Earnings summaries and quarterly performance for PROVIDENT FINANCIAL SERVICES.

Executive leadership at PROVIDENT FINANCIAL SERVICES.

Anthony Labozzetta

President and Chief Executive Officer

Adriano Duarte

Executive Vice President and Chief Accounting Officer

Bennett MacDougall

Executive Vice President, General Counsel and Corporate Secretary

Carolyn Powell

Executive Vice President and Chief Human Resources Officer

Christopher Martin

Executive Chairman

James Christy

Executive Vice President and Chief Risk Officer

James Nigro

Executive Vice President and Chief Credit Officer

Ravi Vakacherla

Executive Vice President and Chief Digital and Innovation Officer

Thomas Lyons

Senior Executive Vice President and Chief Financial Officer

Thomas Shara

Executive Vice Chairman

Timothy Matteson

Executive Vice President and Chief Administrative Officer

Valerie Murray

Executive Vice President and Chief Wealth Management Officer

Vito Giannola

Executive Vice President and Chief Banking Officer

William Fink

Executive Vice President and Chief Lending Officer

Board of directors at PROVIDENT FINANCIAL SERVICES.

Brian Flynn

Director

Brian Gragnolati

Director

Edward Leppert

Director

James Dunigan

Director

James Hanson

Director

John Pugliese

Lead Independent Director

Matthew Harding

Director

Nadine Leslie

Director

Robert McCracken

Director

Ursuline Foley

Director

Research analysts who have asked questions during PROVIDENT FINANCIAL SERVICES earnings calls.

Feddie Strickland

Hovde Group

5 questions for PFS

Mark Fitzgibbon

Piper Sandler & Co.

5 questions for PFS

Manuel Navas

D.A. Davidson & Co.

3 questions for PFS

Timothy Switzer

KBW

3 questions for PFS

Tim Switzer

Keefe, Bruyette & Woods (KBW)

3 questions for PFS

Bill Young

RBC Capital Markets

2 questions for PFS

Dave Storms

Stonegate

2 questions for PFS

Steve Moss

Raymond James

2 questions for PFS

Thomas Reid

Raymond James

1 question for PFS

Recent press releases and 8-K filings for PFS.

