Earnings summaries and quarterly performance for RESMED.

Executive leadership at RESMED.

Board of directors at RESMED.

Carol Burt

Director

Christopher DelOrefice

Director

Desney Tan

Director

Harjit Gill

Director

Jan De Witte

Director

John Hernandez

Director

Karen Drexler

Director

Nicole Mowad-Nassar

Director

Peter Farrell

Chairman Emeritus and Director

Richard Sulpizio

Director

Ronald Taylor

Lead Independent Director

Research analysts who have asked questions during RESMED earnings calls.

Anthony Petrone

Mizuho Group

7 questions for RMD

Dan Hurren

MST Marquee

7 questions for RMD

Brett Fishbin

KeyBanc Capital Markets

5 questions for RMD

David Bailey

Morgan Stanley

5 questions for RMD

Lyanne Harrison

Bank of America

5 questions for RMD

Craig Wong-Pan

RBC Capital Markets

4 questions for RMD

Davinthra Thillainathan

Goldman Sachs

4 questions for RMD

Laura Sutcliffe

UBS

4 questions for RMD

Matt Taylor

Jefferies & Company Inc.

4 questions for RMD

Saul Hadassin

Barrenjoey Capital Partners

4 questions for RMD

David Low

JPMorgan Chase & Co.

3 questions for RMD

Brandon Vazquez

William Blair & Company, L.L.C.

2 questions for RMD

Jon Block

Stifel, Nicolaus & Company, Incorporated

2 questions for RMD

Michael Matson

Needham & Company

2 questions for RMD

Andrew Paine

CLSA

1 question for RMD

Margaret Kaczor Andrew

William Blair

1 question for RMD

Mathieu Chevrier

Citigroup Inc.

1 question for RMD

Matthew Taylor

Jefferies

1 question for RMD

Nathan Trebek

Wells Fargo

1 question for RMD

Nathan Treybeck

Wells Fargo Securities

1 question for RMD

Steven Wheen

Jarden

1 question for RMD

Suraj Kalia

Oppenheimer & Co. Inc.

1 question for RMD

Recent press releases and 8-K filings for RMD.

