Earnings summaries and quarterly performance for Zurn Elkay Water Solutions.

Executive leadership at Zurn Elkay Water Solutions.

Todd Adams

Chief Executive Officer

David Pauli

Chief Financial Officer

Jeffrey LaValle

Vice President, General Counsel and Secretary

Jeffrey Schoon

President

Mark Peterson

Senior Vice President and Chief Administrative Officer

Michael Troutman

Chief Information Officer

Sudhanshu Chhabra

Senior Vice President of Zurn Elkay Business Systems

Board of directors at Zurn Elkay Water Solutions.

Research analysts who have asked questions during Zurn Elkay Water Solutions earnings calls.

Bryan Blair

Oppenheimer

8 questions for ZWS

Brett Linzey

Mizuho Securities

6 questions for ZWS

Adam Farley

Stifel Financial Corp.

5 questions for ZWS

Jeffrey Hammond

KeyBanc Capital Markets

5 questions for ZWS

Andrew Buscaglia

BNP Paribas

3 questions for ZWS

Andrew Krill

Deutsche Bank

3 questions for ZWS

Michael Halloran

Baird

3 questions for ZWS

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

3 questions for ZWS

Ben Pezan

Baird

2 questions for ZWS

David Tarantino

Robert W. Baird & Co.

2 questions for ZWS

Ed

Jotun

2 questions for ZWS

James

Jefferies

2 questions for ZWS

Joseph Ritchie

Goldman Sachs

2 questions for ZWS

Pez Saini

Robert W. Baird & Co.

2 questions for ZWS

Joe Ritchie

Goldman Sachs

1 question for ZWS

Recent press releases and 8-K filings for ZWS.

