Earnings summaries and quarterly performance for Workday.

Executive leadership at Workday.

Carl M. Eschenbach

Chief Executive Officer

Aneel Bhusri

Co-Founder and Executive Chair

Gerrit Kazmaier

President, Product and Technology

Mark Garfield

Chief Accounting Officer

Richard H. Sauer

Chief Legal Officer, Head of Corporate Affairs, and Corporate Secretary

Robert Enslin

President, Chief Commercial Officer

Zane Rowe

Chief Financial Officer

Board of directors at Workday.

Elizabeth Centoni

Director

George J. Still, Jr.

Director

Jerry Yang

Director

Lynne M. Doughtie

Director

Mark J. Hawkins

Lead Independent Director

Michael L. Speiser

Director

Michael M. McNamara

Director

Rhonda J. Morris

Director

Thomas F. Bogan

Director

Wayne A.I. Frederick, M.D.

Director

Research analysts who have asked questions during Workday earnings calls.

Brent Thill

Jefferies

10 questions for WDAY

Karl Keirstead

UBS

10 questions for WDAY

Mark Murphy

JPMorgan Chase & Co.

10 questions for WDAY

Brad Zelnick

Credit Suisse

9 questions for WDAY

Michael Turrin

Wells Fargo

9 questions for WDAY

Raimo Lenschow

Barclays

8 questions for WDAY

S. Kirk Materne

Evercore ISI

8 questions for WDAY

Bradley Sills

Bank of America

6 questions for WDAY

Aleksandr Zukin

Wolfe Research

5 questions for WDAY

Keith Weiss

Morgan Stanley

5 questions for WDAY

Alex Zukin

Wolfe Research LLC

4 questions for WDAY

John DiFucci

Guggenheim Securities

3 questions for WDAY

Kash Rangan

Goldman Sachs

3 questions for WDAY

Kasthuri Rangan

Goldman Sachs

3 questions for WDAY

Brad Sills

Bank of America Corporation

2 questions for WDAY

Derrick Wood

TD Cowen

2 questions for WDAY

Gabriela Borges

Goldman Sachs

2 questions for WDAY

James Wood

TD Cowen

2 questions for WDAY

Kirk Materne

Evercore Partners

2 questions for WDAY

Rishi Jaluria

RBC Capital Markets

2 questions for WDAY

Scott Berg

Needham & Company, LLC

2 questions for WDAY

Recent press releases and 8-K filings for WDAY.

- Workday reported Q4 FY26 subscription revenue of $2.360 billion, an increase of 16%, and full-year FY26 subscription revenue of $8.833 billion, up 14%. Total revenue for Q4 was $2.532 billion, growing 15%, and for the full year was $9.552 billion, up 13%.

- For FY27, the company expects subscription revenue between $9.925 billion and $9.950 billion, representing 12%-13% growth, and anticipates a non-GAAP operating margin of approximately 30%. This outlook incorporates an accelerated pace of AI investment across product and go-to-market.

- Workday's AI initiatives saw 1.7 billion AI actions delivered across its platform in FY26, with emerging AI products generating over $100 million in new ACV in Q4 and an overall ARR from these solutions now exceeding $400 million. The company repurchased $2.9 billion of its shares for the full year FY26.

- For Fiscal Year 2026, Workday reported total revenues of $9.552 billion, a 13.1% year-over-year increase, with subscription revenues at $8.833 billion, up 14.5% year-over-year, and a Non-GAAP operating margin of 29.6%.

- In Q4 Fiscal Year 2026, total revenues reached $2.532 billion, growing 14.5% year-over-year, while subscription revenues were $2.360 billion, an increase of 15.7% year-over-year, achieving a Non-GAAP operating margin of 30.6%.

- Workday provided Fiscal Year 2027 guidance, forecasting total revenues between $10.635 billion and $10.660 billion (11%-12% year-over-year growth) and subscription revenues between $9.925 billion and $9.950 billion (12%-13% year-over-year growth), with a projected Non-GAAP operating margin of 30.0%.

- Co-founder and chair Aneel Bhusri returned as chief executive officer, and the company acquired Pipedream, an integration platform for AI agents. Workday also expanded its global customer base to over 11,500.

- Workday reported Q4 FY26 subscription revenue of $2.360 billion, up 16%, and total revenue of $2.532 billion, up 15%. For the full year FY26, subscription revenue reached $8.833 billion, a 14% increase, and total revenue was $9.552 billion, up 13%. The company achieved a Q4 non-GAAP operating margin of 30.6% and a full-year non-GAAP operating margin of 29.6%. Free cash flow for FY26 was $2.78 billion, up 27%, and $2.9 billion in shares were repurchased during the full year.

