Earnings summaries and quarterly performance for RAMBUS.

Executive leadership at RAMBUS.

Luc Seraphin

Chief Executive Officer and President

Desmond Lynch

Senior Vice President, Finance, and Chief Financial Officer

John Shinn

Senior Vice President, General Counsel, Secretary and Chief Compliance Officer

Sean Fan

Executive Vice President, Chief Operating Officer

Board of directors at RAMBUS.

Research analysts who have asked questions during RAMBUS earnings calls.

Gary Mobley

Loop Capital

8 questions for RMBS

Kevin Cassidy

Rosenblatt Securities

8 questions for RMBS

Aaron Rakers

Wells Fargo

7 questions for RMBS

Tristan Gerra

Robert W. Baird & Co.

7 questions for RMBS

Mehdi Hosseini

Susquehanna Financial Group

6 questions for RMBS

Blayne Curtis

Jefferies Financial Group

3 questions for RMBS

Kevin Garrigan

WestPark Capital

3 questions for RMBS

Nam Kim

Arete Research

2 questions for RMBS

Natalia Sukhotina Winkler

Evercore ISI

2 questions for RMBS

Sebastien Naji

William Blair

2 questions for RMBS

Bastian Falken

Susquehanna

1 question for RMBS

Bastien Faucon

Susquehanna

1 question for RMBS

Nam Hyung Kim

Arete Research

1 question for RMBS

Recent press releases and 8-K filings for RMBS.

