Earnings summaries and quarterly performance for MODINE MANUFACTURING.

Executive leadership at MODINE MANUFACTURING.

Neil Brinker

President and Chief Executive Officer

Brian Agen

Vice President, Chief Human Resources Officer

Eric McGinnis

President, Climate Solutions

Erin Roth

Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer

Michael Lucareli

Executive Vice President and Chief Financial Officer

Board of directors at MODINE MANUFACTURING.

Research analysts who have asked questions during MODINE MANUFACTURING earnings calls.

Brian Drab

William Blair & Company

7 questions for MOD

Matt Summerville

D.A. Davidson & Co.

7 questions for MOD

Noah Kaye

Oppenheimer & Co. Inc.

7 questions for MOD

Jeff Van Sinderen

B. Riley Securities

6 questions for MOD

Chris Moore

CJS Securities

5 questions for MOD

David Tarantino

Robert W. Baird & Co.

4 questions for MOD

Brian Sponheimer

Gabelli Funds

3 questions for MOD

Christopher Hillary

Roubaix Capital, LLC

1 question for MOD

Neal Burk

UBS Group AG

1 question for MOD

Neil Burke

UBS

1 question for MOD

Recent press releases and 8-K filings for MOD.

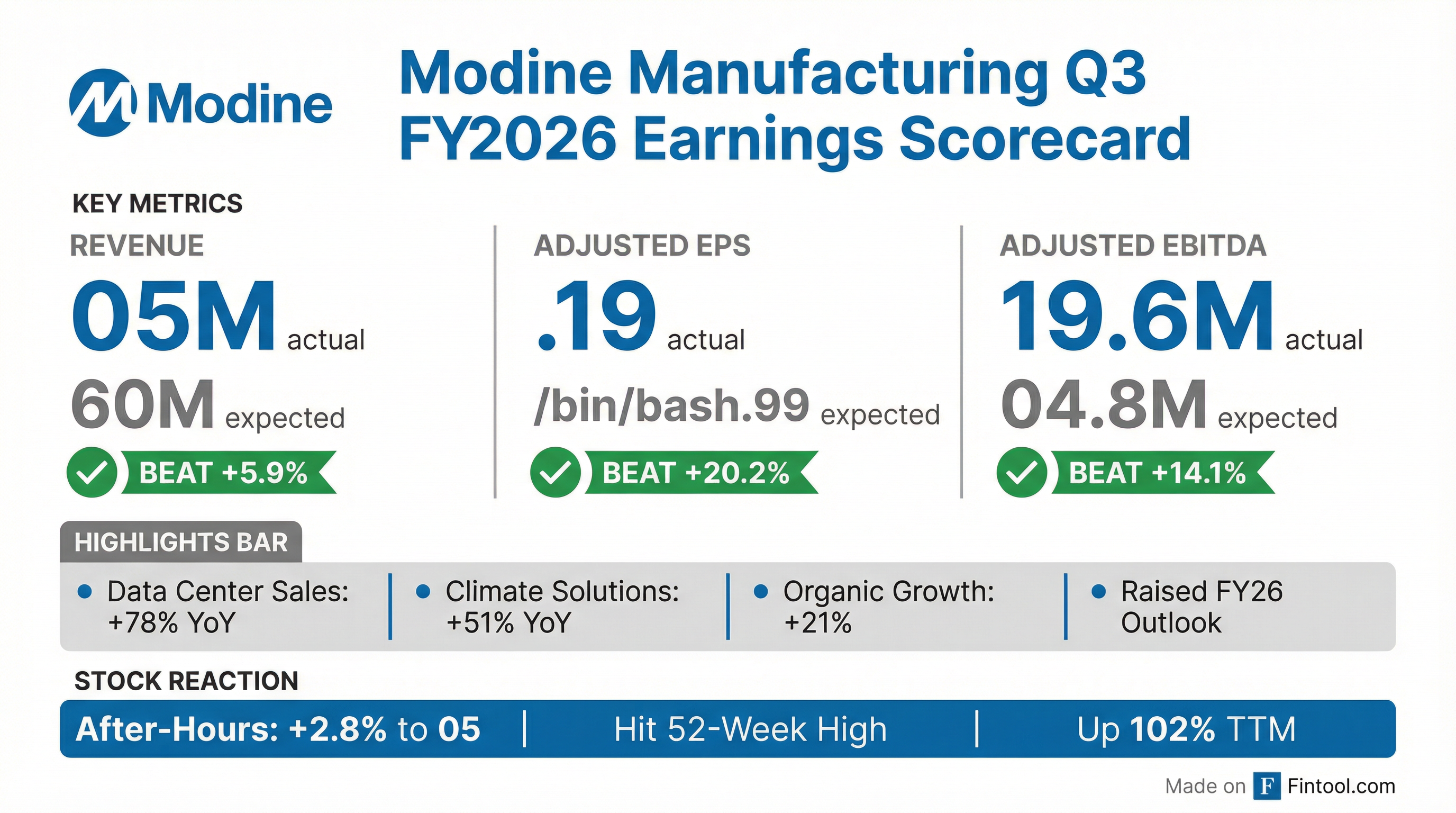

- Modine reported strong Q3 FY26 financial results, with Net Sales of $805.0 million, Adjusted EBITDA of $119.6 million, and Adjusted EPS of $1.19.

- The company announced a plan to spin off its Performance Technologies segment and combine it with Gentherm, with Modine shareholders owning 40% of the combined entity. This transaction values the business at $1 billion.

- The Climate Solutions segment delivered 51% revenue growth in Q3 FY26, including 78% growth in Data Centers, driven by hyperscale and colocation customers.

- Modine raised its Fiscal 2026 outlook, now anticipating Net Sales growth of 20% to 25% ($3.10B to $3.23B) and Adjusted EBITDA between $455 million and $475 million, primarily due to an increasing data center outlook.

- Modine announced the spin-off of its Performance Technologies segment, combining it with Gentherm. Modine will receive approximately $210 million in cash, and shareholders will receive a tax-free distribution equaling 40% of the combined ownership. This transaction, valuing the segment at $1 billion, is expected to close in Q4 of the calendar year and will allow Modine to become a pure-play Climate Solutions company.

- The Climate Solutions segment delivered a 51% increase in revenues in Q3 2026, with organic growth of 36%, primarily driven by a 78% increase in data center sales. The company is on track to achieve over $1 billion in data center sales this fiscal year and expects 50%-70% annual growth in data center revenue over the next two years, aiming for $2 billion by fiscal 2028.

