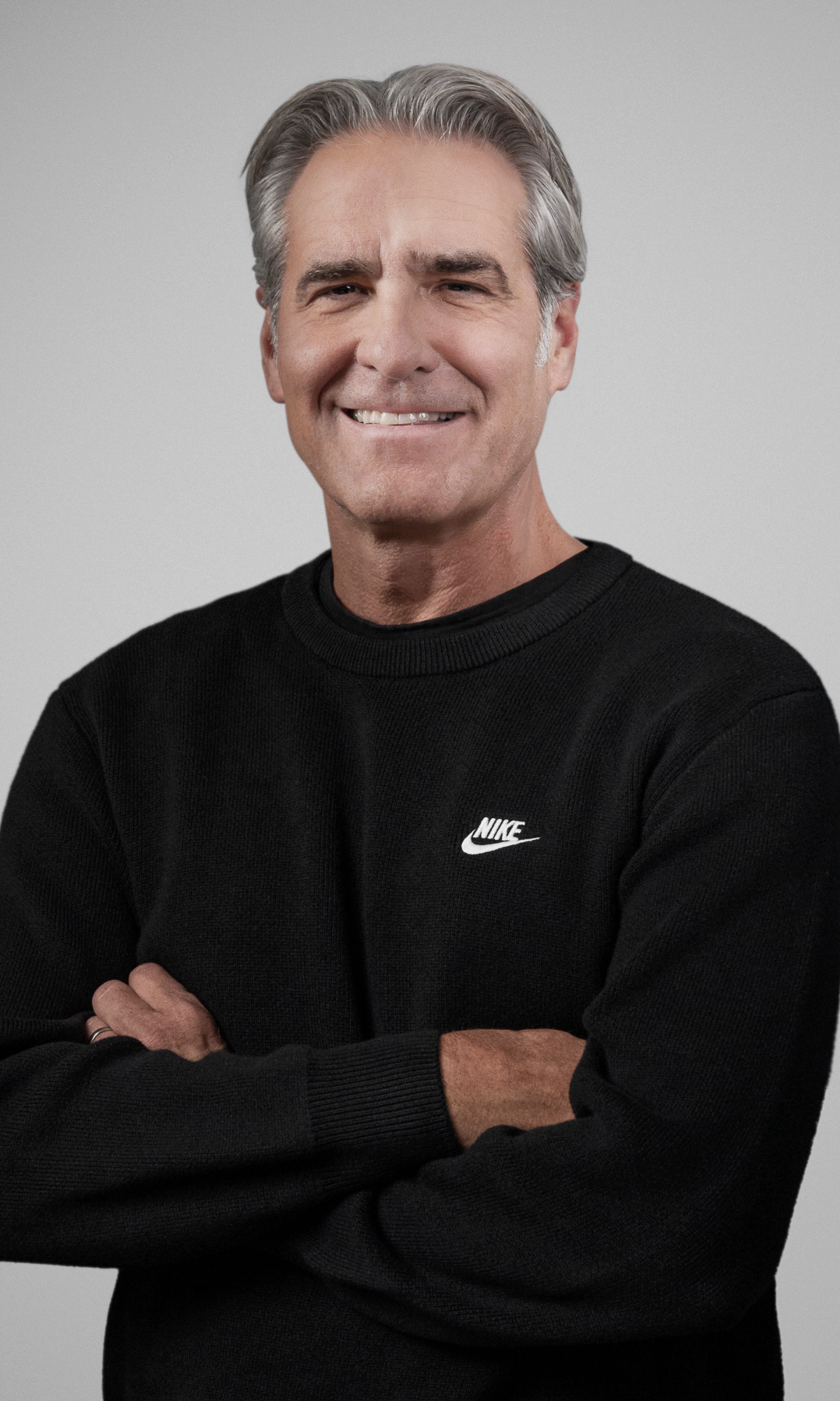

Elliott Hill

About Elliott Hill

Elliott Hill, age 61, is NIKE’s President & Chief Executive Officer and a director since 2024; he joined the Board upon his CEO appointment on October 14, 2024 and serves on the Board’s Executive Committee (not independent under NYSE rules) . Hill spent 1988–2020 at NIKE in senior commercial roles across Europe and North America, culminating as President, Consumer & Marketplace; he brings deep global retail, brand/marketing, HR/talent, financial, and governance expertise . NIKE’s FY2025 Annual Cash Incentive Plan (PSP) paid 0% (Adjusted Revenue and Adjusted EBIT both below threshold), and the FY2023–2025 PSU cycle also paid 0% on 4th percentile Relative TSR, underscoring the performance reset facing the new CEO . CEO target pay is 93% at-risk (PSP, PSUs, options, RSUs), closely tying Hill’s realizable pay to performance and NIKE’s stock price .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| NIKE, Inc. | President, Consumer & Marketplace | 2018–2020 | Led all commercial and marketing operations for NIKE and Jordan Brand, including P&L across four geographies . |

