Earnings summaries and quarterly performance for KENNAMETAL.

Executive leadership at KENNAMETAL.

Sanjay Chowbey

President and Chief Executive Officer

Dave Bersaglini

Vice President and President, Metal Cutting Segment

Faisal Hamadi

Vice President and President, Infrastructure Segment

Michelle Keating

Vice President, Secretary and General Counsel

Patrick Watson

Vice President and Chief Financial Officer

Board of directors at KENNAMETAL.

Research analysts who have asked questions during KENNAMETAL earnings calls.

Angel Castillo Malpica

Morgan Stanley

7 questions for KMT

Julian Mitchell

Barclays Investment Bank

7 questions for KMT

Tami Zakaria

JPMorgan Chase & Co.

6 questions for KMT

Steven Fisher

UBS

5 questions for KMT

Stephen Volkmann

Jefferies

4 questions for KMT

Steve Barger

KeyBanc Capital Markets Inc.

4 questions for KMT

Christian Zylstra

KeyBank

2 questions for KMT

Joseph Ritchie

Goldman Sachs

2 questions for KMT

Michael Feniger

Bank of America

2 questions for KMT

Christopher Dankert

Loop Capital Markets

1 question for KMT

Jacob Moore

Sidoti & Company, LLC

1 question for KMT

Recent press releases and 8-K filings for KMT.

