Earnings summaries and quarterly performance for NVR.

Executive leadership at NVR.

Board of directors at NVR.

AA

Alexandra A. Jung

Detailed

Director

AE

Alfred E. Festa

Detailed

Director

CE

C. E. Andrews

Detailed

Director

DA

David A. Preiser

Detailed

Director

GR

George R. Oliver

Detailed

Director

MM

Mel Martinez

Detailed

Director

MJ

Michael J. DeVito

Detailed

Director

SB

Sallie B. Bailey

Detailed

Director

SW

Susan Williamson Ross

Detailed

Director

WG

W. Grady Rosier

Detailed

Director

Research analysts covering NVR.

Recent press releases and 8-K filings for NVR.

NVR announces Q4 2025 and full year results

NVR

Earnings

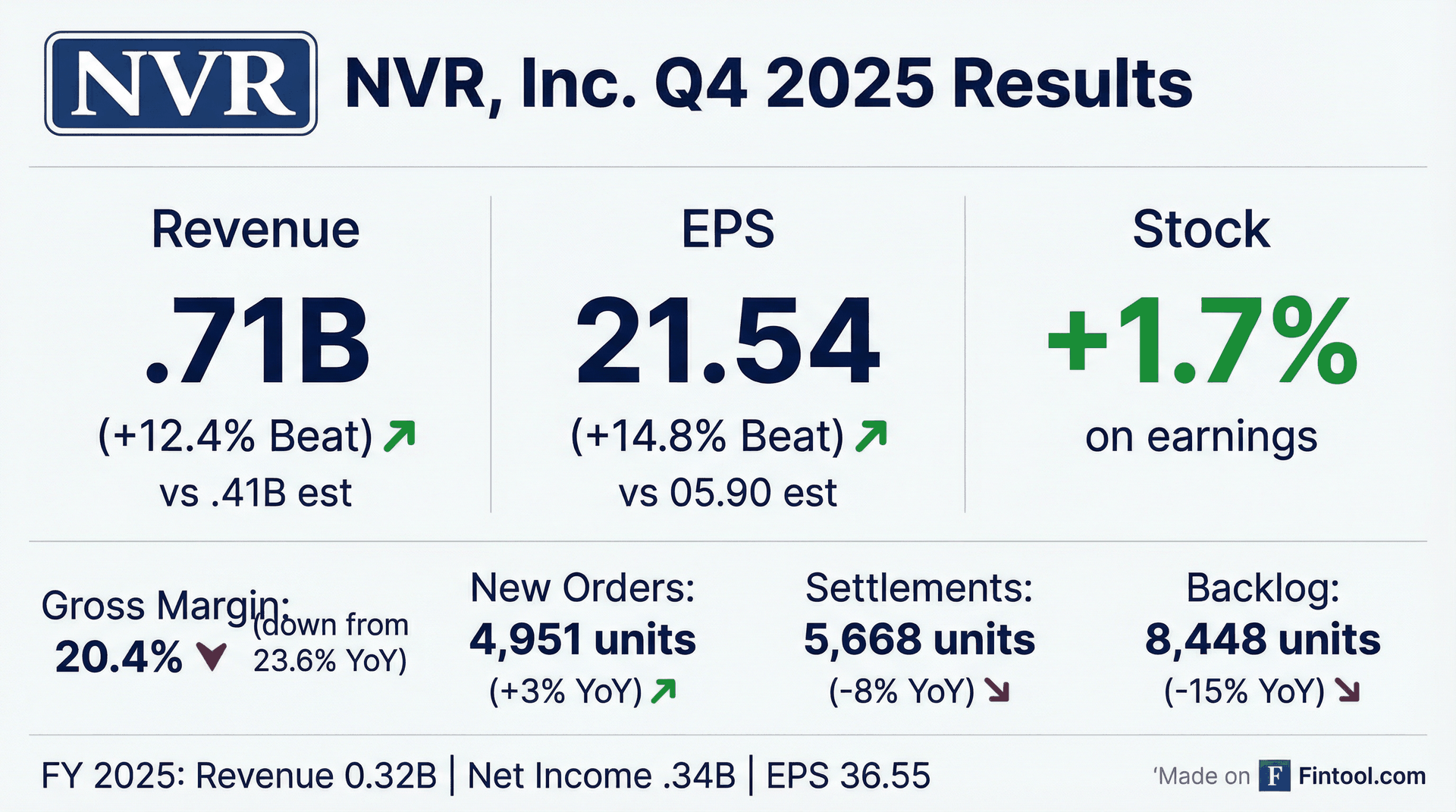

- NVR reported Q4 net income of $363.8 million ($121.54 diluted EPS), down 20% year-over-year, on Q4 revenue of $2.71 billion, down from $2.85 billion a year earlier.

- For the full year 2025, consolidated revenue was $10.32 billion (–2% YoY); net income was $1.34 billion (–20% YoY) with diluted EPS of $436.55 (–14% YoY).

- In homebuilding, Q4 new orders rose 3% to 4,951 units, while Q4 backlog fell 15% to 8,448 units; homebuilding revenue was $2.64 billion (–5%), with gross margin down to 20.4%.