| NIKE, Inc. | President, Geographies & Integrated Marketplace | 2016–2018 | Senior leadership across global geographies and integrated marketplace strategy . |

| NIKE, Inc. | President, Geographies & Sales | 2013–2016 | Led global sales and geography execution . |

| NIKE, Inc. | VP/GM, North America | 2010–2013 | Ran North America P&L . |

| NIKE, Inc. | VP, Global Retail | 2006–2010 | Oversaw global retail operations . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Texas Christian University | Board of Trustees | Current (as of 2025 proxy) | Higher-education governance and community engagement . |

Fixed Compensation

| Item | FY2025 Value | Notes |

|---|---|---|

| Base salary (rate) | $1,500,000 | Per CEO offer letter dated Sep 19, 2024 . |

| Salary paid (actual) | $951,923 | Reflects partial-year service in FY2025 . |

| Target annual bonus (PSP) | 200% of base salary | Prorated for FY2025; performance-based . |

| Actual annual bonus paid | $0 | FY2025 PSP payout was 0% for all NEOs . |

| One-time sign-on cash | $4,000,000 | Must be repaid if Hill resigns within two years of start or is blocked by a non-compete preventing service at NIKE . |

| All other compensation (FY2025) | $345,574 | Includes $243,649 personal aircraft use; $75,614 relocation (incl. $31,993 tax gross-ups under standard policy) . |

| Nonqualified deferred comp – contributions | $317,308 | Executive contributions to DCP in FY2025 . |

Performance Compensation

Annual Cash Incentive (PSP) – FY2025

| Metric | Weight | Target Opportunity (Hill) | Actual Company Result | Payout |

|---|---|---|---|---|

| Adjusted Revenue | 50% | $2,250,000 (target; threshold $562,500; max $4,500,000) | $46.4B (below threshold) | 0% |

| Adjusted EBIT | 50% | $2,250,000 (target; threshold $562,500; max $4,500,000) | $3.5B (below threshold) | 0% |

| Total PSP Payout | — | — | — | 0% |

Notes: Two equally weighted metrics; single-year performance period; Committee can exercise discretion; FY2025 targets were set below FY2024 given macro environment .

Long-Term Incentive Awards – FY2025 Grants (CEO mix and specifics)

| Award Type | Shares/Units | Key Terms | Grant-Date Fair Value |

|---|---|---|---|

| PSUs (annual) | Threshold 24,222; Target 96,888; Max 193,776 | Metric: Relative TSR 9/1/2024–8/31/2027; cap at 100% if absolute TSR negative; +/-20pp People & Planet modifier; vest Sep 2027 | $9,609,352 |

| Stock Options (annual) | 227,750 | Exercise $81.60; vest 25% annually 9/1/2025–9/1/2028; expire 10/14/2034 | $5,832,678 |

| RSUs (annual) | 29,067 | Vest 25% annually on 9/1/2025–9/1/2028 | $2,371,867 |

| RSUs (sign-on) | 35,621 | Vest one-third on 10/14/2025, 10/15/2026, 10/15/2027 | $2,906,674 |

| CEO LTI Target Mix | PSUs 50%; Options 35%; RSUs 15% | Total target LTI $15.5M for FY2025 | — |

Cycle performance note: The prior three-year PSU cycle (FY2023–2025) paid 0% at the 4th percentile Relative TSR; People & Planet modifier did not apply .

Equity Ownership & Alignment

Beneficial Ownership (as of June 30, 2025)

| Title of Class | Shares Beneficially Owned | Percent of Class |

|---|---|---|

| Class B | — | — (<0.1%) |

Note: Table omits percent if <0.1%; unvested RSUs/PSUs and unexercisable options generally are excluded from “beneficial ownership” unless acquirable within 60 days .

Outstanding and Unvested Equity (as of May 31, 2025)

| Instrument | Quantity/Status | Strike/Value Reference | Key Dates |

|---|---|---|---|

| Stock Options (unexercisable) | 227,750 | $81.60; stock was $60.59 on May 30, 2025 (no intrinsic value) | Expiration 10/14/2034; vesting annually 9/1/2025–9/1/2028 |

| RSUs (unvested) | 64,688 units; $3,919,446 MV | MV as of 5/31/2025 | 29,067: vest 9/1/2025–9/1/2028; 35,621: vest 10/14/2025, 10/15/2026, 10/15/2027 |

| PSUs (target unearned) | 24,222 units; $1,467,611 payout value ref | Earned on Relative TSR with modifier; vest Sep 2027 | Performance period 9/1/2024–8/31/2027; vest Sep 2027 |

Ownership policies:

- CEO stock ownership guideline: 8x base salary; new execs must achieve within 5 years; as of May 31, 2025, CEO and other execs had met or were on track to meet their guideline within the required period .

