Earnings summaries and quarterly performance for RPC.

Executive leadership at RPC.

Board of directors at RPC.

Research analysts who have asked questions during RPC earnings calls.

JD

John Daniel

Daniel Energy Partners

5 questions for RES

Also covers: ACDC, CLB, CVEO +19 more

DC

Donald Crist

Johnson Rice & Company, L.L.C.

3 questions for RES

Also covers: AESI, ARIS, FTK +6 more

Stephen Gengaro

Stifel Financial Corp.

3 questions for RES

Also covers: ACDC, AESI, AMRC +24 more

CM

Charles Minervino

Susquehanna International Group

2 questions for RES

Also covers: DNOW, MRC, OIS

Derek Podhaizer

Piper Sandler Companies

2 questions for RES

Also covers: AESI, FLOC, FTI +14 more

DC

Don Crist

Johnson Rice & Company L.L.C.

2 questions for RES

Also covers: AESI, CLB, HP +4 more

CM

Chuck Minervino

Susquehanna

1 question for RES

KB

Kassimo Boda

Gabelli

1 question for RES

Recent press releases and 8-K filings for RES.

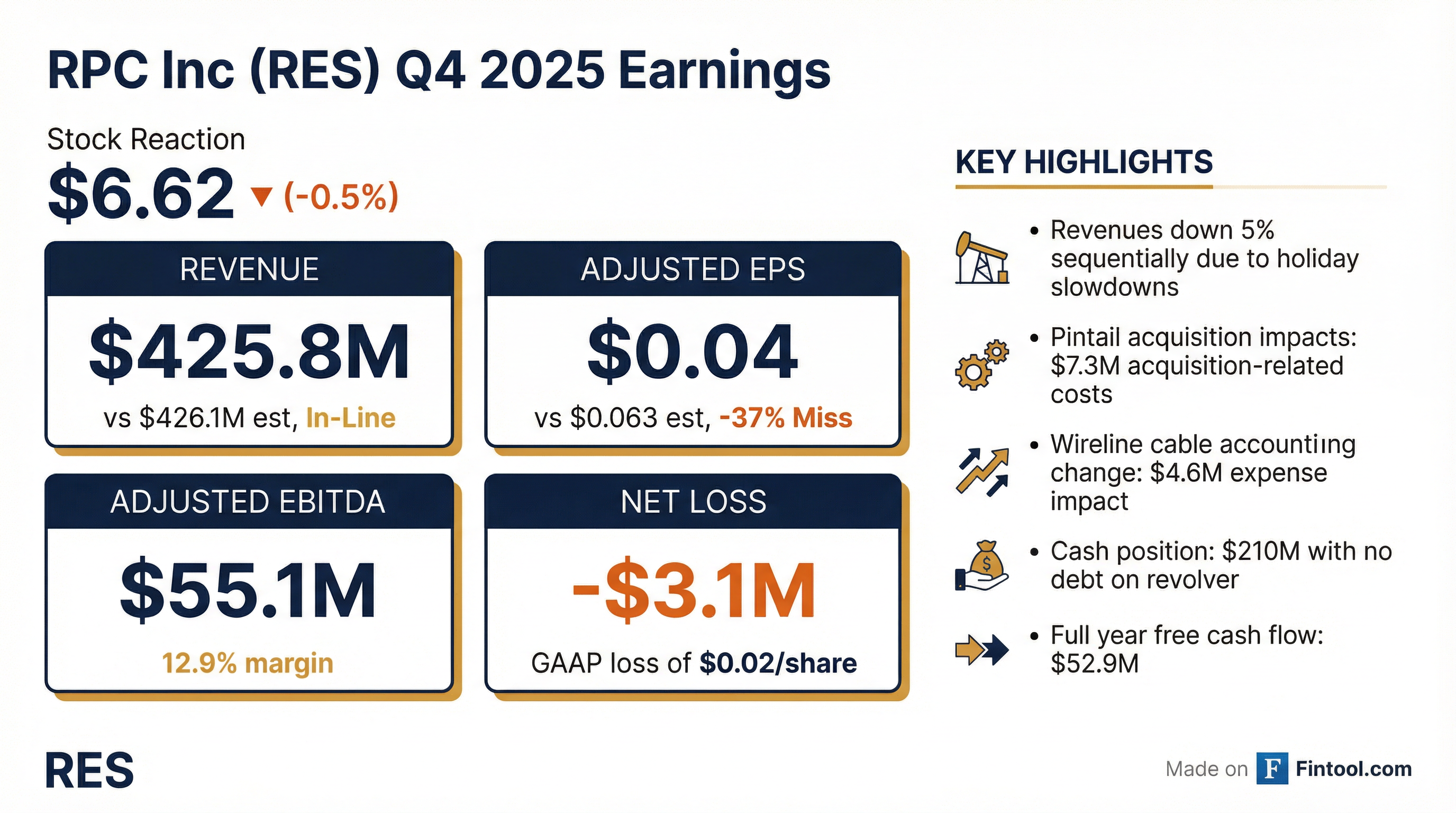

RPC Inc. Reports Q4 2025 Results with Sequential Revenue Decline

RES

Earnings

Demand Weakening

Accounting Changes

- RPC Inc. reported Q4 2025 revenues of $426 million, representing a 5% sequential decrease from Q3 2025, with adjusted diluted EPS of $0.04 and adjusted EBITDA of $55.1 million.

