Earnings summaries and quarterly performance for DXC Technology.

Executive leadership at DXC Technology.

Board of directors at DXC Technology.

Research analysts who have asked questions during DXC Technology earnings calls.

Jonathan Lee

Arias Resource Capital

6 questions for DXC

Rod Bourgeois

DeepDive Equity Research

6 questions for DXC

Bryan Bergin

TD Cowen

5 questions for DXC

Keith Bachman

BMO Capital Markets

5 questions for DXC

Paul Obrecht

Wolfe Research

4 questions for DXC

Antonio Jaramillo

Morgan Stanley

3 questions for DXC

James Friedman

Susquehanna Financial Group, LLLP

3 questions for DXC

Jamie Friedman

Susquehanna International Group

3 questions for DXC

Tien-tsin Huang

JPMorgan Chase & Co.

3 questions for DXC

Brendan Biles

JPMorgan

2 questions for DXC

James Faucette

Morgan Stanley

2 questions for DXC

Tyler DuPont

Bank of America

2 questions for DXC

Bryan Keane

Deutsche Bank

1 question for DXC

Jason Kupferberg

Bank of America

1 question for DXC

Matthew Roswell

RBC Capital Markets

1 question for DXC

Zachary Ajzenman

TD Cowen

1 question for DXC

Recent press releases and 8-K filings for DXC.

- DXC Technology has completed an enterprise-wide deployment of Amazon Quick, an AI-powered digital workspace, across its 115,000 employees in 70 countries.

- This deployment is noted as one of the largest enterprise implementations of Amazon Quick to date, utilizing DXC's "Customer Zero" approach to validate the technology internally.

- DXC also launched the DXC Amazon Quick Practice, a new business unit designed to help customers securely deploy and operationalize AI at scale across complex enterprise ecosystems.

- The new practice is supported by over 10,000 Amazon-certified professionals and leverages DXC's internal deployment experience to accelerate customer AI adoption.

- Boomi has achieved 50% customer growth in just over three years, now serving over 30,000 customers worldwide, including more than a quarter of the Fortune 500.

- The company's AI Activation Platform is gaining significant traction, with over 75,000 AI agents running in production for mission-critical operations.

- Boomi expanded its core platform through strategic acquisitions of Rivery and Thru, Inc., with the latter leading to more than 270% customer adoption for its managed file transfer capabilities.

- Boomi has also grown its global headcount by nearly 40% over the past three years and expanded its strategic partner ecosystem.

- DXC Technology reported Q3 Fiscal 2026 total revenue of $3.2 billion, a 4.3% year-over-year decline, with an Adjusted EBIT margin of 8.2% and non-GAAP EPS of $0.96.

- For Q4 Fiscal 2026, the company anticipates total organic revenue to decline 4%-5%, with full-year free cash flow of approximately $650 million and $250 million in share repurchases for Fiscal Year 2026. DXC also plans to retire $400 million in bonds and repurchase $250 million in shares in H1 Fiscal 2027.

- DXC is advancing its dual-track strategy, which includes launching a refreshed brand and developing Fast-Track AI-infused solutions such as CoreIgnite and Agentic Security Operations Center, with the goal for these initiatives to achieve 10% of run rate revenue by the end of Q2 Fiscal 2029.

- For Q3 2026, DXC Technology reported Non-GAAP diluted EPS of $0.96, an Adjusted EBIT Margin of 8.2%, and organic revenue growth of (4.3%).

- The company provided Q4 FY26 guidance for Non-GAAP diluted EPS between $0.65-$0.75 and organic revenue growth of (4.0%) – (5.0%). For Full Fiscal Year 2026, guidance includes ~$3.15 Non-GAAP diluted EPS and ~$650M Free Cash Flow.

- DXC is executing a two-track strategy with a Core Track for heritage businesses and a Fast Track for new AI-fueled businesses, targeting 10% of run rate revenue from Fast Track by the end of Q2 fiscal 2029.

- Capital allocation priorities include repurchasing $60 million of shares in Q4 FY26 and $250 million in the first half of FY27, and retiring the remaining $400 million of senior notes due September 2027. The company reported $266 million in Free Cash Flow for Q3 FY26 and net debt of $1.9 billion.