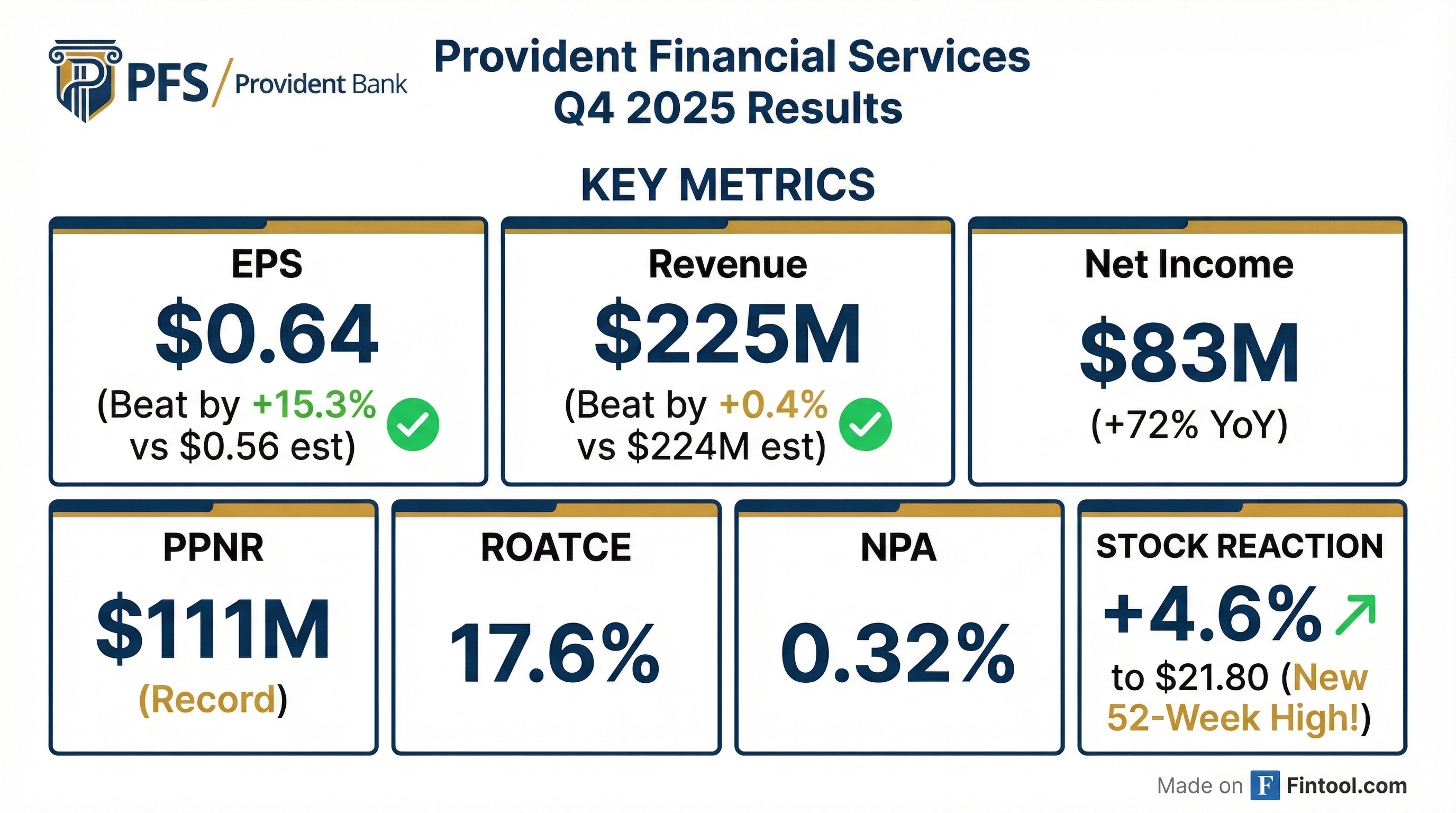

- Provident Financial Services, Inc. (PFS) reported Diluted EPS of $0.64 and record revenues of $226 million for Q4 2025.

- The company achieved strong Q4 2025 profitability with a 1.34% Return on Average Assets (ROAA), 1.78% Pre-Provision Net Revenue (PPNR) ROAA, and 17.58% Return on Average Tangible Common Equity (ROATCE).

- PFS saw significant growth in Q4 2025, with total commercial loans increasing 5.4% annualized and core deposits expanding $260 million (6.6% annualized).

- The balance sheet remained robust, evidenced by Tangible Book Value (TBV) growth of 4% quarter-over-quarter to $15.70 and 15% year-over-year, alongside an improved net charge-off ratio of 0.09%.

- For 2026, PFS projects 4-6% annualized loan and deposit growth, a reported Net Interest Margin (NIM) of 3.40% to 3.50%, and an efficiency ratio target of approximately 51.0%.

- Provident Financial Services, Inc. reported net income of $83.4 million, or $0.64 per basic and diluted share, for the three months ended December 31, 2025, and $291.2 million, or $2.23 per basic and diluted share, for the full year ended December 31, 2025.

- The company achieved record revenue of $225.7 million for the fourth quarter of 2025, marking its third consecutive quarter of record revenues, comprised of net interest income of $197.4 million and non-interest income of $28.3 million.

- As of December 31, 2025, total assets were $24.98 billion, total deposits increased to $19.28 billion, and the loan pipeline totaled $2.74 billion.

- The President and CEO, Anthony J. Labozzetta, expects continued earnings per share growth and to compound tangible book value in 2026.

- Provident Financial Services reported Q4 2025 net earnings of $83 million or $0.64 per share, driven by record revenues of $226 million.

- The company achieved an annualized return on average assets of 1.34% and an adjusted return on average tangible common equity of 17.6% for Q4 2025.

- A new share repurchase authorization for an additional 2 million shares was announced.

- For 2026, the company projects loans and deposits to grow in the 4%-6% range, non-interest income to average $28.5 million per quarter, and targets a core return on average assets in the 1.20%-1.30% range.

- A core system conversion is scheduled for the fall of 2026, with approximately $5 million in non-recurring charges expected largely in Q3 and Q4 2026.

- Provident Financial Services reported net earnings of $83 million or $0.64 per share for Q4 2025, achieving an annualized return on average assets of 1.34% and a record $111 million in pre-provision net revenue.

- The company recorded record revenues of $226 million, driven by record net interest income of $197 million and record non-interest income of $28.3 million. Asset quality remained strong, with non-performing assets improving to 0.32%.

- For 2026, Provident Financial Services projects loans and deposits to grow in the 4%-6% range, non-interest income to average $28.5 million per quarter, and targets a core return on average assets in the 1.20%-1.30% range. Core net interest margin is expected to expand by 3-5 basis points for the next two quarters, with reported NIM estimated in the 3.4-3.5% range for 2026.

- A new share repurchase authorization for an additional 2 million shares was announced, with organic growth remaining the primary capital deployment objective. The company also plans a core system conversion in the fall of 2026, expecting approximately $5 million in non-recurring charges.