- The sequential revenue decline was broad-based, with pressure pumping revenues decreasing 6% due to holiday shutdowns and a fleet idled in October, which the company does not expect to reactivate until returns improve.

- The company changed its accounting treatment for wireline cables from capitalization to expensing, effective Q4 2025, due to increased activity and a change in work type, which impacted cost of revenues and reduced capital expenditures.

- RPC Inc. ended Q4 2025 with approximately $210 million in cash and anticipates 2026 capital expenditures to be in the range of $150 million-$180 million, including $15 million delayed from 2025.

4 days ago

RPC Inc. Reports Q4 2025 Financial Results with Revenue Decline and Accounting Change

RES

Earnings

Demand Weakening

Accounting Changes

- RPC Inc. reported Q4 2025 revenues of $426 million, a 5% sequential decrease, with adjusted diluted EPS at $0.04 and adjusted EBITDA of $55.1 million, reflecting broad-based declines across most businesses.

- The company experienced a sequential revenue decline across the majority of its service lines, particularly in December, with pressure pumping revenues decreasing 6% and technical services revenues down 4%.

- RPC Inc. changed its accounting treatment for wireline cables in Q4 2025, now expensing them instead of capitalizing, due to increased activity and changes in work type, which increased cost of revenues and reduced capital expenditures but had no free cash flow impact.

- Full year 2025 capital expenditures totaled $148 million, and the company projects 2026 capital expenditures to be between $150 million and $180 million, with flexibility to adjust spending based on activity.

- Despite a challenging 2025, RPC Inc. maintains a strong balance sheet with $210 million in cash and is focused on strategic growth in less capital-intensive service lines, evaluating M&A and potential stock buybacks.

4 days ago

RPC Inc. Reports Q4 2025 Revenue Decline and Operational Adjustments

RES

Earnings

Demand Weakening

Accounting Changes

- RPC Inc. reported Q4 2025 revenues of $426 million, representing a 5% sequential decrease, with adjusted diluted EPS of $0.04 and adjusted EBITDA of $55.1 million.

- The sequential revenue decline was broad-based across most service lines, including a 6% decrease in pressure pumping, which led to the idling of a fleet in October 2025.

- Effective Q4 2025, the company changed its accounting for wireline cables from capitalization to expensing due to increased activity and changes in work type, impacting cost of revenues and capital expenditures but not free cash flow.

- RPC Inc. ended Q4 2025 with approximately $210 million in cash and no borrowings on its revolving credit facility, while projecting 2026 capital expenditures to be in the range of $150 million-$180 million.

- Management noted that recent winter storms in Q1 2026 will impact near-term profitability due to lost operating days and associated costs, and they are evaluating M&A opportunities in oilfield services and broader energy sectors.

4 days ago

RPC, Inc. Reports Q4 and Full Year 2025 Financial Results

RES

Earnings

Accounting Changes

Demand Weakening

- RPC, Inc. reported Q4 2025 revenues of $425.8 million, a 5% sequential decrease, while full-year 2025 revenues grew 15% to $1.6 billion, primarily due to the Pintail Completions acquisition.

- The company posted a net loss of $3.1 million and Loss Per Share of $0.02 for Q4 2025, a significant decline from the prior quarter's net income. Full-year 2025 net income was $32.1 million, down 65% year-over-year.

- Adjusted EBITDA for Q4 2025 was $55.1 million, a sequential decrease, partly impacted by a $4.6 million change in accounting for wireline cable expenses. Full-year Adjusted EBITDA was $232.7 million, essentially flat compared to the prior year.

- RPC, Inc. ended 2025 with $210.0 million in cash and cash equivalents and no outstanding debt on its credit facility. The company returned $35.1 million in dividends and repurchased $2.9 million of common stock during the year.

- Management cited modest revenue declines in Q4 due to holiday slowdowns and a weak December with reduced customer activity, noting a challenging macro environment and increased crude oil price volatility.

4 days ago

RPC, Inc. Reports Fourth Quarter and Full Year 2025 Financial Results

RES

Earnings

Accounting Changes

M&A

- RPC, Inc. reported fourth quarter 2025 revenues of $425.8 million, a 5% sequential decrease, leading to a net loss of $3.1 million and $0.02 loss per share.

- For the full year 2025, revenues increased 15% to $1.6 billion, primarily due to the Pintail Completions acquisition, while net income decreased 65% to $32.1 million (or $0.15 EPS).

