Earnings summaries and quarterly performance for MANITOWOC CO.

Executive leadership at MANITOWOC CO.

Aaron Ravenscroft

President & Chief Executive Officer

Brian Regan

Executive Vice President & Chief Financial Officer

James Cook

Executive Vice President, Human Resources

Jennifer Peterson

Executive Vice President, General Counsel and Secretary

Leslie Middleton

Executive Vice President, Americas and EU Mobile Cranes

Board of directors at MANITOWOC CO.

Research analysts who have asked questions during MANITOWOC CO earnings calls.

Steven Fisher

UBS

3 questions for MTW

Clay Williams

Goldman Sachs

2 questions for MTW

Kevin O'Regan

Wells Fargo

2 questions for MTW

Clifford Ransom

Ransom Research, Inc.

1 question for MTW

Jerry Revich

Goldman Sachs Group Inc.

1 question for MTW

Joseph Grabowski

Robert W. Baird & Co.

1 question for MTW

Mircea Dobre

Robert W. Baird & Co.

1 question for MTW

Tami Zakaria

JPMorgan Chase & Co.

1 question for MTW

Recent press releases and 8-K filings for MTW.

- Manitowoc Company, Inc. filed an 8-K on February 10, 2026, announcing investor presentations from February 11-14, 2026, which include an investor presentation detailing its strategy and financial aspirations.

- For the year ended December 31, 2025, the company reported ~$2.2 billion in Net Sales, $122 million in Adjusted EBITDA (5.3%), and 5.3% Adjusted ROIC.

- The company has set aspirational long-term targets of $3.0 billion in Revenue, $1.0 billion in Non-New Machine Sales, 12% Adjusted EBITDA, and 15% Adjusted ROIC.

- Strategic initiatives focus on improving margin and return profiles, increasing higher-margin recurring revenue, and leveraging a strong acquisition track record, with capital allocation prioritizing high ROIC investments, managing leverage, and opportunistic share repurchases.

