Earnings summaries and quarterly performance for Hess Midstream.

Research analysts who have asked questions during Hess Midstream earnings calls.

DI

Doug Irwin

Citigroup Inc.

5 questions for HESM

Also covers: AROC, DKL, KGS +1 more

JM

John Mackay

Goldman Sachs Group, Inc.

5 questions for HESM

Also covers: AM, ARIS, CQP +16 more

PS

Praneeth Satish

Wells Fargo

4 questions for HESM

Also covers: ARIS, CSIQ, ENB +11 more

JT

Jeremy Tonet

JPMorgan Chase & Co.

3 questions for HESM

Also covers: AEE, AEP, AM +45 more

NM

Naomi Marfatia

Mizuho Securities USA LLC

3 questions for HESM

Also covers: AM

DI

Douglas Irwin

Citigroup

2 questions for HESM

JK

Jacqueline Koletas

The Goldman Sachs Group, Inc.

2 questions for HESM

Also covers: KNTK, TRGP

NK

Noah Katz

JPMorgan Chase & Co.

2 questions for HESM

Also covers: AM, ARIS, EE +2 more

SJ

Saumya Jain

UBS Group AG

1 question for HESM

SJ

Saumya Jain

UBS

1 question for HESM

Also covers: AMTX, BLDP, CLMT +8 more

Recent press releases and 8-K filings for HESM.

Hess Midstream Reports Strong 2025 Results and Provides 2026 and Long-Term Guidance

HESM

Earnings

Guidance Update

Dividends

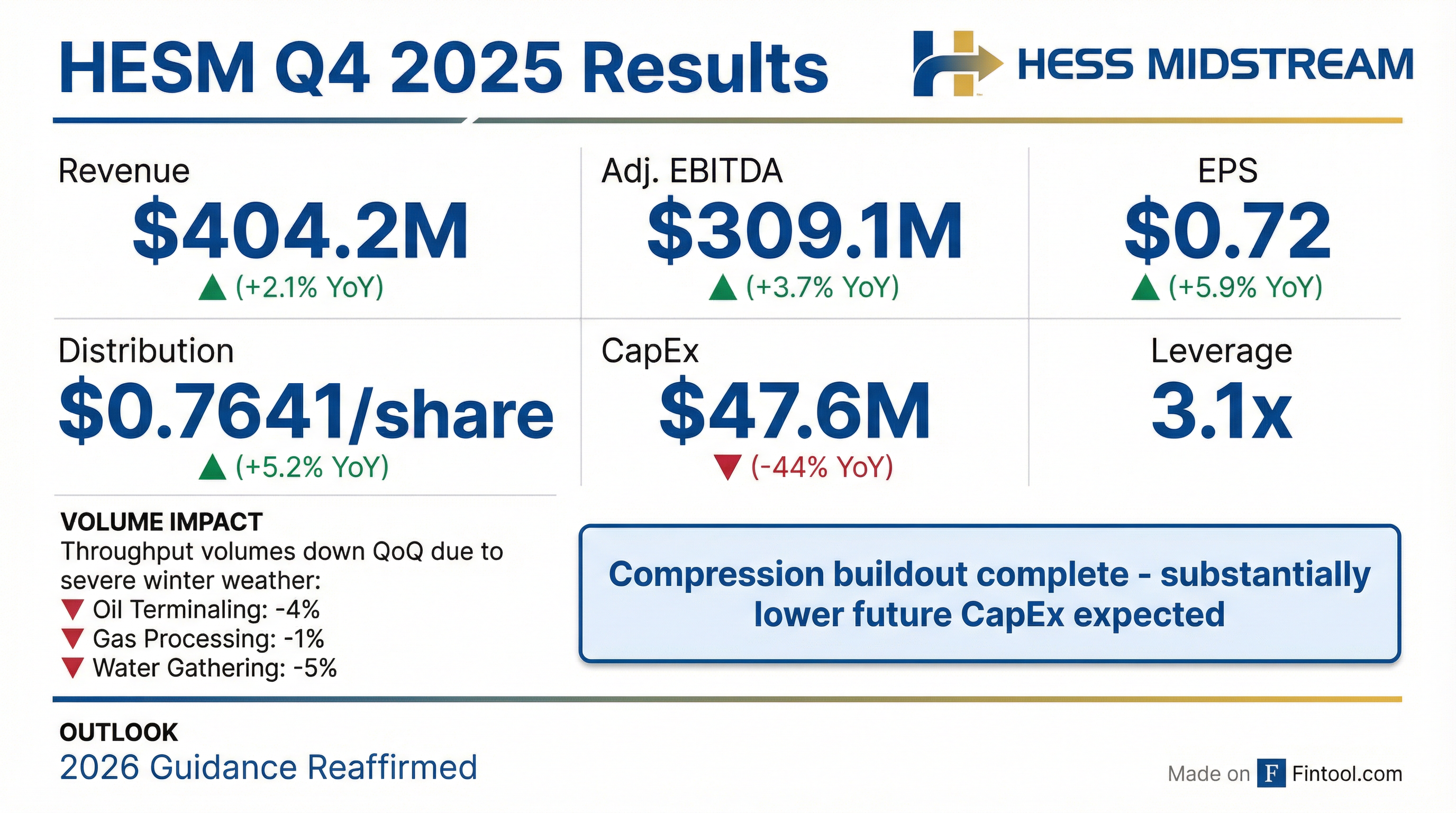

- Hess Midstream reported Q4 2025 net income of $168 million and Adjusted EBITDA of $309 million, with full-year 2025 Adjusted EBITDA reaching $1,238 million, representing approximately 9% growth from 2024.

