Earnings summaries and quarterly performance for MetroCity Bankshares.

Executive leadership at MetroCity Bankshares.

Nack Y. Paek

Detailed

Chief Executive Officer

CEO

AM

Abdul Mohdnor

Detailed

Executive Vice President and Chief Compliance Officer

FT

Farid Tan

Detailed

President and Chief Executive Officer of the Bank

HH

Howard Hwasaeng Kim

Detailed

Executive Vice President, Chief Lending Officer and Chief Operating Officer; President of the Bank

LS

Lucas Stewart

Detailed

Executive Vice President and Chief Financial Officer

Board of directors at MetroCity Bankshares.

Research analysts covering MetroCity Bankshares.

Recent press releases and 8-K filings for MCBS.

MetroCity Bankshares Reports Q4 and Full-Year 2025 Earnings, Completes First IC Acquisition

MCBS

Earnings

M&A

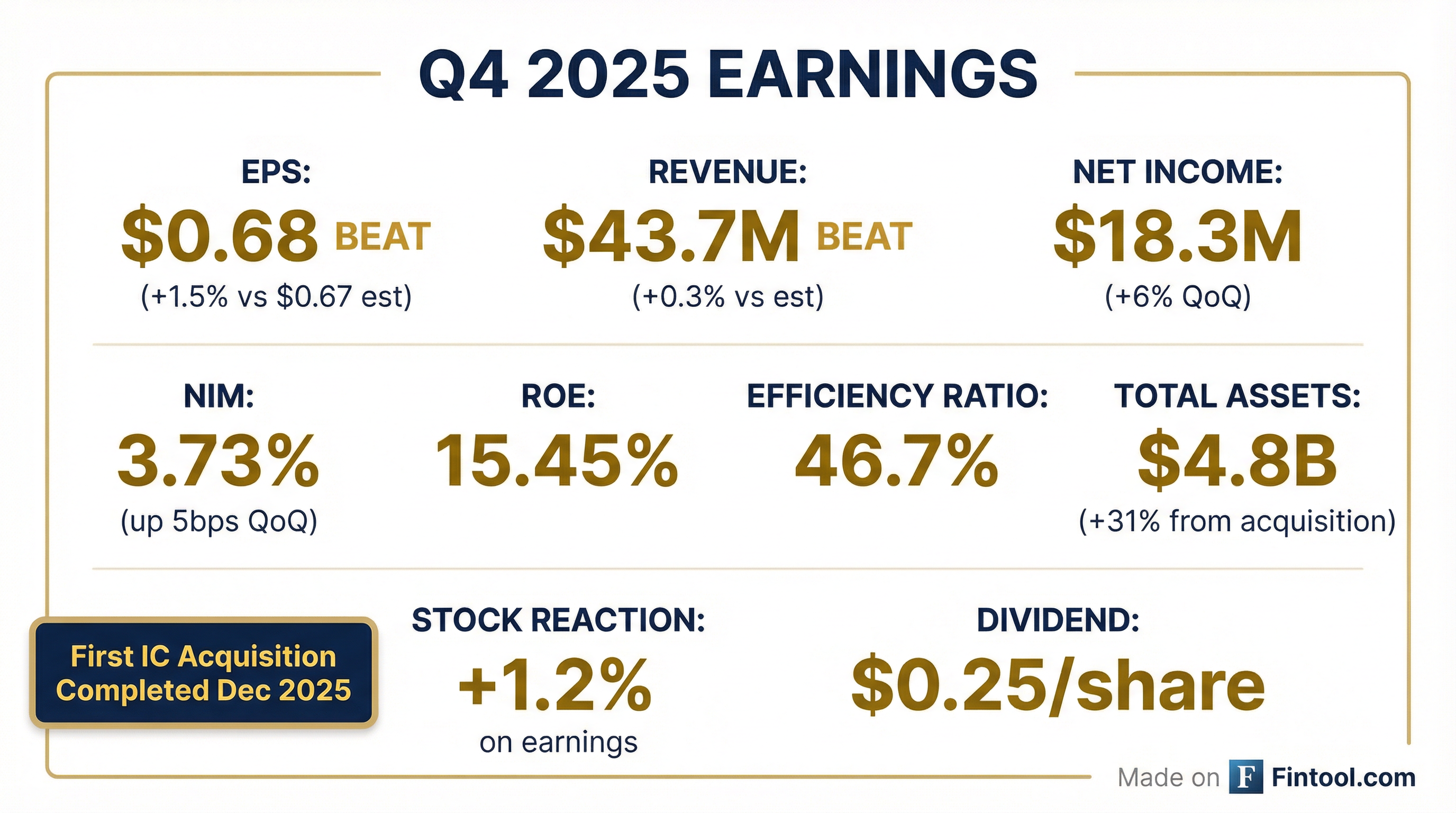

- MetroCity Bankshares, Inc. reported net income of $18.3 million or $0.68 per diluted share for the fourth quarter of 2025, and $68.7 million or $2.64 per diluted share for the full year 2025.

- The company completed its acquisition of First IC Corporation on December 1, 2025, which significantly contributed to balance sheet growth.

- Total loans held for investment increased by $1.1 billion (36.6%) to $4.1 billion, and total deposits increased by $952.9 million (35.4%) to $3.65 billion from the third quarter of 2025, primarily due to the acquisition.

- For the fourth quarter of 2025, key performance indicators included an annualized return on average assets of 1.80%, an annualized return on average equity of 15.45%, a net interest margin of 3.73%, and an efficiency ratio of 46.7%.