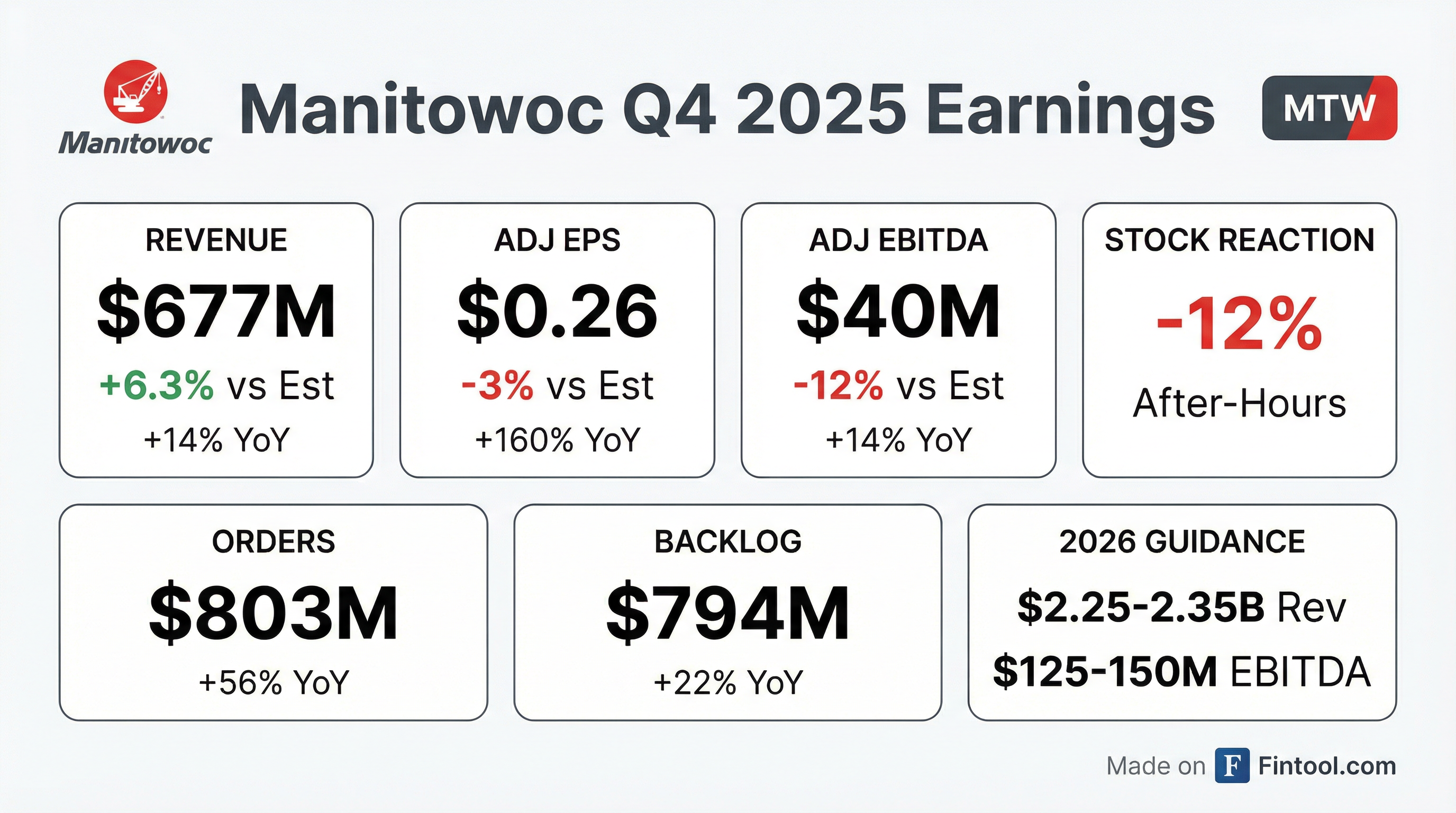

- Manitowoc reported Q4 2025 Net Sales of $677 million and full-year 2025 Net Sales of $2,241 million. The company also saw a significant increase in Q4 2025 Orders to $803 million and Backlog to $794 million.

- For the full year 2025, Manitowoc achieved record non-new machine sales of $690 million, marking a 10% year-over-year increase.

- Full-year 2025 Adjusted EBITDA was $122 million and Adjusted Diluted EPS was $0.32. Free cash flow for 2025 was -$15 million, which included a $45 million payment related to an EPA matter.

- The company issued full-year 2026 guidance, forecasting Net Sales between $2.250 billion and $2.350 billion, Adjusted EBITDA between $125 million and $150 million, and Adjusted DEPS between $0.45 and $0.90.

- The Manitowoc Company reported Q4 2025 orders of $803 million, a 56% increase year-over-year, with backlog ending the year at $794 million, up 22%. Net sales for the quarter were $677 million, up 14% year-over-year, and adjusted EBITDA was $40 million.

- For the full year 2025, net sales reached $2.24 billion, and non-new machine sales grew 10% to a record $690 million, reflecting progress on the CRANES+50 strategy. Adjusted EBITDA for the year was $122 million.

- The company provided 2026 guidance including net sales in the range of $2.25-$2.35 billion and adjusted EBITDA between $125-$150 million. Free cash flow is projected to be $40-$65 million, with net leverage expected to improve to below three times.

- Market conditions showed improvement in Europe, with new tower crane orders up 64% year-over-year in Q4, and Asia-Pacific, while the Americas remained complicated due to tariffs and flat rental rates. January orders were approximately $225 million.

- A restructuring plan was implemented, projected to save $10 million in 2026, and the company achieved a record low Recordable Injury Rate (RIR) of 0.94.

- Manitowoc Co reported Q4 2025 orders of $803 million, a 56% increase year-over-year, with year-end backlog reaching $794 million, up 22%. Net sales for the quarter were $677 million, up 14% year-over-year, and adjusted EBITDA was $40 million.

- For the full year 2025, net sales were $2.24 billion, and adjusted EBITDA was $122 million. Non-new machine sales grew 10% year-over-year to $690 million, reflecting progress on the CRANES+50 strategy.

- The company provided 2026 guidance, expecting net sales between $2.25 billion and $2.35 billion, adjusted EBITDA between $125 million and $150 million, and free cash flow between $40 million and $65 million.

- Market conditions showed improvement in Europe and Asia-Pacific, with European tower crane orders up 64% year-over-year in Q4, while the Americas remained complicated by tariffs. The Middle East business remains positive despite some challenges.

- Manitowoc achieved a recordable injury rate (RIR) of 0.94 in 2025, the first time below 1, and launched 11 new cranes during the year, with two more large cranes to be unveiled in March 2026.