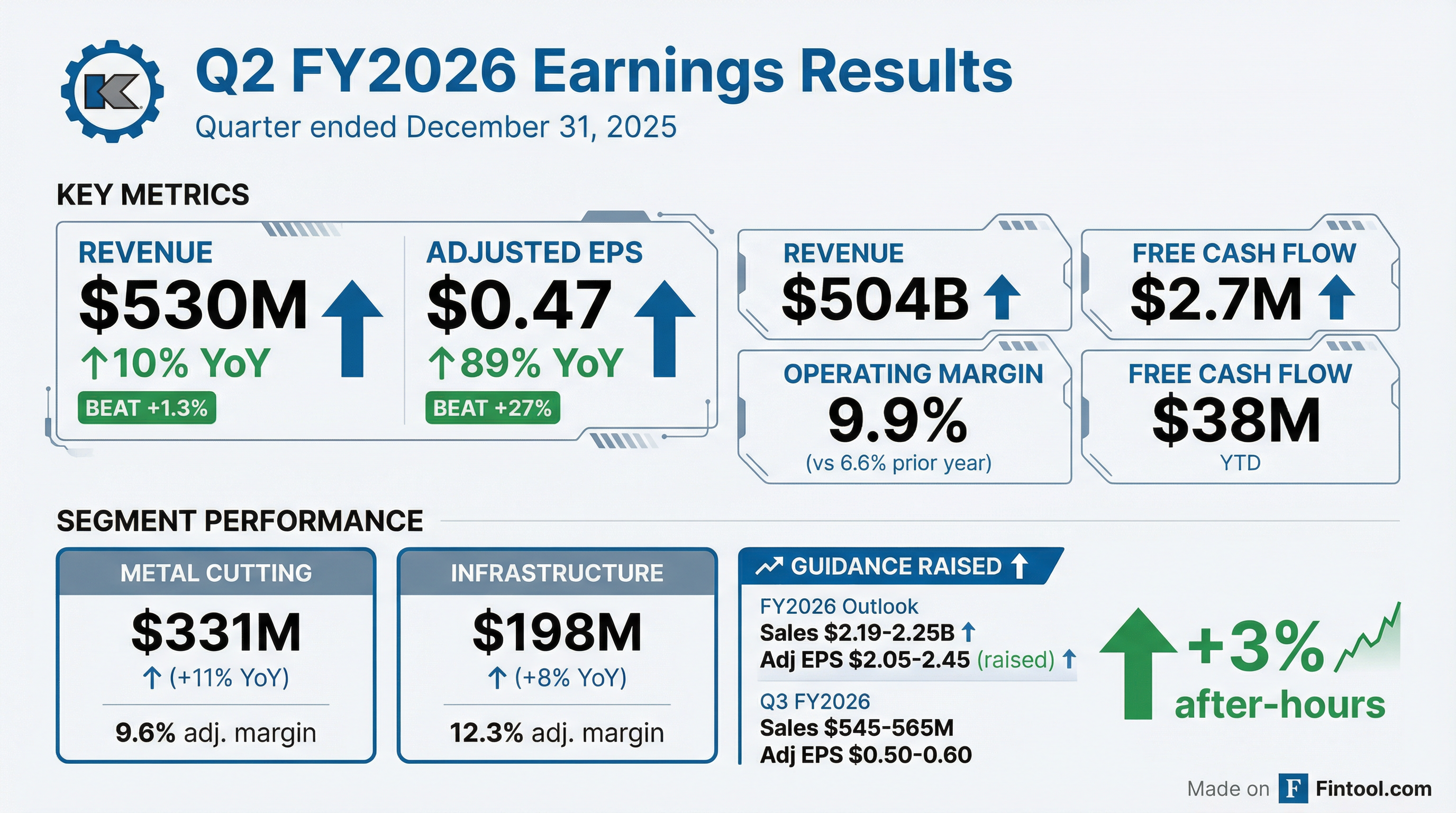

- Kennametal reported strong Q2 2026 results, with organic sales up 10% and Adjusted EPS increasing to $0.47 from $0.25 in the prior year quarter, both exceeding previous outlooks.

- The company raised its Fiscal Year 2026 sales outlook to $2.19 billion-$2.25 billion and Adjusted EPS to $2.05-$2.45, primarily due to additional pricing actions related to rising tungsten costs and favorable price raw timing.

- For Q3 2026, sales are projected between $545 million and $565 million and Adjusted EPS between $0.50 and $0.60, reflecting the effects of customer buy-ahead in Q2 and continued price raw timing benefits.

- Volume trends, adjusted for the Q2 buy-ahead, show improvement, with Q2 flat and Q3 projected at +1%, indicating a positive direction for overall volume.

- Rising tungsten prices are at historically high levels, impacting working capital and leading to no share repurchases in Q2, though the company remains confident in its ability to price for and offset these costs.

- Kennametal reported strong Q2 2026 financial results, with organic sales growth of 10% and Adjusted EPS of $0.47, up from $0.25 in the prior year quarter.

- The company raised its fiscal year 2026 sales outlook to between $2.19 billion and $2.25 billion and Adjusted EPS outlook to a range of $2.05-$2.45.

- Performance was driven by higher sales volumes, including customer buy-ahead ahead of price increases, modest improvements in certain end markets, and $8 million in restructuring savings.

- Kennametal continues to return cash to shareholders, having repurchased $70 million or 3 million shares under its authorization and paying a dividend.

- Kennametal reported Q2 FY26 sales of $530 million, reflecting 10% organic growth year-over-year.

- Adjusted EPS for Q2 FY26 was $0.47 per share, significantly up from $0.25 adjusted in the prior year.

- Adjusted EBITDA reached $90 million, with a 17.1% margin, representing a 320 basis point increase compared to the prior year.

- The company returned $15 million to shareholders via dividends during the quarter.

- Kennametal updated its FY26 outlook, projecting sales between $2.19 billion and $2.25 billion and adjusted EPS in the range of $2.05 to $2.45.

- KMT reported strong Q2 2026 results, with sales increasing 10% organically year-over-year and Adjusted EPS rising to $0.47, both exceeding previous outlooks.

- The company raised its fiscal year 2026 outlook, now expecting sales between $2.19 billion and $2.25 billion and Adjusted EPS in the range of $2.05-$2.45.

- Performance and the updated outlook are driven by price realization, customer "buy-ahead" activity due to rising tungsten costs, and $8 million in restructuring savings in Q2, with $30 million expected for the full fiscal year.

- KMT repurchased $70 million or 3 million shares under its $200 million authorization and continues to pay dividends.

