Earnings summaries and quarterly performance for ALLSTATE.

Executive leadership at ALLSTATE.

Thomas J. Wilson

Chair, President and Chief Executive Officer

Christine DeBiase

Executive Vice President, Chief Legal Officer and General Counsel

Elizabeth A. Brady

Executive Vice President, Chief Marketing, Customer and Communications Officer

Eric K. Ferren

Senior Vice President, Controller and Chief Accounting Officer

Jesse E. Merten

President, Property-Liability

John E. Dugenske

Interim Chief Financial Officer

Mario Rizzo

Chief Operating Officer

Mark Q. Prindiville

Executive Vice President and Chief Risk Officer

Suren Gupta

Executive Vice President, President, Protection Products & Enterprise Services

Zulfikar Jeevanjee

Executive Vice President, Chief Information Officer and Chief Information Security Officer

Board of directors at ALLSTATE.

Andrea Redmond

Director

Donald E. Brown

Director

Gregg M. Sherrill

Lead Director

Jacques P. Perold

Director

Judith A. Sprieser

Director

Kermit R. Crawford

Director

Margaret M. Keane

Director

Maria R. Morris

Director

Monica J. Turner

Director

Perry M. Traquina

Director

Richard T. Hume

Director

Siddharth N. (Bobby) Mehta

Director

Research analysts who have asked questions during ALLSTATE earnings calls.

C. Gregory Peters

Raymond James

7 questions for ALL

Robert Cox

The Goldman Sachs Group, Inc.

6 questions for ALL

Elyse Greenspan

Wells Fargo

5 questions for ALL

David Motemaden

Evercore ISI

4 questions for ALL

Joshua Shanker

Bank of America Merrill Lynch

4 questions for ALL

Michael Zaremski

BMO Capital Markets

4 questions for ALL

Jamminder Bhullar

JPMorgan Chase & Co.

3 questions for ALL

Jian Huang

Morgan Stanley

3 questions for ALL

Yaron Kinar

Oppenheimer & Co. Inc.

3 questions for ALL

Alex Scott

Barclays PLC

2 questions for ALL

Andrew Kligerman

TD Cowen

2 questions for ALL

Bob Cheong Kwong

Morgan Stanley

2 questions for ALL

Bob Huang

Morgan Stanley

2 questions for ALL

David Mokman

Evercore ISI

2 questions for ALL

Hristian Getsov

Wells Fargo

2 questions for ALL

Paul Newsom

Piper Sandler

2 questions for ALL

Vikram Gandhi

HSBC

2 questions for ALL

Bob Hong

Morgan Stanley

1 question for ALL

Charles Peters

Raymond James

1 question for ALL

Christian Gitzo

Wells Fargo & Company

1 question for ALL

Jack Kendall

Goldman Sachs

1 question for ALL

Jimmy Bhullar

JPMorgan Chase & Co.

1 question for ALL

Jing Li

Keefe, Bruyette & Woods (KBW)

1 question for ALL

Josh Shanker

Bank of America

1 question for ALL

Mike Zaremski

BMO Capital Markets

1 question for ALL

Recent press releases and 8-K filings for ALL.

