Earnings summaries and quarterly performance for John Marshall Bancorp.

Executive leadership at John Marshall Bancorp.

Board of directors at John Marshall Bancorp.

Research analysts covering John Marshall Bancorp.

Recent press releases and 8-K filings for JMSB.

John Marshall Bancorp, Inc. Reports Strong Q4 and Full Year 2025 Financial Results

JMSB

Earnings

Dividends

Share Buyback

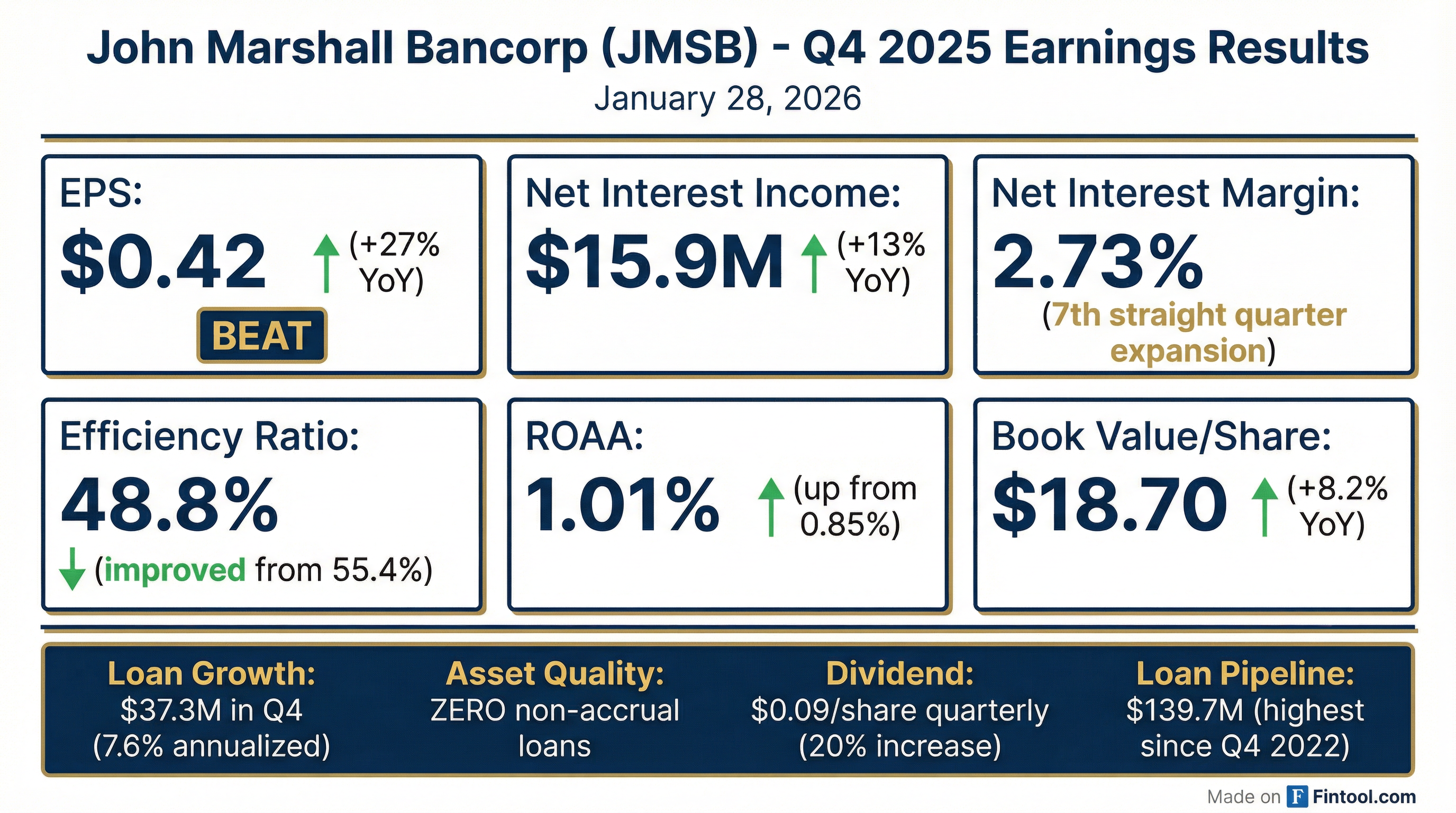

- John Marshall Bancorp, Inc. reported net income of $5.9 million for the quarter ended December 31, 2025, a 23.9% increase compared to $4.8 million for the same period in 2024. Diluted earnings per common share were $0.42, up 27.3% from $0.33 in Q4 2024. For the full year 2025, net income increased by 24.0% to $21.2 million.

- The company experienced strong loan growth, with its loan portfolio increasing by $103.2 million or 5.5% from December 31, 2024, to December 31, 2025. New loan commitments totaled $139.7 million in Q4 2025.