- Kennametal Inc. reported sales of $530 million for the fiscal 2026 second quarter ended December 31, 2025, marking a 10% increase on both a reported and organic basis.

- The company achieved diluted earnings per share (EPS) of $0.44 and adjusted EPS of $0.47 for the quarter, representing increases of 92% and 89% respectively.

- Kennametal raised its annual outlook for fiscal year 2026, now expecting sales between $2.190 billion and $2.250 billion and adjusted EPS between $2.05 and $2.45.

- A quarterly cash dividend of $0.20 per share was declared, payable on February 24, 2026.

- Kennametal reported sales of $530 million for its fiscal 2026 second quarter ended December 31, 2025, an increase of 10 percent on both a reported and organic basis compared to the prior year quarter.

- Operating income for the quarter was $53 million, and adjusted operating income was $56 million, representing increases of 66 percent and 68 percent, respectively.

- Diluted earnings per share (EPS) were $0.44, and adjusted EPS were $0.47, marking increases of 92 percent and 89 percent, respectively, for the fiscal 2026 second quarter.

- The company raised its annual outlook for fiscal 2026, with sales now expected to be between $2.190 billion and $2.250 billion, and adjusted EPS projected to be between $2.05 and $2.45.

- Kennametal's Board of Directors declared a quarterly cash dividend of $0.20 per share, payable on February 24, 2026, to shareholders of record as of February 10, 2026.

- On November 17, 2025, Kennametal Inc. and Kennametal Europe GmbH entered into an unsecured $650 million five-year Seventh Amended and Restated Credit Agreement.

- This agreement replaces the company's previous Sixth Amended and Restated Credit Agreement dated June 14, 2022.

- The $650 million borrowing capacity includes sublimits of $50 million for Letters of Credit, $100 million for Swingline Loans, and $300 million for multicurrency borrowings.

- The agreement matures on November 17, 2030, and the borrowing capacity may be increased by an aggregate amount not to exceed $300 million.

- A financial covenant in the agreement stipulates that the Consolidated Leverage Ratio must not exceed 3.75 to 1.00, though this can be temporarily increased to 4.25 to 1.00 during a "Leverage Increase Period" following a Qualified Acquisition.

- KMT reported Q1 FY26 sales of $498 million, achieving 3% organic growth, and adjusted EPS of $0.34 per share, marking the first quarter of organic growth in two years.

- The company generated $17 million in cash from operations but recorded negative Free Operating Cash Flow (FOCF) of $(5) million for Q1 FY26.

- KMT returned $25 million to shareholders in Q1 FY26, comprising $10 million in share repurchases and $15 million in dividends.

- For Q2 FY26, KMT anticipates sales between $500 million and $520 million and adjusted EPS between $0.30 and $0.40. The full-year FY26 outlook projects sales between $2.10 billion and $2.17 billion and adjusted EPS in the range of $1.35 to $1.65.

- KMT reported strong Q1 2026 results, with sales up 3% organically year-over-year and adjusted EPS of $0.34, both exceeding previous outlooks.

- This marks the company's first quarter of organic growth in two years, supported by $8 million in restructuring savings.

- The company updated its fiscal year 2026 outlook, now expecting sales between $2.1 billion and $2.17 billion and adjusted EPS in the range of $1.35 to $1.65.

- KMT returned $25 million to shareholders in Q1 2026 through $10 million in share repurchases and $15 million in dividends.

- Despite rising tungsten costs, which are at historically high levels, KMT remains confident in its ability to offset the impact through pricing actions.

- Kennametal Inc. reported Q1 2026 sales of $498 million, a 3% increase on both a reported and organic basis, and adjusted diluted EPS of $0.34, up 18%.

- The company returned approximately $25 million to shareholders in Q1 2026, comprising $10 million in share repurchases and $15 million in dividends.

- Kennametal raised its fiscal year 2026 outlook, now expecting sales between $2.100 billion and $2.170 billion and adjusted EPS between $1.35 and $1.65.

Quarterly earnings call transcripts for KENNAMETAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more