- Nonperforming assets totaled $26.1 million, representing 0.55% of total assets, at December 31, 2025.

8 days ago

MetroCity Bankshares Reports Q4 and Full Year 2025 Earnings

MCBS

Earnings

M&A

- MetroCity Bankshares reported net income of $18.3 million ($0.68 diluted EPS) for the fourth quarter of 2025 and $68.7 million ($2.64 diluted EPS) for the full year 2025, showing increases compared to previous periods.

- The company completed its acquisition of First IC Corporation and First IC Bank on December 1, 2025, which significantly impacted its balance sheet.

- As of December 31, 2025, total assets increased to $4.8 billion, with total loans held for investment at $4.05 billion and total deposits at $3.65 billion.

- Key performance indicators for Q4 2025 included an annualized return on average assets of 1.80%, an annualized return on average equity of 15.45%, and a net interest margin of 3.73%.

8 days ago

MetroCity Bankshares, Inc. Completes Acquisition of First IC Corporation

MCBS

M&A

- MetroCity Bankshares, Inc. (MCBS) completed its acquisition of First IC Corporation, the parent company of First IC Bank, effective after the close of business on December 1, 2025.

- As a result of the merger, MetroCity now has approximately $4.8 billion in total assets, $4.0 billion in total loans, and $3.6 billion in total deposits.

- The combined entity operates 30 full-service branches and two loan production offices across Alabama, California, Florida, Georgia, New Jersey, New York, Texas, and Virginia.

- First IC Corporation shareholders received an aggregate of 3,384,381 shares of MCBS common stock and approximately $110.6 million in cash.

- Following the merger, MetroCity Bankshares, Inc. has approximately 28,818,282 shares of common stock outstanding.

Dec 2, 2025, 4:20 PM

MetroCity Bankshares Completes Acquisition of First IC Corporation

MCBS

M&A

New Projects/Investments

- MetroCity Bankshares, Inc. (MCBS) completed its acquisition of First IC Corporation (FIEB) on December 1, 2025.

- Following the acquisition, MetroCity now has approximately $4.8 billion in total assets, $4.0 billion in total loans, and $3.6 billion in total deposits.

- The combined entity operates 30 full-service branches and two loan production offices across eight states.

- The acquisition is expected to strengthen MetroCity's competitive position and increase its financial flexibility.

Dec 2, 2025, 1:30 PM

MetroCity Bankshares and First IC Corporation Announce Expected Merger Closing Date

MCBS

M&A

- MetroCity Bankshares, Inc. and First IC Corporation announced that their merger is expected to be completed on December 1, 2025.

- The completion of the merger is subject to the satisfaction or waiver of remaining customary closing conditions.

- MetroCity had previously received all required regulatory approvals and non-objections for the merger, as well as the approval of First IC shareholders.

- As of September 30, 2025, MetroCity Bankshares, Inc. had $3.6 billion in assets, and First IC Corporation had $1.2 billion in assets.

Nov 14, 2025, 4:05 PM

MetroCity Bankshares and First IC Corporation Announce Expected Merger Closing Date

MCBS

M&A

- MetroCity Bankshares, Inc. and First IC Corporation announced on November 14, 2025, that their merger is expected to be completed on December 1, 2025.

- MetroCity has secured all necessary regulatory approvals and non-objections, and First IC shareholders have approved the merger.

- As of September 30, 2025, MetroCity Bankshares reported $3.6 billion in assets, while First IC Corporation had $1.2 billion in assets.

Nov 14, 2025, 1:30 PM

MetroCity Bankshares, Inc. Reports Q3 2025 Earnings and Merger Update

MCBS

Earnings

M&A

- MetroCity Bankshares, Inc. reported net income of $17.3 million, or $0.67 per diluted share, for the third quarter of 2025.

- For the nine months ended September 30, 2025, net income was $50.4 million, or $1.96 per diluted share.

- Key performance metrics for Q3 2025 included an annualized return on average assets of 1.89%, an annualized return on average equity of 15.69%, an efficiency ratio of 38.7%, and a net interest margin of 3.68%.

- All required regulatory approvals for the merger with First IC Corporation and First IC Bank were received on July 15, 2025, with the merger expected to be completed later in the fourth quarter of 2025.

- Total loans, including loans held for sale, increased by $71.6 million to $3.20 billion from the second quarter of 2025, primarily due to a $232.7 million increase in loans held for sale to provide liquidity for the upcoming merger.

Oct 17, 2025, 3:14 PM

MetroCity Bankshares Reports Third Quarter 2025 Earnings and Acquisition Update

MCBS

Earnings

M&A

- MetroCity Bankshares, Inc. reported net income of $17.3 million, or $0.67 per diluted share, for the third quarter of 2025, an increase from $16.8 million, or $0.65 per diluted share, in the second quarter of 2025.

- Key performance indicators for Q3 2025 included an annualized return on average assets of 1.89%, a net interest margin of 3.68%, and an efficiency ratio of 38.7%.

- Total loans, including loans held for sale, increased by $71.6 million to $3.20 billion from the second quarter of 2025, and total assets reached $3.63 billion as of September 30, 2025.

- The company announced that all required regulatory approvals and shareholder approval for its merger with First IC Corporation and First IC Bank were received on July 15, 2025, with the merger anticipated to be completed in the fourth quarter of 2025.

Oct 17, 2025, 2:30 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more