Earnings summaries and quarterly performance for IQVIA HOLDINGS.

Executive leadership at IQVIA HOLDINGS.

Ari Bousbib

Chief Executive Officer

Bhavik Patel

President, Commercial Solutions

Eric Sherbet

Executive Vice President, General Counsel and Secretary

Ronald Bruehlman

Executive Vice President and Chief Financial Officer

W. Richard Staub

President, Research & Development Solutions

Board of directors at IQVIA HOLDINGS.

Carol Burt

Director

Colleen Goggins

Director

James Fasano

Director

John Danhakl

Director

John Leonard

Lead Independent Director

Leslie Wims Morris

Director

Sheila Stamps

Director

Todd Sisitsky

Director

William Kaelin Jr.

Director

Research analysts who have asked questions during IQVIA HOLDINGS earnings calls.

David Windley

Jefferies Financial Group Inc.

7 questions for IQV

Elizabeth Anderson

Evercore ISI

7 questions for IQV

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

7 questions for IQV

Justin Bowers

Deutsche Bank AG

6 questions for IQV

Eric Coldwell

Robert W. Baird & Co.

5 questions for IQV

Ann Hynes

Mizuho Financial Group

3 questions for IQV

Jeffrey Garro

Stephens Inc.

3 questions for IQV

Michael Cherny

Leerink Partners

3 questions for IQV

Michael Ryskin

Bank of America Merrill Lynch

3 questions for IQV

Jack Meehan

Nephron Research LLC

2 questions for IQV

Jailendra Singh

Truist Securities

2 questions for IQV

Anne McCormick

JPMorgan Chase & Co.

1 question for IQV

Charles Rhyee

TD Cowen

1 question for IQV

Christine Rains

William Blair

1 question for IQV

Daniel Clark

Leerink Partners

1 question for IQV

Dan Leonard

UBS Group AG

1 question for IQV

Luke Sergott

Barclays

1 question for IQV

Matthew Sykes

Goldman Sachs Group Inc.

1 question for IQV

Salem Salem

Barclays

1 question for IQV

Shlomo Rosenbaum

Stifel Financial Corp.

1 question for IQV

Tejas Savant

Morgan Stanley

1 question for IQV

Recent press releases and 8-K filings for IQV.

- Q4 near-10% reported (7% constant currency) growth; legacy TAS real-world grew double-digits; TAS split ~33% real-world, ~25% info, 20% consulting and ~22% tech

- Go-forward Commercial Solutions guided to 7–9% growth and R&DS to 4%, with M&A contributing ~150 bps from deals like Cedar Gate

- AI strategy leverages proprietary global dataset from 150k data feeds; deployed 150 AI agents across 30 use cases (e.g., launch planning) to build a durable moat

- CFO transition to Mike Fedock emphasizes continuity; targets 0–30 bps annual EBITDA margin expansion, maintains 3–4x leverage and opportunistic M&A/share buybacks

- IQVIA expects ~150 bps contribution from M&A at the enterprise level in 2026, with roughly two-thirds benefiting Commercial Solutions and the balance in R&DS.

- The company’s proprietary, “messy” and dynamic data ecosystem—built over 71 years from 150,000 global feeds and hundreds of millions in annual spend—constitutes a durable AI moat, with limited erosion risk (primary market research is only 5% of its consulting & analytics).

- In 2025, non-operational factors (FX & pass-throughs) compressed EBITDA margins by 70 bps, mix and pricing by another 100 bps, while productivity initiatives added ~100 bps; IQVIA targets 0–30 bps of annual margin expansion going forward.

- CRO cancellations normalized in 2025 to ~$2 billion (down from $3 billion in 2024), with no observed impact from AI on RFP flow or cancellations.

- Leverage remains comfortable at 3–4× net debt/EBITDA; capital deployment is opportunistic, favoring share repurchases amid current valuations while maintaining an acquisitive pipeline.

- IQVIA expects 7-9% reported revenue growth, driven by momentum in Commercial Solutions and R&DS segments.

- M&A is projected to add 150 basis points to enterprise growth, with two-thirds of the benefit in Commercial Solutions and the balance in R&DS.

- The company’s proprietary real-world data forms a durable AI moat, having deployed over 150 AI agents across 30 use cases to enhance client solutions.

- Clinical trial cancellations returned to a ~$2 billion annual run rate in 2025 (vs. $3 billion in 2024), with no impact observed from AI integration.

- CFO succession emphasizes continuity in capital allocation, targeting 3–4x net leverage and remaining opportunistic on M&A versus share repurchase based on valuation.

- IQVIA entered an agreement to acquire certain discovery services assets from Charles River Laboratories, adding five specialized in vitro drug discovery sites.

