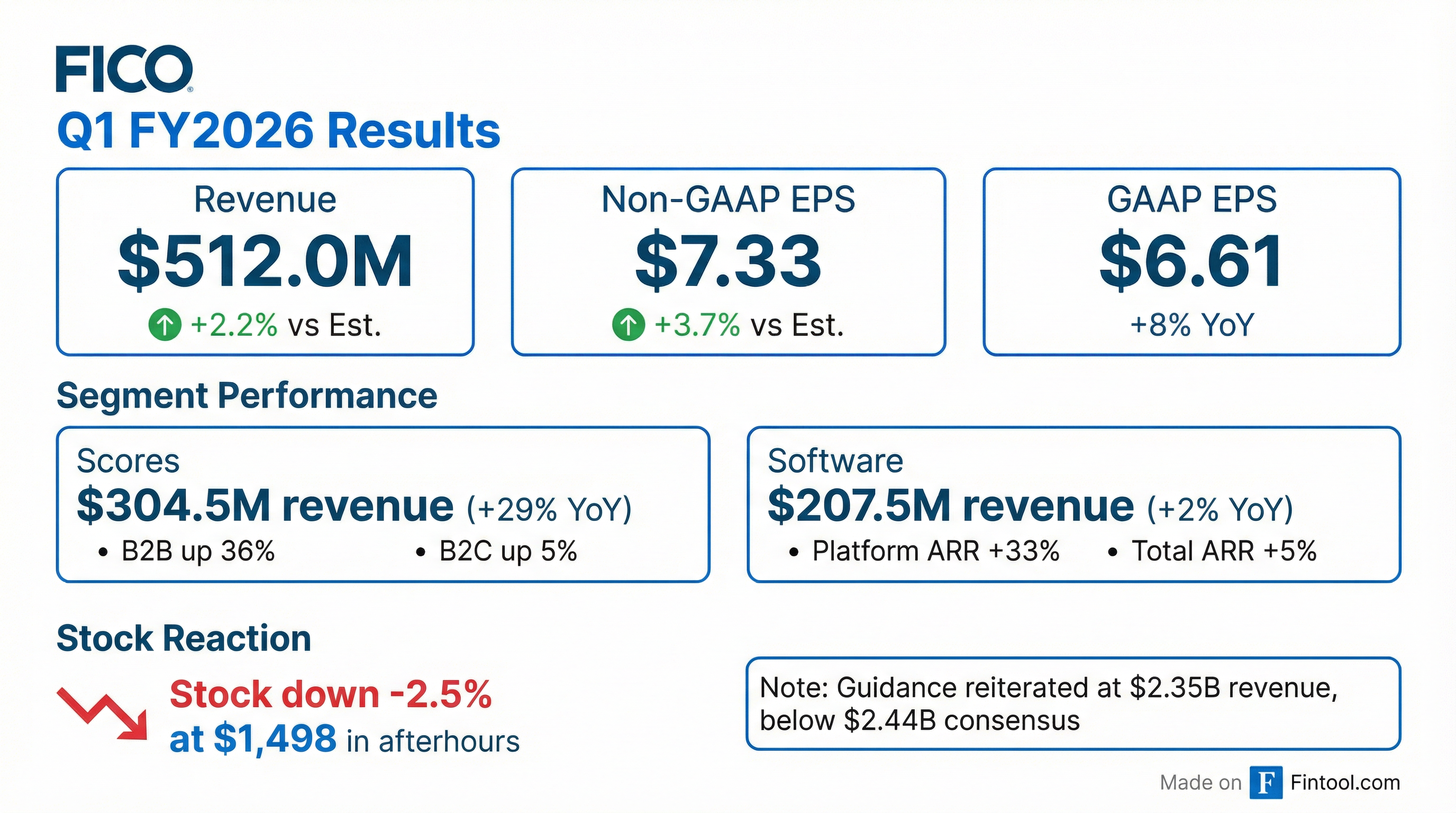

- Q1 revenues of $512 M (+16% YoY); GAAP net income $158 M (+4%), GAAP EPS $6.61 (+8%); non-GAAP net income $176 M (+22%), non-GAAP EPS $7.33 (+27%); free cash flow $165 M

