Earnings summaries and quarterly performance for LA-Z-BOY.

Executive leadership at LA-Z-BOY.

Board of directors at LA-Z-BOY.

Research analysts who have asked questions during LA-Z-BOY earnings calls.

Anthony Lebiedzinski

Sidoti & Company, LLC

8 questions for LZB

Also covers: BSET, CNXN, CRWS +14 more

BG

Bobby Griffin

Raymond James Financial

6 questions for LZB

Also covers: APC, ARKO, CASY +12 more

Taylor Zick

KeyBanc Capital Markets Inc.

3 questions for LZB

Also covers: ETD

Bradley Thomas

KeyBanc Capital Markets Inc.

2 questions for LZB

Also covers: CENT, ETD, FIVE +10 more

Robert Griffin

Raymond James & Associates, Inc.

2 questions for LZB

Also covers: ARKO, CASY, LEG +7 more

TZ

Taylor Zeckan

KeyBanc Capital Markets

2 questions for LZB

TZ

Taylor Zwick

KeyBanc Capital Markets

1 question for LZB

Recent press releases and 8-K filings for LZB.

La-Z-Boy Reports Strong Q3 2026 Results and Provides Q4 2026 Guidance

LZB

Earnings

Guidance Update

New Projects/Investments

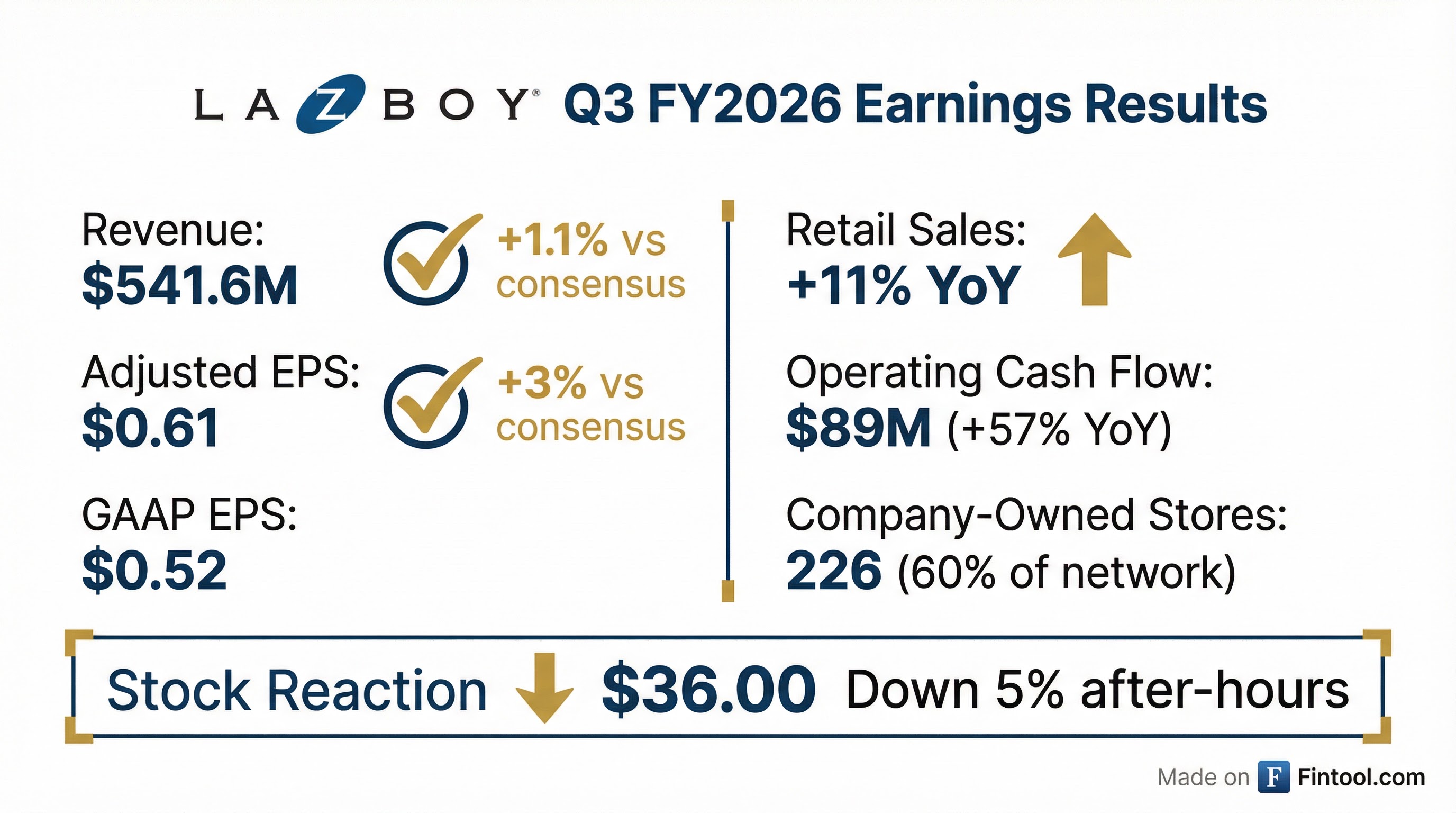

- La-Z-Boy reported strong Q3 2026 results with total delivered sales of $542 million, up 4% year-over-year, an adjusted operating margin of 6.1%, and adjusted diluted EPS of $0.61. The company also generated $89 million in operating cash flow.