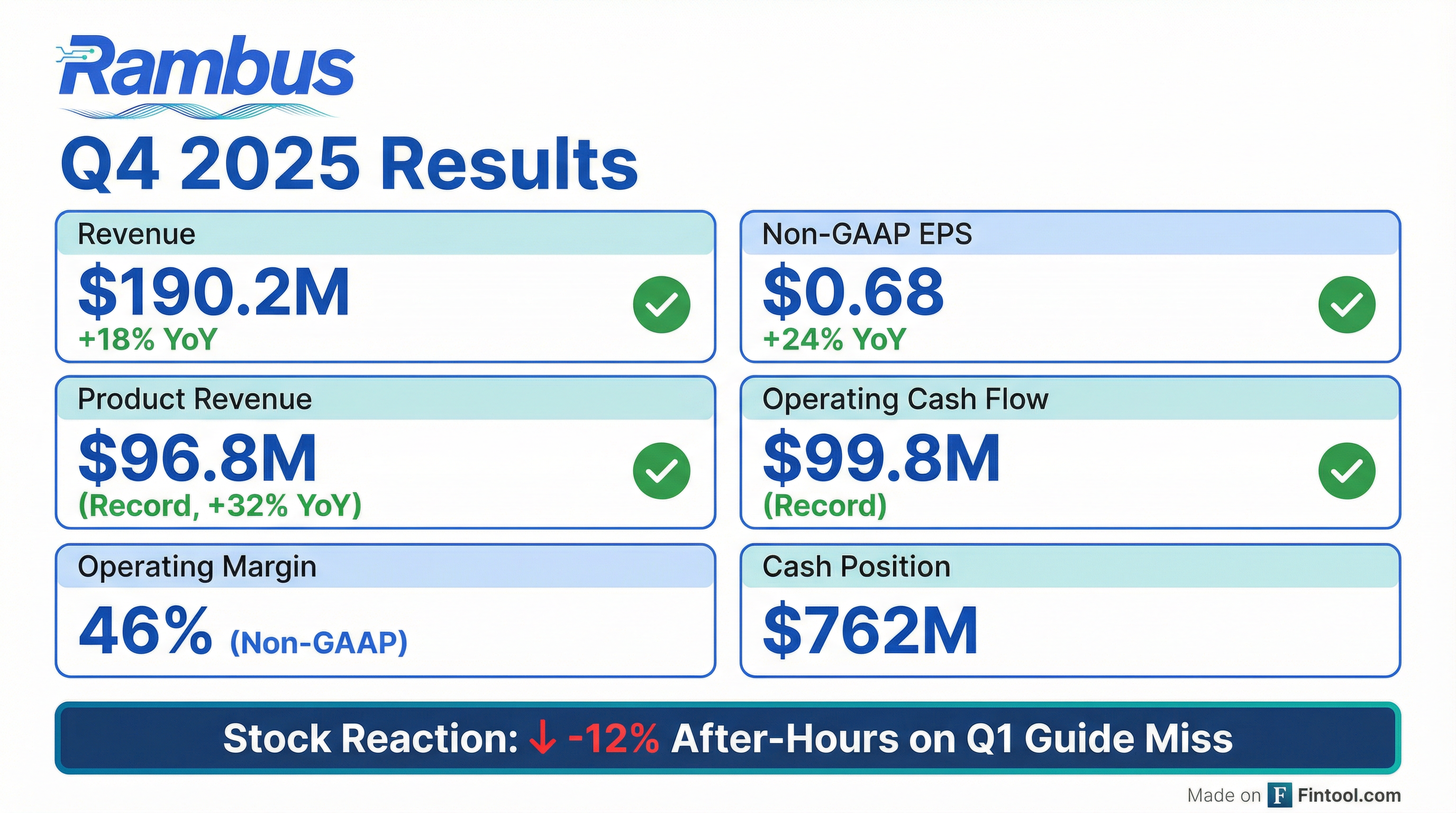

- Rambus achieved record revenue and earnings for the full year 2025, with product revenue reaching $348 million, a 41% year-over-year increase.

- The company reported strong Q4 2025 results, including $190.2 million in revenue and $74.7 million in non-GAAP net income.

- Rambus generated a record $360 million in cash from operations in 2025, up 56% from 2024, and ended Q4 2025 with $761.8 million in cash, cash equivalents, and marketable securities.

- For Q1 2026, Rambus expects revenue between $172 million and $178 million and non-GAAP EPS between $0.56 and $0.64, noting a one-time supply chain issue impacting product revenue by a low double-digit $ million.

- Despite the Q1 issue, the company anticipates product business to return to strong growth in Q2 2026 and grow faster than the market for the full year 2026, driven by DDR5 market share gains (mid-40% in 2025) and increasing contributions from new products like PMICs.

- Rambus achieved record revenue and earnings results for fiscal year 2025, with total revenue reaching $707.6 million.

- The company reported record product revenue of $348 million for FY 2025, marking a 41% increase from 2024, and generated record quarterly and annual cash from operations of $360 million, up 56% year over year.

- For Q4 2025, GAAP Net Income was $63.8 million and Non-GAAP Net Income was $74.7 million.

- Rambus provided a Q1 2026 Non-GAAP outlook, projecting Product Revenue between $84 million and $90 million and Licensing Billings between $66 million and $72 million.

- Rambus reported record full-year 2025 revenue and earnings, with product revenue of $348 million, up 41% year-over-year, and generated a record $360 million in cash from operations.

- For Q4 2025, the company delivered revenue of $190.2 million and non-GAAP net income of $74.7 million.

- Q1 2026 revenue is projected to be between $172 million and $178 million, with non-GAAP EPS between $0.56 and $0.64. This guidance reflects a low double-digit million impact on product revenue due to a resolved one-time supply chain issue, with strong recovery anticipated in Q2 2026.

- The company maintained its leadership in DDR5, ending 2025 with mid-40% market share in DDR5 RCDs, and expects to grow faster than the market in 2026.

- Strategic focus remains on delivering solutions for AI hardware, with increasing design wins for HBM4, GDDR7, PCIe 7 digital IP, and security IP.

- Rambus achieved record full-year revenue and earnings in 2025, with product revenue growing 41% year-over-year to $348 million. The company also generated a record $360 million in cash from operations, a 56% increase from 2024.

- For Q4 2025, Rambus reported total revenue of $190.2 million and non-GAAP net income of $74.7 million. Product revenue for the quarter was $96.8 million.

- The company provided Q1 2026 revenue guidance of $172 million to $178 million and non-GAAP EPS guidance of $0.56 to $0.64. This Q1 product revenue is impacted by a one-time supply chain issue that is resolved, with strong growth expected to resume in Q2 2026. The Q1 revenue impact from this issue is estimated to be around low double-digit $ million.

- Rambus maintained leadership in DDR5 RCDs, with market share in the mid-40s for 2025. The company expects to grow faster than the market in 2026 and anticipates gross margins to remain in the 61%-63% range for the year.

- Rambus reported record financial results for fiscal year 2025, with total revenue of $707.6 million and product revenue of $347.8 million, representing a 41% increase from 2024. The company also achieved record annual cash from operations of $360.0 million.

- For the fourth quarter ended December 31, 2025, GAAP revenue was $190.2 million and GAAP diluted net income per share was $0.58.

- For the first quarter of 2026, Rambus anticipates licensing billings between $66 million and $72 million and product revenue between $84 million and $90 million.

- Rambus operates three main businesses: patent licensing (generating $210 million annually with a 100% margin), Silicon IP (which was $120 million last year and is growing 10%-15% annually with a 95% gross margin), and a fabless IC business (expected to reach $340 million this year, growing 40% over last year with a 61%-63% gross margin).

