Earnings summaries and quarterly performance for SHERWIN WILLIAMS.

Executive leadership at SHERWIN WILLIAMS.

Heidi Petz

Chair, President and Chief Executive Officer

Allen Mistysyn

Senior Vice President – Finance and Chief Financial Officer

Benjamin Meisenzahl

Senior Vice President – Finance and Chief Financial Officer (effective January 1, 2026)

Justin Binns

President, Global Architectural

Karl Jorgenrud

President, Global Industrial

Mary Garceau

Senior Vice President – Chief Legal Officer and Secretary

Board of directors at SHERWIN WILLIAMS.

Research analysts who have asked questions during SHERWIN WILLIAMS earnings calls.

Aleksey Yefremov

KeyBanc Capital Markets

9 questions for SHW

Arun Viswanathan

RBC Capital Markets

9 questions for SHW

Garik Shmois

Loop Capital Markets

9 questions for SHW

Ghansham Panjabi

Robert W. Baird & Co.

9 questions for SHW

Gregory Melich

Evercore ISI

9 questions for SHW

John Ezekiel Roberts

Mizuho Securities

9 questions for SHW

John McNulty

BMO Capital Markets

9 questions for SHW

Kevin McCarthy

Vertical Research Partners

9 questions for SHW

Patrick Cunningham

Citigroup

9 questions for SHW

Vincent Andrews

Morgan Stanley

9 questions for SHW

David Begleiter

Deutsche Bank

8 questions for SHW

Laurence Alexander

Jefferies

8 questions for SHW

Eric Bosshard

Cleveland Research Company

7 questions for SHW

Jeffrey Zekauskas

JPMorgan Chase & Co.

7 questions for SHW

Chris Parkinson

Wolfe Research, LLC

6 questions for SHW

Chuck Cerankosky

Northcoast Research

6 questions for SHW

Josh Spector

UBS Group

6 questions for SHW

Mike Harrison

Seaport Research Partners

6 questions for SHW

Duffy Fischer

Goldman Sachs

5 questions for SHW

Michael Sison

Wells Fargo

5 questions for SHW

Aron Ceccarelli

Berenberg

4 questions for SHW

Matthew Deyoe

Bank of America

4 questions for SHW

Charles Cerankosky

Northcoast Research

3 questions for SHW

Christopher Parkinson

Wolfe Research

3 questions for SHW

Joshua Spector

UBS

3 questions for SHW

Michael Harrison

Seaport Research Partners

3 questions for SHW

Michael Leithead

Barclays

3 questions for SHW

Mike Sison

Wells Fargo

3 questions for SHW

Patrick Fischer

Goldman Sachs

3 questions for SHW

Steve Byrne

Bank of America

3 questions for SHW

Adam Baumgarten

Zelman & Associates

2 questions for SHW

Jeff Chaykowski

JPMorgan Chase & Co.

2 questions for SHW

Matt Dale

Bank of America

2 questions for SHW

Duffy Fisher

Goldman Sachs Group Inc.

1 question for SHW

Emily Fusco

Deutsche Bank

1 question for SHW

Mike Sisson

Wells Fargo Securities

1 question for SHW

Recent press releases and 8-K filings for SHW.

