Earnings summaries and quarterly performance for Ispire Technology.

Executive leadership at Ispire Technology.

Board of directors at Ispire Technology.

Research analysts who have asked questions during Ispire Technology earnings calls.

Pablo Zuanic

Zuanic & Associates

5 questions for ISPR

Also covers: ACB, AFCG, CGC +14 more

BP

Bo Pei

U.S. Tiger Securities

3 questions for ISPR

Also covers: COIN, NIPG

NA

Nick Anderson

ROTH MKM

3 questions for ISPR

Also covers: TPB

NA

Nicholas Anderson

Roth MKM

2 questions for ISPR

Also covers: TLRY, TPB

SF

Scott Fortune

ROTH MKM

1 question for ISPR

Also covers: , AYRWF, CRLBF +10 more

Recent press releases and 8-K filings for ISPR.

Ispire Technology Reports Q2 2026 Results and Strategic Progress

ISPR

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

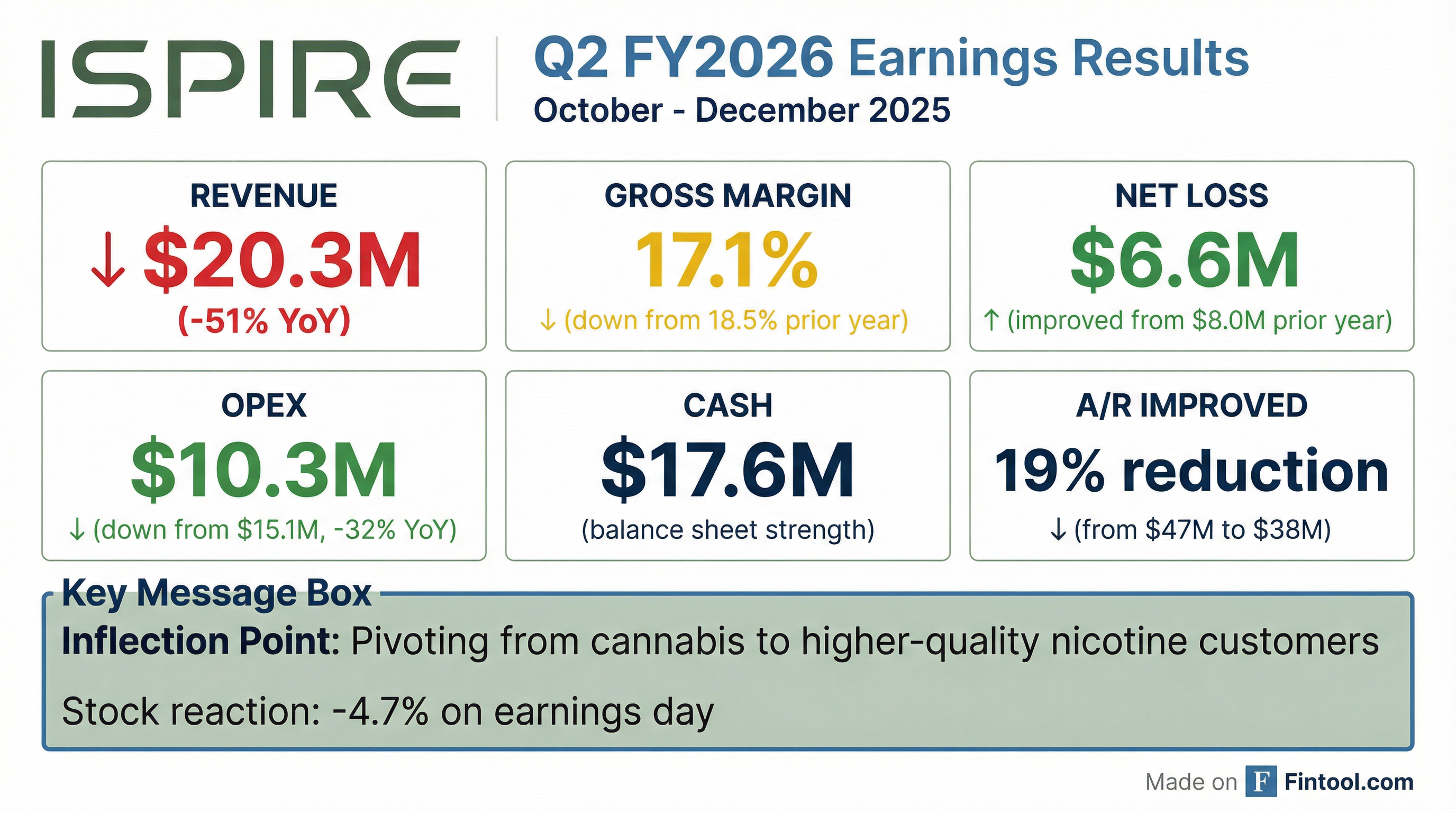

- Ispire Technology reported Q2 2026 revenue of $20.3 million, a decrease from $41.8 million in Q2 2025, primarily due to a strategic shift towards higher-quality nicotine sector customers.

