Earnings summaries and quarterly performance for NEWS.

Executive leadership at NEWS.

Board of directors at NEWS.

Research analysts who have asked questions during NEWS earnings calls.

Craig Huber

Huber Research Partners

6 questions for NWSA

David Karnovsky

JPMorgan Chase & Co.

5 questions for NWSA

Entcho Raykovski

Evans & Partners

5 questions for NWSA

David Joyce

Seaport Research Partners

4 questions for NWSA

Kane Hannan

Goldman Sachs

4 questions for NWSA

Alan Gould

Loop Capital

3 questions for NWSA

Brian Han

Morningstar

2 questions for NWSA

David Jarvis

Macquarie

2 questions for NWSA

Elsa Li

UBS

2 questions for NWSA

Evan Karatzas

UBS Group AG

2 questions for NWSA

Lucy Huang

UBS

2 questions for NWSA

Anja Rakowski

Evans and Partners

1 question for NWSA

Darren Leung

Macquarie

1 question for NWSA

Jason Bazinet

Citigroup

1 question for NWSA

Recent press releases and 8-K filings for NWSA.

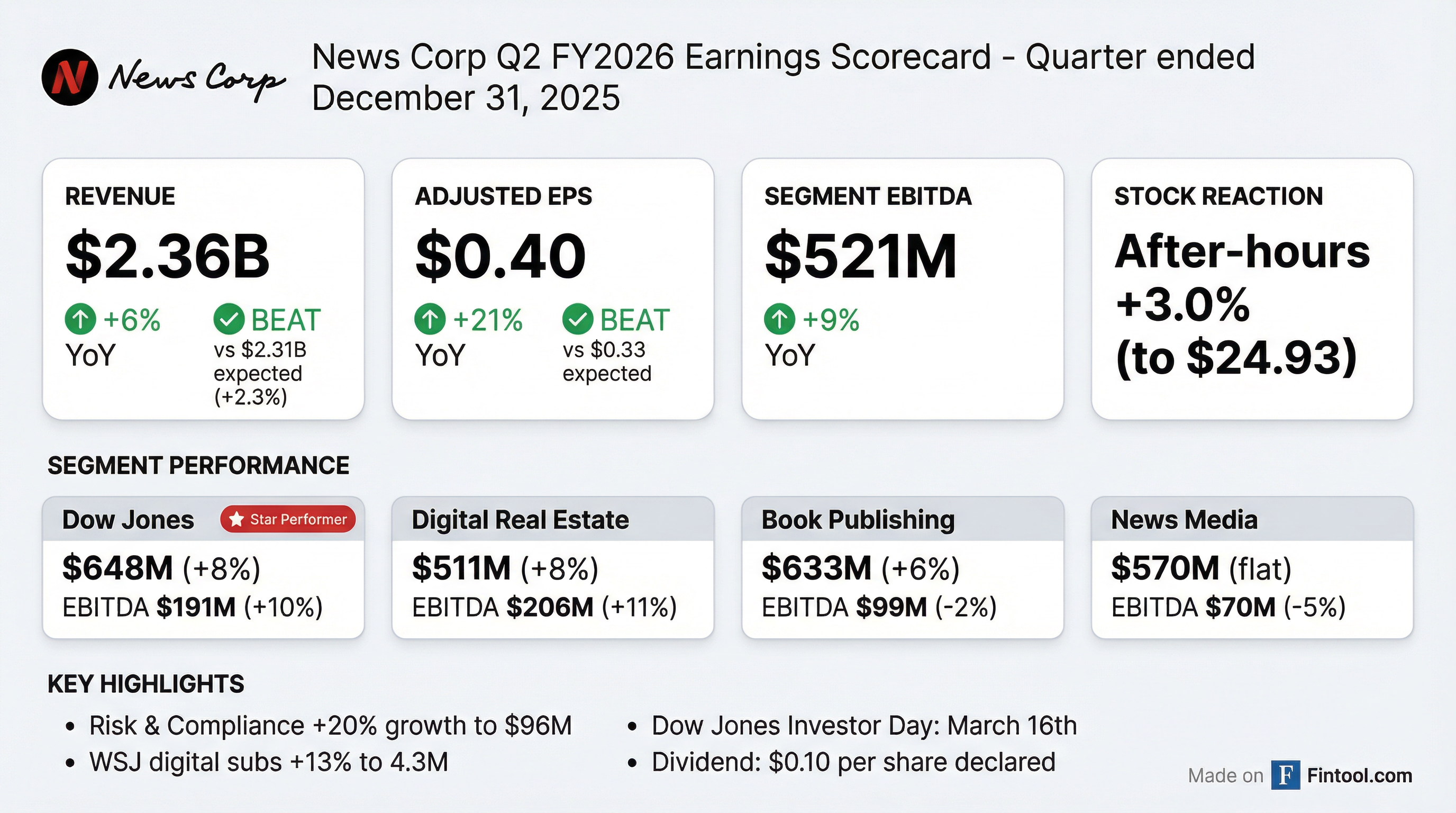

- Adjusted EPS of $0.40, up 21% year-over-year and 21.21% above the Zacks consensus estimate.

- Revenue of $2.36 billion, a 6% year-over-year increase.

- Total segment EBITDA rose 9% to $521 million, marking the 11th consecutive quarter of year-over-year EBITDA growth.

- Dow Jones revenue grew 8% to $648 million, driven by 20% growth in Risk & Compliance and roughly 12% in professional information.

- Quarterly dividend maintained at $0.10 per share, and management noted an expanded Bloomberg partnership including AI rights.

- Posted revenue of $2.4 billion (+6%), total segment EBITDA of $521 million (+9%), adjusted EPS of $0.40, and expanded margin to 22.1%.