- The retail segment's delivered sales increased 11% to $252 million, driven by new and acquired stores, while wholesale delivered sales grew 1% to $367 million. Written same-store sales for the retail segment decreased 4%.

- The company advanced strategic initiatives, including a 15-store acquisition for $86 million, the planned closure of its U.K. manufacturing facility, and the sale of non-core casegoods businesses. These actions are expected to yield an annualized 75-100 basis points adjusted operating margin improvement.

- For Q4 2026, La-Z-Boy anticipates sales between $560 million and $580 million and an adjusted operating margin of 7.5% to 9%, reflecting a cautious macroeconomic outlook and recent adverse weather events.

Feb 18, 2026, 1:30 PM

La-Z-Boy Reports Strong Q3 2026 Results and Provides Q4 Guidance

LZB

Earnings

Guidance Update

M&A

- La-Z-Boy reported Q3 2026 total delivered sales of $542 million, an increase of 4% year-over-year, with an adjusted operating margin of 6.1% and adjusted diluted EPS of $0.61. The company also generated $89 million in operating cash flow, up 57% from the prior year.

- The retail segment's delivered sales grew 11% to $252 million, driven by the acquisition of a 15-store network in the Southeast for $86 million and the opening of 4 new company-owned stores during the quarter.

- Strategic initiatives, including the planned closure of the U.K. manufacturing facility and the sale of non-core casegoods businesses, are expected to be substantially complete by fiscal year-end, leading to an annualized impact of a $30 million net sales decrease and 75-100 basis points of adjusted operating margin improvement to the entire enterprise.

- For Q4 2026, La-Z-Boy anticipates sales between $560 million and $580 million and an adjusted operating margin in the range of 7.5% to 9%, reflecting a continued cautious macroeconomic outlook and short-term impacts from adverse weather.

Feb 18, 2026, 1:30 PM

LZB Reports Q3 2026 Results and Provides Q4 2026 Guidance

LZB

Earnings

Guidance Update

M&A

- La-Z-Boy reported Q3 2026 total delivered sales of $542 million, a 4% increase year-over-year, with an adjusted operating margin of 6.1% and adjusted diluted EPS of $0.61. The company also generated $89 million in operating cash flow, up 57% year-over-year.

- The company is actively optimizing its portfolio, having completed a 15-store acquisition for $86 million and progressing with the planned closure of its U.K. manufacturing facility and the sale of its Kincaid Upholstery and American Drew/Kincaid casegoods businesses. These strategic initiatives are expected to result in an annualized $30 million net sales decrease and 75-100 basis points adjusted operating margin improvement.

- For Q4 2026, La-Z-Boy forecasts sales between $560 million and $580 million and an adjusted operating margin of 7.5% to 9%, reflecting a cautious macroeconomic outlook and short-term weather impacts.

Feb 18, 2026, 1:30 PM

La-Z-Boy Reports Strong Q3 2026 Results and Provides Q4 Outlook

LZB

Earnings

Guidance Update

M&A

- La-Z-Boy Incorporated reported Q3 2026 sales of $542 million, a 4% increase year-over-year, with adjusted diluted EPS of $0.61 and an adjusted operating margin of 6.1%.

- The Retail segment's written and delivered sales grew 11%, while the Wholesale segment's delivered sales increased 1%.

- The company made significant progress on strategic initiatives, including opening four new company-owned stores, integrating a 15-store acquisition, and signing a letter of intent for the sale of its wholesale casegoods businesses.

- La-Z-Boy generated $89 million in operating cash flow for the quarter, marking a 57% increase from the previous year.

- For the fourth quarter, the company anticipates sales to be in the range of $560-580 million and an adjusted operating margin of 7.5-9.0%.

Feb 17, 2026, 9:16 PM

La-Z-Boy Announces Strong Q3 Fiscal 2026 Results and Strategic Progress

LZB

Earnings

M&A

Revenue Acceleration/Inflection

- La-Z-Boy reported third quarter fiscal 2026 sales of $542 million, a 4% increase year-over-year, with adjusted diluted EPS of $0.61 for the period ended January 24, 2026.

- The company experienced strong segment growth, with Retail segment delivered sales increasing 11% and Wholesale segment delivered sales increasing 1%.

- La-Z-Boy generated $89 million in operating cash flow for the quarter, marking a 57% increase versus the prior year, and ended the period with $306 million in cash and no external debt.

- Key strategic initiatives included the integration of a 15-store acquisition, the planned closure of its U.K. manufacturing facility, and the completion of the Kincaid upholstery business sale, along with a letter of intent for the sale of wholesale casegoods businesses.

- The company returned approximately $24 million to shareholders during the quarter, comprising $10 million in dividends and $14 million in share repurchases.

