Earnings summaries and quarterly performance for Outdoor Holding.

Executive leadership at Outdoor Holding.

Board of directors at Outdoor Holding.

Research analysts who have asked questions during Outdoor Holding earnings calls.

Recent press releases and 8-K filings for POWW.

Outdoor Holding Company Reports Strong Q3 2026 Results with Increased Profitability

POWW

Earnings

Share Buyback

New Projects/Investments

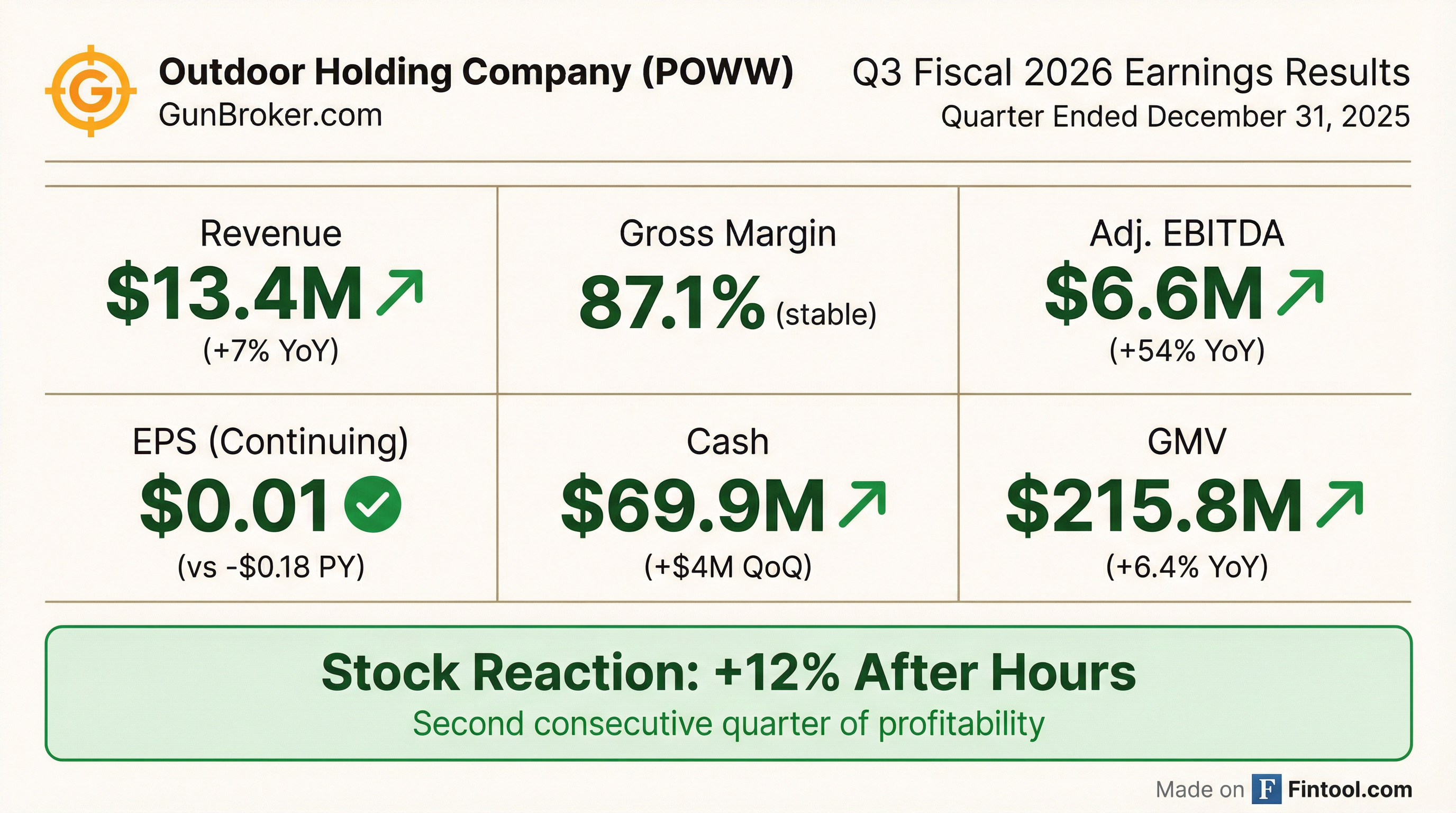

- Outdoor Holding Company reported strong fiscal Q3 2026 results, with net sales of $13.4 million, a 7% increase year-over-year, and net income before discontinued operations of $1,465,000 compared to a loss in the prior year.

