Earnings summaries and quarterly performance for RMR GROUP.

Executive leadership at RMR GROUP.

Adam Portnoy

President and Chief Executive Officer

Christopher Bilotto

Executive Vice President

Jennifer Clark

Executive Vice President, General Counsel and Secretary

John Murray

Executive Vice President

Matthew Brown

Executive Vice President, Chief Financial Officer and Treasurer

Matthew Jordan

Chief Operating Officer and Executive Vice President

Board of directors at RMR GROUP.

Research analysts who have asked questions during RMR GROUP earnings calls.

John Massocca

B. Riley Financial

5 questions for RMR

Mitch Germain

Citizens JMP

5 questions for RMR

Ronald Kamdem

Morgan Stanley

2 questions for RMR

Tyler Batory

Oppenheimer & Co. Inc.

2 questions for RMR

Bryan Maher

B. Riley Securities

1 question for RMR

Recent press releases and 8-K filings for RMR.

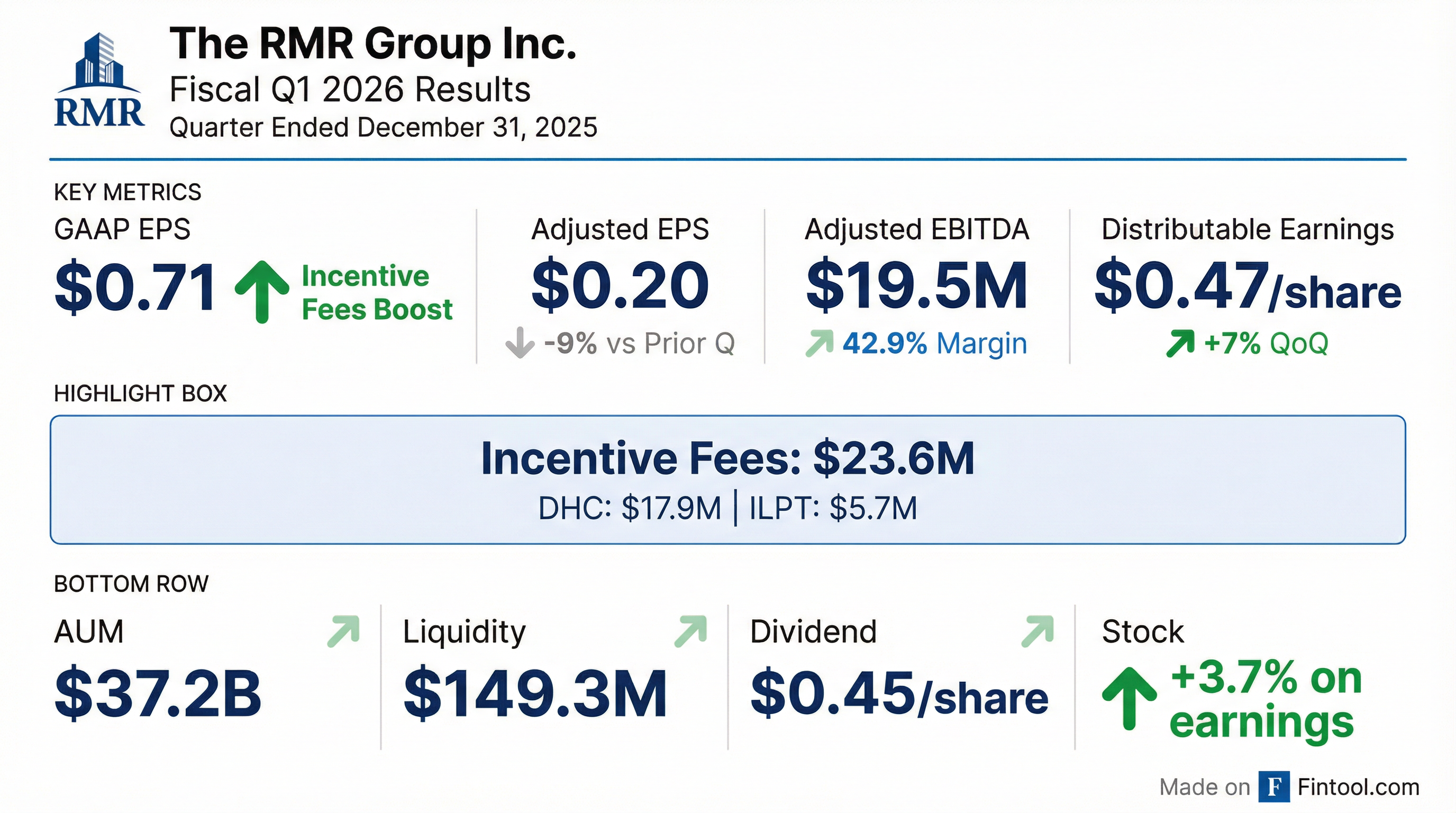

- The RMR Group reported Q1 2026 Distributable Earnings of $0.47 per share, Adjusted Net Income of $0.20 per share, and Adjusted EBITDA of $19.5 million.

- The company received $23.6 million in incentive fees for calendar year 2025, including $17.9 million from DHC and $5.7 million from ILPT, which were paid in January.

- For Q2 2026, RMR expects Adjusted EBITDA between $17 million and $19 million, Distributable Earnings of 41 to 43 cents per share, and Adjusted Net Income of 12 to 14 cents per share.