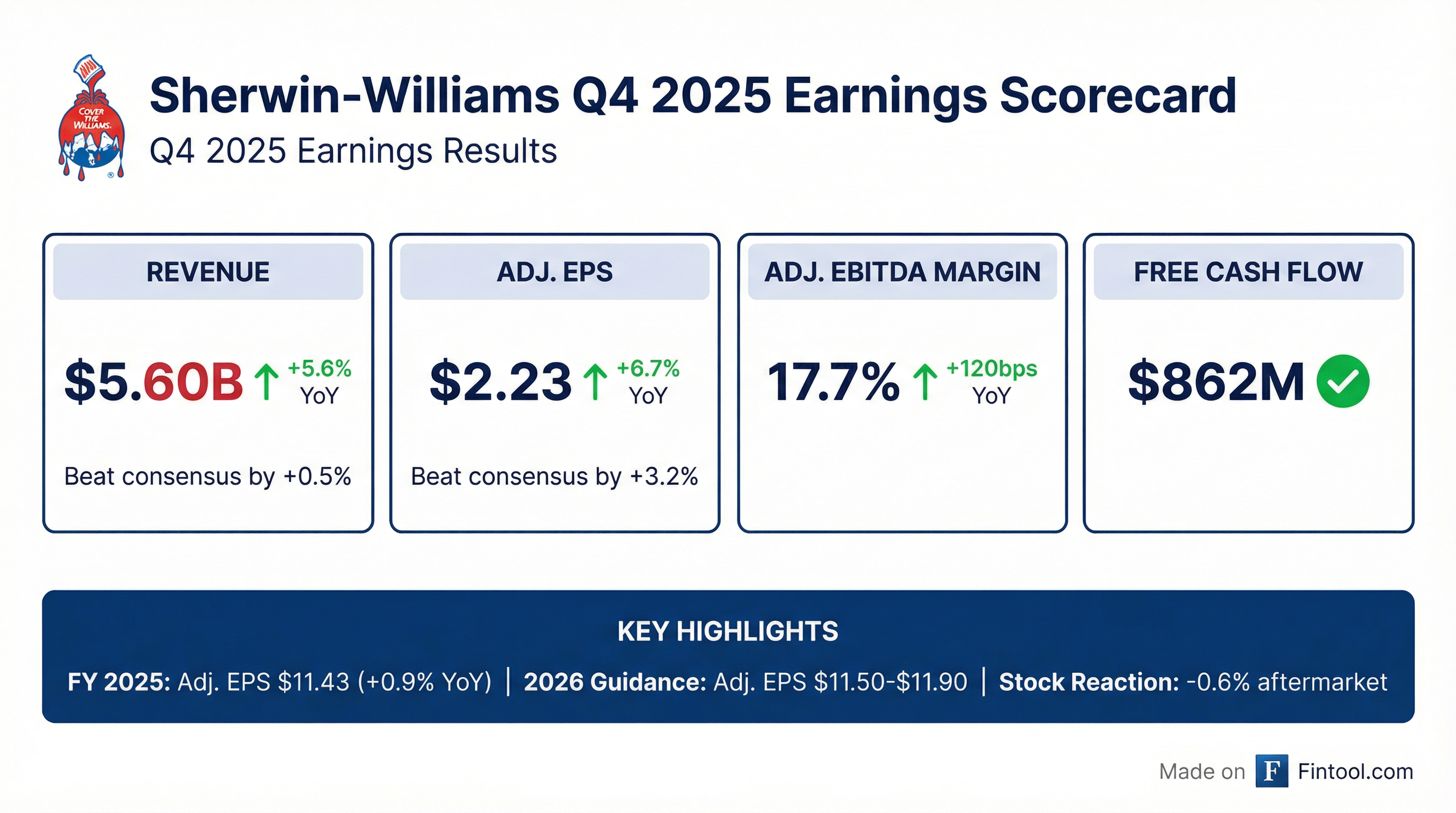

- Q4 consolidated sales rose by a mid-single-digit percentage (incl. low-single-digit contribution from Suvinil), with adjusted EPS up 6.7%, adjusted EBITDA +13.4% to 17.7% margin, and free cash flow conversion of 90.1%.

- FY2025 delivered record consolidated sales and adjusted diluted EPS of $11.43, net operating cash grew 9.4% to $3.5 billion (14.6% of sales), and free cash flow was $2.7 billion (59% conversion).

- Returned $2.5 billion to shareholders via share repurchases and dividends (47th consecutive dividend increase); net debt/EBITDA was 2.3×, and the 401(k) match was reinstated effective February 1, 2026.

- Completed the Suvinil acquisition, integrating the first full quarter in Q4 (dilutive to margin but flat excl. purchase accounting); plan to open 80–100 net new stores in U.S. and Canada in 2026.

- 2026 guidance: consolidated sales up low- to mid-single digits, diluted net income per share of $10.70–$11.10 (adjusted $11.50–$11.90).

- Sherwin-Williams posted 4Q 2025 sales of $5.596 B, up 5.6% Y/Y, with gross margin at 48.5% (-10 bps) and SG&A at 34.6% of sales (-90 bps).

- Adjusted EPS rose 6.7% to $2.23, and adjusted EBITDA increased 13.4% to $993.1 M (17.7% of sales).

- Net operating cash flow grew 16.9% to $1.093 B, achieving a free cash flow conversion of 90.1%.

- For 1Q 2026, Sherwin-Williams expects mid-single-digit sales growth, and full-year adjusted EPS of $11.50–$11.90.

- In Q4 2025, consolidated sales rose mid-single digits, including a low-single-digit contribution from the Suvinil acquisition; adjusted diluted EPS increased 6.7%, adjusted EBITDA grew 13.4% (margin of 17.7%), and free cash flow conversion was 90.1%.

- For full-year 2025, the company delivered record consolidated sales and record adjusted diluted EPS of $11.43, with net operating cash up 9.4% to $3.5 billion, free cash flow of $2.7 billion (59% conversion), net debt/EBITDA of 2.3×, $2.5 billion returned to shareholders, and completion of the Suvinil acquisition.

- Q4 segment highlights: Paint Stores Group saw high-single-digit growth in Protective & Marine and mid-single-digit in Residential Repaint; Consumer Brands sales benefited from Suvinil; Performance Coatings margin expanded 150 bps to 19%.

- 2026 guidance: consolidated sales up low- to mid-single-digit %, diluted EPS of $10.70–$11.10 ($11.50–$11.90 adjusted for acquisition amortization), low-single-digit positive price mix, raw materials up low single digits, SG&A up low single digits, and year-end net debt/EBITDA of 2.0–2.5×.