- For the fourth quarter of 2025, Manitowoc Company reported orders of $803 million, an increase of 56% year-over-year, with net sales of $677 million, up 14% year-over-year, and Adjusted EBITDA of $40 million.

- Full year 2025 results included net sales of $2.24 billion and Adjusted EBITDA of $122 million, with tariffs unfavorably impacting results by $39 million for the year.

- The company's non-new machine sales grew 10% to $690 million in 2025, demonstrating progress on its CRANES+50 strategy, which has a long-term goal of $1 billion.

- Manitowoc provided 2026 guidance, projecting net sales in the range of $2.25 billion to $2.35 billion and Adjusted EBITDA between $125 million and $150 million.

- For the fourth quarter of 2025, Manitowoc reported net sales of $677.1 million, an increase of 13.6% year-over-year, and adjusted diluted earnings per share of $0.26. Orders for the quarter were $803.4 million, up 55.8% year-over-year.

- For the full year 2025, net sales increased 2.9% year-over-year to $2,240.9 million, with adjusted diluted earnings per share of $0.32. The company ended the year with a backlog of $793.5 million, up 22.0% year-over-year.

- Manitowoc provided full-year 2026 guidance, expecting net sales between $2.25 billion and $2.35 billion, adjusted EBITDA between $125 million and $150 million, and adjusted diluted earnings per share between $0.45 and $0.90.

- A restructuring plan implemented in January 2026 is expected to deliver $10 million in annualized savings in 2026.

- The Manitowoc Company reported net sales of $677.1 million for Q4 2025, a 13.6% increase year-over-year, and full-year 2025 net sales of $2,240.9 million, up 2.9% year-over-year.

- For full-year 2025, adjusted net income was $11.6 million, or $0.32 per diluted share, and adjusted EBITDA was $121.7 million.

- The company ended 2025 with a backlog of $793.5 million, representing a 22.0% increase year-over-year, and generated $78.3 million in free cash flow in Q4 2025.

- Manitowoc provided full-year 2026 guidance, projecting net sales between $2.25 billion and $2.35 billion, adjusted EBITDA between $125 million and $150 million, and adjusted diluted earnings per share between $0.45 and $0.90.

- A restructuring plan initiated in January 2026 is anticipated to yield $10 million in annualized savings in 2026.

- MGX Equipment Services, a wholly-owned subsidiary of The Manitowoc Company, Inc. (MTW), has signed a strategic dealer agreement with Hiab.

- This partnership expands the distribution and service network for HIAB loader cranes across 13 U.S. states, including Colorado, Delaware, Iowa, Maryland, Minnesota, Montana, Nebraska, New Jersey, North Dakota, South Dakota, Virginia, Wyoming, and Utah.

- The agreement is expected to accelerate growth for MGX and Manitowoc in the U.S. by enhancing direct-to-customer reach, service capabilities, and customer engagement.

- The Manitowoc Company's MGX Equipment Services has completed a strategic dealer agreement with Hiab to distribute HIAB loader cranes and provide aftermarket support across 13 U.S. states.

- This partnership is expected to accelerate MGX and Manitowoc's growth by improving response times, service capability, and customer engagement, while also helping both firms scale in previously undercovered regions.

- The agreement covers sales and service for Hiab customers in Colorado, Delaware, Iowa, Maryland, Minnesota, Montana, Nebraska, New Jersey, North Dakota, South Dakota, Virginia, Wyoming, and Utah.

- Manitowoc has a market capitalization near $533 million and displays mixed financial indicators, with its Z-Score in a grey area and its Beneish M-Score suggesting a low risk of earnings manipulation.

- Broadwind reported preliminary full-year 2025 revenue in the range of $155 million to $160 million, net income between $4.7 million and $5.7 million, and non-GAAP Adjusted EBITDA between $8 million and $9 million.

- For full-year 2026, the company introduced financial guidance, projecting total revenue between $140.0 million and $150.0 million and non-GAAP Adjusted EBITDA between $8.0 million and $10.0 million.

- The 2026 guidance reflects the sale of its Manitowoc, Wisconsin operations on September 8, 2025, which contributed approximately $41 million to 2025 revenue.

- Management forecasts organic revenue growth of more than 20% for 2026 compared to 2025, excluding contributions from the recently divested Manitowoc facility.

Quarterly earnings call transcripts for MANITOWOC CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more