- Scores segment revenue $305 M (+29% YoY) led by B2B mortgage originations; Software revenue $207 M (+2%), including 37% platform growth

- Record ACV bookings of $38 M; total software ARR $766 M (+5%), platform ARR $303 M (+33%); platform NRR 122% vs non-platform 91%

- Non-GAAP operating margin 54% (+432 bps YoY); cash and marketable securities $218 M; repurchased 95,000 shares at avg. $1,707

- Reiterated fiscal 2026 guidance, with update to be provided on the Q2 earnings call

- Q1 revenues of $512 million, up 16% YoY; GAAP net income $158 million (+4%) and GAAP EPS $6.61 (+8%); non-GAAP net income $176 million (+22%) and non-GAAP EPS $7.33 (+27%).

- Free cash flow of $165 million in Q1 and $718 million over the trailing four quarters (+7% YoY); repurchased 95,000 shares at $1,707 avg. price for $163 million in Q1.

- Scores segment revenue $305 million (+29% YoY), led by B2B (+36%) and mortgage originations (+60%); software segment revenue $207 million (+2% YoY), record ACV bookings of $38 million, ARR $766 million (+5%), platform ARR $303 million (+33%) and net retention 103%.

- Reiterated FY 2026 guidance; non-GAAP operating margin 54% (+432 bps YoY), cash and marketable investments $218 million, total debt $3.2 billion at a 5.22% weighted-avg. interest rate.

- Total revenue of $512 million, up 16% YoY; scores revenue $304.5 million (+29% YoY) and software revenue $207.4 million (+2% YoY).

- GAAP net income $158 million (+4% YoY) with GAAP EPS $6.61 (+8% YoY); non-GAAP net income $176 million (+22% YoY) and non-GAAP EPS $7.33 (+27% YoY).

- Trailing-twelve-month free cash flow $718 million (+7% YoY); returned $163 million to shareholders in Q1 via share repurchases.

- FY26 guidance: revenues $2.35 billion (+18% YoY), GAAP EPS $33.47 (+26% YoY), non-GAAP EPS $38.17 (+28% YoY).

- FICO reported Q1 revenue of $512 M (+16% YoY), GAAP net income of $158 M (+4%), GAAP EPS of $6.61 (+8%), non-GAAP EPS of $7.33 (+27%), and free cash flow of $165 M.

- Scores segment revenue was $305 M (+29% YoY); Software segment revenue was $207 M (+2% YoY), including platform revenue growth of 37% and non-platform decline of 13%.

- Total software ARR reached $766 M (+5% YoY), with platform ARR of $303 M (+33% YoY); quarterly ACV bookings hit a record $38 M, and TTM ACV was $119 M (+36% YoY).

- Returned capital through repurchasing 95,000 shares at an average price of $1,707; reiterated fiscal 2026 guidance with continued margin expansion.

- FICO reported first-quarter fiscal 2026 revenue of $512.0 million, up 16% year-over-year, and GAAP EPS of $6.61, versus $6.14 in Q1 FY2025.

- Non-GAAP EPS was $7.33, with non-GAAP net income of $175.6 million and free cash flow of $165.4 million.

- Scores segment revenue rose 29% to $304.5 million, while Software revenue increased 2% to $207.5 million; Software ARR grew 5%, driving a 103% dollar-based net retention rate.

- The company reiterated FY2026 guidance for $2.35 billion in revenues, GAAP EPS of $33.47, and non-GAAP EPS of $38.17.

- Revenue rose 16% year-over-year to $512.0 million in Q1 FY26 (vs. $440.0 million).

- GAAP net income was $158.4 million (EPS $6.61), up from $152.5 million (EPS $6.14) a year ago.

- Non-GAAP EPS reached $7.33 (vs. $5.79), with free cash flow of $165.4 million.

- Reiterated FY26 guidance: $2.35 billion revenue, GAAP EPS $33.47, non-GAAP EPS $38.17.

Quarterly earnings call transcripts for FAIR ISAAC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more