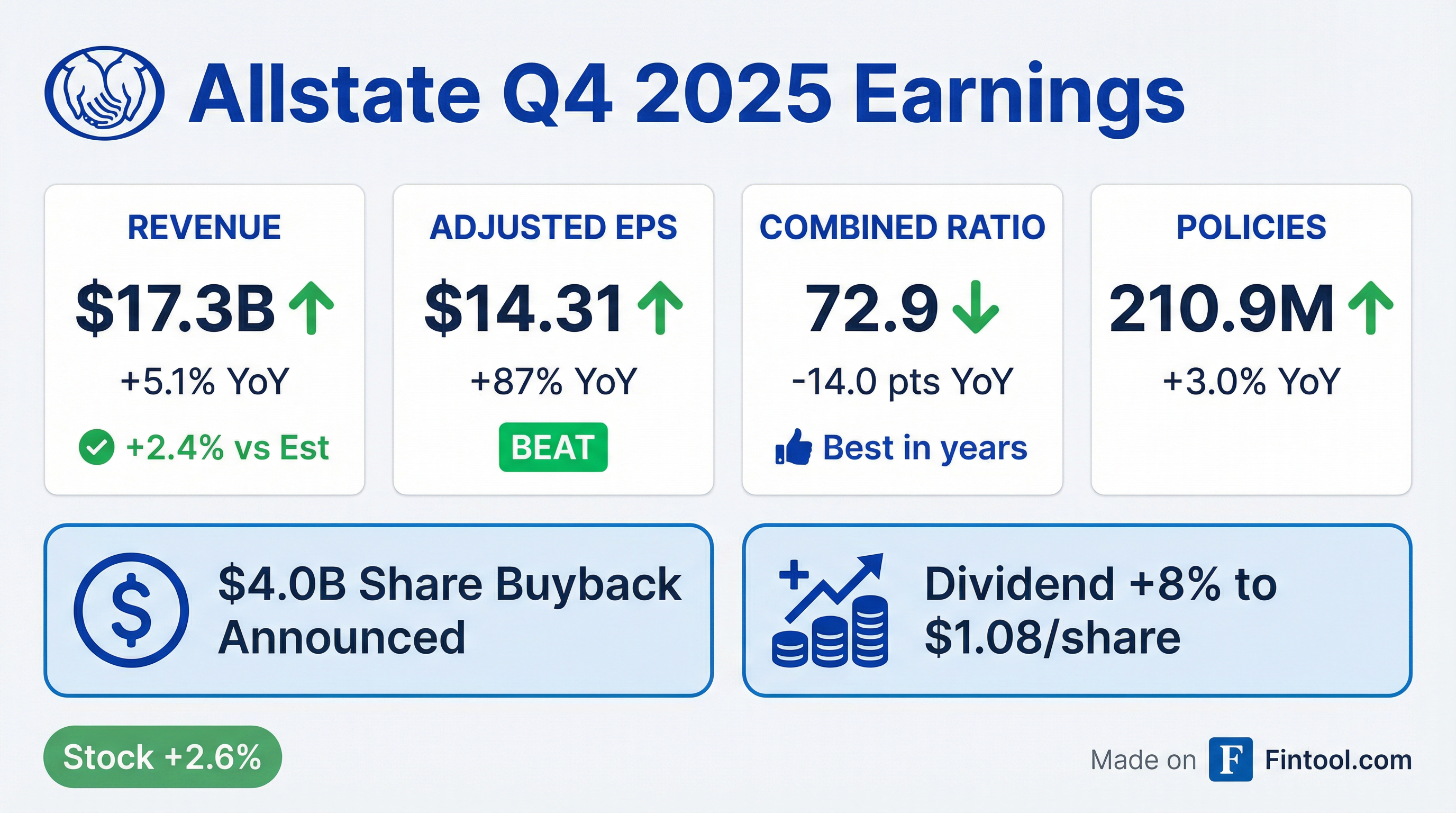

- Allstate reported Q4 revenue of $17.3 billion and full-year revenue of $67.7 billion, with net income of $3.8 billion in Q4 and $10.2 billion for 2025.

- Affordability initiatives, including the SAVE program, reduced premiums by 17% for 7.8 million customers, and the ASC auto product cut rates by 9% on average in 32 states.

- Personal lines new business more than doubled from 5.5 million in 2019 to 11.6 million in 2025, and total personal lines policies in force rose to 38.1 million, demonstrating market share gains.

- Allstate returned $2.2 billion to shareholders through dividends, raised its quarterly dividend by 8% to $1.08 per share, and authorized a $4 billion share repurchase program.

- Allstate generated $3.788 billion of net income in Q4 2025, delivering GAAP EPS of $14.37 and adjusted EPS of $14.31, versus $2.062 billion and EPS of $7.07/$7.67 in Q4 2024.

- The Property-Liability combined ratio improved to 80.8% (underlying 87.6%), down from 93.5% (underlying 93.0%) in the prior-year quarter, driven by lower catastrophe losses and favorable reserve reestimates.

- Book value per common share increased to $108.45 at December 31, 2025, up from $72.35 a year earlier.

- Return on common shareholders’ equity rose to 42.3% in Q4 2025, compared with 25.8% in Q4 2024.

- Q4 2025 revenues of $17.345 B, net income of $3.803 B ($14.37/share), adjusted net income of $3.788 B ($14.31/share); FY 2025 revenues $67.685 B, net income $10.165 B ($38.06/share), adjusted net income $9.304 B ($34.83/share)

- Property-Liability combined ratio of 85.0 for auto and 84.4 for homeowners, with underwriting income of $5.724 B (auto) and $2.393 B (homeowners)

- Investment portfolio carrying value grew to $83.2 B, generating net investment income of $3.449 B and a total return of 5.8% in 2025

- Returned over $2.2 B to shareholders via dividends and repurchases, approved a $1.08/share quarterly dividend and authorized a $4 B buyback program