- DXC Technology reported Q3 Fiscal 2026 total revenue of $3.2 billion, representing a 4.3% year-to-year decline, with a book-to-bill ratio of 1.12 for the quarter and non-GAAP EPS of $0.96.

- The company provided Q4 Fiscal 2026 guidance anticipating an adjusted EBIT margin in the range of 6.5%-7.5% and non-GAAP diluted EPS of $0.65-$0.75.

- For the full Fiscal Year 2026, DXC expects an organic revenue decline of approximately 4.3%, an adjusted EBIT margin of approximately 7.5%, and non-GAAP diluted EPS of approximately $3.15, with free cash flow remaining at approximately $650 million.

- DXC is advancing Fast-Track initiatives focused on AI-infused solutions, such as Core Ignite for banking, with the goal of achieving 10% of run rate revenue by the end of Q2 Fiscal 2029.

- In Q3, the company launched a refreshed brand and established a centralized sales enablement function, while also utilizing AI internally to drive cost reductions.

- DXC Technology reported Q3 Fiscal 2026 revenue of $3.2 billion, a 4.3% year-over-year decline, with an Adjusted EBIT margin of 8.2% and Non-GAAP EPS of $0.96.

- The company achieved a quarterly book-to-bill ratio of 1.12, bringing the trailing 12-month ratio to 1.02, marking the fourth consecutive quarter above one.

- DXC is advancing its dual-track strategy, including a refreshed brand and Fast-Track initiatives like Core Ignite, which are expected to contribute 10% of run rate revenue by the end of Q2 Fiscal 2029.

- For full-year Fiscal 2026, DXC updated its guidance to an organic revenue decline of approximately 4.3%, an Adjusted EBIT margin of approximately 7.5%, and Non-GAAP diluted EPS of approximately $3.15, while maintaining its Free Cash Flow expectation of approximately $650 million.

- The company repurchased $190 million in shares year-to-date through Q3 FY26 and plans to repurchase an additional $60 million in Q4, bringing the full-year total to approximately $250 million. It also plans to repurchase $250 million in shares in the first half of Fiscal 2027.

