Earnings summaries and quarterly performance for MASCO CORP /DE/.

Executive leadership at MASCO CORP /DE/.

Jonathon Nudi

President and Chief Executive Officer

Heath M. Eisman

Vice President, Controller and Chief Accounting Officer

Imran Ahmad

Group President

Jai Shah

Group President

Kenneth G. Cole

Vice President, General Counsel and Secretary

Renee Straber

Vice President, Chief Human Resource Officer

Richard A. Marshall

Vice President, Masco Operating System

Richard J. Westenberg

Vice President, Chief Financial Officer and Treasurer

Board of directors at MASCO CORP /DE/.

Research analysts who have asked questions during MASCO CORP /DE/ earnings calls.

Anthony Pettinari

Citigroup Inc.

7 questions for MAS

John Lovallo

UBS Group AG

7 questions for MAS

Stephen Kim

Evercore ISI

7 questions for MAS

Michael Rehaut

JPMorgan Chase & Co.

6 questions for MAS

Sam Reid

Wells Fargo

6 questions for MAS

Susan Maklari

Goldman Sachs Group Inc.

5 questions for MAS

Trevor Allinson

Wolfe Research, LLC

5 questions for MAS

Matthew Bouley

Barclays PLC

4 questions for MAS

Matthew Bouley

Barclays

4 questions for MAS

Mike Dahl

RBC Capital Markets

4 questions for MAS

Adam Baumgarten

Zelman & Associates

3 questions for MAS

Keith Hughes

Truist Financial Corporation

3 questions for MAS

Philip Ng

Jefferies

3 questions for MAS

Rafe Jadrosich

Bank of America

3 questions for MAS

Collin Varren

Deutsche Bank

2 questions for MAS

Eric Bussard

Cleveland Research

2 questions for MAS

Michael Dahl

RBC Capital Markets

2 questions for MAS

Susan McClary

Goldman Sachs

2 questions for MAS

Trevor Allison

Wolfe Research LLC

2 questions for MAS

Aatish Shah

Evercore ISI

1 question for MAS

Andrew Azzi

JPMorgan Chase & Co.

1 question for MAS

Christopher Kalata

RBC Capital Markets

1 question for MAS

Garik Shmois

Loop Capital Markets

1 question for MAS

Gregory Andreopoulos

Citigroup

1 question for MAS

Maggie

Jefferies

1 question for MAS

Maggie Grady Miller

Jefferies

1 question for MAS

Phil Ng

Jefferies Financial Group Inc.

1 question for MAS

Richard Reid

Wells Fargo & Company

1 question for MAS

Spencer Kaufman

UBS Group AG

1 question for MAS

Recent press releases and 8-K filings for MAS.

- Masco reported 2025 sales of $7.6 billion, EPS of $3.96, and operating profit of $1.3 billion, with margins slightly down due to tariff headwinds.

- The company’s segments include Plumbing (2025 sales $5.2 billion, margins 17.6%) and Decorative Architectural Products (Behr Paint, 2025 sales $2.4 billion, margins 18.9%).

- Management expects 2026 end-market conditions to improve modestly, guiding flat to low single-digit sales growth and margin recovery, while targeting ≥10% annual EPS growth, maintaining dividend hikes, and deploying ≥$600 million in buybacks/acquisitions.

- Strategic priorities for 2026 include empowering an executive committee of business unit presidents, building centers of excellence for digital and brand marketing, and shifting incentive metrics to emphasize 40% top-line growth alongside 60% profit.

- Innovation goals aim for 25% of revenue from products launched in the past three years, with recent initiatives in touchless faucets, water filtration, water-based primer, and wellness offerings like Sauna360 and cold plunges.

- Masco reported $7.6 B in 2025 sales, $3.96 EPS, and $1.3 B operating profit, with margins pressured by tariffs but expecting recovery in 2026.

- The Plumbing segment (Delta Faucet, Hansgrohe, Watkins) generated $5.2 B sales at 17.6% margin, while Behr Paint delivered $2.4 B sales at 18.9% margin.

- Strategy centers on brand-building, innovation, and operational excellence, targeting 25% of sales from products introduced in the past three years and enhancing digital capabilities.

- Capital allocation priorities include reinvesting 2–2.5% of sales, maintaining leverage <2.5×, 13th consecutive dividend increase to $1.28, $600 M share repurchases/acquisitions in 2026, and targeting 10%+ annual EPS growth.

- Outlook remains focused on the repair & remodel cycle, leveraging record home equity, aging housing stock, and millennial housing trends, with cautious optimism for green shoots in 2026.

- Masco reported 2025 sales of $7.6 billion, EPS of $3.96, and operating profit of $1.3 billion, with margins down due to tariffs, and guided 2026 end-market growth flat to low single digits.

- The company’s two segments include Plumbing (Delta Faucet, Hansgrohe, Watkins Wellness) with $5.2 billion in sales and 17.6% margins, and Decorative Architectural Products (Behr Paint, KILZ) with $2.4 billion in sales and 18.9% margins.

