Earnings summaries and quarterly performance for CLARIVATE.

Executive leadership at CLARIVATE.

Matti Shem Tov

Chief Executive Officer

Bar Veinstein

President, Academia & Government

Henry Levy

President, Life Sciences & Healthcare

Jonathan Collins

Executive Vice President and Chief Financial Officer

Maroun Mourad

President, Intellectual Property

William Graff

Executive Vice President, Chief Information Officer

Board of directors at CLARIVATE.

Adam Levyn

Director

Andrew Snyder

Chair of the Board

Anthony Munk

Director

Jane Okun Bomba

Director

Kenneth Cornick

Director

Saurabh Saha

Director

Suzanne Heywood

Director

Usama Cortas

Director

Valeria Alberola

Director

Wendell Pritchett

Director

Research analysts who have asked questions during CLARIVATE earnings calls.

George Tong

Goldman Sachs

8 questions for CLVT

Manav Patnaik

Barclays

7 questions for CLVT

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

6 questions for CLVT

Toni Kaplan

Morgan Stanley

5 questions for CLVT

Andrew Nicholas

William Blair & Company

4 questions for CLVT

Ashish Sabadra

RBC Capital Markets

4 questions for CLVT

Owen Lau

Oppenheimer & Co. Inc.

3 questions for CLVT

Scott Wurtzel

Wolfe Research

3 questions for CLVT

Surinder Thind

Jefferies Financial Group

3 questions for CLVT

Adam Parrington

Stifel Financial Corp.

2 questions for CLVT

Gregory Parrish

Morgan Stanley

2 questions for CLVT

Peter Christiansen

Citigroup Inc.

2 questions for CLVT

William Qi

RBC Capital Markets

2 questions for CLVT

Cole

Jefferies

1 question for CLVT

David Paige Papadogonas

RBC Capital Markets

1 question for CLVT

Guru Sidaarth

Oppenheimer & Co. Inc.

1 question for CLVT

Kwun Sum Lau

Oppenheimer

1 question for CLVT

Will Qi

RBC Capital Markets

1 question for CLVT

Recent press releases and 8-K filings for CLVT.

