Earnings summaries and quarterly performance for Magnolia Oil & Gas.

Executive leadership at Magnolia Oil & Gas.

Board of directors at Magnolia Oil & Gas.

Research analysts who have asked questions during Magnolia Oil & Gas earnings calls.

Carlos Escalante

Wolfe Research

7 questions for MGY

Noah Hungness

Firm Not Mentioned in Transcript

7 questions for MGY

Tim Moore

EF Hutton

5 questions for MGY

Zach Parham

JPMorgan Chase & Co.

5 questions for MGY

Charles Meade

Johnson Rice & Company L.L.C.

4 questions for MGY

Neal Dingmann

Truist Securities

4 questions for MGY

Tim Rezvan

KeyBanc Capital Markets

4 questions for MGY

Oliver Huang

TPH&Co.

3 questions for MGY

Peyton Dorne

UBS

3 questions for MGY

Phillips Johnston

Capital One Securities, Inc.

3 questions for MGY

Leo Mariani

ROTH MKM

2 questions for MGY

Neil Mehta

Goldman Sachs

2 questions for MGY

Phillip Jungwirth

BMO Capital Markets

2 questions for MGY

Foo Fam

Roth Capital

1 question for MGY

Hsu-Lei Huang

Tudor, Pickering, Holt & Co.

1 question for MGY

Jeff Jay

Daniel Energy Partners

1 question for MGY

Oliver Wang

TPH&Co.

1 question for MGY

Paul Diamond

Citigroup

1 question for MGY

Peyton Dohne

UBS Investment Bank

1 question for MGY

Sean Mitchell

Daniel Energy Partners

1 question for MGY

Timothy Rezvan

KeyBanc Capital Markets Inc.

1 question for MGY

Recent press releases and 8-K filings for MGY.