- For Q3 2026, total sales increased 31%, Adjusted EBITDA improved 37% to a 14.9% margin, and adjusted EPS rose 29% to $1.19. Modine raised its fiscal 2026 outlook, now expecting total sales growth of 20%-25% and Adjusted EBITDA in the range of $455 million-$475 million.

- Modine announced the spin-off of its Performance Technologies segment, which will combine with Gentherm, resulting in Modine receiving approximately $210 million in cash and Modine shareholders gaining 40% ownership in the new combined entity.

- For Q3 fiscal 2026, total sales increased 31%, adjusted EBITDA improved 37% to a 14.9% margin, and adjusted EPS rose 29% to $1.19.

- The Climate Solutions segment saw revenues grow 51% (organic growth of 36%), driven by a 78% increase in data center sales. The company is on track for over $1 billion in data center sales this fiscal year and anticipates 50%-70% annual growth in data center revenue over the next two years.

- The company raised its fiscal 2026 outlook, now projecting total sales growth of 20%-25% and adjusted EBITDA between $455 million-$475 million.

- Modine announced the spin-off of its Performance Technologies segment, which will combine with Gentherm, valuing the business at $1 billion, or 6.8 times trailing 12-month EBITDA. Modine will receive approximately $210 million in cash, and its shareholders will receive 40% ownership in the combined entity.

- The Climate Solutions segment delivered a 51% increase in revenues in Q3 2026, with organic growth of 36%, driven by a 78% increase in data center sales. The company reported record order intake for data centers and is on track with capacity expansion, commissioning four new chiller lines in Q3 2026 and planning four more for Q4 2026.

- Modine raised its fiscal 2026 outlook, now expecting total sales growth of 20%-25% and Adjusted EBITDA between $455 million and $475 million. Climate Solutions sales are projected to grow 40%-45%, with data center sales increasing in excess of 70%.

- For Q4 2026, the Climate Solutions segment is anticipated to achieve a 200+ basis point sequential improvement in EBITDA margin, reaching the 20%-21% range. The Performance Technologies segment is expected to experience a temporary dip in Q4 2026 EBITDA margin but rebound to the 14%+ range in Q1 2027.

- Modine reported net sales of $805.0 million for the third quarter of fiscal 2026, marking a 31 percent increase from the prior year, and adjusted EBITDA of $119.6 million, up 37 percent.

- The company recorded a net loss of $46.8 million and a loss per share of $0.90, primarily due to a $116.1 million non-cash pension termination charge related to the termination of its U.S. pension plan. However, adjusted earnings per share increased by 29 percent to $1.19.

