Earnings summaries and quarterly performance for Genpact.

Executive leadership at Genpact.

BK Kalra

President and Chief Executive Officer

Anil Nanduru

Senior Vice President and Global Business Leader, Consumer & Healthcare and High Tech & Manufacturing

Anthony Radesca

Senior Vice President and Chief Accounting Officer

Heather White

Senior Vice President, Chief Legal Officer and Secretary

Michael Weiner

Senior Vice President, Chief Financial Officer

Piyush Mehta

Senior Vice President, Chief Human Resources Officer and Country Manager, India

Riju Vashisht

Senior Vice President, Chief Growth Officer and Global Business Leader, Enterprise Services and Partnerships and Alliances

Board of directors at Genpact.

Ajay Agrawal

Director

Brian Stevens

Director

Carol Lindstrom

Director

CeCelia Morken

Director

James Madden

Chair of the Board

John Hinshaw

Director

Laura Conigliaro

Director

Mark Verdi

Director

Nicholas Gangestad

Director

Tamara Franklin

Director

Thimaya Subaiya

Director

Research analysts who have asked questions during Genpact earnings calls.

Bradley Clark

BMO Capital Markets

5 questions for G

Bryan Bergin

TD Cowen

5 questions for G

Surinder Thind

Jefferies Financial Group

5 questions for G

Puneet Jain

JPMorgan Chase & Co.

4 questions for G

Sean Kennedy

Mizuho Securities

3 questions for G

David Koning

Robert W. Baird & Co.

2 questions for G

Maggie Nolan

William Blair

2 questions for G

Margaret Nolan

William Blair & Company

2 questions for G

Jacob Hagerty

Robert W. Baird & Co.

1 question for G

Jacob Haggarty

Analyst

1 question for G

Jared Levine

TD Cowen

1 question for G

Kathleen Kronstein

William Blair & Company, L.L.C.

1 question for G

Maggie Nolan

William Blair & Company, L.L.C.

1 question for G

Robert Bamberger

Robert W. Baird & Co.

1 question for G

Recent press releases and 8-K filings for G.

- Genpact delivered FY 2025 revenues of $5.08 billion, an increase of 6.6% year-over-year, with Adjusted Diluted EPS growing 11.3% to $3.65.

- Advanced Technology Solutions (ATS) revenue grew 17% to $1.204 billion in FY 2025, now comprising 24% of total revenue, and contributed to 60 basis points of gross margin expansion to 36%.

- The company secured over $5.5 billion in new bookings in 2025, with Advanced Technology Solutions accounting for more than a third of total bookings, and closed over $200 million in agentic contracts.

- For 2026, Genpact expects revenue growth of at least 7%, with Advanced Technology Solutions revenue growing at least high teens, and anticipates Adjusted Diluted EPS to grow approximately 10%.

- Genpact returned $401 million to shareholders in 2025 through share repurchases and dividends, and the board approved a 10% increase in the regular quarterly dividend to $0.1875.

- Genpact reported a strong close to 2025, with full-year revenue of $5.08 billion, up 6.6%, and adjusted diluted EPS of $3.65, up 11.3%.

- Advanced Technology Solutions (ATS) revenue grew 17% to $1.204 billion in 2025, now representing 24% of total revenue, driven by a focus on data, AI, and agentic solutions, with over $200 million in agentic contracts closed.

- For 2026, the company expects at least 7% revenue growth, with ATS growing in the high teens, and approximately 10% adjusted diluted EPS growth, alongside continued margin expansion.

- Genpact increased its regular quarterly dividend by 10% to $0.1875 per quarter and aims to return approximately 50% of operating cash flows to shareholders through repurchases and dividends.

- Genpact delivered $5.08 billion in revenue for 2025, marking a 6.6% increase year-over-year, with Advanced Technology Solutions (ATS) revenue growing 17% to $1.2 billion and accounting for 24% of total revenue.

- For the full year 2025, adjusted diluted EPS increased 11.3% to a record high of $3.65, and the company generated $813 million in operating cash flow.

- The company provided a positive outlook for 2026, projecting revenue growth of at least 7% and adjusted diluted EPS growth of approximately 10%, with ATS revenue expected to grow at least in the high teens.

- Genpact announced a 10% increase in its regular quarterly dividend to $0.1875 per quarter ($0.75 on an annual basis) and returned $401 million to shareholders in 2025 through share repurchases and dividends.

