Earnings summaries and quarterly performance for RADIANT LOGISTICS.

Executive leadership at RADIANT LOGISTICS.

Board of directors at RADIANT LOGISTICS.

Research analysts who have asked questions during RADIANT LOGISTICS earnings calls.

EA

Elliot Alper

TD Cowen

5 questions for RLGT

Also covers: ARCB, CVLG, FDX +5 more

Jeffrey Kauffman

Vertical Research Partners

4 questions for RLGT

Also covers: ARCB, CHRW, CMI +14 more

KG

Kevin Gainey

Thompson, Davis & Company, Inc.

3 questions for RLGT

Also covers: GLDD, GVA, GXO +3 more

MA

Mark Argento

Lake Street Capital Markets

2 questions for RLGT

Also covers: GAIA, HGBL, JRSH +2 more

JS

Jason Seidl

TD Cowen

1 question for RLGT

Also covers: ARCB, CHRW, CSX +17 more

Recent press releases and 8-K filings for RLGT.

Radiant Logistics Reports Q2 2026 Results, Highlights Adjusted EBITDA Growth and New Technology Initiatives

RLGT

Earnings

New Projects/Investments

Share Buyback

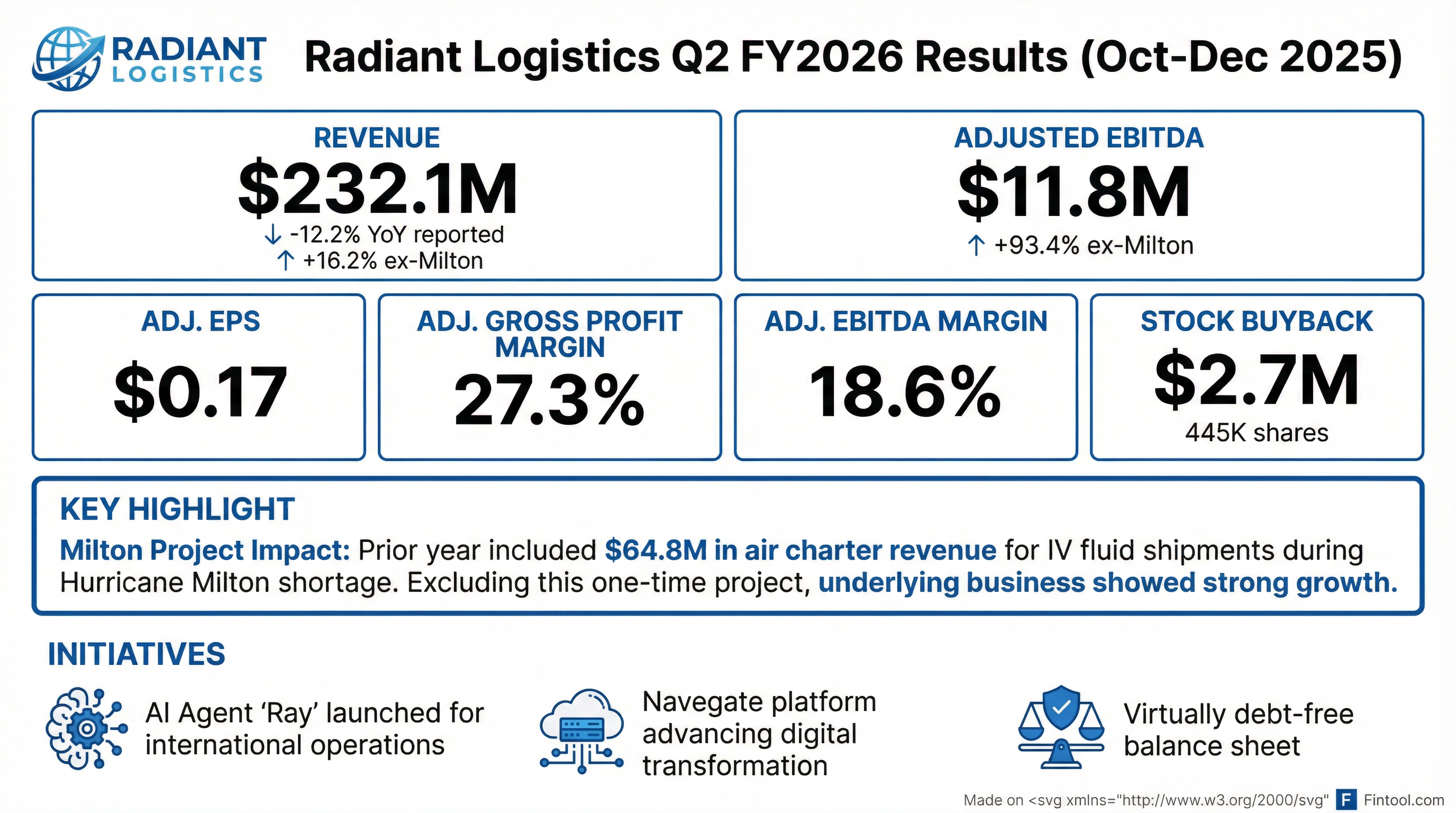

- For the second fiscal quarter ended December 31, 2025, Radiant Logistics reported revenues of $232.1 million and net income attributable to Radiant Logistics of $5.305 million, or $0.11 per basic and fully diluted share.

