Earnings summaries and quarterly performance for PEAPACK GLADSTONE FINANCIAL.

Executive leadership at PEAPACK GLADSTONE FINANCIAL.

Board of directors at PEAPACK GLADSTONE FINANCIAL.

AJ

Anthony J. Consi, II

Detailed

Director

BW

Beth Welsh

Detailed

Director

CM

Carmen M. Bowser

Detailed

Director

EA

Edward A. Gramigna, Jr.

Detailed

Director

FD

F. Duffield Meyercord

Detailed

Chairman of the Board

PJ

Patrick J. Mullen

Detailed

Director

PM

Patrick M. Campion

Detailed

Director

PD

Peter D. Horst

Detailed

Director

PW

Philip W. Smith, III

Detailed

Director

RD

Richard Daingerfield

Detailed

Director

SA

Steven A. Kass

Detailed

Director

SA

Susan A. Cole

Detailed

Director

TS

Tony Spinelli

Detailed

Director

Research analysts covering PEAPACK GLADSTONE FINANCIAL.

Recent press releases and 8-K filings for PGC.

Peapack-Gladstone Financial Corporation Reports Strong Q4 and Full-Year 2025 Financial Results

PGC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

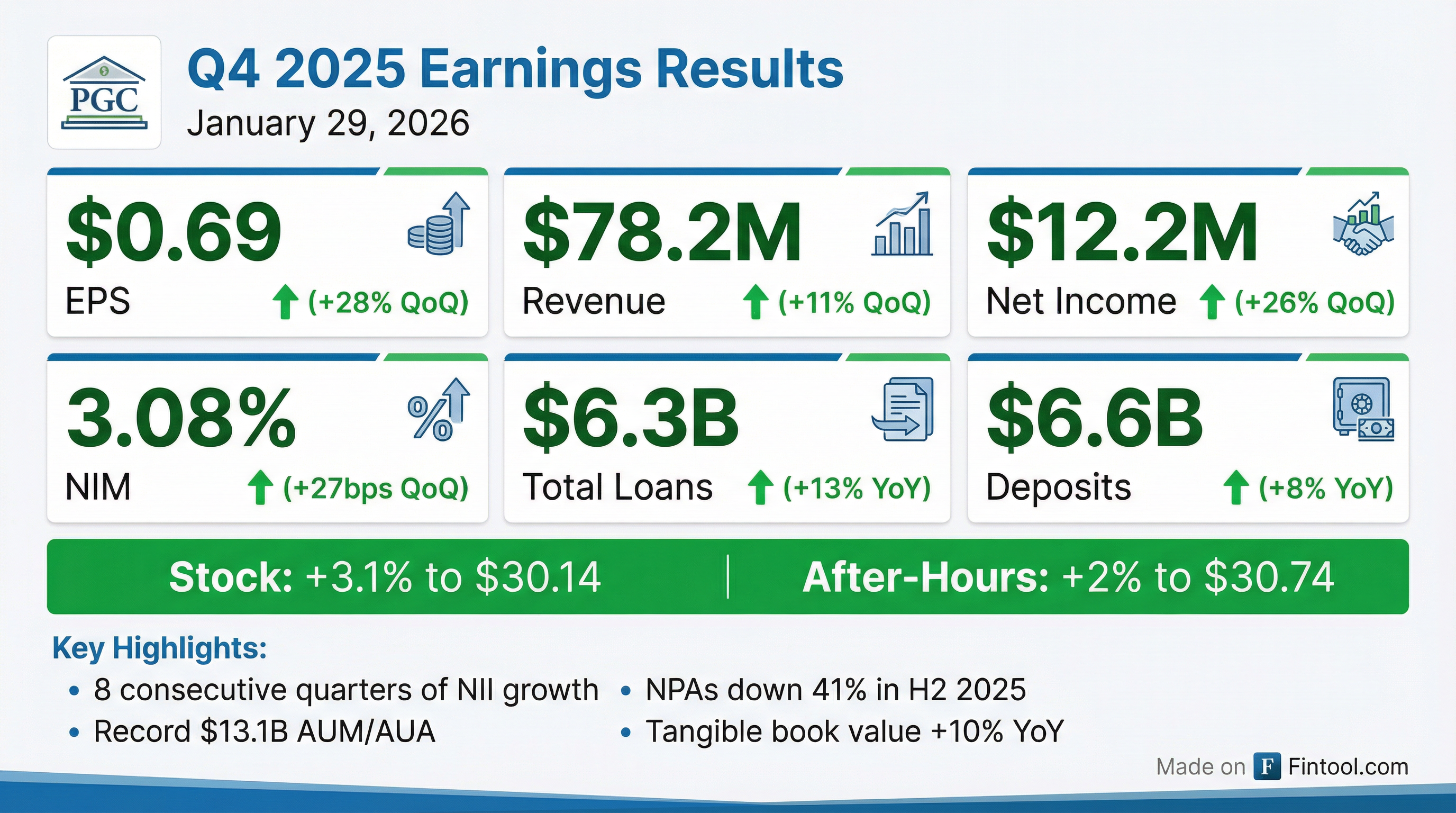

- Peapack-Gladstone Financial Corporation reported net income of $12.2 million and diluted EPS of $0.69 for Q4 2025, marking a 26% and 28% increase, respectively, over Q3 2025. For the full year 2025, net income grew 13% to $37.3 million and diluted EPS increased 14% to $2.10 compared to 2024.

- Net interest income increased 12% to $56.5 million in Q4 2025, and the net interest margin (NIM) expanded to 3.08% from 2.81% in Q3 2025. This was supported by robust deposit growth, with total deposits reaching $6.6 billion (up 8% year-over-year) and noninterest-bearing deposits increasing 28% in 2025.

- Total loans grew 13% to $6.3 billion during 2025 , and the Wealth Management Division's assets under management and administration (AUM/AUA) reached a record $13.1 billion at year-end. The company also improved its efficiency ratio to 68% and reduced nonperforming assets by 19% quarter-over-quarter.

Jan 29, 2026, 9:44 PM

PGC Reports Strong Q4 and Full-Year 2025 Financial Results

