Earnings summaries and quarterly performance for COGNIZANT TECHNOLOGY SOLUTIONS.

Executive leadership at COGNIZANT TECHNOLOGY SOLUTIONS.

Ravi Kumar S

Chief Executive Officer

Alina Kerdman

Senior Vice President, Controller and Chief Accounting Officer

Ganesh Ayyar

President, Intuitive Operations and Automation and Industry Solutions

Jatin Dalal

Chief Financial Officer

John Kim

Chief Legal Officer, Chief Administrative Officer and Corporate Secretary

Surya Gummadi

President, Americas

Board of directors at COGNIZANT TECHNOLOGY SOLUTIONS.

Archana Deskus

Director

Bram Schot

Director

Eric Branderiz

Director

John M. Dineen

Director

Joseph M. Velli

Director

Karima Silvent

Director

Leo S. Mackay, Jr.

Director

Michael Patsalos-Fox

Director

Sandra S. Wijnberg

Director

Stephen J. Rohleder

Chair of the Board of Directors

Vinita Bali

Director

Zein Abdalla

Director

Research analysts who have asked questions during COGNIZANT TECHNOLOGY SOLUTIONS earnings calls.

Tien-tsin Huang

JPMorgan Chase & Co.

8 questions for CTSH

Bryan Bergin

TD Cowen

5 questions for CTSH

James Faucette

Morgan Stanley

4 questions for CTSH

Jason Kupferberg

Bank of America

4 questions for CTSH

Jim Schneider

Goldman Sachs

4 questions for CTSH

Rod Bourgeois

DeepDive Equity Research

4 questions for CTSH

Surinder Thind

Jefferies Financial Group

4 questions for CTSH

Darrin Peller

Wolfe Research, LLC

3 questions for CTSH

Jonathan Lee

Arias Resource Capital

3 questions for CTSH

Bryan Keane

Deutsche Bank

2 questions for CTSH

James Schneider

Goldman Sachs

2 questions for CTSH

Keith Bachman

BMO Capital Markets

2 questions for CTSH

Maggie Nolan

William Blair & Company, L.L.C.

2 questions for CTSH

Margaret Nolan

William Blair & Company

2 questions for CTSH

Yogesh Aggarwal

HSBC Bank

2 questions for CTSH

Amit Daryanani

Evercore

1 question for CTSH

James Friedman

Susquehanna Financial Group, LLLP

1 question for CTSH

Jamie Friedman

Susquehanna International Group

1 question for CTSH

Ramsey El-Assal

Barclays

1 question for CTSH

Yen-yu Lin

Goldman Sachs

1 question for CTSH

Yu Lee

Guggenheim Partners

1 question for CTSH

Recent press releases and 8-K filings for CTSH.

- Cognizant and Palantir entered a strategic partnership to integrate Palantir Foundry and AIP with Cognizant’s TriZetto healthcare platforms and BPaaS operations, aiming to accelerate AI-driven modernization in healthcare and broader enterprise operations.

- The collaboration combines Palantir’s ontology-driven AI capabilities with Cognizant’s industry expertise and global engineering scale to create secure, scalable, enterprise-grade AI solutions with governed, audit-ready workflows.

- Beyond healthcare, the partnership targets enterprise AI transformation across industries, reinforcing Cognizant's AI builder strategy and Palantir’s mission-critical deployment focus.