- The company significantly reduced its net loss to $6.6 million in Q2 2026 from $8 million in Q2 2025 and improved net accounts receivable to $37.9 million as of December 31, 2025, down from $47 million at June 30, 2025.

- Progress continues with the IQTech age-gating technology, which the FDA views as key to unlocking the legal flavored e-cigarette market, with a significant development deal with a global nicotine company expected soon.

- The Malaysian manufacturing facility is on track to ramp up production in fiscal 2026, expanding capacity from 6 to 80 production lines.

- Management anticipates top-line growth, consistent cash flow, and bottom-line improvement in future quarters due to ongoing cost-cutting and customer quality rationalization efforts.

9 hours ago

Ispire Technology Reports Q2 2026 Results Amidst Strategic Pivot and Age-Gating Technology Traction

ISPR

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Ispire Technology reported Q2 2026 revenue of $20.3 million, a decrease from $41.8 million in Q2 2025, attributed to a strategic realignment towards higher-quality nicotine customers and away from lower-value cannabis clients.

- The company significantly reduced its net loss to $6.6 million in Q2 2026 from $8 million in Q2 2025, and operating expenses decreased to $10.3 million from $15.1 million in the prior year period.

- Financial stability improved with net accounts receivable at $37.9 million as of December 31, 2025, down from $47 million at June 30, 2025, and only $1 million in operating cash burned from April to December 2025.

- Ispire's IQTech age-gating technology is gaining significant interest, with a partnership with Charlie's expected to launch in 2-3 months, projecting 2-3 million chips per month initially, and a more significant development deal with a global nicotine company anticipated soon.

- The Malaysian manufacturing facility is on track to ramp up production in fiscal 2026, expanding from 6 to 80 production lines, aligning with the company's strategic focus.

10 hours ago

Ispire Technology Inc. Reports Fiscal Second Quarter 2026 Financial Results

ISPR

Earnings

- Ispire Technology Inc. reported revenue of $20.3 million for the second quarter of fiscal 2026, ended December 31, 2025, a decrease from $41.8 million in the prior comparable period, primarily due to a strategic shift away from lower quality cannabis customers.

- The company's net loss improved to $6.6 million, or $0.12 per share, for the fiscal second quarter of 2026, compared to a net loss of $8.0 million, or $0.14 per share, in the second quarter of fiscal 2025.

- Total operating expenses decreased to $10.3 million for the second fiscal quarter of 2026, down from $15.1 million in the same period last year, driven by disciplined cost controls.

- As of December 31, 2025, Ispire held cash of $17.6 million and successfully reduced net accounts receivable by 19.5% to $37.9 million since June 30, 2025.

12 hours ago

Ispire's IKE Tech Invited to FDA Roundtable on PMTA Submissions

ISPR

New Projects/Investments

Regulatory Compliance

- IKE Tech LLC, a joint venture that includes Ispire Technology Inc. as a founding partner, has been invited by the U.S. Food and Drug Administration (FDA) to participate in its Roundtable Discussion with Small ENDS Manufacturers on Premarket Tobacco Product Application (PMTA) Submissions.

- The invitation-only roundtable, scheduled for February 10, is the first FDA forum of its kind focused on gathering direct feedback from select electronic nicotine delivery system (ENDS) manufacturers.

- IKE Tech will participate on the Manufacturing Controls panel and is developing a blockchain-enabled, Bluetooth-based age-gating component for ENDS products, which recently became the subject of the first-ever component PMTA submission.

- Ispire views this invitation as a significant opportunity to contribute to regulatory dialogue, emphasizing that age-gating technology is a critical component of a responsible ENDS ecosystem and central to the future of regulation.

2 days ago

Ispire Technologies Reports Q1 Fiscal 2026 Financial Results

ISPR

Earnings

New Projects/Investments

Guidance Update

- Ispire Technologies reported Q1 fiscal 2026 revenue of $3.4 million, a reduction from $9.3 million in the prior year, primarily due to a deliberate strategic shift away from the cannabis industry.

- The company significantly reduced total operating expenses by approximately 39% year-over-year to $7.8 million and improved its net loss from $5.6 million to $3.3 million for the quarter ended September 30, 2025.

- Ispire achieved a non-GAAP EBITDA of $600,000 for Q1 fiscal 2026 and reduced its net account receivable from $62.4 million in Q1 fiscal 2025 to $44.5 million in Q1 fiscal 2026.

- Operational progress includes the ICTECH joint venture gaining traction with age-gating technology, ongoing discussions with nicotine companies for GMASH technology, and the build-out of a Malaysian manufacturing facility to increase capacity from 6 to 80 lines.

Nov 6, 2025, 1:00 PM

Ispire Technology Reports Fiscal First Quarter 2026 Financial Results

ISPR

Earnings

Demand Weakening

New Projects/Investments

- Ispire Technology Inc. reported revenue of $30.4 million for the fiscal first quarter ended September 30, 2025, a decrease from $39.3 million in the prior comparable period.

