Earnings summaries and quarterly performance for NXP Semiconductors.

Executive leadership at NXP Semiconductors.

Rafael Sotomayor

President and Chief Executive Officer

Andrew Hardy

Chief Sales Officer

Andrew Micallef

Executive Vice President and Chief Operations and Manufacturing Officer

Christopher Jensen

Executive Vice President and Chief People Officer

Jennifer Wuamett

Executive Vice President, General Counsel, Corporate Secretary and Chief Sustainability Officer

William Betz

Executive Vice President and Chief Financial Officer

Board of directors at NXP Semiconductors.

Research analysts who have asked questions during NXP Semiconductors earnings calls.

Ross Seymore

Deutsche Bank

9 questions for NXPI

Vivek Arya

Bank of America Corporation

9 questions for NXPI

Joshua Buchalter

TD Cowen

8 questions for NXPI

Stacy Rasgon

Bernstein Research

7 questions for NXPI

William Stein

Truist Securities

5 questions for NXPI

Chris Caso

Wolfe Research LLC

4 questions for NXPI

Francois-Xavier Bouvignies

UBS

4 questions for NXPI

Joe Moore

Morgan Stanley

4 questions for NXPI

Tom O'Malley

Barclays

4 questions for NXPI

Christopher Caso

Wolfe Research

3 questions for NXPI

Christopher Danely

Citigroup Inc.

3 questions for NXPI

CJ Muse

Cantor Fitzgerald

3 questions for NXPI

Thomas O’Malley

Barclays Capital

3 questions for NXPI

Blayne Curtis

Jefferies Financial Group

2 questions for NXPI

Christopher Muse

Cantor Fitzgerald

2 questions for NXPI

François Bouvignies

UBS

2 questions for NXPI

Gary Mobley

Loop Capital

2 questions for NXPI

Jim Schneider

Goldman Sachs

2 questions for NXPI

Matthew Prisco

Cantor Fitzgerald

2 questions for NXPI

Tore Svanberg

Stifel Financial Corp.

2 questions for NXPI

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for NXPI

Vijay Rakesh

Mizuho

2 questions for NXPI

Joe Quatrochi

Wells Fargo

1 question for NXPI

Joe Quattrocchi

Wells Fargo & Company

1 question for NXPI

Mark Lipacis

Evercore ISI

1 question for NXPI

Recent press releases and 8-K filings for NXPI.

- On February 6, 2026, NXP B.V. and NXP Funding LLC entered into a Second Amended and Restated Revolving Credit Agreement providing US$3,000,000,000 of senior unsecured revolving credit commitments, including a US$200,000,000 letters-of-credit sub-facility, maturing February 6, 2031.

- Borrowings bear interest at the option of the borrowers at Term SOFR + 0.75%–1.25% or a base rate + 0.0%–0.25%; undrawn commitments incur a quarterly commitment fee of 0.065%–0.15%, based on the Company’s unsecured credit rating.

- The agreement contains customary covenants, including a 3.0 to 1.0 consolidated interest coverage ratio tested quarterly, and allows use of proceeds for general corporate purposes.

- All present and future obligations under the facility are guaranteed by NXP Semiconductors N.V. and NXP USA, Inc. pursuant to the Second Amended and Restated Guaranty.