PGC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- PGC reported diluted EPS of $0.69 for Q4 2025, an increase of 28% quarter-over-quarter, and $2.10 for the full year 2025, up 14% from FY 2024.

- The company's Net Interest Margin (NIM) expanded to 3.08% in Q4 2025, increasing by 27 basis points quarter-over-quarter and 62 basis points year-over-year.

- PGC demonstrated strong balance sheet growth, with total loans increasing by 13% ($738 million) and core relationship deposits growing by 16% ($828 million) in 2025. Wealth Assets Under Management and/or Administration (AUM/AUA) reached a record $13.1 billion as of December 31, 2025.

- Asset quality improved, with nonperforming assets declining 19% quarter-over-quarter to $68.2 million as of December 31, 2025, and nonperforming assets to total assets at 0.91%.

- The efficiency ratio improved to 68% in Q4 2025, marking a fifth consecutive quarter of positive operating leverage.

Jan 29, 2026, 9:00 PM

Enthusiast Gaming Reports Q3 2025 Financial Results

PGC

Earnings

Revenue Acceleration/Inflection

M&A

- Enthusiast Gaming reported net income of $7.0 million, or $0.04 per share, for Q3 2025, a significant improvement from a net loss of $6.7 million, or $(0.04) per share, in Q3 2024.

- Revenue for Q3 2025 was $7.3 million, a decrease from $10.8 million in Q3 2024, as the company focuses on monetizing its owned and operated websites, leading to a gross margin of 86.9%, up from 68.8% in Q3 2024.

- Adjusted EBITDA from continuing operations was $0.3 million in Q3 2025, compared to $0.5 million in Q3 2024. For the nine months ended September 30, 2025, Adjusted EBITDA from continuing operations was $1.2 million, compared to a loss of $0.1 million in the year-ago period.

- The company completed the sale of its Direct Sales Media Business and related creative assets in Q3, resulting in a gain on sale of subsidiaries and assets of $5.5 million, and has been cash-flow positive every month since July.

Nov 13, 2025, 10:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more