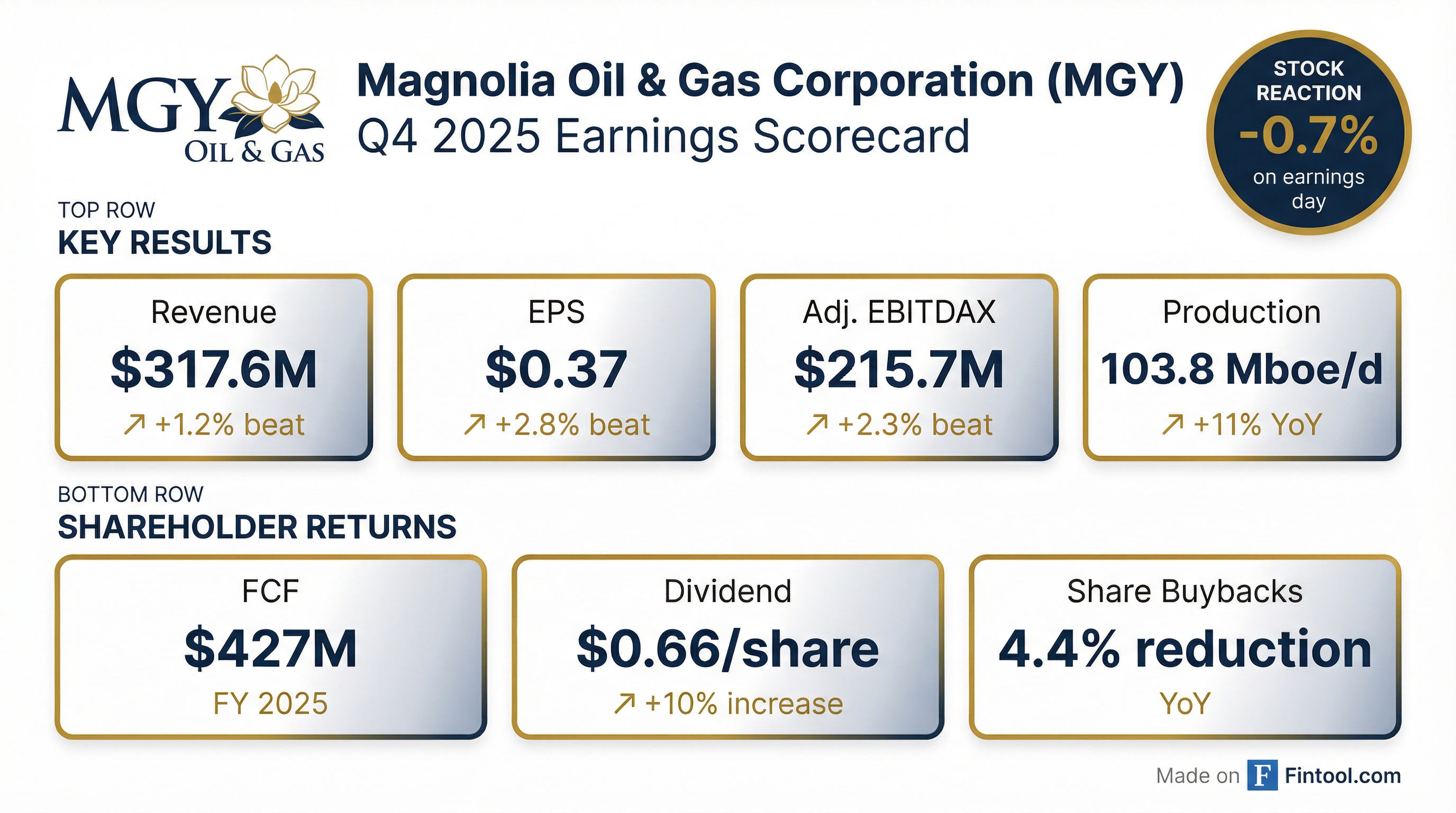

- Magnolia Oil & Gas (MGY) reported strong full year 2025 results, with total production growing 11% to approximately 100,000 barrels of oil equivalent per day and generating over $425 million in free cash flow.

- In Q4 2025, the company achieved a new production record of nearly 104,000 barrels of oil equivalent per day, with adjusted net income of approximately $71 million or $0.38 per diluted share, and adjusted EBITDA of $216 million.

- For 2026, Magnolia expects total production growth of approximately 5% with capital spending anticipated to be approximately flat year-over-year, in the range of $440-$480 million.

- The company returned approximately 75% of its 2025 free cash flow to shareholders, repurchasing approximately 8.9 million shares (reducing diluted share count by 4.5%), and recently announced a 10% dividend increase.

- Magnolia Oil & Gas reported Q4 2025 adjusted net income of $71 million or $0.38 per diluted share and adjusted EBITDA of $216 million. For the full year 2025, adjusted EBITDA was $906 million, and the company generated free cash flow of more than $425 million.

- Total company production for full year 2025 grew by 11% to approximately 100,000 barrels of oil equivalent per day, with oil production growing by 4%. Q4 2025 production reached a new company record, averaging nearly 104,000 barrels of oil equivalent per day.

- The company returned approximately 75% of its free cash flow to shareholders in 2025, repurchasing approximately 8.9 million shares and reducing its diluted share count by roughly 4.5%. A 10% increase in the quarterly dividend to $0.16 per share was also announced.

- For 2026, Magnolia expects capital spending to be approximately flat year-over-year, in the range of $440-$480 million, and anticipates total production growth of approximately 5%. The first quarter 2026 D&C capital expenditures are estimated at $125 million, with production around 102,000 barrels of oil equivalent per day.

- Magnolia Oil & Gas reported full-year 2025 adjusted net income of $336 million and adjusted EBITDAX of $906 million, with total production reaching 99.8 Mboe/d, marking an 11% year-over-year growth.

- The company returned 75% of its $427 million free cash flow, totaling approximately $322 million, to shareholders in 2025, which included ~$205 million in share repurchases and ~$116 million in dividends. Magnolia also recently increased its annualized dividend by 10% to $0.66 per share.

- For 2026, Magnolia projects a year-over-year total production growth of ~5% and D&C capital expenditures between $440 million and $480 million, while maintaining a strong balance sheet with $133 million in net debt and $717 million in liquidity as of December 31, 2025.

- Magnolia Oil & Gas (MGY) delivered strong financial and operational results for Q4 and full year 2025, with Q4 adjusted net income of $71 million or $0.38 per diluted share and Adjusted EBITDA of $216 million.

- For the full year 2025, total company production grew 11% to approximately 100,000 barrels of oil equivalent per day, and the company generated over $425 million in free cash flow.

- The company returned approximately 75% of its free cash flow to shareholders, repurchasing 8.9 million shares (reducing diluted share count by 4.5%) and announcing a 10% increase in its quarterly dividend to $0.16 per share.