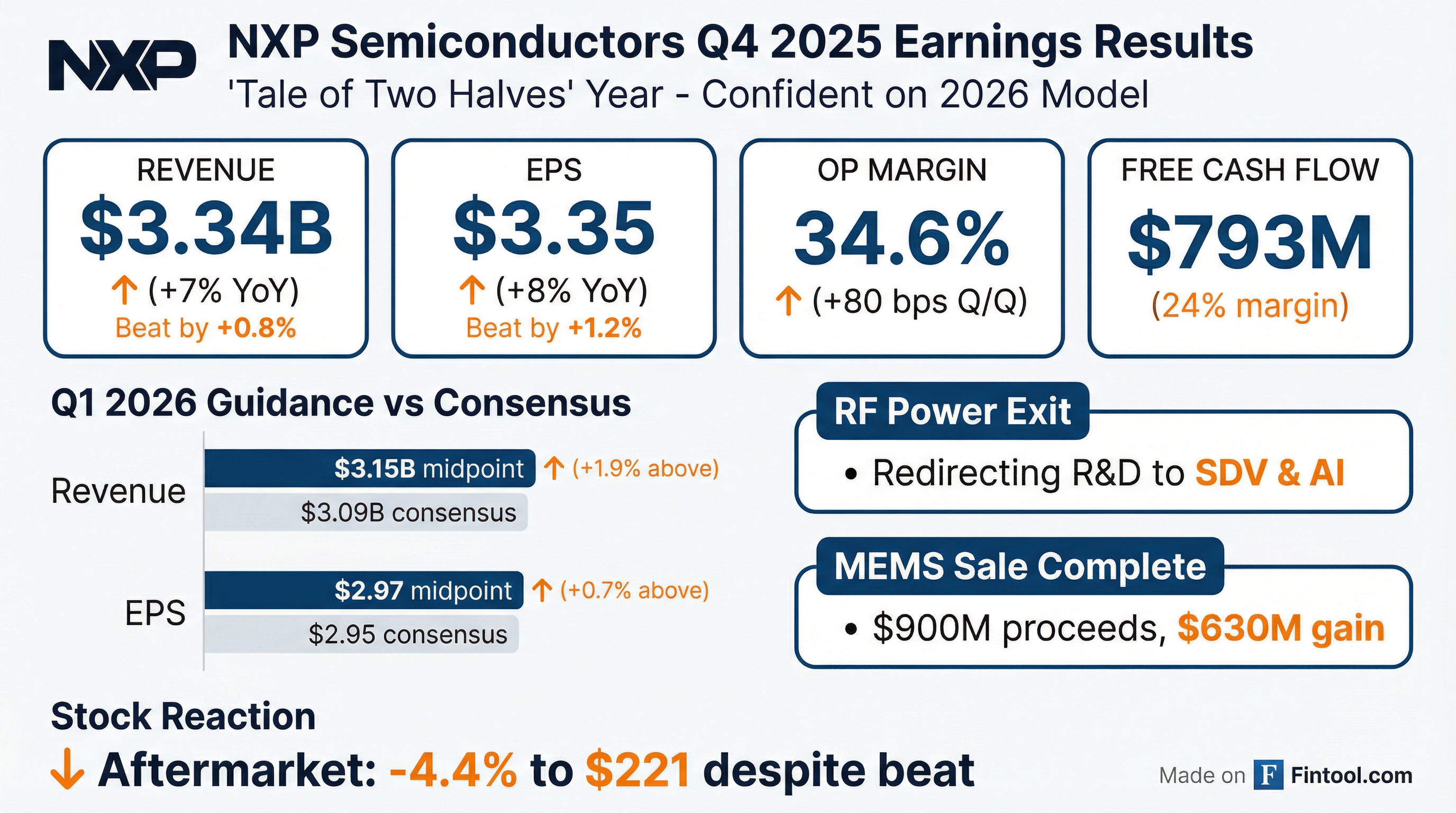

- Revenue of $3.335 B in Q4 2025, up 7% Y/Y and 5% Q/Q

- Non-GAAP gross margin of 57.4% and operating margin of 34.6% in Q4 2025

- Free cash flow of $793 M (margin 23.8%); 100% of excess FCF to shareholders

- Automotive end-market at 58% of 2025 revenue; Q4 automotive sales $1.876 B, +5% Y/Y

- Dividends of $1.9 B in 2025; 95% of non-GAAP FCF returned cumulatively since 2016

- Revenue in Q4 2025 was $3.34 billion, up 7% YoY and 5% sequentially; non-GAAP EPS was $3.35, and non-GAAP operating margin was 35%, all above guidance.

- FY 2025 automotive revenue was $7.1 billion (flat YoY) and industrial & IoT revenue was $2.3 billion (flat YoY), with second-half growth aligning with the long-term 8–12% outlook driven by software-defined vehicle and AI initiatives.

- Ended Q4 with $3.3 billion cash versus $12.2 billion debt (net debt $8.96 billion, net debt/EBITDA 1.9×); returned $338 million in buybacks and $254 million in dividends; non-GAAP free cash flow was $793 million (24% of revenue).

- Q1 2026 guidance: revenue of $3.15 billion ± $100 million (+11% YoY, –6% sequential), non-GAAP EPS of $2.97, gross margin of 57%, and operating expenses of $765 million.

- Strategic actions include a $90 million charge to exit RF Power, sale of the MEMS sensor business for $900 million proceeds (one-time gain ~$630 million), and a shift to headquarters-based geographic reporting.

- NXP reported Q4 revenue of $3.34 billion (+7% YoY, +5% QoQ) and non-GAAP EPS of $3.35, with a 35% non-GAAP operating margin and 10 weeks of distribution inventory.

- In FY 2025, automotive revenue was $7.1 billion (flat YoY) and industrial & IoT was $2.3 billion (flat YoY); mobile rose to $1.6 billion (+6% YoY), while communications infrastructure fell to $1.3 billion (–24% YoY).

- Q1 2026 guidance calls for $3.15 billion in revenue (+11% YoY, –6% QoQ) and non-GAAP EPS of $2.97, driven by mid-single-digit growth in automotive and low-20% growth in industrial & IoT.

- In Q4, NXP returned $338 million via share buybacks and $254 million in dividends; post-quarter repurchases total 36 million shares, and $500 million of March 2026 notes were redeemed.

- Strategic portfolio moves include selling the MEMS sensor business for $900 million (recognizing a ~$630 million gain) and exiting RF Power R&D with a $90 million charge to sharpen focus on SDV and physical AI.

- Q4 revenue was $3.34 billion (+7% YoY, +5% QoQ) and non-GAAP EPS was $3.35, each above guidance midpoints.

- FY 2025 segment results: automotive $7.1 billion (flat YoY), industrial & IoT $2.3 billion (flat YoY), mobile $1.6 billion (+6% YoY), communications infrastructure $1.3 billion (−24% YoY).