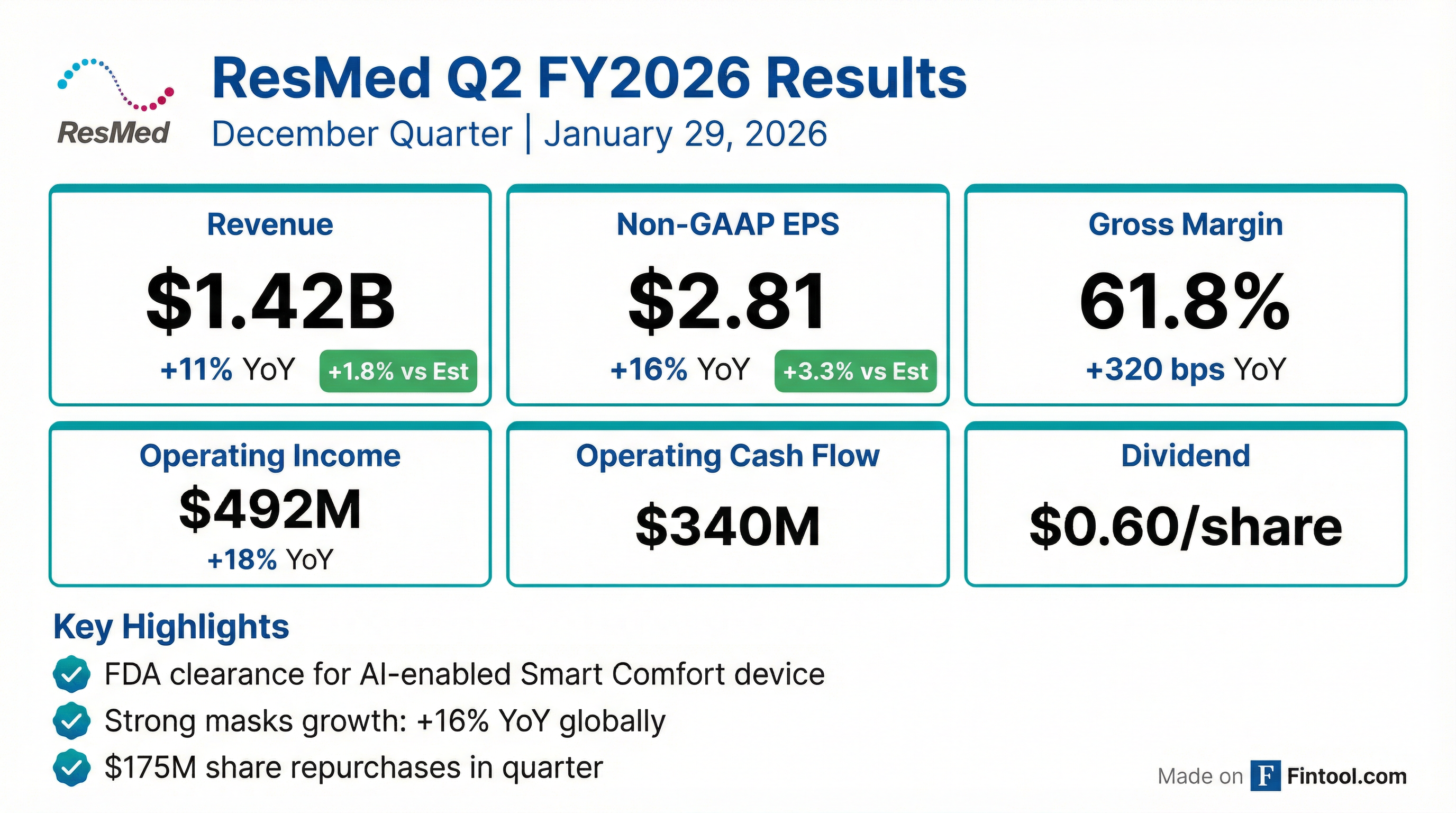

- Group revenue rose to $1.42 billion, an 11% headline increase (9% constant currency); device sales +7% and masks/accessories +14% globally; U.S., Canada & Latin America revenue +11% (6% cc).

- Gross margin expanded 110 bps year-over-year and 30 bps sequentially; operating margin improved to 36.3% of revenue.

- GAAP net income increased 15%, and GAAP EPS grew 16% year-over-year, driven by operational leverage and favorable FX movements.

- Operating cash flow was $340 million; declared a $0.60/share quarterly dividend; repurchased 704k shares for $175 million, with >$600 million in FY 2026 buybacks planned.

- FY 2026 outlook: 62–63% gross margin, 19–20% SG&A as a percentage of revenue, 6–7% R&D as a percentage of revenue (all subject to currency).

- ResMed delivered Q2 FY2026 revenue of $1.42 billion, up 11% headline (9% constant currency), led by 7% growth in devices and 14% growth in masks & accessories across all regions.

- Gross margin expanded 110 bp year-over-year (30 bp sequentially), operating profit rose 19%, lifting operating margin to 36.3%, and diluted EPS increased 16% year-over-year.

- Generated $340 million in operating cash flow, ended the quarter with $1.4 billion in cash and $753 million net cash, and declared a $0.60 per share quarterly dividend.

- Returned $263 million to shareholders in Q2 via dividends and $175 million in share repurchases, and boosted the fiscal 2026 buyback program to over $600 million.

- Revenue for Q2 FY2026 was $1.42 billion, up 11% headline and 9% constant currency.

- Gross margin expanded by 110 bps year-over-year to 62.3%, operating margin rose to 36.3%, and operating profit grew 19%.

- GAAP EPS grew 16%, supported by 310 bps of gross margin expansion from supply chain efficiencies.

- Launched the F30i Comfort and F30i Clear fabric masks and rolled out the AI-enabled Comfort Match feature; the VirtuOx acquisition bolstered home sleep testing capabilities.

- Returned $263 million to shareholders via dividends and $175 million in share repurchases; FY2026 buyback authorization increased to $600 million.

- Revenue of $1.423 B in Q2 FY2026, up 11% YoY (9% constant currency); diluted EPS of $2.68 (non-GAAP $2.81, +16%)

- Gross margin expanded by 320 bps to 61.8% (non-GAAP 62.3%, +310 bps) driven by manufacturing and logistics efficiencies

- Operating cash flow of $340 M; repurchased 704,000 shares for $175 M and declared a quarterly dividend of $0.60 per share

- ResMed delivered Q2 FY26 revenue of $1.423 billion, up 11% year-over-year (9% constant currency).

- GAAP gross margin rose 320 bps to 61.8%; non-GAAP gross margin improved 310 bps to 62.3%.

- Diluted EPS was $2.68 (non-GAAP $2.81), increases of 15% and 16%, respectively, year-over-year.