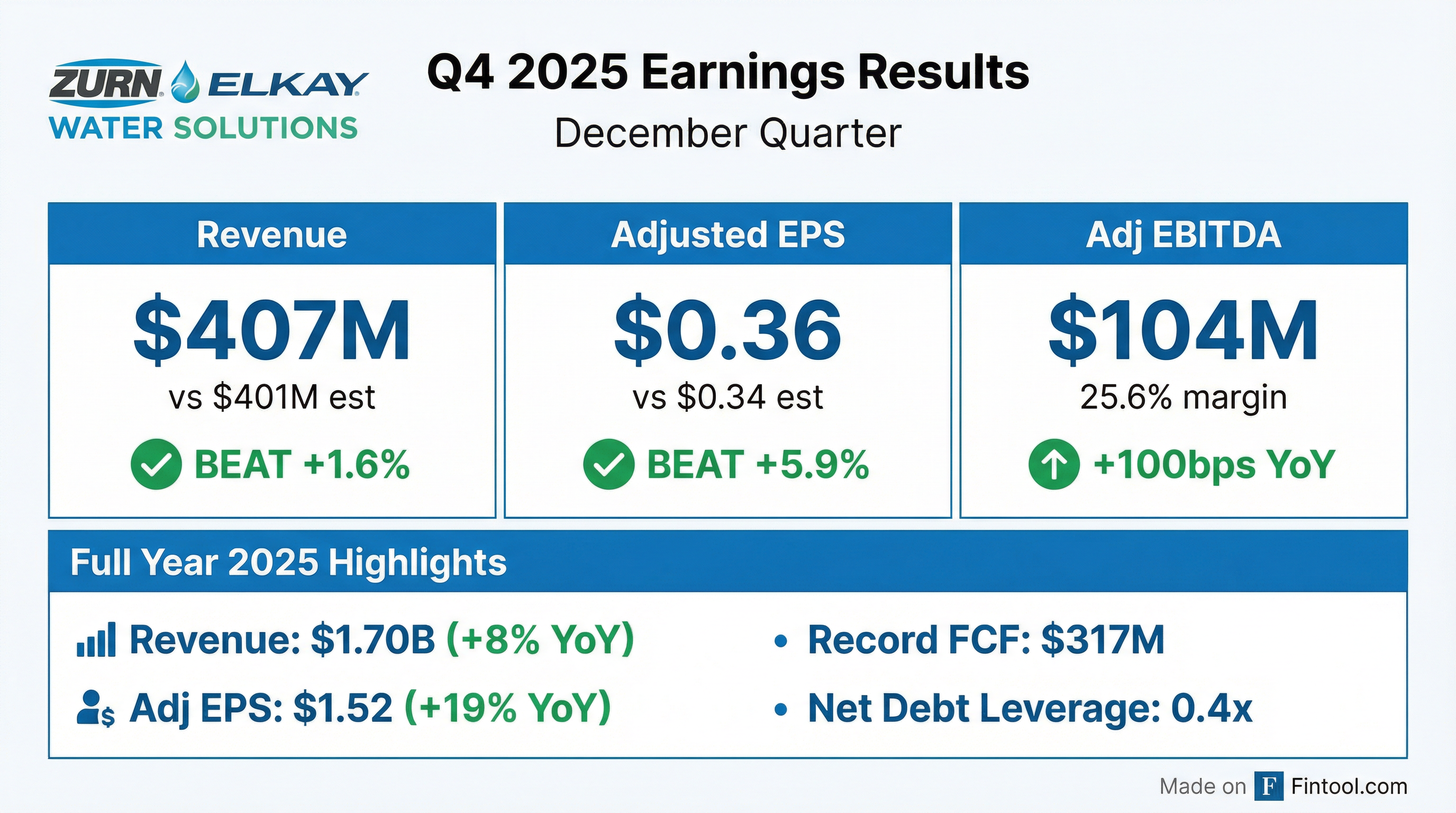

- Zurn Elkay Water Solutions reported strong Q4 2025 sales growth of 10% organically and EBITDA growth of 14% to $104 million, with margins expanding 100 basis points to 25.6%.

- For the full year 2025, the company generated $317 million in free cash flow, an increase of 17% over 2024, and repurchased $160 million of shares while reducing net debt leverage to 0.4 times.

- The company provided a 2026 outlook, projecting mid-single digit core sales growth, incremental adjusted EBITDA margins of approximately 35%, and approximately $335 million in free cash flow.

- Zurn Elkay is actively pursuing new organic growth opportunities in adjacencies and underserved verticals, alongside evaluating M&A opportunities, leveraging its strong balance sheet and cash flow generation.

- The company also highlighted its sustainability efforts, including the launch of ProFiltration and Live EZ products, and a partnership with TerraCycle for filter recycling.

- Zurn Elkay Water Solutions (ZWS) reported Q4 2025 sales of $407 million, representing 10% core and reported growth year-over-year, with adjusted EBITDA reaching $104 million and margins expanding 100 basis points to 25.6%.

- For the full year 2025, the company generated $317 million in free cash flow, up 17% over 2024, and repurchased $160 million of outstanding shares, while leverage declined to 0.4x.

- ZWS provided a 2026 guidance framework, projecting mid-single digit core sales growth, approximately 35% incremental adjusted EBITDA margins, and around $335 million in free cash flow.

- The company is focused on new organic growth opportunities in adjacencies and underserved verticals, supported by its strong balance sheet and cash flow, and is actively cultivating M&A opportunities.

- Zurn Elkay reported Q4 2025 net sales of $407 million, a 10% increase year-over-year, with adjusted EBITDA margin at 25.6%, up 100 basis points year-over-year.

- For the full year 2025, the company achieved net sales of $1,696 million, an 8% increase year-over-year, and adjusted EBITDA margin of 26.1%, up 120 basis points year-over-year.

- Free cash flow for the full year 2025 was $317 million, and the net debt leverage ratio stood at 0.4x as of December 2025.

- The company repurchased $160 million of shares (4.4 million shares), representing approximately 3% of outstanding shares, in Q4 2025.

- For 2026, Zurn Elkay anticipates core sales growth in the mid-single digits and projects free cash flow of approximately $335 million.

- Zurn Elkay Water Solutions Corporation reported net sales of $407 million for Q4 2025, representing 10% core sales growth, and $1,696 million for the full year 2025, with 8% core sales growth.

- Adjusted EPS for Q4 2025 was $0.36 and $1.52 for the full year 2025. Adjusted EBITDA reached $104 million (25.6% of net sales) in Q4 2025 and $442 million (26.1% of net sales) for the full year.

- The company achieved record free cash flow of $317 million in 2025 and maintained a net debt leverage of 0.4x as of December 31, 2025.

- Capital deployment in 2025 included $160 million in common stock repurchases and $64 million in common stock cash dividends.

- For the full year 2026, Zurn Elkay Water Solutions anticipates mid-single digit core sales growth and approximately $335 million in free cash flow, with Q1 2026 core sales growth expected to be 7% to 8%.

- Zurn Elkay Water Solutions reported net sales of $407 million for Q4 2025 and $1,696 million for the full year 2025, representing an 8% increase from 2024.