- Strategic initiatives in agentic solutions are gaining significant traction, with over $200 million in total contract value closed for AP agentic solutions, and the data and AI pipeline is up 50% year-over-year.

- For full-year 2025, Genpact reported net revenues of $5.080 billion, an increase of 6.6% year-over-year, and diluted EPS of $3.13, up 9.8%.

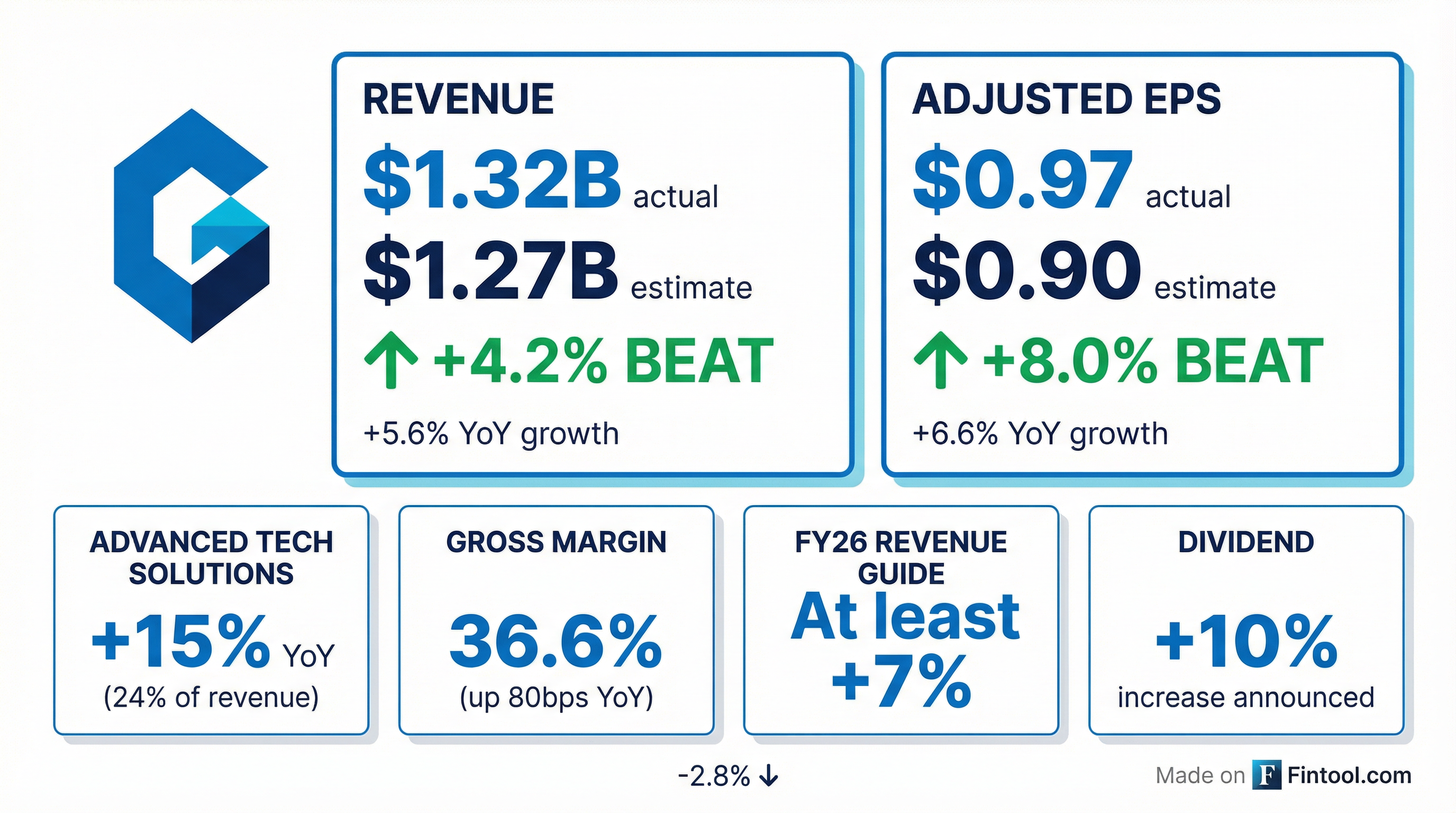

- In the fourth quarter of 2025, net revenues were $1.319 billion, growing 5.6% year-over-year, with diluted EPS at $0.82, up 3.8%.

