Earnings summaries and quarterly performance for Ralliant.

Research analysts who have asked questions during Ralliant earnings calls.

Julian Mitchell

Barclays Investment Bank

3 questions for RAL

Scott Graham

Seaport Research Partners

3 questions for RAL

Chris Krueger

TD Cowen

2 questions for RAL

Christopher Snyder

Morgan Stanley

2 questions for RAL

Deane Dray

RBC Capital Markets

2 questions for RAL

Ian Zaffino

Oppenheimer & Co. Inc.

2 questions for RAL

Kevin Wilson

Truist Securities

2 questions for RAL

Piyush Maheshwari

Citi

2 questions for RAL

Robert Jamieson

Vertical Research Partners

2 questions for RAL

Amit Daryanani

Evercore

1 question for RAL

David Ridley-Lane

Bank of America

1 question for RAL

Piyush Avasthy

Citi

1 question for RAL

Rob Jamison

Vertical Research Partners

1 question for RAL

Recent press releases and 8-K filings for RAL.

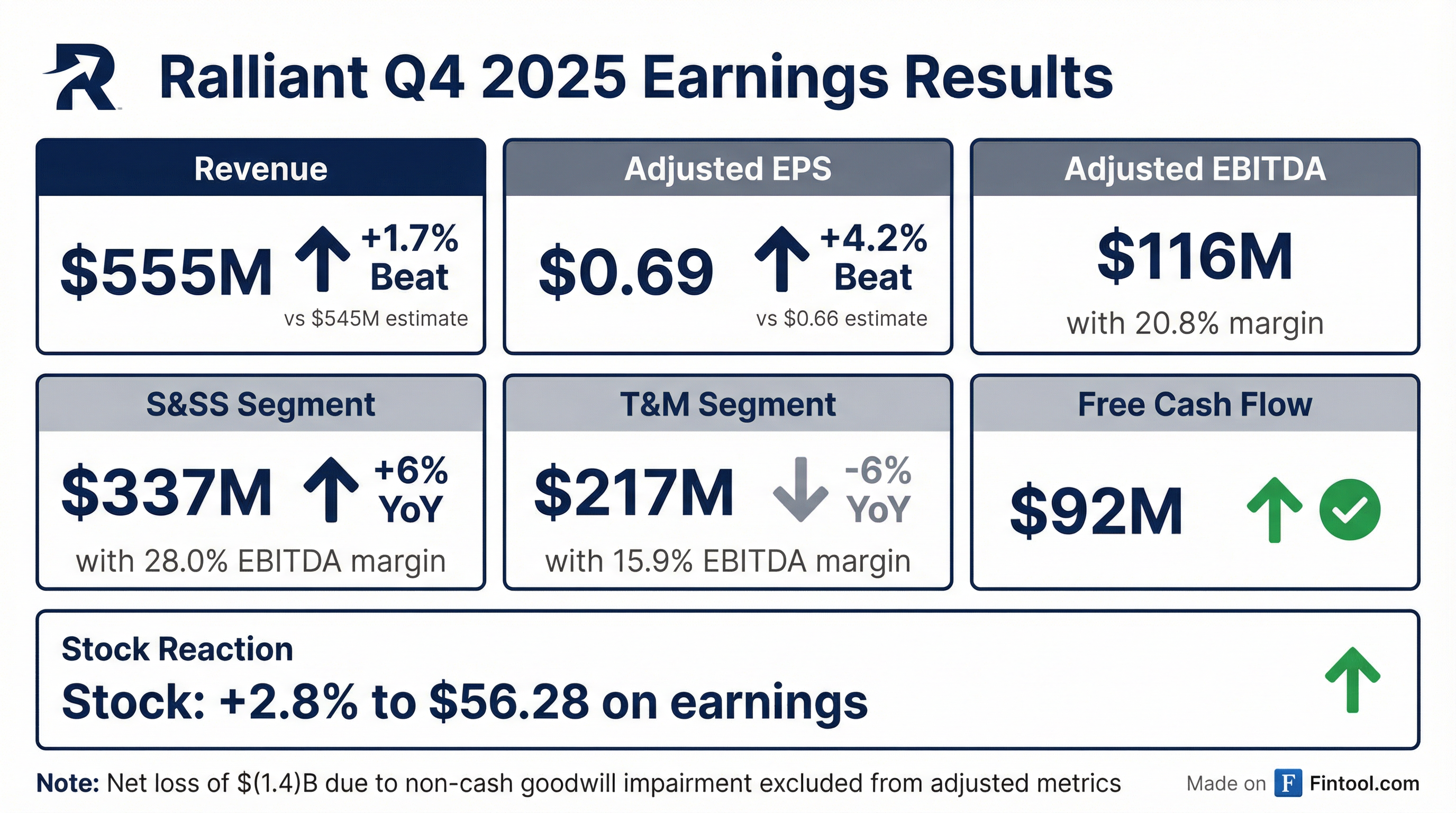

- Ralliant Corporation reported Q4 2025 revenue of $555 million, a 1% year-over-year improvement, with Adjusted EPS of $0.69 and an Adjusted EBITDA margin of 20.8%.