- For 2026, the company expects net income between $650 million and $700 million and Adjusted EBITDA between $1,225 million and $1,275 million, with adjusted free cash flow projected at $850 million to $900 million, reflecting 12% growth over 2025 at the midpoint.

- Capital expenditures are anticipated to significantly decrease, with $150 million planned for 2026 (a 40% reduction from 2025) and further reductions to less than $75 million per year in 2027 and 2028.

- Hess Midstream targets 5% annual distribution growth per Class A share through 2028 and anticipates approximately 10% annualized adjusted free cash flow growth through 2028, supported by gas volume growth, inflation tariff adjustments, and lower operating and capital spend.

- The company's financial strategy includes using significant free cash flow for incremental shareholder returns and debt repayment, expecting to naturally delever below 3x leverage.

4 days ago

Hess Midstream Reports Q4 2025 Results and Provides 2026 and Long-Term Guidance

HESM

Earnings

Guidance Update

Dividends

- Hess Midstream reported Q4 2025 net income of $168 million and Adjusted EBITDA of $309 million, with full-year 2025 Adjusted EBITDA reaching $1,238 million, representing approximately 9% growth from 2024.

- For 2026, the company expects net income between $650 million and $700 million and Adjusted EBITDA between $1,225 million and $1,275 million, which is approximately flat at the midpoint compared to 2025.

- Capital expenditures are projected to significantly decrease to approximately $150 million in 2026 (a 40% reduction from 2025) and further to less than $75 million per year in 2027 and 2028.

- This reduction in capital spending is expected to drive Adjusted Free Cash Flow of $850 million to $900 million in 2026 (12% growth over 2025 at the midpoint), with annualized growth of approximately 10% through 2028.

- The company plans to use this free cash flow for targeted 5% distribution per Class A share growth through 2028, potential incremental share repurchases, and debt repayment, aiming to naturally delever below 3x.

4 days ago

Hess Midstream Reports Q4 2025 Results and Provides 2026 and Long-Term Guidance

HESM

Earnings

Guidance Update

Dividends

- Hess Midstream (HESM) reported Q4 2025 Adjusted EBITDA of $309 million and full-year 2025 Adjusted EBITDA of $1,238 million, marking approximately 9% growth from 2024.

- For 2026, the company projects Adjusted EBITDA between $1,225 million and $1,275 million and expects Adjusted Free Cash Flow of $850 million to $900 million, representing 12% growth over 2025 at the midpoint.

- Capital spending is set to significantly decrease to approximately $150 million in 2026 (a 40% reduction from 2025) and further to less than $75 million per year in 2027 and 2028, leveraging historical investments.

- HESM plans 5% distribution per Class A share growth through 2028, with excess free cash flow allocated to incremental shareholder returns and debt repayment.

- The company's revenues are substantially protected by Minimum Volume Commitments (MVCs), with approximately 95% coverage in 2026, 90% in 2027, and 80% in 2028.

4 days ago

Hess Midstream LP Reports Q4 2025 Estimated Results

HESM

Earnings

Dividends

Guidance Update

- Hess Midstream LP reported net income attributable to Hess Midstream LP of $93.3 million, or $0.72 basic earnings per Class A share, for the fourth quarter of 2025.

- For Q4 2025, Adjusted EBITDA was $309.1 million and Adjusted Free Cash Flow was $207.8 million.

- The company increased its quarterly cash distribution to $0.7641 per Class A share for the fourth quarter of 2025.

- Throughput volumes for oil terminaling, gas processing, and water gathering decreased by 4%, 1%, and 5% respectively in Q4 2025 compared to the prior-year quarter, primarily due to severe winter weather.

- Hess Midstream LP reaffirmed its full year 2026 and long-term guidance and noted the completion of its planned multiyear infrastructure project buildout in 2025, expecting substantially lower future capital spending.

5 days ago

Hess Midstream LP Reports Fourth Quarter and Full Year 2025 Results

HESM

Earnings

Dividends

Guidance Update

- Hess Midstream LP reported net income of $168.0 million and Adjusted EBITDA of $309.1 million for the fourth quarter of 2025. Net income attributable to Hess Midstream LP was $93.3 million, or $0.72 basic earnings per Class A share. For the full year 2025, net income was $684.6 million and Adjusted EBITDA was $1,238.1 million.

- The company increased its quarterly cash distribution to $0.7641 per Class A share for the fourth quarter of 2025, an increase of $0.0093 per Class A share compared with the third quarter of 2025.

- Capital expenditures decreased 44% in the fourth quarter of 2025 compared with the prior-year quarter, primarily due to the completion of its compression buildout.