- Adjusted EBITDA increased 54% to $6.5 million for the quarter, driven by significant operating expense reductions of approximately $22 million year-over-year, including a $1.4 million decline in recurring corporate operating expenses.

- The company aims to achieve a $25 million Adjusted EBITDA run rate before sales growth over the next 12 months and plans to deploy its share repurchase program now that the earnings-related blackout has ended.

- Strategic initiatives include a partnership with Master FFL to streamline the firearms transfer process, incurring an initial investment of $60,000-$120,000 per month impacting COGS, and prioritizing universal payments to enhance the buyer experience and increase take rates.

- The current cash balance stands at $69.9 million, and the company notes increased accessibility to bank debt, which could be used for capital allocation strategies like paying off preferred stock or further share buybacks.

Feb 9, 2026, 2:00 PM

Outdoor Holding Company Reports Strong Q3 2026 Financial Results

POWW

Earnings

Share Buyback

New Projects/Investments

- Outdoor Holding Company reported strong financial results for Q3 fiscal 2026, with net sales of $13.4 million, an increase of 7%, and a gross margin of 87%.

- The company achieved net income of $1,465,000 and earnings per share of $0.01, a significant improvement from a loss in the prior year, driven by a 54% increase in Adjusted EBITDA to $6.5 million due to approximately $22 million in operating expense reductions.

- Outdoor Holding Company generated over $4 million in cash from operations, resulting in a current cash balance of $69.9 million, and intends to deploy capital through its share repurchase program as well as exploring opportunities for reasonably priced bank debt.

- The company is focused on improving user experience through strategic investments like the Master FFL partnership and the development of universal payments to increase take rates and GMV.

Feb 9, 2026, 2:00 PM

Outdoor Holding Company Reports Strong Q3 2026 Results with Increased Profitability and Strategic Initiatives

POWW

Earnings

Guidance Update

Share Buyback

- Outdoor Holding Company reported strong fiscal Q3 2026 results, with net sales of $13.4 million, a 7% increase, and a significant turnaround in profitability, achieving net income of $1,465,000 compared to a loss in the prior year.

- Adjusted EBITDA for Q3 2026 increased 54% to $6.5 million, representing a robust 49% of net sales, primarily driven by substantial operating expense reductions of approximately $22 million year-over-year.

- The company is pursuing strategic initiatives to enhance user experience and increase its take rate, including a partnership with Master FFL and the high-priority implementation of universal payments, which could impact 30% of transactions.

- Management aims to achieve a $25 million Adjusted EBITDA run rate over the next 12 months and plans to deploy its share repurchase program now that the blackout period has ended, leveraging a current cash balance of $69.9 million. Legal costs continue to impact cash generation, but regulatory changes may open opportunities for reasonably priced bank debt.

Feb 9, 2026, 2:00 PM

Outdoor Holding Company Reports Continued Profitability in Q3 Fiscal 2026

POWW

Earnings

Revenue Acceleration/Inflection

Legal Proceedings

- Outdoor Holding Company reported a 7% increase in net revenues to $13.39 million for the third fiscal quarter ended December 31, 2025, achieving net income before discontinued operations of $1.46 million and diluted EPS from continuing operations of $0.01, marking its second consecutive quarter of net profitability.

- Operating expenses decreased by $21.76 million year-over-year, contributing to an increase in Adjusted EBITDA to $6.55 million from $4.26 million in the same period last year.

- The company ended the quarter with $69.9 million in cash and cash equivalents, up from $65.7 million as of September 30, 2025, and generated over $4 million in cash from operations.

- GunBroker.com's total gross merchandise value (GMV) increased 6.4% to $215.8 million, with firearm sales up 8%. The company also settled outstanding litigation and an SEC enforcement action.

Feb 9, 2026, 12:05 PM

Outdoor Holding Company Reports Q3 Fiscal 2026 Results

POWW

Earnings

Revenue Acceleration/Inflection

Legal Proceedings

- Outdoor Holding Company reported net revenues of $13.39 million for its third fiscal quarter ended December 31, 2025, representing a 7% increase compared to the same period last year.

- The company achieved net income before discontinued operations of $1.46 million, marking its second consecutive quarter of net profitability, a significant improvement from a net loss of $(21.18) million in the prior year period.