- The company recorded a $1.4 billion non-cash goodwill impairment in Q4 2025, primarily related to the EA business within the Test and Measurement segment, due to electric vehicle demand headwinds.

- For Q1 2026, Ralliant expects revenue between $508 million and $522 million, and Adjusted EPS of $0.46 to $0.52.

- Full-year 2026 guidance projects revenue between $2.1 billion and $2.2 billion and Adjusted EPS of $2.22 to $2.42.

- The company authorized a quarterly cash dividend of $0.05 per share and has a $200 million share repurchase authorization remaining.

- Ralliant Corporation reported Q4 2025 revenue of $555 million, a 1% year-over-year improvement, with an Adjusted EBITDA margin of 20.8% and Adjusted EPS of $0.69. The company generated $92 million in free cash flow, achieving a 117% conversion rate over the trailing 12 months, and maintained net leverage of 1.9x adjusted EBITDA.

- A $1.4 billion non-cash goodwill impairment was recorded in Q4 2025, primarily related to the EA, Elektro-Automatik business within the Test and Measurement segment, due to lower-than-expected electric vehicle demand and revised forecasts.

- For Q1 2026, Ralliant forecasts revenue between $508 million and $522 million, Adjusted EBITDA margin of 17%-18%, and Adjusted EPS of $0.46-$0.52 per share. The full-year 2026 guidance includes revenue of $2.1 billion-$2.2 billion, Adjusted EBITDA margin of 18%-20%, and Adjusted EPS of $2.22-$2.42 per share.

- The Sensors and Safety Systems segment grew 6% year-over-year in Q4 2025, while the Test and Measurement segment revenue declined 6% year-over-year but showed sequential improvement. The company plans to increase CapEx to 2%-3% of revenue in 2026 to invest in commercial, innovation, and manufacturing for growth.

- Ralliant reported Q4 2025 revenue of $555 million, a 1% year-over-year increase, with an adjusted EBITDA margin of 20.8% and adjusted EPS of $0.69. The company also generated $92 million in free cash flow, achieving a 117% conversion rate over the trailing twelve months.

- The company recorded a $1.4 billion non-cash goodwill impairment in Q4 2025 related to the Elektro-Automatik (EA) business, acquired in January 2024, due to lower-than-expected electric vehicle demand and revised industry forecasts.

- For Q1 2026, Ralliant expects revenue between $508 million and $522 million, an adjusted EBITDA margin of 17%-18%, and adjusted EPS of $0.46-$0.52 per share.

- For the full year 2026, the company projects revenue of $2.1 billion-$2.2 billion, an adjusted EBITDA margin of 18%-20%, and adjusted EPS of $2.22-$2.42 per share.

- Ralliant is focusing on organic investments in commercial, innovation, and manufacturing, particularly in its Sensors and Safety Systems segment, and has authorized a quarterly cash dividend of $0.05 per share and a $200 million share repurchase authorization.

- Ralliant reported Q4 2025 revenue of $555 million and Adjusted EPS of $0.69, with total revenue increasing 1% year-over-year but organic growth remaining flat.

- For Q1 2026, the company anticipates revenue between $508 million and $522 million and Adjusted EPS between $0.46 and $0.52.

- Full-year 2026 guidance projects revenue of $2.1 billion to $2.2 billion, Adjusted EPS of $2.22 to $2.42, and organic revenue growth of +3% to +5%.

- The company declared a quarterly dividend of $0.05 per share on January 29, 2026, and has a $200 million share repurchase authorization that remains fully available.

- Ralliant Corporation reported Q4 2025 revenue of $555 million, a 1% increase year-over-year, and a net loss of $(1.4) billion or $(12.10) per diluted share. This net loss included a $1.4 billion non-cash goodwill impairment charge in the Test & Measurement segment, driven by revised expectations for the EA Elektro-Automatik business due to slower-than-anticipated EV adoption.