- For FY27, Workday anticipates subscription revenue between $9.925 billion and $9.950 billion, representing 12%-13% growth, and a non-GAAP operating margin of approximately 30%. Q1 FY27 subscription revenue is projected at $2.335 billion, a 13% increase, but this is impacted by the DIA contract not continuing from Q4.

- The company demonstrated strong momentum in AI, delivering 1.7 billion AI actions across the platform in FY26 and generating over $100 million in new ACV from emerging AI products in Q4, with overall ARR from these solutions now exceeding $400 million. Key products like Sana Core and Sana Enterprise went into general availability on February 15th.

- Workday's strategy emphasizes organic AI development, with CEO Aneel Bhusri expressing optimism about surpassing the conservative FY27 guidance, particularly as the Flex Credits consumption model and agentic offerings gain traction in the second half of the year. Gross revenue retention remained strong at 97%, and net expansion rates were consistent, contributing roughly 60% of subscription revenue growth.

- Workday reported Q4 FY26 subscription revenue of $2.360 billion, a 16% increase, and full-year FY26 subscription revenue of $8.833 billion, up 14%.

- For FY27, the company expects subscription revenue between $9.925 billion and $9.950 billion, representing 12%-13% growth, and projects a non-GAAP operating margin of approximately 30%.

- CEO Aneel Bhusri has returned to focus on "chapter four", emphasizing innovation and AI, aiming to re-accelerate growth through agentic AI solutions.

- AI solutions are gaining traction, generating over $100 million in new ACV in Q4 and contributing over $400 million in overall ARR.

- Workday forecasts its fiscal 2027 subscription revenue between $9.93 billion and $9.95 billion, which is below the approximately $10 billion Wall Street estimate.

- The company's FY2027 sales guidance of $10.635 billion to $10.66 billion also fell short of the analyst expectation of $10.721 billion.

- Workday's Q1 sales guidance of approximately $2.515 billion was lower than the consensus estimate of $2.532 billion.

- Management attributed the weaker outlook to corporations reducing technology spending amid economic uncertainty, which has impacted new client acquisitions.

- Workday reported fiscal 2026 fourth quarter total revenues of $2.532 billion, a 14.5% increase year-over-year, and full year total revenues of $9.552 billion, up 13.1%.

- For fiscal year 2026, diluted net income per share was $2.59 and non-GAAP diluted net income per share was $9.23.

- The company generated $2.939 billion in operating cash flows for fiscal 2026, an increase of 19.4%, and repurchased approximately 12.8 million shares for $2.9 billion.

- Workday provided fiscal 2027 subscription revenue guidance of $9.925 billion to $9.950 billion, representing 12% to 13% growth, and anticipates a non-GAAP operating margin of approximately 30.0%.

- Aneel Bhusri returned as chief executive officer to lead the company.

- Workday reported fiscal 2026 fourth quarter total revenues of $2.532 billion, an increase of 14.5% year-over-year, with subscription revenues of $2.360 billion, up 15.7%.

- For the full fiscal year 2026, total revenues were $9.552 billion, a 13.1% increase from fiscal 2025, and subscription revenues reached $8.833 billion, up 14.5%.

- The company provided fiscal 2027 subscription revenue guidance of $9.925 billion to $9.950 billion, representing 12% to 13% growth, and projected a non-GAAP operating margin of approximately 30.0%.

- Workday repurchased approximately 12.8 million shares of Class A common stock for $2.9 billion during fiscal 2026.

- Aneel Bhusri returned as chief executive officer, and the company delivered 1.7 billion AI actions across its platform in fiscal 2026, alongside the acquisition of Pipedream.

- Carl Eschenbach has stepped down as CEO and from the board, with co-founder Aneel Bhusri returning as CEO permanently.

- The leadership change is intended to position Workday for a generational shift toward artificial intelligence (AI), which Bhusri views as a larger transformation than SaaS.