- Hedging prohibited; pledging requires pre-approval considering size, foreclosure risk, and reporting controls .

Insider selling pressure watch-outs: RSU vesting dates (9/1/2025, 10/14/2025–10/15/2027) and annual option vesting tranches can drive Form 4 share withholdings/sales for taxes/liquidity; FY2025 options were underwater at $60.59 vs $81.60 strike, reducing near-term exercise-driven selling .

Employment Terms

- Start date and role: Appointed President & CEO on Oct 14, 2024; elected to the Board in connection with appointment .

- Offer letter (Sep 19, 2024): $1.5M base salary; target PSP 200% of base (prorated for FY2025); annual LTI target $15.5M (50% PSUs/35% options/15% RSUs); $4M one-time cash; $3M sign-on RSUs vesting over 3 years; repayment of $4M if resigns within two years or non-compete prevents service at NIKE .

- Clawbacks and policies: Company-wide clawback policy and standalone clawback provisions; no option repricing; no excise tax gross-ups on change in control; no hedging; no dividend equivalents on PSUs/RSUs until vest .

- Non-compete: Entered into NIKE non-competition agreement as part of standard senior executive arrangements .

- Severance (illustrative): For an involuntary termination without cause that is not a divestiture or RIF, aggregate value shown as $1,856,175 (as of 5/31/2025); Hill is retirement-vesting eligible under equity awards .

- Change-in-control: PSP does not accelerate; PSUs/options/RSUs accelerate only with “double trigger” (CIC plus termination or awards not assumed within two years) .

Board Governance

- Director since 2024; Committee: Executive; Not independent due to CEO employment .

- Board attendance: During FY2025, the Board held four meetings; all incumbent directors attended ≥75% of Board/committee meetings .

- Dual-role implications: Executive Chairman role is separate (Mark Parker); CEO-director not independent, but Board maintains independence among other directors and uses standard governance practices (e.g., committee structure, engagement) to mitigate concentration of power .

Deferred Compensation (DCP) – FY2025

| Plan | Executive Contributions | Aggregate Earnings | Withdrawals/Distributions | Aggregate Balance (5/31/2025) |

|---|---|---|---|---|

| DCP | $317,308 | $697,985 | $(822,916) | $9,463,259 |

Compensation Structure Analysis

- 93% of CEO target compensation is at risk (cash PSP + equity), emphasizing performance leverage; FY2025 PSP paid 0% and FY2023–2025 PSUs earned 0% on Relative TSR, signaling strong linkage and reset conditions for the new CEO’s tenure .

- FY2025 CEO LTI mix favors performance equity (50% PSUs) with additional leverage via options (35%), while time-vest RSUs (15%) plus sign-on RSUs support retention; annual PSUs include TSR cap if absolute TSR is negative and a People & Planet modifier to balance financial and ESG outcomes .

- No excise tax gross-ups on CIC; no option repricing; clawback policy in place; relocation-related tax gross-ups applied under standard policy, with Hill receiving $31,993 in FY2025 .

Investment Implications

- Incentive leverage is high and near-term cash incentives are sensitive to revenue and EBIT: FY2025 PSP paid 0%, and FY2023–2025 PSUs paid 0% on 4th percentile Relative TSR, suggesting upside to realizable pay only if Hill’s turnaround drives sustained revenue reacceleration and margin recovery .

- Underwater FY2025 option grants (strike $81.60 vs $60.59 year-end price) limit immediate exercise-related selling, but recurring RSU vesting tranches (9/1/2025–2028; 10/14/2025–10/15/2027) can create periodic supply and Form 4 activity; monitor vest dates and blackout windows for trading flow signals .

- Alignment structures are solid (8x salary ownership guideline; hedging prohibited; pledging restricted with pre-approval), and Hill is on track to meet guidelines within the five-year window, supporting long-term alignment and reducing agency risk .

- Employment protections are standard (double-trigger CIC, non-compete, clawbacks) with modest severance reference value ($1.86M) and a two-year clawback on the $4M sign-on if he departs, lowering near-term resignation risk but increasing accountability to performance milestones .

Appendix: Key FY2025 Compensation Disclosure

Summary Compensation (FY2025)

| Component | FY2025 Amount |

|---|---|

| Salary | $951,923 |

| Sign-on Cash Bonus | $4,000,000 |

| Stock Awards (RSUs/PSUs) | $14,887,893 |

| Option Awards | $5,832,678 |

| Non-Equity Incentive (PSP) | $0 |

| All Other Compensation | $345,574 |

| Total | $26,018,068 |