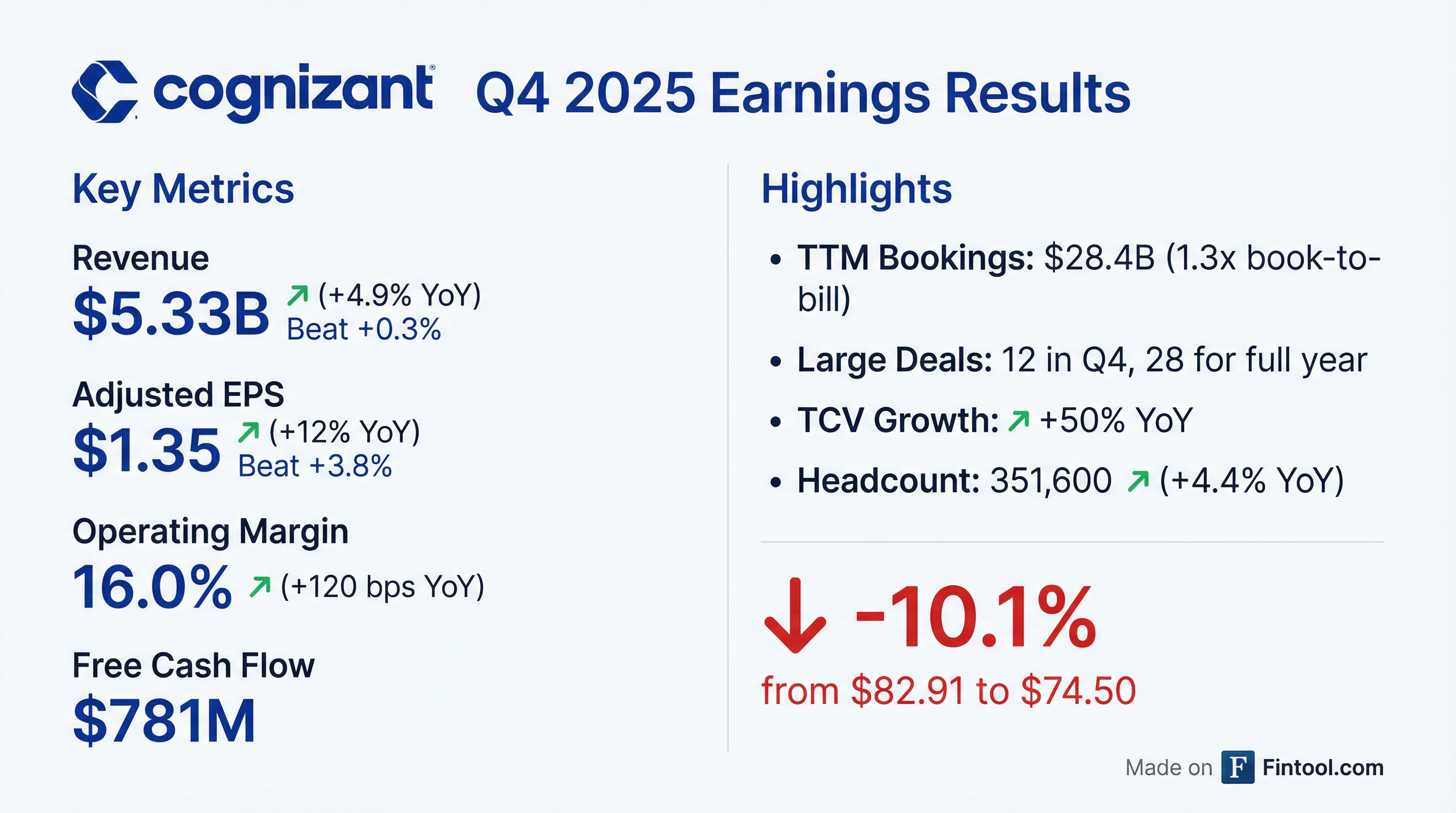

- Q4 revenue of $5.3 B, up 3.8% year-over-year in constant currency; full year revenue of $21.1 B, up 6.4%, surpassing guidance (€20 B target).

- Q4 adjusted operating margin of 16.0%, up 30 bps year-over-year; full year margin of 15.8%, up 50 bps.

- Strong large-deal momentum: Q4 bookings up 9%, with 12 deals > $100 M (including one > $1 B); full year 28 large deals, TCV +50% year-over-year.

- Returned $2 B to shareholders in 2025 via dividends and buybacks; closed 3Cloud acquisition; ended year with net cash $1.3 B.

- 2026 guidance: revenue up 4–6.5% in constant currency (incl. ~150 bps inorganic), adjusted margin 15.9–16.1%, EPS $5.56–5.70, free cash flow conversion 90–100%.

- Q4 2025 revenue was $5.333 B, up 4.9% Y/Y (3.8% constant currency), and full-year 2025 revenue was $21.108 B, up 7.0% Y/Y (6.4% CC).

- Q4 2025 GAAP diluted EPS was $1.34, adjusted diluted EPS was $1.35, with both GAAP and adjusted operating margins at 16.0%.

- Q4 2025 operating cash flow was $858 M and free cash flow was $781 M.

- Full-year 2026 guidance: revenue of $22.14 B–$22.66 B (up 4.9%–7.4% Y/Y), adjusted diluted EPS of $5.56–$5.70 (up 5%–8% Y/Y); Q1 2026 revenue guidance of $5.36 B–$5.44 B (up 4.8%–6.3% Y/Y).

- Q4 revenue was $5.3 billion, up 3.8% year-over-year in constant currency (all organic); full-year 2025 revenue reached $21.1 billion, growing 6.4% cc, driven by Financial Services and North America.

- Q4 adjusted operating margin improved to 16%, up 30 bps; full-year adjusted operating margin was 15.8%, up 50 bps; Q4 adjusted EPS was $1.35 (+12% yoy) and full-year EPS was $5.28 (+11%).

- Large deal momentum continued as Q4 bookings grew 9% yoy with 12 deals over $100 million TCV (including two mega deals), achieving a trailing 12-month book-to-bill of 1.3.

- The company returned $2 billion to shareholders in 2025 via dividends and repurchases, ended Q4 with $1.3 billion net cash, and provided 2026 guidance for 4–6.5% revenue growth cc, 15.9–16.1% margins, and EPS of $5.56–$5.70.