- Modine raised its fiscal 2026 outlook, now anticipating net sales growth between 20 percent and 25 percent and adjusted EBITDA in the range of $455 million to $475 million.

- The Climate Solutions segment drove significant sales growth with a 51 percent increase, largely attributable to a 78 percent increase in data center sales.

- The company announced a plan to spin off its Performance Technologies business and combine it with Gentherm, which will transform Modine into a pure-play climate solutions company focused on high-growth markets.

- Modine reported net sales of $805.0 million, a 31% increase from the prior year, and adjusted EBITDA of $119.6 million, up 37%, for the third quarter ended December 31, 2025.

- The company recorded a net loss of $46.8 million for the quarter, primarily due to a $116.1 million non-cash pension termination charge.

- The Climate Solutions segment's sales increased 51% to $544.6 million, driven by a 78% increase in data center sales.

- Modine raised its fiscal 2026 outlook, now expecting net sales growth between 20% and 25% and adjusted EBITDA in the range of $455 million to $475 million.

- The company announced a pending spin-off and combination of its Performance Technologies business with Gentherm, which will transform Modine into a pure-play climate solutions company.

- Modine and Gentherm have entered into a definitive agreement for Modine to spin-off and combine its Performance Technologies business with Gentherm in a Reverse Morris Trust transaction valued at ~$1.0 billion.

- Modine shareholders are expected to own approximately 40% of the combined company, and the transaction is intended to be tax-free for Modine and its shareholders for U.S. federal income tax purposes.

- Modine will receive a $210 million cash distribution from SpinCo and will retain its Climate Solutions businesses, which generated $1.6 billion in revenue and $307 million in adjusted EBITDA for the twelve months ended September 30, 2025.

- The combined company (Gentherm and Modine Performance Technologies) had pro forma revenue of $2.6 billion and expects to generate approximately $25 million in identified annual cost synergies.

- The transaction is expected to close in the fourth quarter of calendar year 2026.

- Modine announced a tax-free spin-off of its Performance Technologies (PT) business, which will simultaneously combine with Gentherm, valuing the PT business at approximately $1 billion.

- Modine will receive $210 million in cash, and its shareholders will obtain approximately $790 million of Gentherm stock, leading to 40% ownership of the combined company for Modine shareholders.

- The remaining Modine will transform into a pure-play climate solutions company, focusing on high-growth, high-margin opportunities, especially in the data center cooling market.

- The climate solutions segment generated $1.6 billion in revenue for the 12 months ending September 30, 2025, with expected growth of 35%-40% to nearly $2 billion this fiscal year. The data center business is projected to grow 50%-70% annually over the next two years, aiming to replace the $1 billion PT revenue within 12-24 months.

- The transaction is anticipated to close in the fourth quarter of calendar year 2026.

- Modine Manufacturing Company announced a joint agreement to spin off its Performance Technologies (PT) business and combine it with Gentherm, structured as a tax-free Reverse Morris Trust for Modine and its shareholders.

- The transaction values the Performance Technologies business at approximately $1 billion. Modine will receive $210 million in cash, and its shareholders will receive approximately $790 million of Gentherm stock, resulting in 40% ownership of the combined company.

- The remaining Modine will become a pure-play climate solutions company, focusing on high-growth, high-margin opportunities, particularly in the data center cooling market.

- The climate solutions segment generated $1.6 billion in revenue and $307 million in adjusted EBITDA (19.6% margin) for the trailing twelve months ending September 30, 2025. Revenue is expected to grow 35%-40% to nearly $2 billion this fiscal year.

- The data center business, which has grown at a 93% CAGR over the last two years, is anticipated to achieve 50%-70% annual growth over the next two years, with a target to exceed $2 billion in revenue by fiscal 2028 from this market alone. The transaction is expected to close in the fourth quarter of calendar year 2026.

- Modine announced a transaction to spin off its Performance Technologies segment and combine it with Gentherm in a Reverse Morris Trust structure, which is intended to be tax-free for Modine and its shareholders.

- The transaction values the Performance Technologies business at approximately $1 billion.

- Modine will receive a $210 million cash distribution, and Modine shareholders will receive approximately $790 million in Gentherm stock, leading to 40% ownership in the combined company post-closing.

- The deal is expected to close in the fourth quarter of calendar year 2026, subject to various approvals and conditions.

- Following the transaction, the remaining Modine will operate as a pure-play climate solutions company, focusing on high-growth and high-margin opportunities.

Fintool News

In-depth analysis and coverage of MODINE MANUFACTURING.

Quarterly earnings call transcripts for MODINE MANUFACTURING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more