- These assets feature established New Approach Methodologies and a small molecule AI platform backed by over 20 years of curated data, supporting 100+ molecules in clinical trials and multiple approved drugs.

- The acquisition expands IQVIA’s end-to-end drug discovery capabilities across target identification, hit-to-lead, lead optimization and early safety assessment in areas such as Oncology, Neurology and Immunology.

- The transaction is expected to close in Q2 2026.

- Cedar Gate analysis shows a 13% decline in bariatric surgery volume over the past year and a 67% increase in members using GLP-1 medications over two years.

- In 2024, the average cost of bariatric surgery was $24,215 (up 9.62%) vs an annual $5,200 per patient for GLP-1 prescriptions (up 8.33%); GLP-1 users fill an average of 4.77 prescriptions at over $1,100 each.

- Bariatric surgery patients were 80.5% female, compared with 56.2% for GLP-1 prescriptions; 70% of GLP-1 users are 50 or older vs 34% of surgery patients, suggesting broader reach for nonsurgical treatments.

- Long-term outcomes remain uncertain: bariatric surgery shows sustained ~20% weight loss after 10 years, while GLP-1 patients often regain weight after stopping therapy, with only ~33% persisting on treatment at one year and 27% adhering as intended.

- Bio Usawa and Nanoly Bioscience entered a licensing deal valued at up to $500 million, granting Bio Usawa exclusive, worldwide rights to the DynaShield™ thermal-stability platform.

- DynaShield™ uses a specialized polymer scaffold to protect proteins from thermal degradation, enabling room-temperature stability of biologics and vaccines and potentially eliminating the traditional cold-chain requirement.

- By removing refrigeration needs, the agreement aims to cut distribution overhead and spoilage—currently up to 50% of vaccines are wasted annually due to cold-chain failures, which cost the biopharma sector $20–35 billion per year in losses.

- Bio Usawa’s manufacturing scale in emerging markets, combined with Nanoly’s stabilization expertise, is designed to expand affordable, reliable access to life-saving therapies in regions lacking robust refrigeration infrastructure.

- The generative AI in life sciences market is projected to grow from USD 233.74 million in 2024 to USD 1,544.13 million by 2034, at a CAGR of 20.78%.

- IQVIA’s 2024 revenue was USD 15.4 billion, driven by its clinical trial, real-world data, and analytics platforms.

- Key players leveraging AI include Medidata Solutions (SaaS trial platforms), Owkin SA (drug discovery algorithms), Insilico Medicine (molecular design), Heidi Health (clinical workflow automation), and OpenEvidence (AI-driven clinical insights).

- Public sector initiatives—over 500 FDA tech-integrated drug submissions (2016–2023) and the NIH All of Us program ($130 million funding, 297,549 participants)—are bolstering data availability for personalized medicine.

- AI tools are enhancing trial efficiency, patient selection, data interpretation, and automating administrative tasks, thereby accelerating drug development and improving care delivery.