- Adjusted EBITDA for Q2 2026 was $11.774 million. When excluding $5.9 million in Adjusted EBITDA from Project Milton in the comparable prior year period, Adjusted EBITDA increased by $5.7 million, or 93.4%, compared to Q2 2025. The adjusted gross profit margin improved by 340 basis points to 27.3%.

- The company launched Ray, its first AI-powered agent to streamline international quote requests, and continues to develop its Navegate global trade management and collaboration platform, which is expected to serve as a meaningful catalyst for organic growth.

- Radiant Logistics remains virtually debt-free with no net debt as of December 31, 2025, and acquired $2.7 million of its stock through buybacks during the three months ended December 31, 2025.

Feb 9, 2026, 9:30 PM

Radiant Logistics Reports Q2 2026 Results, Highlights Normalized EBITDA Growth and Tech Initiatives

RLGT

Earnings

Share Buyback

New Projects/Investments

- Radiant Logistics reported Q2 2026 Adjusted EBITDA of $11.774 million on $232.1 million in revenues. When excluding $5.9 million from Project Milton in the prior year, Adjusted EBITDA increased by 93.4% to $11.8 million compared to $6.1 million in Q2 2025.

- The company's Adjusted Gross Profit Margin improved to 27.3% in Q2 2026 from 23.9% in the prior year, and its Adjusted EBITDA margin expanded by 780 basis points to 18.6% when excluding the Project Milton impact.

- Radiant Logistics launched Navegate, a proprietary global trade management platform, and Ray, an AI-powered agent for streamlining international quote requests, as key initiatives in its digital transformation.

- The company remains virtually debt-free with no net debt as of December 31, 2025, and acquired $2.7 million of its stock through the three months ended December 31, 2025, as part of its ongoing stock buyback program.

- Management noted a generally increasingly bullish demand environment with some improvement, despite international and ocean imports remaining relatively soft, and observed a recent tightening of capacity.

Feb 9, 2026, 9:30 PM

Radiant Logistics Reports Q2 2026 Results with Strong Adjusted EBITDA Growth Excluding Project Milton

RLGT

Earnings

Share Buyback

New Projects/Investments

- Radiant Logistics reported Q2 2026 revenues of $232.1 million and net income attributable to Radiant Logistics of $5.305 million, or $0.11 per basic and fully diluted share. This compares to revenues of $264.5 million and net income of $6.467 million, or $0.14 per basic and $0.13 per fully diluted share in Q2 2025.

- Adjusted EBITDA for Q2 2026 was $11.774 million. Excluding the $5.9 million Adjusted EBITDA from "Project Milton" in the prior year period, Adjusted EBITDA increased by $5.7 million, or 93.4%, compared to $6.1 million for Q2 2025. The adjusted gross profit margin improved 340 basis points to 27.3%.

- The company remains virtually debt-free with no net debt as of December 31, 2025. Radiant Logistics also acquired $2.7 million of its stock through the three months ended December 31, 2025, as part of its stock buyback program.

- Radiant Logistics is advancing its technology initiatives with the Navegate global trade management platform and the launch of Ray, its first AI-powered agent, aimed at enhancing visibility, automation, and operational efficiencies.

Feb 9, 2026, 9:30 PM

Radiant Logistics Announces Second Fiscal Quarter 2026 Results

RLGT

Earnings

Share Buyback

New Projects/Investments

- Radiant Logistics reported revenues of $232.1 million and net income attributable to Radiant Logistics, Inc. of $5.3 million for the second fiscal quarter ended December 31, 2025.

- Adjusted EBITDA for the second fiscal quarter ended December 31, 2025, was $11.8 million, which represents a 93.4% increase compared to the prior year period when excluding the impact of the Milton Project.

- The company launched its first AI Agent, "Ray," to streamline international operations and is advancing its digital transformation with the Navegate platform.

- Radiant Logistics repurchased 445,058 shares of its common stock at an average cost of $5.97 per share for an aggregate cost of $2.7 million during the three months ended December 31, 2025.

Feb 9, 2026, 9:28 PM

Radiant Logistics Announces Q2 2026 Results

RLGT

Earnings

Share Buyback

Product Launch

- For the second fiscal quarter ended December 31, 2025, Radiant Logistics, Inc. reported revenues of $232.1 million and net income attributable to Radiant Logistics, Inc. of $5.3 million, or $0.11 per basic and fully diluted share.