- The company significantly reduced total operating expenses by approximately 39% to $7.8 million compared to $12.9 million in the first quarter of fiscal 2025.

- This resulted in a reduced net loss of $3.3 million (or $0.06 per share) for the quarter, an improvement from a net loss of $5.6 million (or $0.10 per share) in the prior year.

- Ispire improved its balance sheet by reducing Net Accounts Receivable by approximately 29% from $62.4 million as of September 30, 2024, to $44.5 million as of September 30, 2025, and reported cash and cash equivalents of $22.7 million at September 30, 2025.

- Non-GAAP EBITDA for the quarter ended September 30, 2025, was $0.6 million.

Nov 6, 2025, 12:00 PM

Ispire Technology Outlines Strategic Growth and IP Initiatives

ISPR

New Projects/Investments

Revenue Acceleration/Inflection

- Ispire Technology Inc. (ISPR) is expanding its manufacturing operations in Johor, Malaysia, with a new factory expected to increase gross margins by 15% to 20% and provide a 10x increase in output volume to 100 million pods per month. The company received its nicotine manufacturing license in May.

- ISPR has developed a proprietary, Bluetooth/blockchain-based age-gating technology (IKE Tech) for vaporizers, submitting a U.S. PMTA in April 2024 which was quickly accepted. This technology is viewed as a pathway for FDA approval of flavored vapes and is being discussed for mandatory implementation in countries in Southeast Asia and the Middle East, offering significant licensing potential.

- The company is innovating with new products, including GMASH atomizer technology and an IP-defensible pod system designed to avoid existing patents, particularly JUUL's, aiming to secure a strong position in the regulated nicotine vape market.

- In its cannabis business, ISPR has adjusted payment terms to 100% upfront for most customers, significantly improving its accounts receivable profile, while continuing to focus on product innovation.

Oct 22, 2025, 4:30 PM

ISPR Reports $127 Million in Revenue, Advances Age Verification Technology, and Expands Malaysian Manufacturing

ISPR

Product Launch

New Projects/Investments

- ISPR, a NASDAQ-traded company specializing in vaping devices, generated $127 million in revenue for its last fiscal year ending in June.

- The company is pursuing FDA approval for its point-of-use age verification technology, a blockchain-based chip solution designed to prevent underage access to flavored e-cigarettes. This technology, which demonstrated 100% effectiveness in trials, was submitted in May and is under fast-track review by the FDA, with the potential to be licensed to other tobacco players.

- ISPR is strategically expanding its manufacturing operations in Malaysia, where it has secured the nation's first and only nicotine manufacturer's license. This expansion, including plans for an "I Spire Campus," is intended to support future development and manufacturing deals with major tobacco companies outside of China.

- The company has also developed a glass-based g-mesh technology for e-cigarettes, offering a safer alternative to ceramic cores, and has pivoted its cannabis business to focus on high-quality customers until federal legalization.

Oct 21, 2025, 10:00 PM

ISPR Highlights Vaping Technology, FDA Engagement, and Manufacturing Expansion

ISPR

Product Launch

New Projects/Investments

- ISPR, a NASDAQ-traded company, reported $127 million in revenue for its last fiscal year ending in June, primarily from developing and manufacturing vaping devices for the global e-cigarette and cannabis/CBD industries.

- The company is advancing its point-of-use age-gating technology, a blockchain-based chip for age verification, with an application submitted to the FDA in May for a "component PMTA". The FDA is reviewing this on a fast-track basis, with ISPR planning to license the solution to other tobacco players.

- ISPR introduced GMESH technology, a glass-based wicking mechanism for e-cigarettes, which has attracted attention from major tobacco companies and is being scaled for production in Malaysia.

- The company is expanding its manufacturing capabilities in Malaysia, securing a third factory and holding the country's sole nicotine manufacturing license, partly to address tariff considerations and big tobacco's demand for non-China production.

- ISPR has scaled back its cannabis business exposure since February, now focusing on high-quality customers until federal legalization or rescheduling occurs.

Oct 21, 2025, 10:00 PM

Ispire Technology Reports Q4 and Full Year 2025 Results, Details Strategic Pivot to Nicotine Sector

ISPR

Earnings

New Projects/Investments

CFO Change

- Ispire Technology Inc. reported a decline in total revenue for fiscal year 2025 to $127.5 million from $151.9 million in fiscal year 2024, primarily due to a strategic pivot away from the cannabis sector towards the higher-value nicotine sector.

- The company demonstrated improved financial discipline, reducing net accounts receivable by over 21% year-over-year and cutting annual expenses by an estimated $10.2 million.

- Strategic initiatives include expanding Malaysian manufacturing capabilities to potentially 80 production lines and advancing its international ODM business, which has over $80 million in pipeline revenue.

- The company's ICE-TECH blockchain-based age verification technology achieved a significant milestone with FDA acceptance of its component PMPA submission within an unprecedented four weeks.

Sep 16, 2025, 12:00 PM

Quarterly earnings call transcripts for Ispire Technology.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more