- Operating cash flow totaled $340 million; the company paid $88 million in dividends and repurchased 704,000 shares for $175 million during the quarter.

- The board declared a quarterly cash dividend of $0.60 per share, payable March 19, 2026 (record date February 12, 2026).

- Reported $5.3 billion in trailing-12-month revenues with 33% non-GAAP net operating margin and $1.8 billion in cash flow; plans >$600 million in FY26 share repurchases and raised dividends 13% to $2.40 per share.

- Cited key growth drivers: Big Tech wearables adding sleep apnea detection and GLP-1 drug referrals driving new patient flow via primary care partnerships.

- Launched the AirTouch N30i/F30i fabric masks, introduced the first FDA-cleared AI-enabled comfort management for CPAP, and rolled out “Dawn” digital sleep health concierge to improve therapy adherence.

- Expanded its care ecosystem through tuck-in acquisitions (Virtuox, Ectosense, Somnoware, Brightree) to scale home sleep testing and practice-management software; supports 405 API calls/sec and 11 million myAir users.

- ResMed reported $5.3 billion trailing-12-month revenue with net operating margins of 33% (non-GAAP) and 35% (GAAP).

- Launched fabric-integrated AirTouch N30i and F30i masks, alongside its first FDA-cleared AI-enabled CPAP comfort-coaching device.

- Expanded its digital ecosystem via acquisitions of VirtuOx, Ectosense, Somnoware, and Brightree; myAir app users reached 11 million, generating 405 API calls per second.

- Real-world data on 1.95 million patients show GLP-1 therapy users have a 6.2 percentage-point higher CPAP resupply rate at three years, underscoring drug-device synergy.

- Doubled US manufacturing capacity with a 467,000 sq ft Atlanta facility and a new Indianapolis site to deliver Made-in-America sleep-therapy devices.

- ResMed reported TTM revenue of $5.3 B with non-GAAP/GAAP net margins of 35%/33%, and software now accounts for 12% of its business.

- Launched new fabric-coated AirTouch N30i/F30i masks and its first FDA-cleared AI-enabled device for automated comfort settings, plus the Dawn digital sleep health concierge.

- Expanded its sleep therapy ecosystem via recent acquisitions of VirtuOx (home sleep apnea testing), Ectosense (NightOwl), Somnoware, and Brightree.

- Real-world data on 1.95 M GLP-1 patients shows +310 bps supply resupply at 1 year and +620 bps at 3 years versus control, indicating higher CPAP adherence.

- Announced U.S. manufacturing expansion with a 467k sq ft facility in Atlanta and new operations in Indianapolis to offer Made-in-America CPAP and masks, and noted CPAP is excluded from the new CMS competitive bidding round.

- At the FY2025 Annual General Meeting, shareholders representing 78.39% of shares re-elected all 11 directors, ratified KPMG as auditor, and approved executive compensation and plan amendments.

- CEO Mick Farrell reiterated ResMed’s 2030 strategy to improve 500 million lives by 2030 and highlighted new AI products: Dawn on the Maya app (10.8 million users) and the Compliance Predictor on AirView.

- FY2025 results showed 12% trailing-12-month revenue growth and 14% non-GAAP EPS growth, generating $1.7 billion in operating cash flow.

- Capital was allocated with 6–7% of revenues invested in R&D, 19% in SG&A, increased dividends, $150 million quarterly share repurchases, and M&A deals (Ectosense NightOwl and VirtuOx virtual HST).

- All five proposals passed at the FY 2025 annual general meeting, including the election of 11 directors and ratification of KPMG as auditor, plus advisory approval of executive compensation and plan amendments without any dissenting questions.

- CEO Mick Farrell reaffirmed ResMed’s 2030 strategy targeting high single-digit annual revenue growth, double-digit EPS expansion, and a goal to improve 500 million lives by 2030.

- New AI-driven offerings launched: Dawn, a generative AI sleep concierge on the Maya app (10.8 million users), and the Compliance Predictor on AirView to optimize patient adherence.

- FY 2025 performance delivered 12% revenue growth, 14% non-GAAP EPS growth, and $1.7 billion of operating cash flow, with gross margin up ~200 bps year-over-year.

- Capital deployment included 6–7% of revenue in R&D, SG&A at 19% of sales, quarterly share buybacks increased from $100 million to $150 million, and M&A acquisitions of Ectosense’s NightOwl and virtual testing platform VirtuOx.

Quarterly earnings call transcripts for RESMED.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more