- Operational efficiencies led to a 7% decline in field-level cash operating expenses to $5.12 per BOE in 2025 and organic proved developed finding and development costs of $9.25 per BOE.

- Looking ahead to 2026, Magnolia expects total production growth of approximately 5% with capital spending remaining approximately flat year-over-year in the range of $440-$480 million for drilling, completions, and facilities.

- Magnolia Oil & Gas Corporation reported net income of $71.4 million and Adjusted EBITDAX of $215.7 million for Q4 2025, with full year 2025 net income at $337.3 million and Adjusted EBITDAX at $906.1 million.

- The company achieved record quarterly production, with average daily production reaching 103.8 Mboe/d in Q4 2025, an 11% increase from Q4 2024, and full year 2025 production averaging 99.8 Mboe/d, also an 11% year-over-year growth.

- Magnolia returned 75% of its $426.6 million free cash flow generated in 2025 to shareholders through dividends and share repurchases. The Board increased the share repurchase authorization by an additional 10 million shares, and declared a 10% increase in the quarterly dividend to $0.165 per share.

- The company added 49.8 MMboe of proved developed reserves in 2025, achieving organic proved developed Finding and Development (F&D) costs of $9.25 per boe and a reserve replacement ratio of 137% of its 2025 production.

- Magnolia Oil & Gas reported net income of $71.4 million and diluted EPS of $0.37 for Q4 2025, and $337.3 million and $1.73 respectively for the full year 2025.

- Average daily production increased 11% year-over-year to 103.8 Mboe/d in Q4 2025 and 99.8 Mboe/d for the full year 2025.

- The company returned 75% of its 2025 free cash flow to shareholders, repurchasing 8.9 million shares (a 4.4% reduction in outstanding shares) and increasing its quarterly dividend by 10% to $0.165 per share.

- For 2026, Magnolia projects D&C capital spending of $440 million to $480 million and anticipates approximately 5% full-year total production growth.

- Magnolia Oil & Gas (MGY) declared a 10 percent increase in its quarterly dividend rate to $0.165 per share, resulting in an annualized dividend of $0.66 per share.

- The dividend is payable on March 2, 2026, to shareholders of record as of February 10, 2026.

- This marks the fifth consecutive year Magnolia has increased its dividend rate since initiating payments in 2021.

- The company cited strong performance in 2025, including over 10 percent growth in production volumes and a 4 percent reduction in shares outstanding, as reasons for the increase.

- Magnolia Oil & Gas Corporation (MGY) reported adjusted EBITDAX of $219 million and $134 million in free cash flow for Q3 2025.

- The company returned $80 million to shareholders in Q3 2025, including $51 million for share repurchases of over 2.1 million shares and $29 million in dividend payments.

- Q3 2025 production volumes increased 11% year-over-year to 100.5 thousand bbl of oil equivalent per day.

- MGY anticipates record oil and gas production in Q4 2025 and projects full-year 2025 total production growth of approximately 10%.

- For 2026, the company plans to limit capital spending to 55% of adjusted EBITDAX and expects mid-single-digit total production growth.

- Magnolia Oil & Gas (MGY) reported Q3 2025 adjusted net income of $78 million and adjusted EBITDAX of $219 million, generating $134 million in free cash flow.

- The company achieved a record total production of 100.5 Mboe/d in Q3 2025 and updated its full-year 2025 production growth guidance to ~10%, above the original 5%-7% guidance.

- MGY returned ~$80 million to shareholders in Q3 2025, consisting of $51 million in share repurchases and $29 million in dividends.

- As of September 30, 2025, the company maintained a strong balance sheet with $280 million in cash and $120 million in net debt.

- Magnolia Oil & Gas (MGY) reported Q3 2025 adjusted EBITDAX of $219 million and adjusted net income of $78 million, or $0.41 per diluted share.

- The company achieved a record quarterly total production rate of 100.5 thousand barrels of oil equivalent per day, an 11% increase year-over-year. Full-year 2025 total production growth is now expected to be approximately 10%, exceeding initial guidance.

- MGY generated $134 million in free cash flow in Q3 2025, returning $80 million to shareholders through 2.1 million share repurchases and its quarterly dividend. The cash balance at quarter-end was $280 million.

- Looking to 2026, MGY anticipates mid single digit total production growth with capital spending similar to 2025 levels, maintaining its business model of limiting capital spending to 55% of adjusted EBITDAX.

Quarterly earnings call transcripts for Magnolia Oil & Gas.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more