- Advanced Technology Solutions net revenues demonstrated strong growth, increasing 17.0% to $1.204 billion for the full year 2025 and 15.0% to $323 million for Q4 2025.

- The company announced a 10% increase in its planned quarterly dividend to $0.1875 per common share and repurchased approximately 6.0 million common shares for $283 million during 2025.

- Genpact provided an outlook for full-year 2026, projecting net revenue growth of at least 7% and Adjusted diluted EPS growth of approximately 10%.

- Genpact reported full-year 2025 net revenues of $5.080 billion, an increase of 6.6% year-over-year, with diluted EPS of $3.13 (up 9.8%) and adjusted diluted EPS of $3.65 (up 11.3%).

- For the fourth quarter of 2025, net revenues were $1.319 billion, up 5.6% year-over-year, and adjusted diluted EPS was $0.97, an increase of 6.6%.

- Advanced Technology Solutions demonstrated significant growth, with net revenues increasing 17.0% to $1.204 billion for the full year 2025 and 15.0% to $323 million for Q4 2025.

- The company announced a 10% increase in its planned quarterly dividend to $0.1875 per common share for Q1 2026, resulting in a planned annual dividend of $0.75 per common share.

- Genpact's full-year 2026 outlook projects net revenue growth of at least 7% and adjusted diluted EPS growth of approximately 10%.

- Genpact announced the expansion of its executive team with three leadership appointments on December 10, 2025, to fuel the integration of Advanced Technology Solutions and accelerate growth as part of its GenpactNext strategy.

- The new leaders include Vijay Vijayasankar as Head of Corporate Development, Wayne Busch as Head of NextGen Enterprises, and Sydney Brie Schaub as Chief Legal Officer.

- These appointments aim to accelerate Genpact's start-up partnership ecosystem, build relationships with fast-growing mid-market companies, and drive an AI-first transformation of the legal function.

- Genpact UK Finco plc and Genpact USA, Inc., indirect wholly-owned subsidiaries of Genpact Limited, completed an underwritten public offering of $350 million aggregate principal amount of their 4.950% Senior Notes due 2030 on November 18, 2025.

- The notes are guaranteed on a senior unsecured basis by Genpact Limited and Genpact Luxembourg S.à r.l..

- Interest on the notes accrues at 4.950% per annum and is payable semi-annually in arrears on May 18 and November 18, commencing May 18, 2026.

- The notes will mature on November 18, 2030, and are redeemable prior to October 18, 2030, with a make-whole premium, and at par on or after October 18, 2030.

- Genpact Limited announced the pricing of an underwritten public offering of $350 million aggregate principal amount of 4.950% senior notes due 2030.

- The notes are issued by Genpact UK Finco plc and Genpact USA, Inc., and guaranteed by Genpact and Genpact Luxembourg S.à r.l..

- The Notes Offering is expected to close on November 18, 2025.

- Genpact intends to use the net proceeds for general corporate purposes, which may include repaying or redeeming outstanding 1.750% senior notes due 2026.

- Genpact reported strong Q3 2025 financial results, with revenue reaching $1.291 billion, up 7% year-over-year, and adjusted diluted EPS of $0.97, a 14% increase year-over-year, both exceeding guidance.

- The company's Advanced Technology Solutions (ATS) revenue grew 20% year-over-year to $311 million, representing 24% of Q3 revenue and driving more than half of the total growth year-to-date.

- Following these results, Genpact raised its full-year 2025 net revenue outlook to $5.059 billion-$5.071 billion (6.1%-6.4% growth) and its adjusted diluted EPS guidance to $3.60-$3.61.

- Strategic initiatives are gaining momentum, with partner-related revenue up 56% year-over-year and over 330 GenAI solutions now deployed or going live.

- Genpact Limited reported net revenues of $1.291 billion for the third quarter ended September 30, 2025, an increase of 6.6% year-over-year (6.0% on a constant currency basis).

- Diluted EPS was $0.83, up 12.2% year-over-year, and Adjusted Diluted EPS was $0.97, up 14.1% year-over-year for Q3 2025.

- Advanced Technology Solutions net revenues grew 20.0% year-over-year to $311 million, representing 24% of total net revenues.

- The company repurchased approximately 2.0 million common shares for approximately $90 million during the quarter.

- Genpact updated its full-year 2025 outlook, projecting net revenues in the range of $5.059 billion to $5.071 billion and Adjusted Diluted EPS in the range of $3.60 to $3.61.

Quarterly earnings call transcripts for Genpact.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more