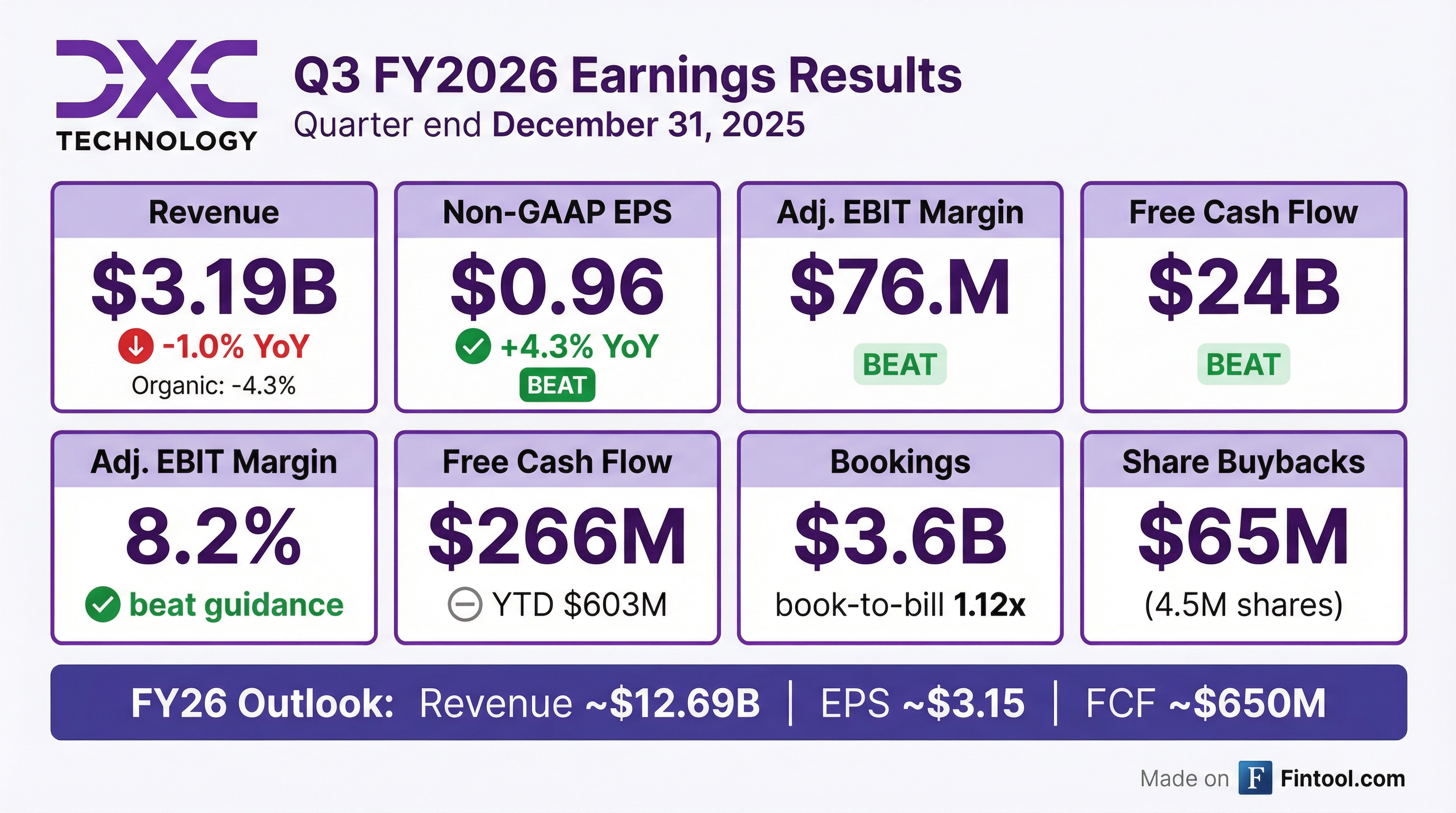

- DXC Technology reported total revenue of $3.19 billion, a 1.0% year-over-year decrease, and non-GAAP diluted earnings per share of $0.96, up 4.3% year-over-year, for the third quarter of fiscal year 2026.

- The company achieved bookings of $3.6 billion with a book-to-bill ratio of 1.12x in Q3 FY2026.

- Free cash flow for the quarter was $266 million, contributing to a year-to-date total of $603 million, up 4.7% year-over-year.

- During the quarter, DXC Technology repurchased $65 million of shares and redeemed $300 million of senior notes.

- For the fourth quarter of fiscal year 2026, the company provided guidance for total revenue in the range of $3.16 billion to $3.19 billion and non-GAAP diluted EPS between $0.65 and $0.75.

- DXC Technology reported third quarter fiscal year 2026 results with total revenue of $3.19 billion, a 1.0% year-over-year decrease (or 4.3% organically), and non-GAAP diluted earnings per share of $0.96, an increase of 4.3% year-over-year.

- The company achieved bookings of $3.6 billion, resulting in a book-to-bill ratio of 1.12x, and generated $266 million in free cash flow for the quarter, bringing the year-to-date total to $603 million.

- During the quarter, DXC Technology repurchased $65 million of shares and redeemed $300 million of senior notes.

- For full fiscal year 2026, the company updated its guidance, expecting total revenue of ~$12.69 billion (a decline of ~4.3% organically), adjusted EBIT margin of ~7.5%, non-GAAP diluted EPS of ~$3.15, and free cash flow of ~$650 million.

- DXC Technology announced a strategic partnership with Ripple to help banks adopt digital asset custody and payment capabilities at enterprise scale.

- The collaboration integrates Ripple's blockchain technology into DXC's Hogan core banking platform, which supports $5 trillion in deposits and 300 million accounts globally.

- This partnership enables financial institutions to deliver regulated digital asset use cases without disrupting their existing core banking infrastructure.

- DXC Technology announced a strategic partnership with Euronet Worldwide, Inc. to expand global issuing and payments capabilities for financial institutions.

- The collaboration involves integrating DXC's Hogan core banking platform with Euronet's Ren platform to accelerate the launch of card issuing, credit, and payment programs.

- This partnership aims to help financial organizations simplify operations, reduce time to market, and scale their offerings in the competitive financial services sector.

Quarterly earnings call transcripts for DXC Technology.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more