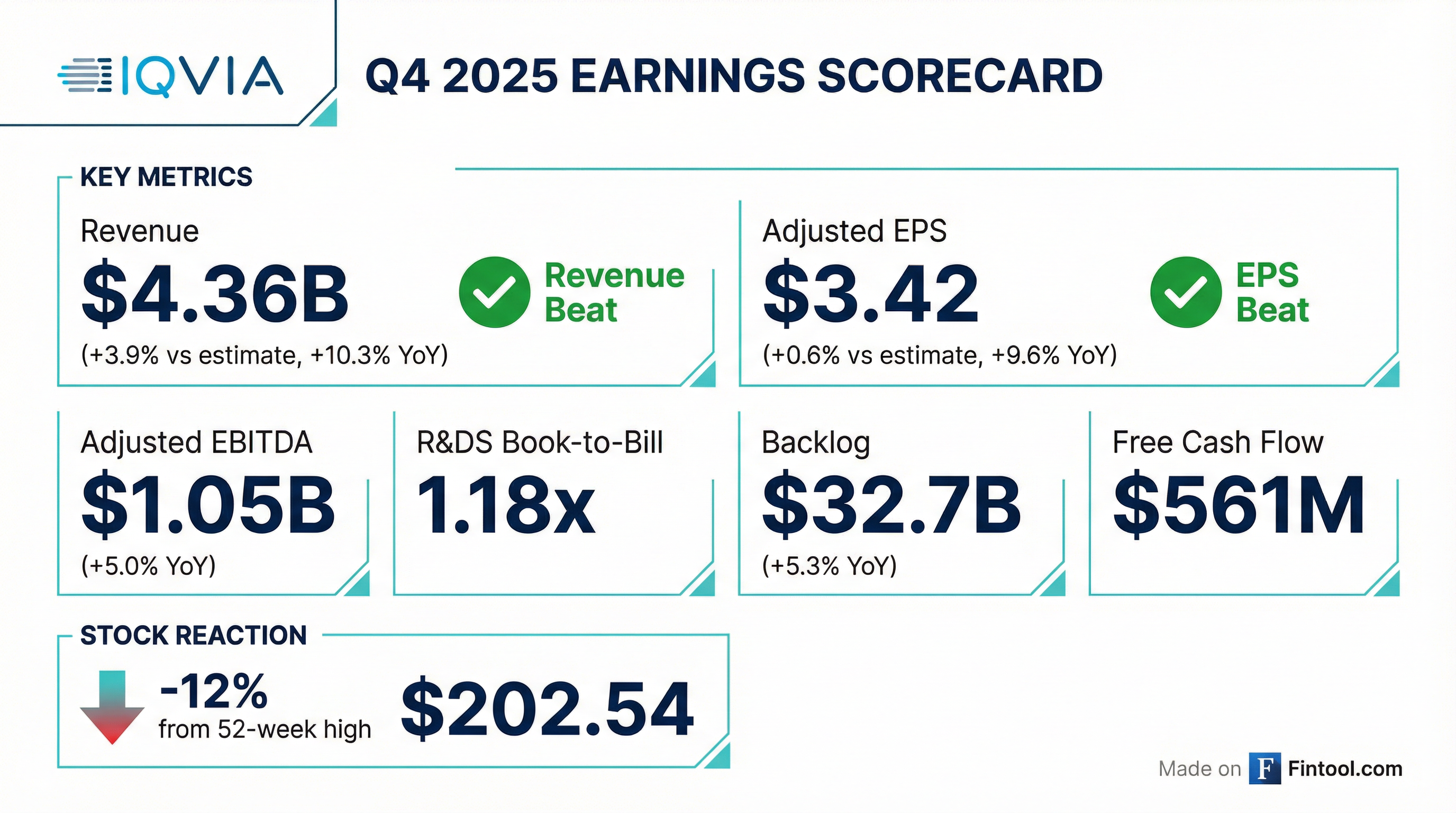

- Q4 revenue of $4,364 M (+10.3% reported; +8.1% constant currency); full-year revenue $16.31 B (+5.9% reported; +4.8% cc).

- Q4 adjusted EPS of $3.42 (+9.6% YoY); full-year adjusted EPS $11.92 (+7.1% YoY).

- Q4 clinical net bookings of $2.7 B (+7% YoY) with a book-to-bill of 1.18; backlog reached $32.7 B (+5.3% YoY).

- Q4 free cash flow $561 M; full-year free cash flow $2.051 B (~100% of adjusted net income); net debt $13.744 B (3.63× trailing EBITDA).

- 2026 guidance: revenue $17.15 B–17.35 B, adjusted EPS $12.55–12.85; 2025 segment recast shows Commercial Solutions at $6.74 B and R&DS at $9.57 B.

- IQVIA delivered Q4 revenue of $4,364 M, up 10.3% year-over-year on an actual FX basis; Adjusted EBITDA was $1,046 M and Adjusted diluted EPS was $3.42.

- Full-year 2025 revenue reached $16,310 M, up 5.9% year-over-year, with Adjusted EBITDA of $3,788 M.

- Operating cash flow for Q4 was $735 M and free cash flow was $561 M, with a net leverage ratio of 3.63x as of December 31, 2025.

- For full-year 2026, the company guides revenue of $17,150 M–$17,350 M, Adjusted EBITDA of $3,975 M–$4,025 M, and Adjusted EPS of $12.55–$12.85.

- Q4 revenue of $4.364 billion (+10.3% reported, +8.1% constant currency), adjusted EBITDA of $1.046 billion (+5%), adjusted EPS of $3.42 (+9.6%), and R&DS backlog of $32.7 billion (+5.3%).

- Full-year 2025 revenue of $16.31 billion (+5.9% reported, +4.8% constant currency), free cash flow of $2.051 billion (≈99% of adjusted net income), and $1.244 billion returned via share repurchases at an average price of $169.

- 2026 guidance: revenue of $17.15–17.35 billion, adjusted EBITDA of $3.975–4.025 billion, and adjusted EPS of $12.55–12.85; 2025 segment recast shows Commercial Solutions at $6.74 billion and R&DS at $9.57 billion.

- CFO Ron Bruehlman will transition to a senior advisory role after this call, marking his final earnings presentation in the CFO role.

Quarterly earnings call transcripts for IQVIA HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more