Earnings summaries and quarterly performance for NEWS.

Executive leadership at NEWS.

Board of directors at NEWS.

Research analysts who have asked questions during NEWS earnings calls.

Craig Huber

Huber Research Partners

6 questions for NWSA

David Karnovsky

JPMorgan Chase & Co.

5 questions for NWSA

Entcho Raykovski

Evans & Partners

5 questions for NWSA

David Joyce

Seaport Research Partners

4 questions for NWSA

Kane Hannan

Goldman Sachs

4 questions for NWSA

Alan Gould

Loop Capital

3 questions for NWSA

Brian Han

Morningstar

2 questions for NWSA

David Jarvis

Macquarie

2 questions for NWSA

Elsa Li

UBS

2 questions for NWSA

Evan Karatzas

UBS Group AG

2 questions for NWSA

Lucy Huang

UBS

2 questions for NWSA

Anja Rakowski

Evans and Partners

1 question for NWSA

Darren Leung

Macquarie

1 question for NWSA

Jason Bazinet

Citigroup

1 question for NWSA

Recent press releases and 8-K filings for NWSA.

- News Corp has pursued 11 consecutive quarters of EBITDA growth, achieving record earnings of $1.4 billion in the last fiscal year through targeted refinement of assets including Dow Jones, digital real estate, and HarperCollins.

- The company is leveraging its role as a content input provider in AI, with existing deals with OpenAI and Bloomberg and ongoing advanced negotiations with additional LLM providers, while enforcing a “woo and sue” approach against unauthorized content use.

- In digital real estate, management highlighted strong engagement at Realtor (4.8 monthly visits per unique user versus Zillow’s 3.5) and sees AI-driven services enhancing its holistic property platform alongside REA Group under new leadership.

- Dow Jones’ risk and compliance division grew 20% year-on-year in the last quarter, supported by acquisitions of Oxford Analytica and Dragonfly, while digital advertising also reached a 12% year-on-year record increase in Q2.

- The board added $1 billion to its share buyback program (raising the quarterly buyback rate 4× year-over-year) and continues to pursue selective M&A in areas like OPIS, CMA, Dragonfly, and Oxford Analytica.

- CEO Robert Thomson highlighted 11 consecutive quarters of EBITDA growth and record fiscal year earnings up 14% to $1.4 billion, driven by digital real estate, Dow Jones and HarperCollins.

- Announced expansion of AI content partnerships—including existing deals with OpenAI and Bloomberg—and a “woo and sue” approach to protect against unauthorized scraping of News Corp assets.

- Showcased strong performance at REA Group and Realtor.com, noting that Realtor.com users visit 4.8 times per month versus Zillow’s ~3.6, underpinned by enhanced news, data and AI-driven tools.

- Reported 20% year-on-year revenue growth in Dow Jones’ risk and compliance unit and 12% digital advertising growth in Q2, bolstered by acquisitions of Oxford Analytica and Dragonfly.

- Increased share buyback authorization by $1 billion, with repurchase activity in the latest quarter 4× higher than a year ago, reflecting management’s view of undervaluation and commitment to disciplined M&A.

- News Corp reported 11 consecutive quarters of EBITDA growth and record FY earnings of $1.4 billion (+14% YoY), with a strong outlook for H2 driven by digital real estate, Dow Jones, and publishing.

- The company is licensing its content to LLM providers—anchored by deals with OpenAI and Bloomberg—and is adopting a “woo and sue” approach to unauthorized scraping as it pursues both horizontal and vertical AI partnerships.

- In digital real estate, Realtor.com users average 4.8 site visits/month (vs. 3.5 at Zillow) and Q2 revenue grew 10% YoY despite low market turnover; REA Group, under new CEO Cameron McIntyre, is focusing on holistic property experiences.

- Dow Jones saw Risk & Compliance revenue +20% YoY and digital advertising +12% YoY in Q2; recent acquisitions of Oxford Analytica and Dragonfly strengthen its real-time intelligence offerings.

- Capital allocation priorities include adding $1 billion to its share buyback (4× pace YoY) and strategic M&A—such as OPIS, CMA, Dragonfly, and Oxford Analytica—and securing a 6.5% stake in DAZN via the Foxtel divestiture ($380 million cash).

- News Corp executed 19 February 2026 buy-back of 1,553,542 Class A common shares for US$38.21 million, and 719,484 Class B common shares for US$20.25 million.