- Organizational changes elevate the presidents of its four business units to the executive committee and establish centers of excellence for digital marketing, brand building, and commercial excellence to drive growth.

- Executive incentive metrics were adjusted to 60% profit and 40% sales weighting in 2026 to emphasize top-line growth alongside profitability.

- Maintaining a disciplined capital allocation strategy, Masco reinvests 2–2.5% of sales, targets a ~30% payout, approved a 13th consecutive dividend increase to $1.28, and plans $600 million for share repurchases or bolt-on acquisitions in 2026.

- Masco operates two core segments: Plumbing (≈ $5.2 B sales, 17.6% margins) including Delta Faucet, Hansgrohe and Watkins Wellness, and Decorative Architectural (≈ $2.4 B sales, 18.9% margins) led by Behr paint at The Home Depot.

- In 2025, Masco generated $7.6 B in sales, $3.96 EPS and $1.3 B operating profit; it faces an estimated $200 M tariff headwind in 2026 with guidance for flat to low-single-digit growth, to be updated at Q1 earnings.

- To boost top-line growth, Masco established a new executive committee and three centers of excellence (digital marketing, brand/consumer insights and commercial excellence), and realigned 2026 incentives to 60% profit / 40% sales growth.

- Maintains disciplined capital allocation: reinvesting 2–2.5% of sales in CapEx, targeting 16.5% working capital, gross debt/EBITDA < 2.5×, a ~30% dividend payout, and deploying ≥ $600 M in 2026 buybacks and bolt-on acquisitions.

- Masco reported 2025 sales of $7.6 billion, EPS of $3.96, and operating profit of $1.3 billion, with margins pressured by tariffs, reaffirming its focus on the less cyclical repair and remodel market.

- The Plumbing segment generated $5.2 billion in sales at 17.6% margins, while Decorative Architectural Products (Behr paint) delivered $2.4 billion in sales at 18.9% margins.

- Under CEO Jon Nudi, Masco formed a new executive committee and three centers of excellence (digital marketing, brand building, commercial excellence) to support its goal of 3–5% organic growth alongside strategic acquisitions and margin expansion.

- Capital allocation priorities include maintaining a 30% dividend payout (current dividend of $1.28), preserving an investment-grade balance sheet, and deploying at least $600 million in 2026 for share buybacks and bolt-on acquisitions.

- Management expects 2026 end-market trends to be flat to low-single-digit growth, citing pent-up consumer demand and improving comparables, but acknowledges tariff uncertainty with a $200 million gross exposure pending regulatory developments.

- Masco reorganized to drive growth by elevating its four business unit presidents (Delta Faucet, Hansgrohe, Watkins Wellness, Behr Paint) to the senior team and creating centers of excellence in digital marketing, brand building, and commercial excellence.

- The company operates two segments: Plumbing (~ $5.2 billion sales, 17.6% margins) and Decorative Architectural (Behr paint: $2.4 billion sales, 18.9% margins), combining for $7.6 billion in 2025 sales and $3.96 EPS.

- Innovation remains central, with a goal for 25% of revenue from products launched in the last three years; recent highlights include the Sauna360 acquisition (adding ~1 pp growth), water-based primer, and digital/steam showers.

- Masco’s disciplined capital allocation targets 2–2.5% of sales reinvested, gross debt/EBITDA < 2.5×, and a 13th consecutive dividend increase to $1.28, alongside a $600 million share buyback/bolt-on acquisition plan for 2026.

- The repair-and-remodel focus is expected to weather current headwinds, supported by record home equity, aging housing stock, and pent-up demand, though consumer confidence remains a key variable.