- For Q4 2025, diluted EPS from continuing operations was $0.24 and Adjusted EPS was $0.36. Full-year 2025 saw diluted EPS from continuing operations of $1.12 and Adjusted EPS of $1.52.

- The company achieved record full-year 2025 Adjusted EBITDA of $442 million (26.1% of net sales) and record free cash flow of $317 million, while also repurchasing $160 million of common stock and paying $64 million in common stock cash dividends.

- For full-year 2026, the company anticipates mid-single digit core sales growth and approximately $335 million in free cash flow.

- Zurn Elkay Water Solutions reported Q3 2025 sales of $455 million, representing 11% core growth year over year, and adjusted EBITDA of $122 million, with margins expanding 120 basis points to 26.8%.

- The company generated $94 million in free cash flow during Q3 2025, which was used to repurchase approximately 600,000 shares, bringing year-to-date repurchases to $135 million. The board also raised the dividend by 22% and refreshed the share buyback program to $500 million.

- Zurn Elkay raised its full-year 2025 outlook, now projecting core sales growth of approximately 8%, adjusted EBITDA between $437 million and $440 million, and free cash flow greater than $300 million.

- The company completed its U.S. pension plan termination in Q3 2025, eliminating an approximately $200 million liability.

- Management anticipates the market outlook for 2026 to be similar to 2025, characterized as a low growth environment, with acceleration in the market pushed to 2027.

- Zurn Elkay reported net sales of $455 million for Q3 2025, driven by an 11% year-over-year increase in core sales.

- Adjusted EBITDA for Q3 2025 grew 16% year-over-year to $122 million, achieving an adjusted EBITDA margin of 26.8%.

- The company increased its quarterly dividend by 22% and authorized an increase in its share buyback program to $500 million, with $25 million in share repurchases during Q3 2025.

- For the full year 2025, Zurn Elkay anticipates Adjusted EBITDA to be between $437 million and $440 million, and free cash flow to be greater than $300 million.

- Zurn Elkay Water Solutions (ZWS) reported Q3 2025 sales of $455 million, an 11% organic year-over-year growth, and EBITDA of $122 million, up 16%, with margins expanding 120 basis points to 26.8%.

- The company generated $94 million in free cash flow during Q3 2025, repurchased 600,000 shares in the quarter, and reduced leverage to 0.6x. The board also raised the dividend 22% and refreshed the share buyback program to $500 million.

- ZWS raised its full-year 2025 outlook, now projecting core sales growth of approximately 8%, adjusted EBITDA between $437 million and $440 million, and free cash flow greater than $300 million.

- The U.S. pension plan termination was completed in Q3 2025, eliminating approximately $200 million in liability. The market outlook for 2026 is expected to be a low growth environment, similar to 2025, with acceleration pushed to 2027.

- Zurn Elkay Water Solutions (ZWS) reported strong Q3 2025 results, with sales reaching $455 million, an 11% core growth year over year, and adjusted EBITDA of $122 million, leading to a 26.8% adjusted EBITDA margin, a 120 basis point expansion.

- The company generated $94 million in free cash flow, deployed $25 million to share repurchases in the quarter (bringing year-to-date repurchases to $135 million), raised its dividend by 22%, and refreshed its share buyback program to $500 million.

- ZWS raised its full-year 2025 outlook, now expecting core sales growth of approximately 8%, adjusted EBITDA between $437 million and $440 million, and free cash flow greater than $300 million.

- The U.S. pension plan termination was completed in Q3 2025, eliminating approximately a $200 million liability, and the company anticipates a tariff cost impact of approximately $50 million for the full year 2025.

- The market outlook for 2026 is projected to be a low growth environment, similar to 2025, with acceleration expected in 2027.

- Zurn Elkay Water Solutions reported net sales of $455 million in Q3 2025, an 11% increase year-over-year, and Adjusted EBITDA grew 16% to $122 million (26.8% of net sales).

- Diluted EPS from continuing operations was $0.35, and Adjusted EPS increased 26% to $0.43 in Q3 2025.

- The company generated free cash flow of $94 million in the quarter, reducing its net debt leverage to a record low of 0.6x as of September 30, 2025.

- Zurn Elkay increased its annual dividend by 22% to $0.44 per share and increased its share repurchase authorization up to $500 million.

- The full year 2025 outlook was raised, with anticipated Adjusted EBITDA of $437 million to $440 million and free cash flow greater than $300 million.

Quarterly earnings call transcripts for Zurn Elkay Water Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more