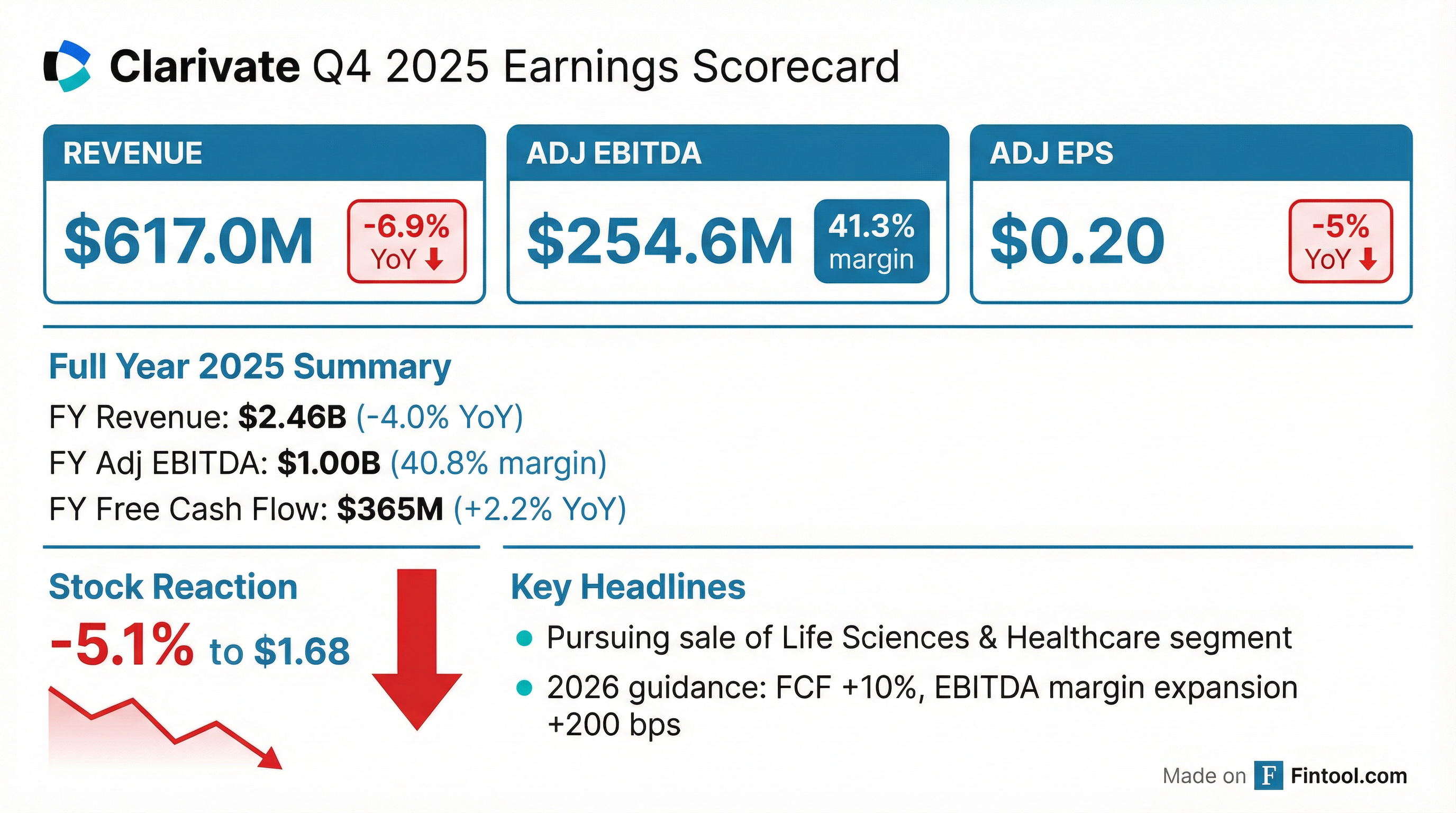

- Clarivate reported full-year 2025 revenue of $2.455 billion and free cash flow of $365 million, marking a 2% increase over the prior year.

- The company announced the initiation of a process to sell its Life Sciences & Healthcare business to enhance focus on its Academia & Government and Intellectual Property segments and strengthen its balance sheet.

- For 2026, Clarivate projects organic annual contract value (ACV) growth of 2% to 3% and free cash flow growth of approximately 10% to $400 million.

- Clarivate's capital allocation strategy for 2026 will prioritize deleveraging, building on $225 million in stock repurchases and $200 million in bond retirements completed in late 2025 and early 2026.

- The company highlighted that 97% of its revenue is derived from proprietary solutions enhanced by AI, with 12 major AI-powered products and features launched in 2025.

- Clarivate delivered on its full-year 2025 financial guide for the first time since 2019, reporting $2.455 billion in revenue, more than $1 billion in adjusted EBITDA, and $365 million in free cash flow.

- The company has initiated a process to sell its Life Sciences & Healthcare business to accelerate value creation, strengthen its balance sheet, and increase focus on the Academia & Government (A&G) and Intellectual Property (IP) markets.

- For 2026, Clarivate guides for 2%-3% organic annual contract value growth, 1%-2% recurring organic revenue growth, and approximately 10% free cash flow growth to $400 million, with diluted adjusted EPS expected to grow about 9% to $0.75.

- In 2025, Clarivate used free cash flow to buy back $225 million of stock and called $200 million of bonds, maintaining net leverage at approximately 4 terms; for 2026, the company plans to lean more towards de-leveraging.

- Clarivate reported full-year 2025 revenue of $2.455 billion and free cash flow of $365 million, successfully delivering on its initial full-year financial guide for the first time since 2019.

- The company provided 2026 guidance, expecting 2%-3% organic annual contract value (ACV) growth and free cash flow of approximately $400 million, representing a 10% increase over 2025.

- Clarivate has initiated a process to sell its Life Sciences & Healthcare business to allow further emphasis on its Academia & Government (A&G) and Intellectual Property (IP) segments and strengthen its balance sheet.

- In 2025, Clarivate bought back $225 million worth of stock and repaid $200 million in bonds, and plans to lean more towards de-leveraging in 2026.

- Clarivate reported full-year 2025 revenues of $2,455.2 million and Adjusted diluted EPS of $0.69, with Free Cash Flow increasing to $365.3 million. The company met its full-year financial guidance for 2025.

- For full-year 2026, Clarivate projects revenues between $2.30 billion and $2.42 billion, Adjusted EBITDA between $980 million and $1.04 billion, and Free Cash Flow between $365 million and $435 million. The outlook anticipates 2.0% to 3.0% organic ACV growth and 0.75% to 2.25% recurring organic revenue growth.

- The company is actively pursuing a sale of its Life Sciences & Healthcare business and is engaged in active discussions with interested parties, aiming to strengthen its balance sheet through reduced leverage.