- Net interest margin (NIM) expanded for the seventh consecutive quarter, reaching 2.73% in Q4 2025, a 21 basis point improvement from 2.52% in Q4 2024. The efficiency ratio improved to 48.8% for Q4 2025, down from 55.4% in Q4 2024.

- The Board of Directors declared a quarterly cash dividend of $0.09 per share on January 27, 2026, representing a 20% increase over the 2025 annual cash dividend. Additionally, the company repurchased 135,640 shares of its common stock during 2025.

- Book value per share increased by 8.2% from $17.28 as of December 31, 2024, to $18.70 as of December 31, 2025.

Jan 28, 2026, 2:10 PM

John Marshall Bancorp Initiates Quarterly Cash Dividend

JMSB

Dividends

- John Marshall Bancorp, Inc. (JMSB) has initiated a quarterly cash dividend program, transitioning from its previous annual dividend payments.

- The initial quarterly cash dividend is $0.09 per share, payable on March 4, 2026, to shareholders of record as of February 11, 2026.

- This initial quarterly dividend represents an annualized 20% increase over the 2025 annual cash dividend of $0.30 per share, with an aggregate payment of approximately $1.3 million.

- The Board's decision is based on the Company's strong and consistent financial performance and aims to enhance shareholder value.

Jan 28, 2026, 2:05 PM

John Marshall Bancorp Reports Strong Q4 and Full-Year 2025 Financial Results

JMSB

Earnings

Dividends

Share Buyback

- John Marshall Bancorp, Inc. reported a 23.9% increase in net income to $5.9 million and a 27.3% increase in diluted earnings per common share to $0.42 for the quarter ended December 31, 2025, compared to the same period in 2024. For the full year 2025, net income rose 24.0% to $21.2 million.

- The Company achieved its seventh consecutive quarter of net interest margin expansion, reaching 2.73% in Q4 2025, a 21 basis point improvement from Q4 2024. The efficiency ratio also improved to 48.8% for Q4 2025 from 55.4% in Q4 2024.

- The loan portfolio, net of unearned income, grew by $103.2 million or 5.5% from December 31, 2024, to December 31, 2025, reaching $1.98 billion. New loan commitments in Q4 2025 were $139.7 million, a 46.7% improvement over Q3 2025.

- Book value per share increased 8.2% to $18.70 as of December 31, 2025, from $17.28 a year prior. The Board of Directors declared a quarterly cash dividend of $0.09 per share, representing a 20% increase over the 2025 annual cash dividend, and the Company repurchased 135,640 shares during 2025.

- Asset quality remained strong with no non-accrual loans and no other real estate owned assets as of December 31, 2025.

Jan 28, 2026, 2:00 PM

John Marshall Bancorp, Inc. Reports Strong Q3 2025 Earnings Growth and Margin Expansion

JMSB

Earnings

Revenue Acceleration/Inflection

Share Buyback

- John Marshall Bancorp, Inc. reported a 27.6% increase in net income to $5.4 million and a 26.7% increase in diluted earnings per common share to $0.38 for the quarter ended September 30, 2025, compared to the same period in 2024.

- The tax-equivalent net interest margin (Non-GAAP) expanded to 2.73% for Q3 2025, up from 2.30% in Q3 2024, contributing to an 18.6% increase in net interest income to $15.6 million.

- The company experienced strong growth in core deposits and loan demand, with total deposits increasing by $71.9 million (15.0% annualized) and loans, net of unearned income, increasing by $21.2 million (4.4% annualized) during Q3 2025.

- Asset quality remained pristine with no loans greater than 30 days past due, no non-accrual loans, and no net charge-offs during Q3 2025. The efficiency ratio improved to 55.6% for Q3 2025 from 58.3% in Q3 2024.

Oct 29, 2025, 1:10 PM

John Marshall Bancorp, Inc. Reports Strong Q2 2025 Financial Performance and Share Repurchase Authorization Extension

JMSB

Earnings

Share Buyback

Revenue Acceleration/Inflection

- John Marshall Bancorp, Inc. reported strong financial results for Q2 2025, with net income increasing 6.1% to $5.1 million and pre-tax, pre-provision earnings rising 12.1% to $7.1 million compared to Q1 2025.

- The company achieved its fifth consecutive quarter of net interest margin expansion, reaching 2.69% in Q2 2025, and saw net interest income grow 5.9% quarter-over-quarter to $14.9 million.

- Asset quality remained excellent, with no loans greater than 30 days past due, no non-accrual loans, and no net charge-offs during Q2 2025 , while new loan commitments increased 40.5% to $135.5 million.

- The company demonstrated robust capitalization and shareholder returns, with book value per share increasing 7.8% year-over-year to $17.83 as of June 30, 2025, and announced an extension of its share repurchase authorization for 700,000 shares.

Sep 3, 2025, 1:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more