- The company's adjusted diluted EPS was $0.04 for Q4 2025 and $0.25 for the full year 2025.

- RPC generated $201.3 million in net cash from operating activities and $52.9 million in free cash flow for the full year 2025, and returned capital to shareholders through $35.1 million in dividends and $2.9 million in stock repurchases.

- A significant accounting change in Q4 2025 involved expensing wireline cables, which were previously capitalized, negatively impacting operating income and Adjusted EBITDA.

4 days ago

RPC Inc. Reports Q3 2025 Financial Results with Revenue Growth and Strategic Shift

RES

Earnings

Guidance Update

Demand Weakening

- RPC Inc. reported a 6% sequential increase in Q3 2025 revenues to $447.1 million, with adjusted EBITDA reaching $72.3 million and adjusted diluted EPS at $0.09.

- The company is strategically growing less capital-intensive service lines, which accounted for 72% of total Q3 2025 revenues and saw a 3% sequential increase, while also electing to lay down a pressure pumping fleet in October and reduce staffing.

- RPC Inc. ended Q3 2025 with over $163 million in cash and no outstanding debt, while projecting full-year 2025 capital spending between $170 million to $190 million.

- Management anticipates continued challenging conditions in the oilfield services market in the near term due to market uncertainties and reported an unusually high effective tax rate of 42.6% for Q3 2025.

Oct 30, 2025, 1:00 PM

RPC, Inc. Reports Third Quarter 2025 Financial Results and Declares Dividend

RES

Earnings

Dividends

Demand Weakening

- RPC, Inc. reported revenues of $447.1 million for the third quarter ended September 30, 2025, a 6% sequential increase, with net income rising 28% sequentially to $13.0 million and diluted Earnings Per Share (EPS) of $0.06.

- Adjusted EBITDA for Q3 2025 was $72.3 million, representing a 10% sequential increase.

- The Board of Directors declared a regular quarterly cash dividend of $0.04 per share, payable on December 10, 2025.

- Management observed sequential improvement in most service line revenues, including a 14% increase in pressure pumping and a 19% increase in coiled tubing.

- The company anticipates additional headwinds in the fourth quarter due to oil prices recently dipping below $60 a barrel, expected holiday slowdowns, and customer budget exhaustion.

Oct 30, 2025, 11:21 AM

RPC Reports Third Quarter 2025 Financial Results and Declares Dividend

RES

Earnings

Dividends

Demand Weakening

- RPC, Inc. reported revenues of $447.1 million for the third quarter ended September 30, 2025, marking a 6% sequential increase.

- Net income for Q3 2025 was $13.0 million, up 28% sequentially, with diluted Earnings Per Share (EPS) at $0.06.

- Adjusted EBITDA increased 10% sequentially to $72.3 million.

- The company's Board of Directors declared a regular quarterly cash dividend of $0.04 per share, payable on December 10, 2025.

- Management anticipates additional headwinds in the fourth quarter for the oilfield services market due to factors such as oil prices dipping below $60 a barrel, expected holiday slowdowns, and customer budget exhaustion.

Oct 30, 2025, 10:45 AM

RPC, Inc. Reports Q3 2025 Earnings and Details Strategic Acquisitions

RES

Earnings

M&A

New Projects/Investments

- RPC, Inc. reported Q3 2025 revenues of $447.1 million, a 6% sequential increase, with net income of $13.0 million and diluted earnings per share of $0.06.

- The company completed the acquisition of Pintail (wireline) in April 2025 for $245 million, which generated $409 million in 2024 revenues, and Spinnaker (cementing) in 2023 for $80 million.

- RPC is strategically rebalancing its service line portfolio, with Pressure Pumping now representing approximately one-third of total revenues, and is focused on increasing operational scale and leveraging costs through M&A.

- For the full year 2024, RPC, Inc. recorded revenues of $1,415.0 million and net income of $91.4 million.

Oct 29, 2025, 11:00 PM

Canadian North Resources Reports High Metal Extraction Rates from Bioleaching Tests

RES

New Projects/Investments

- Canadian North Resources Inc. confirmed high metal extractions in the second set of bioleaching lab-scale tests for its Ferguson Lake project, achieving 99% Nickel, 98% Cobalt, and 90.6% Copper from massive sulphides.

- The bioleaching process demonstrated the ability to maintain self-sustaining reactions at low temperatures (52 - 65°C) without external acid or heat, suggesting a low-energy consumption development potential.

- Copper extraction rates reached 90.6% in 65°C bench-scale tests, with most metals (87.7% Cu, 98.6% Ni, and 98.2% Co) extracted within a 28-day leach time.

- Initial treatment of bioleaching residues also showed over 80% recoveries for palladium (82%) and gold (83%).

Oct 7, 2025, 12:00 PM

Quarterly earnings call transcripts for RPC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more