- Mortgage banking closed loan production in Q4 was $1.51 billion (–11% YoY), with segment pretax income up 24% to $57.2 million.

Jan 28, 2026, 6:47 PM

NVR reports Q4 and full year 2025 results

NVR

Earnings

Share Buyback

- Q4 net income was $363.8 M ($121.54 diluted EPS), down 20% (13% EPS), on $2.71 B revenue, down 5% YoY

- Fiscal 2025 revenue of $10.32 B (–2%), net income of $1.34 B (–20%); diluted EPS $436.55, down 14%

- Homebuilding: Q4 new orders rose 3% to 4,951 units but backlog fell 15% to 8,448 units; Q4 gross margin narrowed to 20.4%

- Mortgage banking: Q4 closed loan production was $1.51 B (–11%) while income before tax rose 24% to $57.2 M

- Share repurchases totaled 243,082 shares at a cost of $1.82 B in 2025

Jan 28, 2026, 2:00 PM

NVR announces Q3 2025 earnings

NVR

Earnings

Demand Weakening

- NVR reported Q3 net income of $342.7 million and diluted EPS of $112.33, down 20% and 14% year-over-year, respectively.

- Consolidated revenues totaled $2.61 billion, with homebuilding revenues of $2.56 billion (-4%); homebuilding income before tax was $411.4 million (-18%).

- New orders declined 16% to 4,735 units, and backlog units fell 19% to 9,165 (backlog value decreased 17% to $4.39 billion).

- Mortgage banking closed loan production was $1.54 billion (-7%), with income before tax of $32.7 million (-6%).

Oct 22, 2025, 1:30 PM

NVR announces Q3 2025 results

NVR

Earnings

Demand Weakening

- Delivered net income of $342.7 million, or $112.33 per diluted share, down 20% and 14%, respectively, versus Q3 2024.

- Consolidated revenues totaled $2.61 billion, a 4% decrease year-over-year.

- Homebuilding: revenues fell 4% to $2.56 billion; gross margin declined to 21.0% (from 23.4%); new orders decreased 16% to 4,735 units, and backlog units were down 19% to 9,165 units.

- Mortgage banking closed loan production was $1.54 billion (−7%), with income before tax of $32.7 million (−6%).

Oct 22, 2025, 1:00 PM

NVR announces share repurchase authorization

NVR

Share Buyback

- Board authorized repurchase of up to $750 million of common stock with no expiration date.

- Repurchases will occur in the open market and/or through privately negotiated transactions as market conditions permit.

- This continues the stock repurchase program launched in 1994, aligned with NVR’s strategy of maximizing shareholder value.

- Authorization prohibits purchases from the company’s officers, directors or its Profit Sharing/401(k) and ESOP trusts.

- As of August 7, 2025, NVR had 2,872,926 shares of common stock outstanding.

Aug 8, 2025, 6:30 PM

NVR announces Q2 2025 results

NVR

Earnings

- NVR reported Q2 net income of $333.7 million and diluted EPS of $108.54, declines of 17% and 10% respectively versus Q2 2024; consolidated revenue was $2.60 billion, essentially flat year-over-year.

- For the six months ended June 30, 2025, revenue rose 1% to $5.00 billion, while net income fell 20% to $633.3 million and diluted EPS dropped 14% to $203.20.

- Homebuilding new orders fell 11% to 5,379 units with an average sales price of $458,100; backlog units decreased 13% to 10,069 units (dollar backlog $4.75 billion).

- Mortgage banking loan production rose 2% to $1.56 billion, but segment pre-tax income declined 34% to $29.6 million, primarily due to lower secondary marketing gains.

Jul 23, 2025, 1:00 PM

NVR Inc. Authorizes $750M Share Repurchase

NVR

Share Buyback

- NVR, Inc. has been authorized by its Board of Directors to repurchase up to $750 million of its outstanding common stock, with no set expiration date.

- The repurchase program will proceed in the open market or via privately negotiated transactions, excluding shares held by officers, directors, and certain employee plans.

- As of May 5, 2025, the company had 2,924,012 shares outstanding, reflecting its current capital structure.

May 6, 2025, 6:20 PM

NVR Inc. Announces Q1 2025 Results

NVR

Earnings

Revenue Acceleration/Inflection

- Net income for Q1 2025 fell 24% to $299.6 million with diluted earnings at $94.83 compared to Q1 2024 levels, indicating a notable decline (documents ).

- Consolidated revenues increased by 3% to $2.40 billion in Q1 2025, reflecting modest growth in the period (documents ).

- The homebuilding segment experienced a 12% decrease in new orders and a slight drop in average sales price, alongside a decrease in the gross profit margin from 24.5% to 21.9% (documents ).

Apr 22, 2025, 1:00 PM

NVR Inc Enters New Credit Agreement

NVR

Debt Issuance

- On March 11, 2025, NVR Inc entered into a Second Amended and Restated Credit Agreement featuring a five-year, $300 million senior unsecured revolving credit facility with an uncommitted accordion feature that could increase the aggregate commitment to $600 million and includes a $100 million sublimit for letters of credit.

- The new agreement extends the maturity date from February 11, 2026 to March 11, 2030 and maintains key financial covenants, continuing the terms of its previous credit agreement.

Mar 12, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more