Feb 17, 2026, 9:15 PM

La-Z-Boy Reports Q2 2026 Results and Strategic Portfolio Optimization

LZB

Earnings

M&A

New Projects/Investments

- La-Z-Boy reported Q2 2026 adjusted sales of $522 million and adjusted diluted EPS of $0.71, which was flat compared to the prior year.

- The company completed its largest independent store acquisition of 15 stores, adding an estimated $40 million net to the total company's annual sales. Concurrently, it announced plans to exit non-core wholesale case goods businesses and close its U.K. manufacturing facility. These strategic actions are expected to result in an approximate $30 million net sales decrease and a 75-100 basis points adjusted operating margin improvement for the entire enterprise annually, with completion expected by the end of the fiscal year.

- La-Z-Boy continues its distribution network transformation, consolidating two additional distribution centers in Q2, aiming to reduce its footprint from 15 to three hubs. This multi-year project is projected to yield 50-75 basis points of wholesale segment margin improvement (up to 50 basis points on total enterprise margin) upon completion.

- The company opened five new company-owned stores in the quarter and 15 new stores in the last 12 months, expanding its La-Z-Boy store network, with company-owned stores now representing 60% of the 370-store network.

Nov 19, 2025, 1:30 PM

La-Z-Boy Reports Solid Q2 2026 Results and Provides Q3 Guidance

LZB

Earnings

Guidance Update

M&A

- La-Z-Boy reported Q2 2026 delivered sales of $522 million and an adjusted operating margin of 7.1%, with adjusted diluted EPS at $0.71, which was flat versus the prior year.

- The company generated $50 million in operating cash flow for the quarter and announced a 10% dividend increase, marking the fifth consecutive year of double-digit increases.

- Strategic initiatives include the acquisition of a 15-store network in the Southeast U.S. and plans to exit non-core businesses (Kincaid Case Goods, American Drew Case Goods, and Kincaid Upholstery) and close its U.K. manufacturing facility, with these exits expected to be substantially completed by the end of the fiscal year.

- These strategic actions are projected to result in an approximate $30 million net sales decrease and a 75-100 basis points adjusted operating margin improvement for the entire enterprise annually.

- For Q3 2026, La-Z-Boy expects sales between $525 million and $545 million and an adjusted operating margin of 5-6.5%.

Nov 19, 2025, 1:30 PM

La-Z-Boy Reports Q2 2026 Results, Announces Dividend Increase and Strategic Portfolio Optimization

LZB

Earnings

Dividends

M&A

- La-Z-Boy reported Q2 2026 delivered sales of $522 million, a slight increase year-over-year, with an adjusted operating margin of 7.1% and adjusted diluted EPS of $0.71.

- The company generated $50 million in operating cash flow, tripling the prior year's comparable period, and announced a 10% dividend increase, marking the fifth consecutive year of double-digit increases.

- Strategic initiatives include the acquisition of 15 company-owned stores (expected to add $40 million net to the total company annually) and plans to exit non-core businesses (expected to result in a $70 million sales headwind from these businesses).

- The combined impact of these strategic actions is projected to result in an approximate $30 million net sales decrease and a significant adjusted operating margin improvement of 75-100 basis points to the entire enterprise annually.

- For Q3 2026, La-Z-Boy anticipates sales between $525-$545 million and an adjusted operating margin in the range of 5-6.5%.

Nov 19, 2025, 1:30 PM

La-Z-Boy Reports Solid Q2 2026 Results, Advances Retail Acquisition and Strategic Initiatives

LZB

Earnings

M&A

Guidance Update

- La-Z-Boy Incorporated reported Q2 2026 sales of $522 million, a slight increase from the prior year, with GAAP diluted EPS of $0.70 and adjusted diluted EPS of $0.71.

- The company completed a 15-store acquisition in the southeast U.S. region, estimated to add $80 million in annual Retail sales.

- Strategic initiatives, including exiting non-core businesses and proposing the closure of a UK manufacturing facility, are projected to reduce sales by approximately $30 million net and increase margins by 75-100 basis points by the end of the fiscal year.

- The quarterly dividend was increased by 10% to $0.242 per share, marking the fifth consecutive year of double-digit increases.

- For fiscal Q3, La-Z-Boy expects sales to be in the range of $525-545 million (1-4% year-over-year growth) and an adjusted operating margin of 5.0-6.5%.

Nov 18, 2025, 9:17 PM

La-Z-Boy Announces Strategic Leadership Realignment

LZB

Management Change

- La-Z-Boy Incorporated announced a strategic realignment of its commercial leadership on October 13, 2025, aimed at strengthening its focus on core businesses and positioning for scalable, long-term growth.

- Tj Linz was appointed President, Wholesale Brands, effective October 10, 2025.

- Rob Sundy was appointed President, Retail, effective October 10, 2025.

- Rebecca Reeder, who served as President, Retail La-Z-Boy Furniture Galleries, will be leaving the company effective October 31, 2025.

Oct 14, 2025, 12:59 PM

Quarterly earnings call transcripts for LA-Z-BOY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more