- Q4 revenue of $17.3 B and full-year revenue of $67.7 B; Q4 net income of $3.8 B (adjusted $14.31/share) and full-year net income of $10.2 B (adjusted $9.3 B, $34.83/share)

- Property-Liability premiums earned up 4.4% in auto and 15% in homeowners; auto combined ratio improved by 10 points, generating $5.7 B of auto underwriting income and $2.4 B from homeowners

- Protection Services policies in force grew 3.3% to 172 M, revenue rose 11.7% to $3.3 B, with adjusted net income of $218 M; domestic revenue +8.1%, international +39.7%

- Returned $2.2 B to shareholders in 2025, increased quarterly dividend by 8% to $1.08/share, and initiated a $4 B share repurchase program following completion of the existing $1.5 B program

- Q4 revenues rose to $17.3 B and FY 2025 revenues to $67.7 B; Q4 net income applicable to common shareholders was $3.8 B and FY net income was $10.2 B; adjusted EPS was $14.31 (Q4) and $34.83 (FY).

- Property-Liability segment drove 4.4% auto premium growth (2.3% policy growth) and 15% homeowners premium growth (2.5% policy growth); auto combined ratio improved by 10 pts and homeowners recorded ratio was 84.4 with an underlying combined ratio of 57.9.

- The SAVE affordability program cut premiums for 7.8 M customers by an average of 17%, and ASC auto rates were reduced in 32 states by 9% on average.

- Transformative Growth initiatives lowered expenses, expanded property-liability market share across 38 auto-growing states (over 70% of premiums) and 36 homeowners-growing states, with renters insurance growing fastest.

- Returned $2.2 B to shareholders in 2025; raised quarterly dividend by 8% to $1.08/share and authorized a $4 B share repurchase program.

- Allstate reduced premiums for 7.8 million auto and homeowners customers by an average of 17% through tailored coverage reviews to offset cost inflation in 2025.

- Policies in force reached 210.9 million in Q4 2025, up 3.0% year-over-year, driven by broad distribution and simple, connected products.

- Total revenues were $17.3 billion in Q4 and $67.7 billion for the full year, up 5.1% and 5.6%, respectively; Q4 net income applicable to common shareholders was $3.8 billion, full-year net income was $10.2 billion.

- The quarterly dividend will increase to $1.08 per share in Q2 2026 and a $4.0 billion share repurchase program will commence upon completion of the existing $1.5 billion program.

- Allstate reduced premiums for 7.8 million auto and homeowners customers by an average 17% in 2025 to offset cost inflation.

- Q4 2025 revenues rose 5.1% YoY to $17.3 billion; full-year revenues were $67.7 billion (+5.6%); Q4 net income applicable to common shareholders was $3.8 billion vs. $1.9 billion a year ago; FY net income was $10.2 billion.

- Policies in force reached 210.9 million in Q4, up 3.0% from the prior year.

- The quarterly dividend will increase to $1.08 per share, and a $4.0 billion share repurchase program will commence once the existing $1.5 billion program is completed.

- Allstate estimated $80 million of December 2025 catastrophe losses ($64 million after-tax) and $209 million for Q4 2025 ($165 million after-tax).

- Total Allstate Protection policies in force reached 38.275 million as of December 31, 2025, up 0.2% month-over-month and 2.0% year-over-year.

- Auto policies stood at 25.504 million, rising 0.2% from November and 2.3% year-over-year.

- Homeowners policies were 7.697 million, up 0.3% month-over-month and 2.5% year-over-year.

- Commercial lines policies totaled 176 thousand, up 0.6% from November but down 17.4% year-over-year.

- Allstate reports estimated catastrophe losses for December 2025 of $80 million ($64 million after-tax) and Q4 2025 total losses of $209 million ($165 million after-tax).

- Allstate Protection policies in force as of December 31, 2025: Auto 25.504 million; Homeowners 7.697 million; Other personal lines 4.898 million; Commercial lines 176 thousand; Total 38.275 million.

- The December 2025 monthly release is furnished (not filed) under Regulation FD as Exhibit 99 to the Form 8-K.

- Allstate incurred estimated catastrophe losses of $46 million (or $36 million after-tax) in November 2025; losses for October + November totaled $129 million (or $101 million after-tax).

- Total policies in force reached 38.2 million as of November 30, 2025, up 0.1% month-over-month and 1.5% year-over-year; auto and homeowners lines saw the strongest growth.

- Financial updates and material announcements are posted on Allstate’s investor website; forward-looking statements are subject to standard risk factors.

Quarterly earnings call transcripts for ALLSTATE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more