- Adjusted diluted earnings per share (EPS) for Q4 2025 was $0.69.

- The company generated $102 million in operating cash flow and $92 million in free cash flow in Q4 2025.

- For Q1 2026, Ralliant anticipates revenue between $508 million and $522 million and adjusted EPS between $0.46 and $0.52.

- The Board of Directors declared a quarterly cash dividend of $0.05 per share for Q1 2026 and noted that a $200 million share repurchase authorization remains fully available.

- Ralliant reported Q4 2025 revenue of $555 million and a net loss of $(1.4) billion, primarily due to a $1.4 billion non-cash goodwill impairment charge, leading to a diluted net loss per share of $(12.10), while adjusted diluted EPS was $0.69.

- For the full year 2025, the company recorded a net loss of $(1,222.5) million or $(10.78) per diluted share, with adjusted net earnings of $305.3 million or $2.69 per adjusted diluted share.

- Ralliant issued Q1 2026 revenue guidance of $508 to $522 million and adjusted EPS of $0.46 to $0.52.

- For full-year 2026, the company projects revenue of $2.1 to $2.2 billion and adjusted EPS of $2.22 to $2.42.

- The Board of Directors declared a quarterly cash dividend of $0.05 per share for Q1 2026 and noted a $200 million share repurchase authorization remains fully available.

- Ralliant Corporation entered into Amendment No. 1 to its Credit Agreement on November 24, 2025.

- The amendment reduces the Term SOFR interest rate by 0.10% for the company's revolving credit facility and term loans.

- It also eliminates the ratings-based pricing grid that previously applied to the revolving credit facility and term loans.

- The company permanently reduced outstanding undrawn commitments to $0 for its three-year and eighteen-month term loans, thereby eliminating the 0.125% ticking fee on these commitments.

- Ralliant, an independent public company since its spin-off five months ago (June 30th), operates with two segments: Sensors and Safety Systems (60% of business) and Test and Measurement (40% of business), reporting $2 billion in revenue last year.

- The company highlights strong growth vectors in defense, with almost twice its annual revenues in backlog for 2026-2028, and power grid modernization, driven by aging infrastructure and retrofits.

- Ralliant plans to increase its CapEx rate from 2% to 2%-3% of revenue by 2026 to support organic growth, including potential expansion of its defense business footprint by 2027-2028.

- The Test and Measurement segment is experiencing a modest recovery, showing 400-500 basis points of margin improvement from Q2 to Q3, with new product launches like the MP5000 opening new market adjacencies.

- Ralliant recently completed its spin-off, holding its first earnings call as an independent public company after separating about five months ago (June 30th). The company reported $2 billion in revenue last year with 7,000 employees globally.

- The business is diversified into Sensors and Safety Systems (60%) and Test and Measurement (40%). The Sensors and Safety Systems segment, particularly its defense business, has a strong backlog with almost twice its annual revenues established for 2026, 2027, and 2028.

- Key growth vectors include defense, power grid, and electrification. The power grid business is capitalizing on aging infrastructure and a two-year transformer waitlist through retrofits and AI-driven analytics.

- The Test and Measurement segment is showing sequential revenue improvement despite negative year-over-year trends, with new product launches aimed at expanding market share and driving future growth.

- Ralliant's capital allocation prioritizes organic growth and shareholder returns, with CapEx projected to increase from 2% to 2%-3% of revenue by 2026 to fund growth initiatives.

- Ralliant, which became an independent public company five months ago, recently held its first earnings call and operates with two segments: Sensors and Safety Systems (60% of business) and Test and Measurement (40% of business), reporting $2 billion in revenue last year.

- The Sensors and Safety Systems segment, including the PacSci EMC defense business, has a strong backlog of nearly twice its annual revenues for 2026-2028 and plans capacity expansion. The power grid business is capitalizing on the need to upgrade 70% of the U.S. grid infrastructure that is over 25 years old.

- The Test and Measurement segment is experiencing a modest recovery with sequential revenue improvement since Q1 and has launched two new products, including the MP5000, which opens a new market adjacency.

- Ralliant targets a total growth rate of 3%-5% and plans to increase its CapEx rate from 2% to 2%-3% of revenue in 2026 to support organic growth. The Sensors and Safety Systems segment operates at high 20s EBITDA %, while Test and Measurement aims for mid-teens to low 20s through cycle, showing 400-500 basis points improvement from Q2 to Q3.

Quarterly earnings call transcripts for Ralliant.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more