Earnings summaries and quarterly performance for HAWKINS.

Executive leadership at HAWKINS.

Patrick Hawkins

Detailed

Chief Executive Officer and President

CEO

DG

Drew Grahek

Detailed

Vice President - Operations

JO

Jeffrey Oldenkamp

Detailed

Executive Vice President, Chief Financial Officer and Treasurer

RE

Richard Erstad

Detailed

Vice President, General Counsel and Secretary

SR

Shirley Rozeboom

Detailed

Vice President - Health & Nutrition

Board of directors at HAWKINS.

Research analysts covering HAWKINS.

Recent press releases and 8-K filings for HWKN.

Hawkins, Inc. Reports Record Q3 Fiscal 2026 Results with Revenue Growth and Acquisition Impact

HWKN

Earnings

M&A

Revenue Acceleration/Inflection

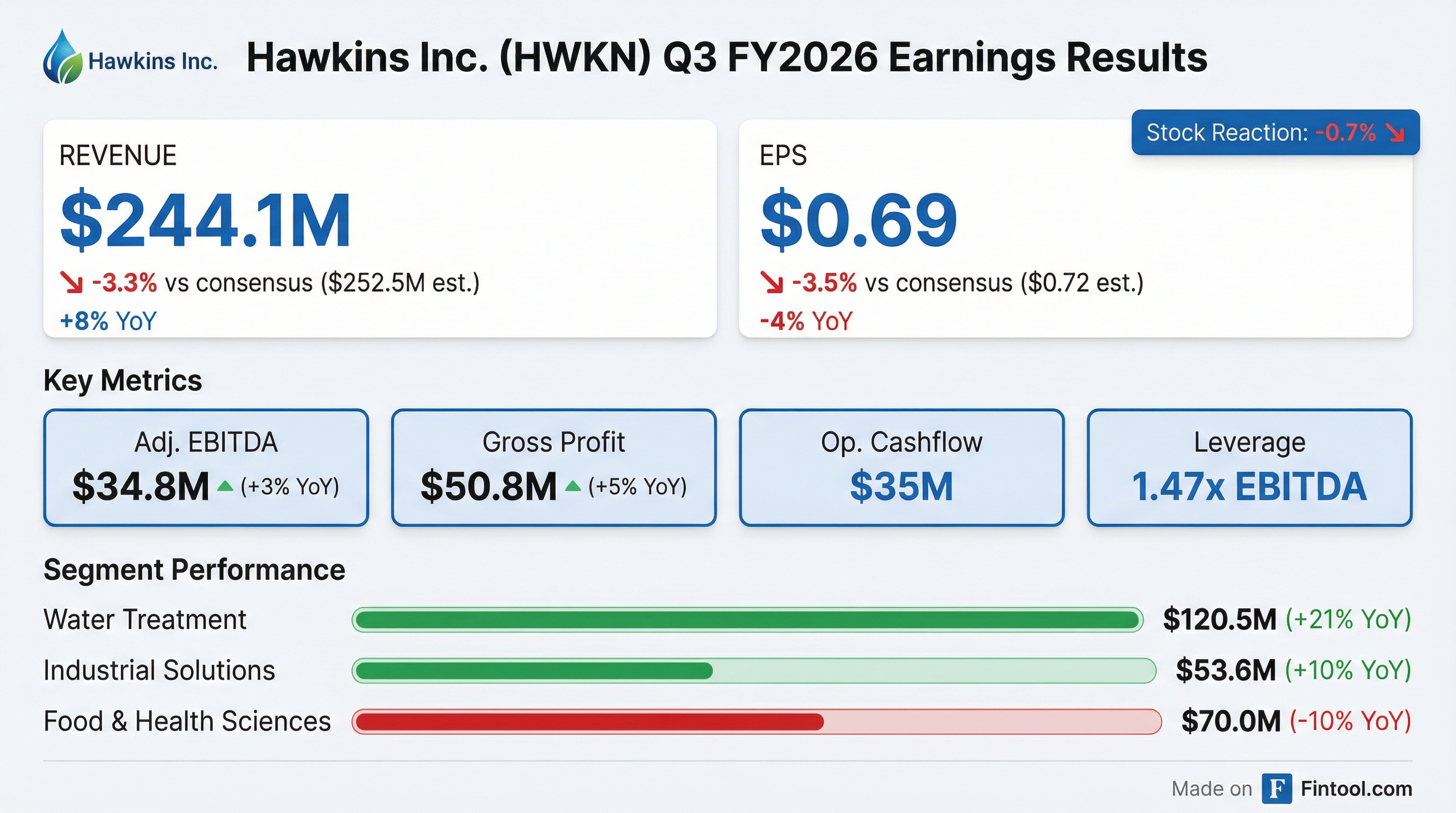

- Hawkins, Inc. announced record third quarter fiscal 2026 results for revenue, gross profit, operating income, and Adjusted EBITDA.

