Earnings summaries and quarterly performance for STANDARD BIOTOOLS.

Executive leadership at STANDARD BIOTOOLS.

Board of directors at STANDARD BIOTOOLS.

Research analysts who have asked questions during STANDARD BIOTOOLS earnings calls.

MS

Matthew Stanton

Jefferies

4 questions for LAB

Also covers: AZTA, BLFS, CDXS +5 more

KB

Kyle Boucher

TD Cowen

3 questions for LAB

Also covers: MYGN, SEER, SOPH +2 more

Paul Knight

KeyBanc Capital Markets

3 questions for LAB

Also covers: A, ATR, AVTR +16 more

Daniel Brennan

TD Cowen

1 question for LAB

Also covers: A, ADPT, AVTR +25 more

LB

Lucas Baranowski

KeyBanc Capital Markets Inc.

1 question for LAB

Also covers: AZTA, TKNO

Recent press releases and 8-K filings for LAB.

Standard BioTools Reports Fourth Quarter and Full Year 2025 Financial Results

LAB

Earnings

Guidance Update

M&A

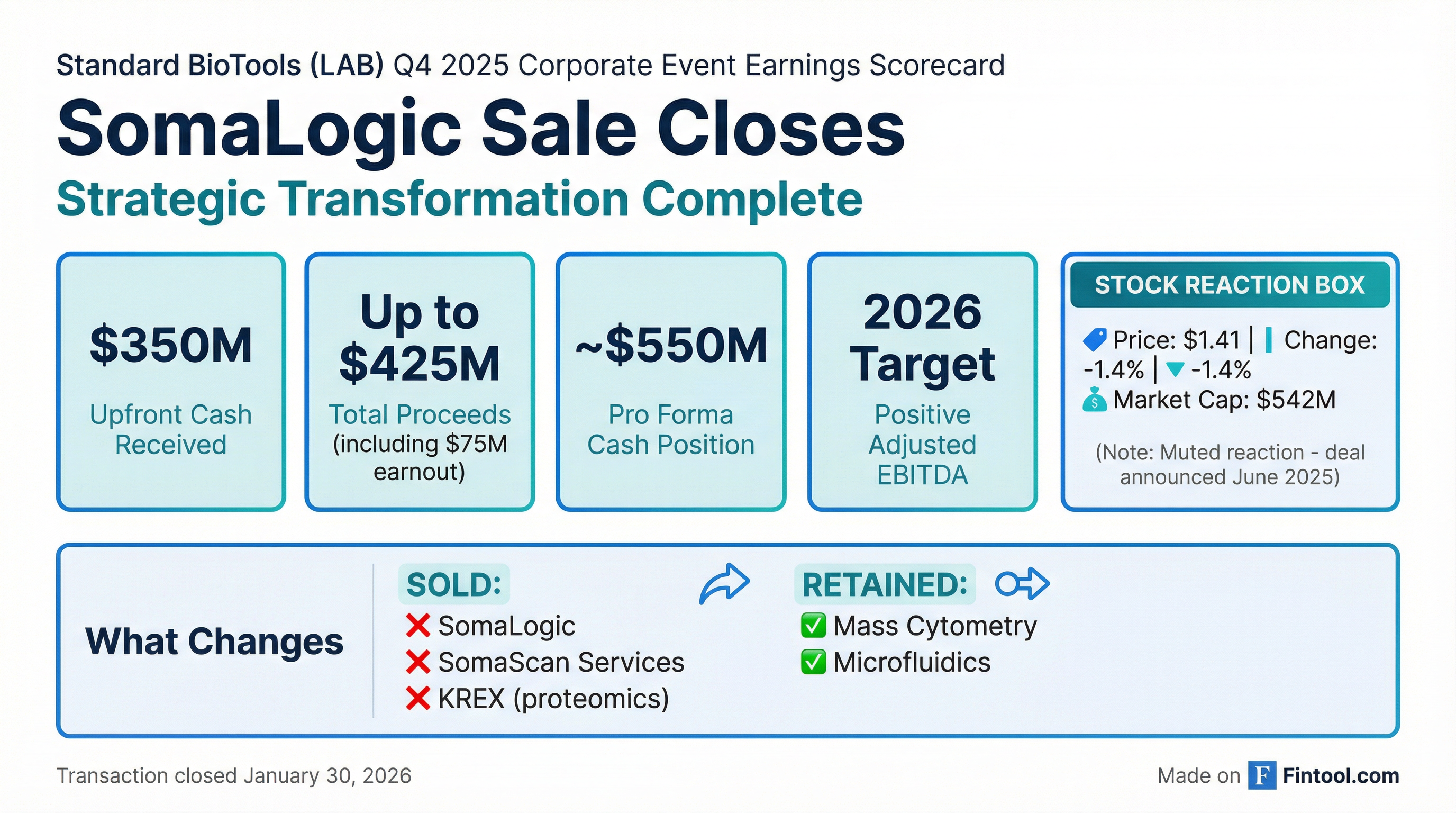

- Standard BioTools reported fourth quarter 2025 revenue from continuing operations of $23.8 million and full year 2025 revenue of $85.3 million.

- The company achieved net income from continuing operations of $13.9 million in Q4 2025, primarily due to a $38.4 million partial release of the U.S. deferred tax valuation allowance.