- Q4 revenue was $5.3 billion, up 3.8% YoY in constant currency (all organic); FY 2025 revenue reached $21.1 billion, up 6.4%, surpassing guidance.

- Q4 adjusted operating margin was 16.0%, up 30 bps YoY; FY 2025 margin was 15.8%, exceeding guidance by 50 bps.

- Full-year 2026 guidance calls for revenue growth of 4–6.5% in constant currency (midpoint ~5.25%, incl. ~150 bps inorganic) and adjusted EPS of $5.56–5.70, implying 5–8% YoY EPS growth.

- Returned $2.0 billion to shareholders in 2025 via dividends and share repurchases; net cash of $1.3 billion at year-end, excluding restricted cash for the 3Cloud deal.

- Completed acquisition of 3Cloud, adding >1,200 Azure specialists; signed 28 deals >$100 million TCV (including 12 in Q4 and five mega-deals), driving record TCV growth.

- Q4 2025 revenue of $5.33 B (up 4.9% Y/Y; 3.8% CC) and full-year 2025 revenue of $21.11 B (up 7.0% Y/Y; 6.4% CC).

- Q4 GAAP operating margin of 16.0% and adjusted operating margin of 16.0%, delivering GAAP EPS of $1.34 and adjusted EPS of $1.35; full-year 2025 GAAP margin 16.1% (adjusted 15.8%) with GAAP EPS $4.56 and adjusted EPS $5.28.

- Q4 operating cash flow $858 M and free cash flow $781 M; full-year 2025 operating cash flow $2.88 B and free cash flow $2.67 B; returned approximately $2 B to shareholders via $610 M dividends and $1.38 B repurchases.

- 2026 guidance: revenue $22.14–$22.66 B (4.9–7.4% Y/Y; 4.0–6.5% CC), adjusted operating margin 15.9–16.1%, adjusted EPS $5.56–$5.70; Q1 2026 revenue $5.36–$5.44 B (4.8–6.3% Y/Y; 2.7–4.2% CC).

- Q4 revenue of $5.3 B, up 4.9% YoY (3.8% CC); FY revenue of $21.1 B, up 7.0% YoY (6.4% CC)

- Adjusted operating margin expanded 50 bps to 15.8%, and adjusted EPS grew 11% to $5.28 for FY2025

- TTM bookings reached $28.4 B, up 5% with book-to-bill 1.3x, including 28 large deals signed in 2025

- 2026 guidance: revenue growth of 4.0–6.5% CC, adjusted OPM of 15.9–16.1%, adjusted EPS of $5.56–5.70

- Returned $2 B to shareholders in 2025; plans $1.6 B return in 2026 (including $1 B buybacks and a $0.33 Q1 dividend)

- Cognizant expands global AI collaboration with Adobe to integrate generative AI into enterprise content supply chains, combining Adobe’s creative and experience platforms with Cognizant’s AI Builder and managed services for governance and scalability.

- The collaboration leverages Adobe Firefly Services, Custom Models, Firefly Design Intelligence, Substance 3D, automation, and Frame.io to embed generative AI into clients’ workflows, from ideation to production and compliance.

- Adobe estimates AI-enabled content transformations can deliver an average 7.1× net ROI over three years, while Cognizant benchmarking shows 30–70% improvements in ideation, 70–80% gains in asset production, faster campaign launches and multi-year returns above 7×.

- Initial focus industries include healthcare & life sciences, financial services, retail and consumer goods, with a plan to expand globally across additional sectors.

- Cognizant (NASDAQ: CTSH) announced a multi-year strategic partnership with Microsoft to help enterprises become AI-powered frontier firms by co-building industry-grade AI solutions and co-selling globally across sectors such as Financial Services, Healthcare & Life Sciences, Retail, and Manufacturing.

- The collaboration will embed agentic AI and Copilot capabilities into Cognizant’s Work IQ, Foundry IQ, and Fabric IQ, while scaling Microsoft 365 Copilot and GitHub Copilot adoption and upskilling associates in Azure and Azure AI Foundry.

- Cognizant will leverage proprietary platforms like TriZetto, Skygrade, and FlowSource to deliver sector-specific advancements and modernize software engineering at scale.

- Cognizant has entered into a definitive agreement to acquire 3Cloud, a leading Microsoft Azure services provider, to advance its AI builder strategy and enterprise AI solutions.

- 3Cloud will add 1,000+ Azure experts, 1,500+ Microsoft certifications, and nearly 1,200 employees to Cognizant’s global capabilities.

- Since 2020, 3Cloud has delivered 20% organic CAGR and expects 20%+ growth in 2025, driven by strong demand for Azure-powered transformation.

- The transaction is expected to close in Q1 2026, subject to regulatory approvals, with financial terms undisclosed.

Quarterly earnings call transcripts for COGNIZANT TECHNOLOGY SOLUTIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more