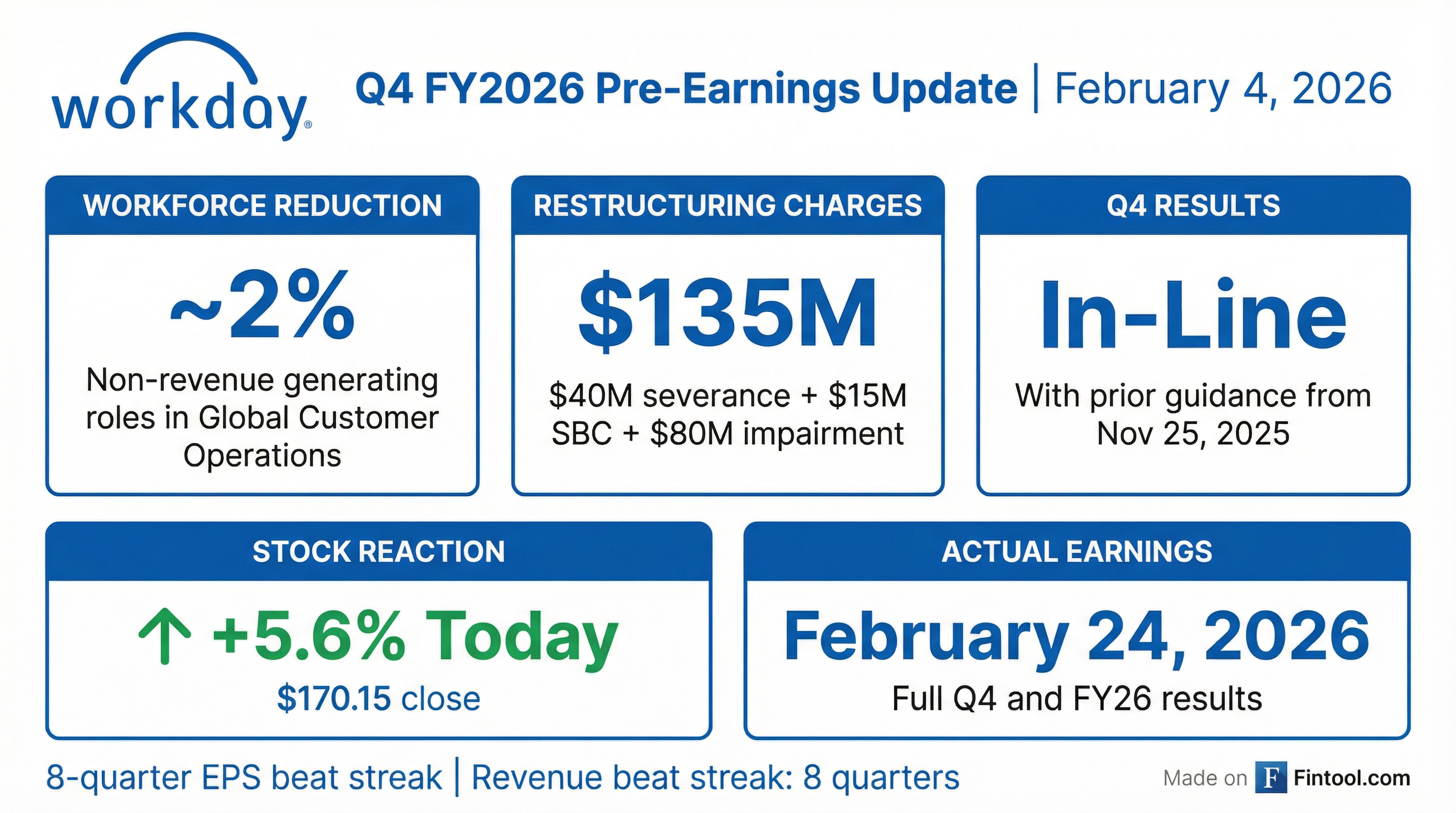

- This follows recent cost-cutting measures, including workforce reductions of approximately 8.5% in early 2025 and a more recent 2% reduction.

- Workday reiterated that fiscal 2026 Q4 and full-year results are expected to be in line with prior guidance.

- Workday, Inc. announced that co-founder Aneel Bhusri is returning as Chief Executive Officer, effective February 6, 2026, replacing Carl Eschenbach, who stepped down from the role and the board.

- Mr. Bhusri's compensation includes an initial annual base salary of $1,250,000 and an annual target cash bonus of up to 200% of his base salary starting in fiscal year 2027.

- Mr. Bhusri is also expected to be granted equity awards on March 5, 2026, including an RSU award valued at $60,000,000 and a performance-based RSU award valued at $75,000,000.

- Carl Eschenbach will receive a lump sum cash payment of $3,601,355 and accelerated vesting of 139,773 shares of outstanding time-based and previously achieved price-based RSUs, plus an additional 24,153 shares from his April 2025 RSU award.

- Workday reaffirmed its Fiscal 2026 Fourth Quarter and Full-Year Outlook.

- Co-founder and current executive chair Aneel Bhusri is returning as chief executive officer of Workday, effective immediately.

- Carl Eschenbach is stepping down as CEO and as a member of the board, and will continue to support the company as a strategic advisor to the CEO.

- Workday reaffirms its fiscal 2026 fourth quarter and full-year financial outlook, with the exception of its GAAP operating margin.

Fintool News

In-depth analysis and coverage of Workday.

Quarterly earnings call transcripts for Workday.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more