- Adjusted EBITDA was $11.8 million for the second fiscal quarter ended December 31, 2025; excluding the $5.9 million impact from the Milton Project in the prior year, adjusted EBITDA increased by 93.4% compared to the second fiscal quarter ended December 31, 2024.

- The company repurchased 445,058 shares of its common stock at an average cost of $5.97 per share for an aggregate cost of $2.7 million during the three months ended December 31, 2025.

- Radiant Logistics announced the launch of "Ray", its first AI-powered agent, to streamline international operations, and is advancing its digital transformation with the Navegate platform.

Feb 9, 2026, 9:05 PM

Radiant Logistics announces renewal of its stock repurchase program

RLGT

Share Buyback

- Radiant Logistics, Inc. announced on November 17, 2025, that its board of directors authorized the repurchase of up to five million shares of the company’s common stock.

- This repurchase program is authorized through December 31, 2027.

- As of November 14, 2025, the company had 46,873,197 shares outstanding.

- The company expects to fund these repurchases from existing cash balances, cash available under its revolving credit facility, and future cash flows from operations.

- Management believes the current share price does not adequately reflect Radiant Logistics' long-term growth prospects, making the share repurchase a potential investment opportunity.

Nov 17, 2025, 9:57 PM

Radiant Logistics Announces Renewal of Stock Repurchase Program

RLGT

Share Buyback

- Radiant Logistics, Inc. has authorized the repurchase of up to five million shares of its common stock through December 31, 2027.

- As of November 14, 2025, the company had 46,873,197 shares outstanding.

- The repurchases will be funded from existing cash balances, cash available under the company's revolving credit facility, and future cash flows from operations.

- Bohn Crain, Founder and CEO, stated that the current share price does not adequately reflect Radiant's long-term growth prospects, making the repurchase an excellent investment opportunity.

Nov 17, 2025, 9:05 PM

Radiant Logistics, Inc. Announces Q1 2026 Financial Results and Acquisition

RLGT

Earnings

M&A

Share Buyback

- Radiant Logistics, Inc. reported revenues of $226.7 million for the first fiscal quarter ended September 30, 2025, an 11.3% increase compared to the prior year period.

- Net income attributable to Radiant Logistics, Inc. for the quarter was $1.3 million, or $0.03 per basic and fully diluted share, while adjusted EBITDA was $6.8 million, which would have been $8.1 million when normalized to exclude a one-time $1.3 million bad debt expense.

- The company completed the acquisition of an 80% ownership interest in Weport, S.A. de C.V., a Mexico-based logistics provider, effective September 1, 2025.

- Radiant Logistics repurchased 139,992 shares of its common stock for $0.8 million during the quarter ended September 30, 2025, and an additional 341,466 shares for $2.0 million subsequent to quarter-end through November 7, 2025.

Nov 10, 2025, 9:55 PM

Radiant Logistics Announces First Fiscal Quarter 2025 Results

RLGT

Earnings

Share Buyback

M&A

- For the three months ended September 30, 2025, Radiant Logistics reported revenues of $226.7 million, an increase of 11.3% compared to the prior year, while net income attributable to Radiant Logistics, Inc. decreased to $1.3 million, or $0.03 per basic and fully diluted share.

- Adjusted EBITDA for the quarter was $6.8 million, a 28.4% decrease from the comparable prior year period. Normalizing for a $1.3 million bad debt expense, adjusted EBITDA would have been $8.1 million.

- The company completed the acquisition of an 80% ownership interest in Weport, S.A. de C.V., a Mexico-based logistics company, effective September 1, 2025.

- Radiant Logistics repurchased 139,992 shares of its common stock for $0.8 million during the three months ended September 30, 2025, and an additional 341,466 shares for $2.0 million subsequent to September 30, 2025, through November 7, 2025.

Nov 10, 2025, 9:05 PM

Radiant Logistics, Inc. Announces Q4 and Full Year 2025 Financial Results and Acquisition Updates

RLGT

Earnings

M&A

Share Buyback

- Radiant Logistics, Inc. reported full-year fiscal 2025 revenues of $902.7 million, a 12.5% increase year-over-year, with adjusted EBITDA growing 24.4% to $38.8 million.

- Net income attributable to Radiant Logistics, Inc. for fiscal year 2025 significantly increased to $17.3 million, or $0.37 per basic share, up from $7.7 million, or $0.16 per basic share, in the comparable prior year period.

- The company expanded its operations through three green-field acquisitions and three strategic operating partner conversions in fiscal 2025, which generated $6.0 million in adjusted EBITDA for the year.

- Effective September 1, 2025, Radiant Logistics, Inc. acquired an 80% ownership interest in Weport, S.A. de C.V., a Mexico-based company, to further scale its North American footprint.

- During fiscal year 2025, the company executed a stock buy-back, purchasing 145,717 shares of common stock for an aggregate cost of $0.8 million.

Sep 15, 2025, 8:45 PM

Quarterly earnings call transcripts for RADIANT LOGISTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more