- Adjusted EBITDA increased to $6.55 million from $4.26 million year-over-year, driven by a $21.76 million decrease in operating expenses.

- The company ended the quarter with $69.9 million in cash and cash equivalents, an increase from $65.7 million as of September 30, 2025, having generated over $4 million in cash from operations during the quarter.

- Operational highlights included a 6.4% increase in total gross merchandise value (GMV) to $215.8 million and the settlement of outstanding litigation and an enforcement action by the Securities Exchange Commission.

Feb 9, 2026, 12:00 PM

Outdoor Holding Company Authorizes Share Repurchase Program

POWW

Share Buyback

- Outdoor Holding Company's Board of Directors authorized a discretionary share repurchase program on January 4, 2026.

- The company may repurchase up to $15 million of its outstanding common stock.

- This program is effective over the next twelve (12) months.

- Repurchases will be funded from existing cash balances, future operating cash flows, or other legally available funds.

Jan 5, 2026, 11:31 AM

Outdoor Holding Company Authorizes Share Repurchase Program

POWW

Share Buyback

- Outdoor Holding Company (POWW) announced that its Board of Directors has authorized a discretionary share repurchase program for up to $15 million of its outstanding common stock.

- This program is effective for the next twelve (12) months.

- The company stated that this authorization reflects a focus on disciplined capital allocation and long-term shareholder value.

Jan 5, 2026, 11:30 AM

Outdoor Holding Company Settles SEC Administrative Matter

POWW

Legal Proceedings

Financial Restatement

Management Change

- Outdoor Holding Company (OHC) announced on December 16, 2025, that it reached a settlement with the U.S. Securities and Exchange Commission (SEC) to resolve a previously disclosed investigation.

- The settlement does not include a civil penalty or monetary sanction for OHC.

- OHC agreed to cease and desist from future violations of federal securities laws, which stemmed from issues including undisclosed executive officer roles, related party transactions, improper capitalization of costs, understated stock compensation expenses, misleading Adjusted EBITDA calculations, and inadequate internal accounting controls.

- As part of its remediation, OHC has restated financial statements for fiscal years 2022, 2023, and 2024, each quarter within fiscal year 2024, and the first quarter of fiscal year 2025.

- The company has also replaced prior senior leadership, expanded accounting personnel, and implemented enhanced internal controls and governance, including adding two new independent board members in August 2025.

Dec 16, 2025, 11:30 AM

Outdoor Holding Company Reports Strong Q2 2026 Financial Turnaround

POWW

Earnings

Share Buyback

Legal Proceedings

- Outdoor Holding Company reported Q2 2026 net sales of $11,984,000, which were essentially flat year-over-year, and maintained a strong gross margin of 87.1%.

- The company achieved a net income from continuing operations of $1,405,000 (or $0.01 EPS) for the quarter, a significant improvement from a loss in the prior year, and generated $2.3 million in cash primarily from operations.

- Adjusted EBITDA increased by 24% to $4.9 million, largely due to a significant $6.7 million reduction in operating expenses.

- Despite broader industry trends showing adjusted NIX down over 5%, the company's firearm sales on GunBroker were up over 3%, leading to an increase in market share.

- Outdoor Holding Company ended the quarter with approximately $65.7 million in cash and intends to use part of this balance for share repurchases.

Nov 10, 2025, 2:00 PM

Outdoor Holding Company Reports Q2 Fiscal 2026 Results with First Quarterly Profit

POWW

Earnings

Revenue Acceleration/Inflection

Delisting/Listing Issues

- Outdoor Holding Company reported its first quarterly profit in several periods, with net income from continuing operations of $1.40 million for the second fiscal quarter ended September 30, 2025, a significant improvement from a net loss of ($5.87) million in the prior year period.

- Net revenues were $11.98 million, flat year-over-year, while Adjusted EBITDA increased to $4.91 million from $3.95 million, and diluted EPS from continuing operations improved to $0.01 from ($0.06).

- Operational efficiencies contributed to a $6.71 million decrease in operating expenses year-over-year and an improved gross profit margin of 87.1%.

- The company completed the divestiture of its ammunition manufacturing division, transitioning to a pure-play e-commerce marketplace operator, and regained full compliance with Nasdaq Continued Listing Rules.

Nov 10, 2025, 12:05 PM

Quarterly earnings call transcripts for Outdoor Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more