- Q1 2026 guidance: revenue $3.15 billion (+11% YoY, −6% QoQ) and non-GAAP EPS $2.97, with no broad-based channel restocking assumed; non-GAAP gross margin ~57%.

- Strategic actions include exiting RF Power (∼$90 million restructuring charge) and selling the MEMS sensor business for $900 million gross proceeds (∼$630 million gain).

- Q4 capital returns totaled $338 million in buybacks and $254 million in dividends; ended with $3.3 billion cash, $12.2 billion debt, net debt/EBITDA 1.9×.

- Q4 revenue was $3.34 billion (+7% y/y); full-year revenue was $12.27 billion (–3% y/y), with Q4 non-GAAP gross margin at 57.4% and full-year at 56.8%.

- Q4 non-GAAP diluted EPS was $3.35 (vs. $3.18 in Q4 2024); full-year non-GAAP diluted EPS was $11.81 (vs. $13.09 in 2024).

- Q4 non-GAAP free cash flow was $793 million (23.8% of revenue), and full-year free cash flow was $2,425 million (19.8%); Q4 capital return totaled $592 million (74.7% of FCF), including $338 million in buybacks and $254 million in dividends.

- Issued Q1 2026 guidance: revenue of $3.05–3.25 billion (up 8–15% y/y) and non-GAAP EPS of $2.77–3.17 per diluted share.

- Q4 revenue was $3.34 billion and adjusted EPS was $3.35, both above expectations.

- Guided Q1 revenue to $3.05–3.25 billion (midpoint $3.15 billion) and adjusted EPS to $2.77–3.17 (midpoint $2.97), exceeding analyst estimates.

- Strength in automotive (≈ 55% of sales) and industrial (≈ 18%), while communications revenue fell 18% year-over-year.

- GAAP profit was $455 million (or $1.79/share), down from $495 million (or $1.93), but free cash flow margin rose to 23.8% from 8.4% and inventory days fell to 153.

- NXP posted Q4 revenue of $3.34 billion (+7% YoY) and full-year revenue of $12.27 billion (–3% YoY); Q4 GAAP diluted EPS was $1.79 and non-GAAP diluted EPS was $3.35, while full-year GAAP and non-GAAP diluted EPS were $7.95 and $11.81, respectively.

- In Q4, NXP achieved a 54.2% GAAP gross margin and 22.3% GAAP operating margin, with non-GAAP gross and operating margins of 57.4% and 34.6%, respectively.

- Operating cash flow in Q4 was $891 million, yielding non-GAAP free cash flow of $793 million (23.8% of revenue); the company returned $592 million of capital in the quarter (including $338 million of share buybacks and $254 million of dividends) and $1.924 billion for the full year.

- For Q1 2026, NXP expects revenue of $3.05–3.25 billion (+8–15% YoY), GAAP EPS of $4.01–4.41, and non-GAAP EPS of $2.77–3.17 per share.

- During Q4, NXP completed acquisitions of Aviva Links for $243 million and Kinara for $307 million, and on February 2, 2026, sold its MEMS sensors business line for $900 million (plus up to $50 million in earn-outs).

- NXP introduced the S32N7 super-integration processor series built on a 5 nm foundation to centralize vehicle core functions, promising up to 20% reduction in total cost of ownership through hardware consolidation and efficiency gains.

- The series supports scalable AI-driven features across propulsion, dynamics, body, gateway and safety domains via a centralized hub with high-performance networking and a future-proof data backbone.

- It offers a portfolio of 32 variants with application and real-time compute, hardware isolation, and AI/data acceleration, meeting strict automotive safety and security requirements.

- Bosch is the first OEM to deploy the S32N7 in its vehicle integration platform, co-developing reference designs and safety frameworks to accelerate system deployment.

- The top-tier S32N79 variant is now sampling with customers.

- NXP has acquired Kinara to integrate its NPU with NXP’s i.MX application processor, targeting the $32 billion industrial edge SAM (growing to $45 billion by 2027); initial Kinara NPU revenues expected in late 2027/early 2028.

- Management sees its trough in Q1 2025, with automotive backlog digestion (60% of auto revenues) and a 10% sequential uptick in Industrial & IoT in Q4; it targets 11 weeks of channel inventory, prioritizing high-velocity products.

- Automotive CAGR of 8–12% (2024–2027) driven by: software-defined vehicles rising from $1 billion in 2024 to $2 billion by 2027; 77 GHz radar from $0.9 billion to $1.3 billion; electrification from $0.5 billion to $0.9 billion; and connectivity from $0.4 billion to $0.7 billion by 2027.

- In Industrial & IoT, processors (i.MX, RT crossover and MCUs) form the core, with >$500 million of new application processors, connectivity and security drivers scaling through 2026.

- Financial targets include 57–63% non-GAAP gross margin with ~100 bps GM gain per $1 billion revenue; the VSMC JV in Singapore adds ~200 bps in 2028. Excess free cash flow will be 100% returned via dividends and buybacks once net debt/EBITDA is ≤ 2×.

Fintool News

In-depth analysis and coverage of NXP Semiconductors.

Quarterly earnings call transcripts for NXP Semiconductors.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more