- Total debt outstanding decreased by $101.2 million to $4,469.9 million as of December 31, 2025, with an additional $100.0 million debt repayment made in January 2026. Clarivate also repurchased 21.2 million shares in Q4 2025.

- Clarivate reported full-year 2025 total revenues of $2,455.2 million, a net loss of $201.1 million, and Adjusted EBITDA of $1,001.8 million.

- For the full year 2025, the company generated $365.3 million in free cash flow and repurchased 56.0 million shares totaling approximately $225 million.

- The company achieved 1.8% organic ACV growth and improved its organic recurring revenue mix by 800 basis points to 88% of total revenue in 2025.

- For full-year 2026, Clarivate forecasts revenues between $2.30 billion and $2.42 billion, Adjusted EBITDA between $980 million and $1.04 billion, Adjusted Diluted EPS between $0.70 and $0.80, and Free Cash Flow between $365 million and $435 million.

- Clarivate is actively pursuing a sale of its Life Sciences & Healthcare business to strengthen its balance sheet and allow further emphasis on the Academia & Government and Intellectual Property markets.

- Claritev (CTEV) reported Q4 2025 revenue of $246.6 million, exceeding expectations, but posted a loss per share of -$4.88, missing estimates.

- The company highlighted a year of strategic transformation in 2025, which contributed to record bookings and a return to top-line growth.

- Operational wins in Q4 included signing 10 new logos and delivering its first DaaS product, an NSA Data API.

- Management expects to return to positive free cash flow in 2026.

- Independent data providers indicate mixed financial health, noting a trailing-twelve-month revenue of ~$951 million, a three-year revenue growth rate of -5.6%, and a negative Altman Z-Score.

- Clarivate's subsidiary, Camelot Finance S.A., completed the full redemption of its remaining $100 million aggregate principal amount of 4.50% senior secured notes due 2026 on January 30, 2026, funded by cash on hand. This action led to the satisfaction and discharge of the Indenture for these notes.

- As part of its capital allocation strategy, Clarivate repurchased approximately 21 million ordinary shares for $75 million during Q4 2025.

- For the full year 2025, the company repurchased approximately 56 million ordinary shares for $225 million.

- These activities reflect Clarivate's focus on strengthening its balance sheet, enhancing financial flexibility, and returning capital to shareholders.

- Clarivate's subsidiary, Camelot Finance S.A., fully redeemed the remaining $100 million aggregate principal amount of its 4.50% senior secured notes due 2026 on January 30, 2026, using cash on hand.

- This redemption is part of Clarivate's ongoing efforts to simplify its capital structure, reduce debt, and enhance financial flexibility.

- During the fourth quarter of 2025, Clarivate repurchased approximately 21 million ordinary shares for $75 million.

- For the full year 2025, Clarivate repurchased approximately 56 million ordinary shares for $225 million.

- Clarivate Plc released its 2026 Drugs to Watch report on January 6, 2026, identifying eleven therapies expected to deliver significant clinical impact and strong commercial potential.

- These therapies are anticipated to reshape treatment approaches across metabolic disease, oncology, immunology, rare conditions, and neurological disorders, with the potential to achieve blockbuster status (defined as $1 billion in annual sales) or transform care within five years.

- Key therapies highlighted include Orforglipron and Retatrutide developed by Eli Lilly and Co for obesity and T2DM, and Mezigdomide by Bristol Myers Squibb for multiple myeloma.

- Clarivate views Generative AI (GenAI) as a significant opportunity, leveraging its proprietary, non-replicable data across its Academic & Government, Life Science, and Intellectual Property segments to develop new products and enhance existing ones, thereby increasing retention and creating upsell opportunities.

- The company's Value Creation Plan (VCP), announced in February 2025, is progressing well, with 88% of organic revenue now subscription-based and a continued transition from one-time offerings to subscription models.

- Clarivate is experiencing accelerating ACV growth, aiming for a 2% exit rate by year-end, and expects to reach market growth rates of 3-4% for Academic & Government, mid-single digits for Life Science, and 4% for Intellectual Property over the next few years, supported by new product innovations and a recovering IP market with new patent filings up 5% in 2024.

- For 2026, Clarivate anticipates margin expansion driven by internal AI deployment for efficiencies in areas like content operations and customer care, as well as the completion of disposals of subpar margin businesses.

- The company maintains a balanced capital allocation strategy, having repurchased approximately $150 million of stock and paid down $100 million of debt by the end of Q3.

Quarterly earnings call transcripts for CLARIVATE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more