- In Q4 2025, consolidated sales rose by a mid-single-digit percentage, adjusted diluted EPS increased 6.7%, adjusted EBITDA grew 13.4% (17.7% of sales) and free cash flow conversion was 90.1% year-over-year.

- For full year 2025, the company delivered record consolidated sales and record adjusted diluted EPS; net operating cash grew 9.4% to $3.5 billion (14.6% of sales), free cash flow was $2.7 billion with 59% conversion, and net debt/EBITDA ended at 2.3× after returning $2.5 billion to shareholders.

- 2026 outlook calls for consolidated sales up low- to mid-single-digit, adjusted diluted EPS of $11.50–$11.90 excluding ~$0.80/share of acquisition amortization, with raw materials and GAAP SG&A each expected to increase low single digits.

- FY 2025 consolidated net sales increased 2.1% to $23.57 billion; diluted net income per share was $10.26 (-2.7%), and adjusted diluted net income per share was $11.43 (+0.9%).

- Q4 2025 net sales rose 5.6% to $5.596 billion; diluted EPS was $1.92 (+1.1%) and adjusted diluted EPS was $2.23 (+6.7%).

- Generated $3.45 billion of net operating cash (14.6% of sales) and returned $2.4 billion to shareholders through dividends and share repurchases.

- 2026 guidance: diluted EPS of $10.70–$11.10, adjusted diluted EPS of $11.50–$11.90, and net sales growth of low- to mid-single digits.

- Full-year net sales rose 2.1% to $23.57 billion in 2025 versus 2024.

- Full-year diluted EPS was $10.26 (down 2.7%), while adjusted diluted EPS increased 0.9% to $11.43.

- Q4 net sales grew 5.6% to $5.60 billion, and adjusted diluted EPS rose 6.7% to $2.23.

- Generated $3.45 billion in net operating cash (14.6% of net sales) and returned $2.4 billion to shareholders via dividends and share repurchases.

- 2026 guidance calls for adjusted diluted EPS of $11.50 – $11.90 and diluted EPS of $10.70 – $11.10.

- On November 17, 2025, Sherwin-Williams entered into an Amended and Restated Credit Agreement with Citicorp USA, Inc., extending the maturity of $75 million of revolving and letter of credit commitments from December 20, 2025 to December 20, 2030.

- The new agreement carries substantially the same representations, warranties, covenants, and events of default as the prior May 9, 2016 facility.

- Total commitments under the facility step down over time, starting at $875 million through June 20, 2026 and declining to $200 million by December 20, 2030.

- Consolidated sales increased at the high end of the guided range; adjusted EBITDA margin expanded 60 bps to 21.4%; adjusted diluted EPS grew 6.5%; $864 million returned to shareholders via share repurchases and dividends.

- Paint Stores Group sales rose mid-single digits % with high-end, low-single-digit price mix and low-single-digit volume growth; segment profit grew mid-single digits % and segment margin increased by 40 bps.

- Consumer Brands Group: price mix up low single digits %, volume down mid-single digits %, FX a slight headwind; adjusted segment margin improved despite an 85 bps restructuring drag; closed the Suvinil acquisition and eight net Sherwin-Williams stores in Latin America.

- Performance Coatings Group sales in line with expectations; volume, acquisitions, and FX up low single digits %; packaging grew double digits and auto-refinish mid-single digits; segment profit and margin declined with a 30 bps restructuring headwind.

- Updated full-year 2025 guidance: sales up low single digits % vs. 2024; adjusted diluted EPS of $11.25–$11.45; plan to open 80–100 North American paint stores.

- Sherwin-Williams delivered solid third-quarter performance with consolidated sales up at the high end of its guided range, adjusted EBITDA margin expanding 60 bps to 21.4%, and adjusted diluted EPS rising 6.5%.

- The company returned $864 million to shareholders through share repurchases and dividends year-to-date.

- Closed the acquisition of Suvinil, bolstering its Consumer Brands Group footprint in Latin America.

- Raised full-year 2025 sales guidance to up low single-digit % versus 2024 and narrowed adjusted diluted EPS outlook to $11.25–$11.45 per share.

- 2026 initial outlook includes a 7% price increase in Paint Stores Group effective January 1, raw material costs up low single digits, and expectations for a “softer for longer” demand environment.

- Consolidated sales increased at the high end of guided range, with Paint Stores and Consumer Brands outperforming and Performance Coatings in line; adjusted EBITDA margin expanded 60 bps to 21.4% and adjusted EPS grew 6.5%

- Returned $864 million to shareholders through share repurchases and dividends; opened 23 net new stores in Q3 and 61 year-to-date, driving volume growth

- Closed acquisition of Suvinil in Latin America, expected to boost Q4 consolidated sales by a low-single-digit % with mid-teens EBITDA accretion potential and minimal EPS headwind

- Temporarily paused company 401(k) matching contributions effective October 1 to preserve jobs amid prolonged soft demand, with plans to reinstate once performance allows

Quarterly earnings call transcripts for SHERWIN WILLIAMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more