- Hess Midstream LP is reaffirming its full year 2026 and long-term guidance issued on December 9, 2025.

5 days ago

Hess Midstream LP Announces Distribution Per Share Increase

HESM

Dividends

Guidance Update

- Hess Midstream LP declared a quarterly cash distribution of $0.7641 per Class A share for the quarter ended December 31, 2025, which is an increase of $0.0093 per Class A share compared to the third quarter of 2025.

- This distribution is payable on February 13, 2026, to Class A shareholders of record as of February 5, 2026.

- The company targets annual distribution per Class A share growth of at least 5% through 2028, supported by expected Adjusted Free Cash Flow growth through 2028.

Jan 26, 2026, 9:15 PM

Hess Midstream Announces 2026 Guidance and Extends Capital Program

HESM

Guidance Update

Dividends

New Projects/Investments

- Hess Midstream expects net income between $650 million and $700 million and Adjusted EBITDA between $1,225 million and $1,275 million for 2026.

- Total capital expenditures are projected to be approximately $150 million in 2026, a significant reduction from 2025, with further reductions to less than $75 million annually in both 2027 and 2028.

- The company anticipates annualized growth of approximately 5% for net income and Adjusted EBITDA and approximately 10% for Adjusted Free Cash Flow through 2028 from 2026 levels.

- Hess Midstream is targeting annual distribution per Class A share growth of at least 5% through 2028 and expects to generate approximately $1 billion of Adjusted Free Cash Flow after Distributions through 2028 for incremental shareholder returns and debt repayment.

Dec 9, 2025, 12:30 PM

Hess Midstream Reports Q3 2025 Results, Narrows Full Year Guidance, and Suspends Kappa Gas Plant Project

HESM

Earnings

Guidance Update

Share Buyback

- Hess Midstream reported Q3 2025 net income of $176 million and Adjusted EBITDA of $321 million, maintaining a gross adjusted EBITDA margin of approximately 80%.

- The company narrowed its full year 2025 guidance, expecting net income of $685 million-$695 million and Adjusted EBITDA of $1,245 million-$1,255 million, implying approximately 10% year-on-year growth at the midpoint.

- Full year 2025 capital expenditures are now projected to be approximately $270 million, a reduction following the suspension of the Kappa gas plant project, which is anticipated to provide additional free cash flow.

- In Q3 2025, Hess Midstream executed a $100 million share and unit repurchase and increased its distribution by 2.4%, targeting annual distribution growth of at least 5% through 2027.

Nov 3, 2025, 3:00 PM

Hess Midstream Reports Q3 2025 Results, Updates Guidance, and Suspends Kappa Gas Plant Project

HESM

Earnings

Guidance Update

Share Buyback

- Hess Midstream reported Q3 2025 net income of $176 million and Adjusted EBITDA of $321 million. The company narrowed its full-year 2025 guidance for net income to $685 million-$695 million and Adjusted EBITDA to $1,245 million-$1,255 million, implying approximately 10% year-on-year EBITDA growth at the midpoint.

- In Q3, Hess Midstream executed a $100 million share and unit repurchase and increased its distribution by 2.4%, or approximately 10% on an annualized basis per Class A share. The company targets annual distribution per Class A share growth of at least 5% through 2027.

- Activities on the Kappa gas plant have been suspended and the project removed from forward plans, resulting in a revised full-year 2025 capital expenditures expectation of approximately $270 million and significantly lower capital going forward. This is expected to provide additional free cash flow, with excess adjusted free cash flow of approximately $140 million anticipated after fully funding targeted distributions.

- Q3 throughput volumes averaged 462 million cubic feet per day for gas processing, 130,000 barrels of oil per day for crude terminaling, and 137,000 barrels of water per day for water gathering, with gas gathering and processing increasing approximately 3% from Q2. The company expects fourth quarter volumes to be relatively flat with Q3 due to lower third-party volumes and planned maintenance.

Nov 3, 2025, 3:00 PM

Hess Midstream Reports Q3 2025 Results, Updates Full-Year Guidance, and Suspends Capa Gas Plant Project

HESM

Earnings

Guidance Update

Share Buyback

- Hess Midstream (HESM) reported Q3 2025 net income of $176 million and Adjusted EBITDA of $321 million, with gas gathering and processing throughputs increasing approximately 3% from the second quarter.

- The company narrowed its full-year 2025 guidance for Adjusted EBITDA to $1.245 billion-$1.255 billion and revised capital expenditures down to approximately $270 million due to the suspension of the Capa gas plant project.

- HESM executed a $100 million share and unit repurchase in Q3 and increased its distribution by 2.4%, maintaining a target of at least 5% annual growth per Class A share through 2027. The lower capital expenditures are expected to drive continued growth in free cash flow.

- Management expects 2026 EBITDA to be relatively flat with 2025 but anticipates free cash flow growth due to significantly lower capital requirements. Guidance for 2026 and 2028 Minimum Volume Commitments (MVCs) will be released in December.

Nov 3, 2025, 3:00 PM

Quarterly earnings call transcripts for Hess Midstream.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more