- The company’s US$1 billion repurchase program to acquire Class A and Class B common stock has so far deployed approximately US$61.86 million.

- Transactions are reported daily to the ASX under listing rule 3.8A in compliance with program requirements.

- National vacancy rate climbed to 7.6% in 2025, up from 7.2% in 2024, tipping market power toward renters.

- 44 of the 50 largest metros are now renter-friendly or balanced, with only 6 markets remaining landlord-friendly.

- Median asking rent fell 1.5% year-over-year to $1,672 in January, marking the 29th consecutive month of declines.

- Milwaukee’s vacancy rate more than doubled to 10.8% in 2025 from 4.9% in 2024, the most dramatic metro-level shift.

- Select coastal hubs—Boston, San Jose, and New York—remain landlord-friendly (vacancies < 5%) and saw rents rise in San Jose (+1.9%) and New York (+0.8%).

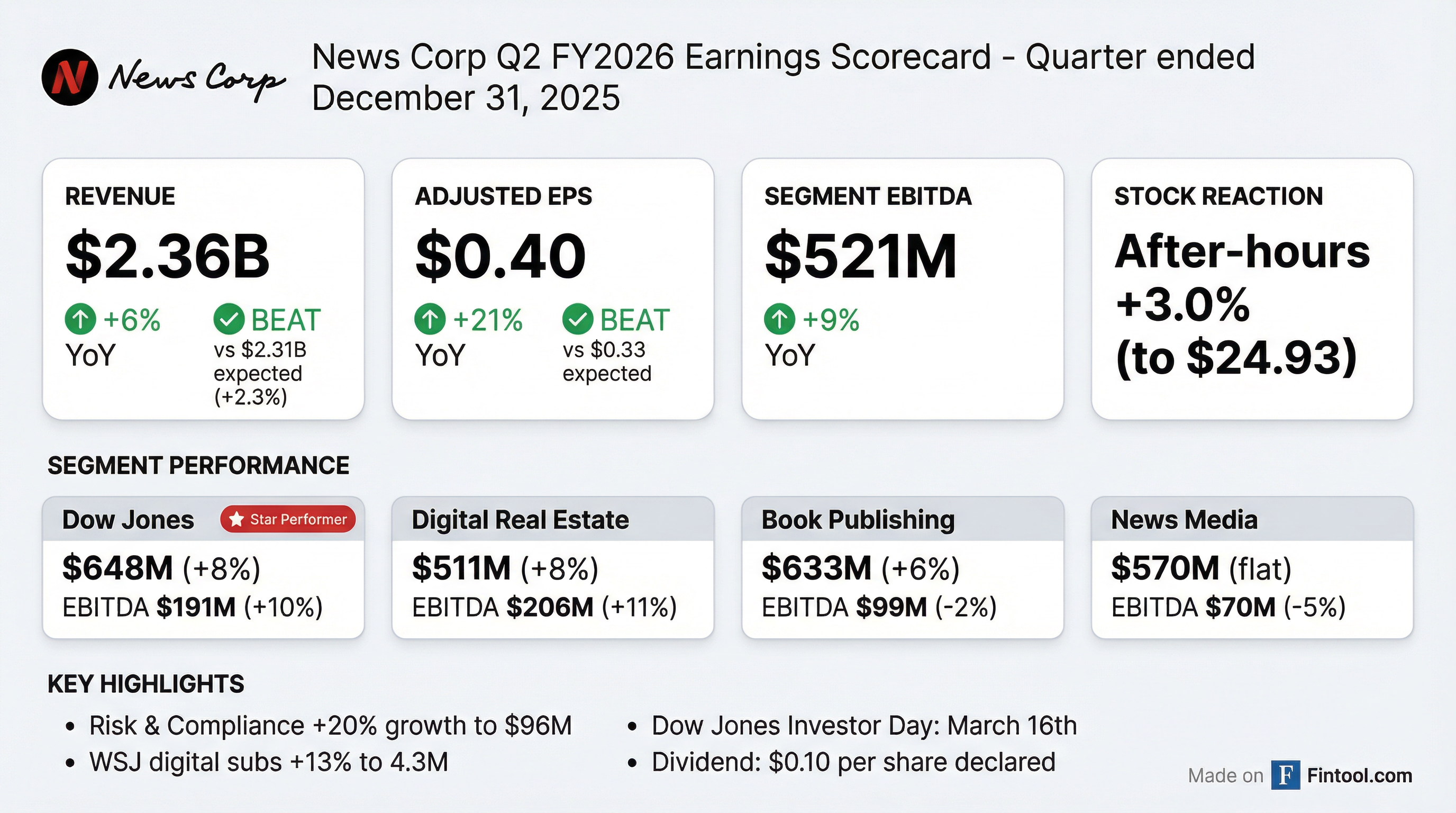

- Adjusted EPS of $0.40, up 21% year-over-year and 21.21% above the Zacks consensus estimate.