- Provident Financial Services reported net earnings of $83 million or $0.64 per share for Q4 2025, with record revenues of $226 million, driven by record net interest income of $197 million and record non-interest income of $28.3 million. The company achieved an annualized return on average assets of 1.34% and an adjusted return on average tangible common equity of 17.6%.

- The company saw net commercial loan growth of 5.5% in 2025, with a year-end loan pipeline of $2.7 billion. Core deposits grew $260 million or 6.6% annualized in Q4 2025. Asset quality remained strong, with non-performing assets improving to 0.32% and full-year 2025 net charge-offs at just seven basis points of average loans.

- For 2026, PFS expects loans and deposits to grow in the 4%-6% range, non-interest income to average $28.5 million per quarter, and targets a core return on average assets between 1.20%-1.30%. The company also announced a new share repurchase authorization for an additional 2 million shares and plans a core system conversion in the fall of 2026, with approximately $5 million in non-recurring charges.

- Provident Financial Services, Inc. reported net income of $83.4 million, or $0.64 per basic and diluted share, for the three months ended December 31, 2025, and $291.2 million, or $2.23 per basic and diluted share, for the full year ended December 31, 2025.

- For the fourth quarter of 2025, net interest income increased to $197.4 million with a net interest margin of 3.44%. Non-interest income totaled $28.3 million and non-interest expense was $114.7 million.

- The company's total assets reached $24.98 billion and total deposits increased to $19.28 billion at December 31, 2025.

- Asset quality showed improvement, with total non-performing loans at $78.4 million, or 0.40% of total loans, at December 31, 2025.

- The Annual Meeting of Stockholders is scheduled for May 21, 2026, as a virtual meeting.

- Provident Financial Services, Inc. (PFS) announced the authorization of its tenth stock repurchase program, which will begin upon the completion of the existing program.

- The existing stock repurchase program has 814,247 shares remaining available for repurchase.

- Under the new authorization, combined with the remaining shares from the existing program, the company may repurchase up to 2.15% of its currently outstanding shares of common stock, or approximately 2.81 million shares.

- The repurchase program has no expiration date and its completion is not subject to a specific timeframe.

- PACCAR reported annual revenues of $28.44 billion and net income of $2.38 billion ($4.51 per diluted share) in 2025, which included a $264.5 million after-tax, non-recurring charge related to civil litigation in Europe. Adjusted net income for 2025 was $2.64 billion ($5.01 per diluted share).

- For the fourth quarter of 2025, consolidated revenues were $6.82 billion and net income was $556.9 million ($1.06 per diluted share), compared to $7.91 billion and $872.0 million ($1.66 per diluted share) in the fourth quarter of 2024, respectively.

- PACCAR Parts achieved record annual revenues of $6.87 billion and pretax income of $1.67 billion in 2025. PACCAR Financial Services (PFS) also reported record annual revenues of $2.21 billion and pretax income of $485.4 million in 2025.

- PACCAR declared cash dividends of $2.72 per share during 2025.

- The company invested $1.17 billion in capital projects and research and development in 2025 and estimates investments of $725-$775 million in capital projects and $450-$500 million in R&D for 2026.

- Thomas M. Lyons, Senior Executive Vice President and Chief Financial Officer of Provident Financial Services and Provident Bank, has announced his retirement.

- His departure is expected by June 30, 2026, or upon the appointment of his successor, for whom a nationwide search is currently underway.

- Following the appointment of his successor, Mr. Lyons will serve as a Special Advisor until his final employment date of January 31, 2027, receiving an annualized base salary of $300,000 during this advisory period.

- Provident Financial Services, Inc. reported record revenue of $221.8 million and diluted EPS of $0.55 for the third quarter ended September 30, 2025. The company's Adjusted Return on Average Assets (ROAA) was 1.16% and Adjusted Return on Average Tangible Equity (ROATE) was 16.01%.

- The total commercial loan portfolio increased by $191.2 million, or 4.59% annualized, to $16.70 billion as of September 30, 2025, with total deposits reaching $19.1 billion.

- Asset quality remained strong, with non-performing assets to total assets at 0.41% and annualized net charge-offs at 0.11% of loans for Q3 2025. A provision for credit losses of $7.0 million was recorded.

- Tangible book value per share grew 3.6% to $15.13, and the tangible common equity ratio improved by 19 basis points to 8.22% as of September 30, 2025.

- For the remainder of 2025, the company anticipates 5% annualized loan growth and 1-3% annualized deposit growth, with Net Interest Margin (NIM) projected to be in the 3.38% to 3.45% range.

Quarterly earnings call transcripts for PROVIDENT FINANCIAL SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more