- RMR is actively focused on private capital fundraising, particularly for a multifamily fund, with a goal to raise approximately $250 million for its enhanced growth venture and to offload existing residential assets from its balance sheet.

- RMR reported Q1 2026 Distributable Earnings of $0.47 per share, Adjusted Net Income of $0.20 per share, and Adjusted EBITDA of $19.5 million, all exceeding or meeting the high end of expectations.

- The company received $23.6 million in incentive fees for calendar year 2025, primarily from DHC and ILPT, which contributed to its liquidity.

- Client companies DHC and SVC continued significant deleveraging efforts in 2025 and Q1 2026 through asset sales and debt repayments, while ILPT refinanced over $1.2 billion of debt in 2025.

- RMR is actively expanding its private capital initiatives, including hiring for international capital formation and focusing on launching a multifamily fund, with a goal to raise approximately $250 million for an enhanced growth venture.

- For Q2 2026, RMR anticipates Adjusted EBITDA of $17 million-$19 million, Distributable Earnings between $0.41 and $0.43 per share, and Adjusted Net Income between $0.12 and $0.14 per share.

- RMR Group's Q1 2026 financial results exceeded or were at the high end of expectations, reporting Distributable Earnings of $0.47 per share, Adjusted Net Income of $0.20 per share, and Adjusted EBITDA of $19.5 million.

- The company received $23.6 million in incentive fees for calendar year 2025, primarily from DHC and ILPT, which were paid in January and enhanced liquidity.

- RMR is focused on private capital growth, with a primary goal of launching a multifamily fund in fiscal year 2026 and expanding its credit strategy through the Seven Hills mortgage REIT, where RMR increased its ownership to 20.3%.

- For Q2 2026, RMR expects Adjusted EBITDA between $17 million and $19 million, Distributable Earnings between $0.41 and $0.43 per share, and Adjusted Net Income between $0.12 and $0.14 per share.

- RMR ended Q1 2026 with nearly $150 million in total liquidity, including $50 million in cash.

- RMR Group Inc. announced its fiscal first quarter 2026 results for the period ended December 31, 2025, reporting net income attributable to The RMR Group Inc. per common share of $0.71, Adjusted Net Income per share of $0.20, Adjusted EBITDA of $19.5 million, and Distributable Earnings per share of $0.47.

- A quarterly dividend of $0.45 per share on its Class A and Class B-1 Common Stock was declared, payable on or about February 19, 2026, to shareholders of record as of January 26, 2026.

- As of December 31, 2025, Assets Under Management (AUM) totaled $37.2 billion.

- The company sold its loan portfolio for $61.7 million and invested approximately $24.8 million in Seven Hills Realty Trust's (SEVN) common shares rights offering, increasing its equity interest in SEVN to 20.3%.

- RMR earned $23.6 million in aggregate incentive fees for calendar year 2025, which were paid in January 2026.

- RMR reported Q4 2025 distributable earnings of $0.44 per share, adjusted net income of $0.22 per share, and adjusted EBITDA of $20.5 million, which were in line with expectations.

- For Q1 2026, the company expects adjusted EBITDA between $18-$20 million, distributable earnings between $0.42-$0.44 per share, and adjusted net income between $0.16-$0.18 per share, primarily due to the sale of a Lyris Life's business.

- RMR's managed equity REITs completed nearly $2 billion of accretive debt financings and over $300 million in asset sales, with DHC's consolidated shop NOI increasing 8% year over year to $29.6 million.

- OPI initiated a Chapter 11 bankruptcy process, and RMR agreed to continue managing it for a five-year term post-bankruptcy, receiving a fixed business management fee of $14 million per year for the first two years.

- The company launched fundraising for the Enhanced Growth venture, targeting approximately $250 million for multifamily real estate, supported by $100 million in RMR seed investments.

- For the fiscal quarter ended September 30, 2025, RMR Group Inc. reported net income per share of $0.20, Adjusted Net Income per share of $0.22, and Distributable Earnings per share of $0.44.

- The company declared a quarterly dividend of $0.45 per share on its Class A Common Stock and Class B-1 Common Stock.

- As of September 30, 2025, RMR's Assets Under Management (AUM) totaled $39.0 billion.

- During the quarter, RMR acquired two garden-style apartment communities for $143.4 million to further seed its Enhanced Growth Venture portfolio.

- Total liquidity as of September 30, 2025, was $162.3 million, including $62.3 million in cash on hand.

- RMR Group Inc.'s majority-owned subsidiary, RMR LLC, entered into a Restructuring Support Agreement (RSA) with Office Properties Income Trust (OPI) on October 30, 2025, following OPI's commencement of voluntary Chapter 11 bankruptcy cases.

- Pursuant to the RSA, RMR LLC agreed to new business management and property management agreements with OPI, which will have an initial term of five years and are expected to take effect upon OPI's plan of reorganization.

- Under the new business management agreement, RMR LLC will be paid an annual fee of $14.0 million for the first two years.

- The new property management agreement will include a 3% property management fee and a 5% construction supervision fee, consistent with the existing property management agreement.

- The restructuring is anticipated to reduce OPI's total debt from approximately $2.4 billion to $1.3 billion upon emergence from bankruptcy.

Quarterly earnings call transcripts for RMR GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more