- Revenue of $2.36 billion, a 6% year-over-year increase.

- Total segment EBITDA rose 9% to $521 million, marking the 11th consecutive quarter of year-over-year EBITDA growth.

- Dow Jones revenue grew 8% to $648 million, driven by 20% growth in Risk & Compliance and roughly 12% in professional information.

- Quarterly dividend maintained at $0.10 per share, and management noted an expanded Bloomberg partnership including AI rights.

- Posted revenue of $2.4 billion (+6%), total segment EBITDA of $521 million (+9%), adjusted EPS of $0.40, and expanded margin to 22.1%.

- Dow Jones revenues rose 8% to $648 million, segment EBITDA grew 10% to $191 million with a record 29.5% margin, and digital advertising reached $87 million (+12%).

- Digital Real Estate revenues increased 8% to $511 million and EBITDA climbed 11% to $206 million; Realtor.com revenue was up 10% to $143 million, while REA Australia grew 7%.

- Repurchased $172 million of shares in Q2 (4× prior year pace) and expects higher buybacks in H2, reflecting confidence in valuation.

- Revenue of $2.4 B (+6%), total segment EBITDA of $521 M (+9%), margin expanded to 22.1%, and adjusted EPS of $0.40.

- Dow Jones delivered 8% revenue growth to $648 M, 10% EBITDA growth to $191 M, and a record 29.5% profit margin.

- Digital Real Estate segment grew revenues 8% to $511 M and EBITDA 11% to $206 M; REA Australia revenues rose 7% to $368 M and Realtor.com revenues climbed 10% to $143 M, with portal share up to 29%.

- HarperCollins revenues increased 6% to $633 M, despite a $16 M one-time inventory write-off, and management expects stronger H2 performance.

- Share repurchases totaled $172 M in Q2—four times last year’s pace—with an accelerated buyback rate anticipated in H2.

- News Corp delivered $2.4 billion in revenue (up 6% year-over-year) and $521 million in total segment EBITDA (up 9%), driving an adjusted EPS of $0.40 and a margin of 22.1% for the quarter.

- Dow Jones segment revenues rose 8% to $648 million, with segment EBITDA up 10% to $191 million, achieving a record 29.5% profit margin and $87 million in digital advertising (up 12%).

- Digital Real Estate Services produced $511 million in revenues (up 8%) and $206 million in EBITDA (up 11%); REA Australia grew 7%, while Realtor.com revenues increased 10% to $143 million, with continued audience share gains.

- HarperCollins Book Publishing posted $633 million in revenues (up 6%) and $99 million in segment EBITDA (down 2%), impacted by a $16 million inventory write-off, with digital sales representing 20% of consumer revenues.

- News Media revenues were flat at $570 million, while EBITDA declined 5% to $70 million; The Times digital subscriptions reached 659,000 (up 7%) and News Corp Australia subscriptions hit 1.2 million (up 4%), alongside the launch of the California Post.

- Total revenues of $2.36 billion, up 6% year-over-year, driven by Dow Jones, Digital Real Estate Services and Book Publishing growth.

- Net income from continuing operations of $242 million, down 21%; reported EPS of $0.34 versus $0.40 prior year, and Adjusted EPS of $0.40 versus $0.33.

- Total Segment EBITDA of $521 million, up 9%, which includes a $16 million one-time inventory write-off at HarperCollins International.

- Key segment performance: Dow Jones revenues $648 million (+8%), Move (Realtor.com) $143 million (+10%), Book Publishing $633 million (+6%).

- Expanded share buyback program running at over four times the prior rate, reflecting confidence in cash position.

Fintool News

In-depth analysis and coverage of NEWS.

Quarterly earnings call transcripts for NEWS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more