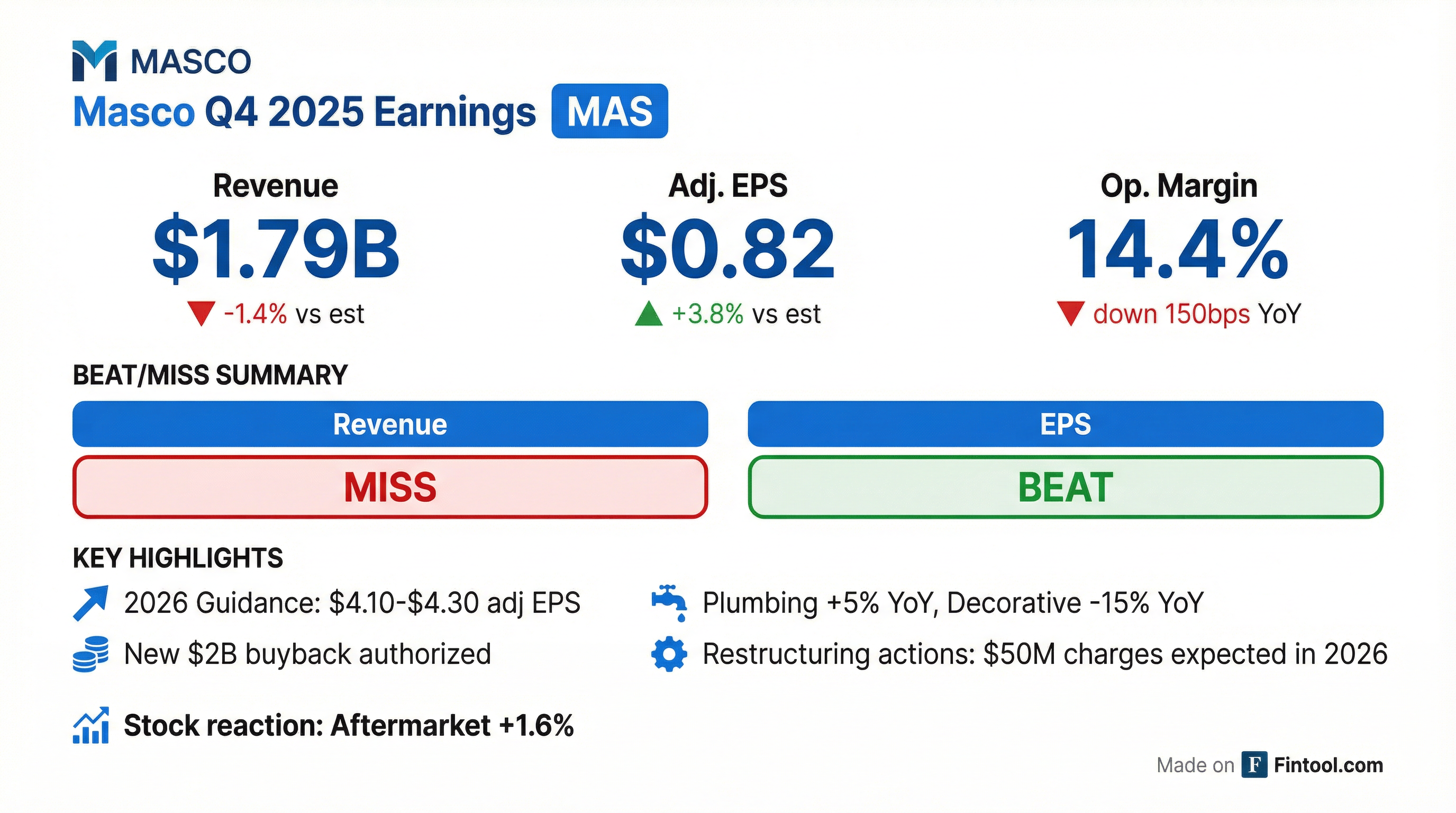

- Q4 2025 revenue of $1,793 million, down 2% (3% ex-currency), with adjusted EPS of $0.82, down 8% year-on-year.

- Plumbing Products sales rose 5% to $1,248 million (16.3% operating margin), while Decorative Architectural Products fell 15% to $545 million (13.9% margin).

- Returned capital via $217 million in share repurchases (3.4 million shares) and raised the quarterly dividend 3% to $0.32 per share.

- Issued 2026 guidance of $4.10–$4.30 in adjusted EPS, with total sales expected flat to up low-single digits.

- Masco reported Q4 2025 net sales down 2%, operating profit of $259 million (14.4% margin), and EPS of $0.82 per share.

- For full-year 2025, net sales decreased 3%, operating profit was $1.3 billion (16.8% margin), EPS was $3.96, and return on invested capital reached 41%; $832 million was returned to shareholders.

- For 2026, Masco expects sales to be flat to up low single digits and operating margin to expand to ~17%.

- The board raised the 2026 dividend by 3% to $1.28 per share, authorized a $2 billion share repurchase program, and plans to deploy ~$600 million of free cash flow to repurchases or acquisitions.

- Integration of Liberty Hardware into the plumbing segment sets full-year margins at ~18% for plumbing and ~19% for decorative architectural products.

- Net sales decreased 2% (3% in local currency) in Q4, with operating profit of $259 million (14.4% margin) and EPS of $0.82.

- For FY 2025, sales declined 3% (2% ex-divestiture/currency), operating profit was $1.3 billion (16.8% margin), EPS $3.96, and $832 million returned to shareholders.

- Q4 segment highlights: plumbing sales up 3% in local currency (North America +4%, International +1%) with $240 million op profit; decorative sales down 15% with $76 million op profit.

- 2026 outlook: sales flat to up low single digits, overall margin ~17%, plumbing margin ~18%, decorative margin ~19%, EPS $4.10–$4.30, dividend up 3% to $1.28 and $2 billion share buyback.

- Masco's Q4 sales fell 2%, or 3% in local currency, with operating profit of $259 million (margin 14.4%) and EPS of $0.82.

- Plumbing segment sales rose 5% (3% ex-currency) with operating profit of $204 million (margin 16.3%), while decorative architectural sales dropped 15% (margin 13.9%).

- FY2025 sales declined 3% (2% ex-currency/divestiture), with operating profit of $1.3 billion (margin 16.8%), EPS $3.96, ROIC 41%, and $832 million returned to shareholders.

- 2026 outlook calls for sales flat to up low single digits, operating margin ~17%, EPS $4.10–$4.30, a 3% dividend increase to $1.28/share, and a new $2 billion buyback program.

Quarterly earnings call transcripts for MASCO CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more