- Over $40 million in annualized cost savings were fully operationalized, and the company exited 2025 with approximately $550 million in cash & investments following the SomaLogic transaction, which will fuel an inorganic growth strategy.

- For fiscal year 2026, Standard BioTools expects revenue in the range of $80 million to $85 million.

4 days ago

Standard BioTools Announces Preliminary Q4 and Full Year 2025 Revenue

LAB

Earnings

Guidance Update

M&A

- Standard BioTools reported preliminary and unaudited fourth quarter 2025 combined company revenue of approximately $56 million and revenue from continuing operations of approximately $24 million. For the full year 2025, the company expects combined company revenue of approximately $185 million and revenue from continued operations of approximately $85 million.

- CEO Michael Egholm stated that 2025 performance reflected "steady execution", ending the year above guidance and exceeding expectations. The sale of SomaLogic to Illumina is on track to close in the first half of 2026, after which Standard BioTools expects to have approximately $550 million in cash and a base business moving towards positive adjusted EBITDA, positioning the company for disciplined M&A.

Jan 8, 2026, 12:00 PM

Standard BioTools Reports Third Quarter 2025 Financial Results

LAB

Earnings

Guidance Update

Layoffs

- For the quarter ended September 30, 2025, Standard BioTools reported total combined company revenue of $46.2 million and revenue from continuing operations of $19.6 million. The company recorded a net loss from continuing operations of $(31.7) million and an adjusted EBITDA loss of $(16.5) million.

- As of September 30, 2025, Standard BioTools had $217.0 million in cash & cash equivalents. The company anticipates an additional $550 million in cash & cash equivalents upon the close of the transaction with Illumina in the first half of 2026.

- An operational restructuring plan, implemented in September 2025, included an approximate 20% reduction-in-force of its global workforce and is expected to deliver over $40 million in annualized cost savings by 2026. The company is on track to achieve positive adjusted EBITDA in 2026.

- For fiscal year 2025, the company expects combined revenue in the range of $165 million to $175 million, with revenue from continuing operations projected to be between $78 million and $83 million.

Nov 4, 2025, 9:10 PM

Standard BioTools Reports Q2 2025 Financial Results and Strategic Sale

LAB

Earnings

Guidance Update

M&A

- Standard BioTools reported Q2 2025 revenue from continuing operations of $21.8 million and a net loss from continuing operations of $17.7 million.

- The company announced the strategic sale of SomaLogic to Illumina for up to $425 million in total cash consideration, with the transaction expected to close in the first half of 2026.

- As of June 30, 2025, cash and cash equivalents were $240 million, with at least $550 million expected at the close of the Illumina transaction.

- Standard BioTools is targeting adjusted EBITDA break-even in 2026.

- For fiscal year 2025, the company expects revenue from continuing operations in the range of $78 million to $83 million.

Aug 11, 2025, 12:00 AM

Standard BioTools' SomaScan Selected for Large-Scale Population Health Study in Singapore

LAB

New Projects/Investments

- Standard BioTools Inc. announced that Precision Health Research, Singapore (PRECISE-SG100K) selected its SomaScan™ 11K Assay to run 100,000 plasma samples from the PRECISE-SG100K biobank.

- The SomaScan platform was chosen for its unmatched proteome coverage, superior reproducibility, and high-quality service, reinforcing its strategic position in the high-impact biobank segment.

- This collaboration aims to transform precision health and medicine and improve patient outcomes in Singapore through data-driven solutions.

- Standard BioTools is a leader in population proteomics, with SomaScan having been used in over 30 biobank studies worldwide, including recent additions totaling nearly 160,000 samples, and its SOMAmer™ technology also powers a pilot program analyzing 50,000 UK Biobank samples.

Aug 6, 2025, 11:00 AM

Standard BioTools sells SomaLogic to Illumina

LAB

M&A

- Sale terms: Standard BioTools will sell SomaLogic to Illumina for $350 M upfront, up to $75 M in earn-out payments (total $425 M), plus a 2% royalty on SOMAmer-based NGS library prep kits for 10 years.

- Financial impact: The transaction is expected to leave the company with at least $550 M in cash & equivalents at closing, simplifying its structure and enabling adjusted EBITDA break-even.

- Ongoing involvement: Standard BioTools retains Single SOMAmer reagent commercialization rights and participation in the Illumina Protein Prep royalty stream.

- Timeline: The deal, unanimously approved by the board, is expected to close in first half of 2026, subject to customary regulatory approvals.

Jun 23, 2025, 12:00 AM

Standard BioTools Q1 2025 Earnings & Financial Results

LAB

Earnings

M&A

Product Launch

- Revenue of $40.8 million was reported in Q1 2025, down 10% YoY amid softer Americas academic funding and broader market headwinds .

- Instrument revenue increased by 24% YoY, driven by strong demand for the Hyperion XTi spatial imaging system and operational improvements .

- Operating performance improved with a 45% reduction in operating loss and a 29% YoY improvement in adjusted EBITDA .

- The company remains focused on strategic M&A with planned deals over the next 18 months and expects its Illumina partnership to provide moderate near-term revenue, with stronger growth anticipated in 2026 .

- Reported a strong balance sheet with $261 million in cash and no material debt as of March 31, 2025 .

May 6, 2025, 8:31 PM

Quarterly earnings call transcripts for STANDARD BIOTOOLS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more