- Dow Jones revenues rose 8% to $648 million, segment EBITDA grew 10% to $191 million with a record 29.5% margin, and digital advertising reached $87 million (+12%).

- Digital Real Estate revenues increased 8% to $511 million and EBITDA climbed 11% to $206 million; Realtor.com revenue was up 10% to $143 million, while REA Australia grew 7%.

- Repurchased $172 million of shares in Q2 (4× prior year pace) and expects higher buybacks in H2, reflecting confidence in valuation.

- Revenue of $2.4 B (+6%), total segment EBITDA of $521 M (+9%), margin expanded to 22.1%, and adjusted EPS of $0.40.

- Dow Jones delivered 8% revenue growth to $648 M, 10% EBITDA growth to $191 M, and a record 29.5% profit margin.

- Digital Real Estate segment grew revenues 8% to $511 M and EBITDA 11% to $206 M; REA Australia revenues rose 7% to $368 M and Realtor.com revenues climbed 10% to $143 M, with portal share up to 29%.

- HarperCollins revenues increased 6% to $633 M, despite a $16 M one-time inventory write-off, and management expects stronger H2 performance.

- Share repurchases totaled $172 M in Q2—four times last year’s pace—with an accelerated buyback rate anticipated in H2.

- News Corp delivered $2.4 billion in revenue (up 6% year-over-year) and $521 million in total segment EBITDA (up 9%), driving an adjusted EPS of $0.40 and a margin of 22.1% for the quarter.

- Dow Jones segment revenues rose 8% to $648 million, with segment EBITDA up 10% to $191 million, achieving a record 29.5% profit margin and $87 million in digital advertising (up 12%).

- Digital Real Estate Services produced $511 million in revenues (up 8%) and $206 million in EBITDA (up 11%); REA Australia grew 7%, while Realtor.com revenues increased 10% to $143 million, with continued audience share gains.

- HarperCollins Book Publishing posted $633 million in revenues (up 6%) and $99 million in segment EBITDA (down 2%), impacted by a $16 million inventory write-off, with digital sales representing 20% of consumer revenues.

- News Media revenues were flat at $570 million, while EBITDA declined 5% to $70 million; The Times digital subscriptions reached 659,000 (up 7%) and News Corp Australia subscriptions hit 1.2 million (up 4%), alongside the launch of the California Post.

- Total revenues of $2.36 billion, up 6% year-over-year, driven by Dow Jones, Digital Real Estate Services and Book Publishing growth.

- Net income from continuing operations of $242 million, down 21%; reported EPS of $0.34 versus $0.40 prior year, and Adjusted EPS of $0.40 versus $0.33.

- Total Segment EBITDA of $521 million, up 9%, which includes a $16 million one-time inventory write-off at HarperCollins International.

- Key segment performance: Dow Jones revenues $648 million (+8%), Move (Realtor.com) $143 million (+10%), Book Publishing $633 million (+6%).

- Expanded share buyback program running at over four times the prior rate, reflecting confidence in cash position.

- In 2025 Q4, the median asking rent in New York City reached $3,585, up 6.6% year-over-year.

- Nearly 89.3% of renters stayed in the same unit year-over-year, signaling record-low turnover and tightening availability.

- 40% of NYC’s rental stock is rent-stabilized, with these units posting a 0.98% vacancy rate in 2023 versus 1.84% for market-rate units.

- Mayor Mamdani intends to impose a rent freeze on stabilized units by October 2026, likely further constraining supply for new movers.

- Under its 2021 Repurchase Program and 2025 Repurchase Program, News Corp is authorized to acquire up to US$1 billion of Class A and Class B common stock under each program.

- On December 29, 2025, the Company repurchased 13,806,776 shares at a total consideration of US$321,508,368.

- To date, News Corp has purchased approximately US$958,716,220 of Class A and Class B shares under the 2021 program.

- The buybacks are executed on market by Goldman Sachs & Co. LLC and settled in USD.

- News Corp continues its stock repurchase initiatives, with up to US$1 billion authorized under each of the 2021 and 2025 Repurchase Programs for Class A and Class B common stock.

- On December 15, 2025, the company bought back 13.53 million Class A shares for US$313.3 million and 28.05 million Class B shares for US$617.9 million, as reported to the ASX.

- Cumulative purchases under the 2021 program total approximately US$933.9 million, nearing the US$1 billion cap.

- Daily ASX disclosures include repurchase volumes, consideration paid, and remaining authorization under the programs.

- News Corp filed an 8-K on December 12, 2025 disclosing daily buy-back notifications to the ASX under its authorized US$1 billion 2021 and US$1 billion 2025 repurchase programs for Class A and Class B common stock.

- On December 11, 2025, the company repurchased 27,907,689 Class B shares for US$614,139,621 and 70,004 shares for US$1,835,805.90, with prices ranging from US$14.88 to US$30.93.

- On the same day, News Corp repurchased 13,469,929 Class A shares for US$311,484,447 and 30,471 shares for US$908,873.75, at prices between US$15.17 and US$35.41.

- To date under the 2021 program, the company has acquired approximately US$928,420,369 of Class A and Class B shares.

- Realtor.com finds typical U.S. mortgage holders would face a 73.2% increase in monthly payments—from $1,291 to $2,236—if purchasing today, underscoring a strong homeowner lock-in effect.

- More affordable markets see smaller penalties (e.g., Pittsburgh at 32.5%; Baltimore at 34.0%), though moving costs remain significant.

- High-priced metros exhibit the largest jumps, with San Jose at 179.6% and Los Angeles at 176.4% increases in estimated payments.

- The lock-in effect is dampening housing supply and mobility, suggesting relief will require lower mortgage rates, stronger income growth, or relocation strategies.

Fintool News

In-depth analysis and coverage of NEWS.

Quarterly earnings call transcripts for NEWS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more