- Revenue grew 8% over the prior year, with the Water Treatment segment growing 21% and the Industrial Solutions segment growing 10%.

- Diluted earnings per share (EPS) for Q3 FY26 was $0.69, a 4% decrease from the prior year, primarily due to an approximately $5 million increase in amortization and interest expense related to six acquisitions completed in the first nine months of fiscal 2026.

- Adjusted EBITDA increased 3% to $34.8 million for the quarter, and the company generated $35 million in operating cash flow, which was used to pay down $15 million of debt, lowering its leverage ratio below 1.5x Adjusted EBITDA. The WaterSurplus acquisition, one of the six, is expected to be accretive in fiscal 2027.

Jan 28, 2026, 9:12 PM

Hawkins, Inc. Reports Third Quarter Fiscal 2026 Results

HWKN

Earnings

M&A

Revenue Acceleration/Inflection

- Hawkins, Inc. (HWKN) announced record third quarter results for revenue, gross profit, operating income, and adjusted EBITDA for the three months ended December 28, 2025.

- Revenue grew 8% to $244.1 million compared to the prior year, with the Water Treatment segment growing 21% and Industrial Solutions segment growing 10%, while the Food & Health Sciences segment decreased 10%.

- Diluted earnings per share (EPS) decreased 4% to $0.69, primarily due to an approximately $5 million increase in amortization and interest expense related to six acquisitions completed in the first nine months of fiscal 2026.

- Adjusted EBITDA increased 3% to $34.8 million for the quarter, with trailing 12-month Adjusted EBITDA reaching $179 million.

- The company generated $35 million in operating cash flow during the quarter, which was used to pay down $15 million of debt, reducing the leverage ratio to 1.47x Adjusted EBITDA.

Jan 28, 2026, 9:10 PM

Hawkins, Inc. Announces Fiscal Q3 2026 Results

HWKN

Earnings

- Hawkins, Inc. reported record third quarter revenue of $244.1 million for fiscal year 2026, an 8% increase over the prior year, and record third quarter year-to-date revenue of $817.8 million, up 12% year-over-year.

- Diluted Earnings Per Share (EPS) for Q3 FY26 was $0.69, with year-to-date EPS at $3.17.

- Adjusted EBITDA for Q3 FY26 reached $34.8 million, a 3% increase year-over-year, and year-to-date adjusted EBITDA was $141.8 million, an 8% increase.

- The company achieved its 31st consecutive quarter of year-over-year operating income growth.

Jan 28, 2026, 9:10 PM

Hawkins, Inc. Reports Record Q2 Fiscal 2026 Revenue and Adjusted EBITDA

HWKN

Earnings

Revenue Acceleration/Inflection

M&A

- Hawkins, Inc. reported record second quarter fiscal 2026 revenue of $280.4 million, a 14% increase from the prior year, and record adjusted EBITDA of $50.4 million, up 9% year-over-year.

- Diluted earnings per share for Q2 FY26 was $1.08, a 7% decrease compared to the prior year, primarily due to a $5 million increase in amortization and interest expense related to acquisitions.

- Revenue growth was led by the Water Treatment segment, which increased 21%, followed by Industrial Solutions with 11% growth, and Food and Health Sciences with 2% growth.

- The company reduced its debt level by $20 million during the quarter, with total debt outstanding at $279.0 million as of September 28, 2025.

Oct 29, 2025, 8:12 PM

Hawkins, Inc. Reports Record Second Quarter Fiscal 2026 Results

HWKN

Earnings

Revenue Acceleration/Inflection

M&A

- Hawkins, Inc. announced record second quarter revenue of $280.4 million, representing a 14% increase over the prior year, and record adjusted EBITDA of $50.4 million, a 9% increase.

- Diluted EPS decreased by 7% to $1.08 per share for the second quarter of fiscal 2026, primarily due to a $5 million increase in amortization and interest expense related to acquisitions.

- The Water Treatment segment led growth with a 21% increase in revenue, contributing to overall segment performance.

- The company reduced its debt level by $20 million during the quarter, with total debt outstanding at $279.0 million as of September 28, 2025.

Oct 29, 2025, 8:10 PM

Hawkins Acquires StillWaters Technology

HWKN

M&A

- Hawkins, Inc. has completed the acquisition of StillWaters Technology, Inc..

- StillWaters Technology distributes water treatment chemicals and equipment to customers in Alabama.

- This acquisition is intended to expand Hawkins' water treatment business in the southern U.S. and increase its customer base in Alabama.

- Hawkins, Inc. is a leading water treatment and specialty ingredients company that generated $974 million in revenue in fiscal 2025.

Aug 29, 2025, 12:32 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more