- The company anticipates significant market expansion in memory interface chips, with the total addressable market (TAM) growing from an $800 million base to $1.4 billion with DDR5 companion chips, and further expansion from high-end client systems and MRDIMM technology.

- MRDIMM technology is projected to multiply Rambus's content by a factor of four per module and is expected to ramp with new Intel and AMD platforms by the end of 2026 or beginning of 2027.

- Rambus maintains a strong financial model, generating $300 million in cash from operations over the last 12 months, with an expected operating margin of 40%-45%, and aims to return 40%-50% of free cash flow to investors.

- The Silicon IP business is strategically focused on security (comprising half of the business) and high-speed interfaces, with minimal exposure to China, representing less than 5% of revenue.

- Rambus's business is comprised of three segments: Patent Licensing ($210 million annual revenue, 100% gross margin), Silicon IP ($120 million last year, 95% gross margin, growing 10-15% annually), and ICs (projected $340 million this year, 61-63% gross margin, growing 40% over last year).

- The company sees significant growth in its IC business, fueled by data center demand and the transition to DDR5 memory, expanding the total addressable market (TAM) for interface and companion chips to $1.4 billion.

- Future growth is anticipated from MRDIMM solutions, which are expected to multiply Rambus's content per module by four and add an additional $600 million to the TAM, with platform ramps projected for late 2026 or early 2027.

- Rambus maintains a strong financial model, generating $300 million in cash from operations over the last 12 months, targeting a 40-45% operating margin, and committing to return 40-50% of free cash flow to investors.

- Rambus's business is comprised of three segments: Patent Licensing generating $210 million annually with a 100% gross margin, Silicon IP which was $120 million last year and is growing 10%-15% annually with a 95% gross margin, and a product business (ICs) projected to be about $340 million this year, growing 40% over last year with a 61%-63% gross margin.

- The company identifies significant market expansion opportunities, including the DDR5 transition adding $600 million in companion chips to the base $800 million interface chip market, and the upcoming MRDIMM technology which could add another $600 million to the total addressable market and is expected to ramp by late 2026/early 2027.

- AI is a catalyst for high-end traditional servers and AI inference is a growth driver for Rambus, as its interface technology is agnostic to processor types. The Silicon IP business is strategically focused on security and high-speed interfaces, with security representing half of that business.

- Rambus's financial model is characterized by strong cash generation, with $300 million in cash from operations over the last 12 months and an expected operating margin of 40%-45%. Capital allocation priorities include organic growth, strategic acquisitions, and returning 40%-50% of free cash flow to investors.

- Rambus's business segments include Patent Licensing ($210 million/year), Silicon IP ($120 million last year, growing 10-15% annually), and a Product Business (data center focused) which was $240 million last year and is projected to grow 40% year-over-year based on Q4 guidance.

- The total addressable market (TAM) for Rambus's chipset solutions is approximately $2 billion, encompassing RCD chips, companion chips (including PMIC), mRDIMM, and client solutions.

- Rambus expects its PMIC (Power Management IC) revenue contribution to product revenue to reach high single digits in Q4 as a percentage of product revenue, with continued growth anticipated through 2026.

- A significant future growth driver is mRDIMM technology, which is JEDEC compliant and expected to ramp in 2026-2027, offering a 4x content increase per module and a target market share of 40-50%.

- The company targets 40-45% operating income and maintains strong gross margins across its segments (100% for patents, ~95% for Silicon IP, and 60-65% long-term for chips), with a capital allocation strategy that includes share buybacks, representing 44% of free cash flow since 2021.

- Rambus operates three business segments: patent licensing ($210 million annually), silicon IP ($120 million last year, growing 10-15% annually), and a product business focused on data centers ($240 million last year, poised for 40% year-over-year growth based on Q4 guidance midpoint).

- The company holds a 40% market share in DDR5 RCD chips, up from 25% in DDR4, with a current Total Addressable Market (TAM) of approximately $800 million.

- New opportunities from companion chips (PMIC, other companion chips) and mRDIMM technology are expected to add an additional $1.2 billion to the TAM, bringing the total market opportunity to about $2 billion.

- Rambus is ramping its PMIC revenue contribution, expecting it to reach high single-digit as a percentage of product revenue in Q4, with continued growth anticipated over 2026.

- The company targets 40-50% market share for mRDIMMs, which are projected to multiply dollar content by 4x per module and are expected to ramp with next-generation Intel and AMD platforms in 2026-2027.

Quarterly earnings call transcripts for RAMBUS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more