Earnings summaries and quarterly performance for RIVERVIEW BANCORP.

Executive leadership at RIVERVIEW BANCORP.

Board of directors at RIVERVIEW BANCORP.

Research analysts covering RIVERVIEW BANCORP.

Recent press releases and 8-K filings for RVSB.

Riverview Bancorp Reports Q3 2026 Financial Results

RVSB

Earnings

Dividends

Share Buyback

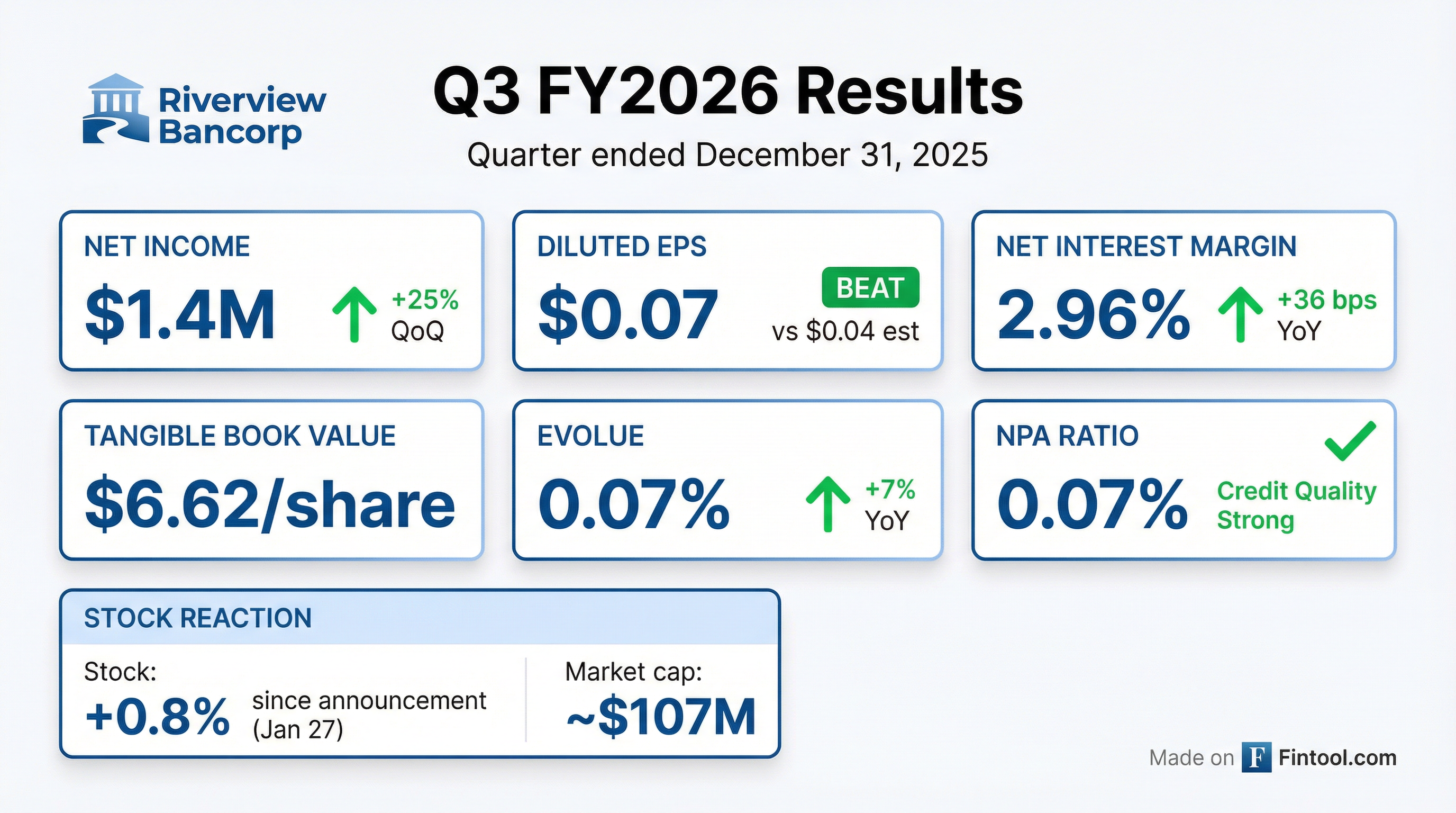

- Riverview Bancorp, Inc. reported net income of $1.4 million and diluted earnings per common share of $0.07 for the third fiscal quarter ended December 31, 2025.

- Net interest income increased to $10.5 million with a net interest margin of 2.96% in Q3 2026, compared to $9.4 million and 2.60% respectively in Q3 2025.

- Total loans increased by $15.1 million to $1.07 billion at December 31, 2025, while total deposits decreased by $2.9 million to $1.23 billion during the quarter.

- The company maintained strong credit quality with non-performing assets at 0.07% of total assets in Q3 2026.

- A cash dividend of $0.02 per share was paid on January 16, 2026, and a $2.0 million stock repurchase plan was completed on November 17, 2025.

Jan 29, 2026, 5:07 PM

Riverview Bancorp Announces Stock Repurchase Program

RVSB

Share Buyback

- Riverview Bancorp, Inc. announced a stock repurchase program on January 28, 2026, which was adopted by its Board of Directors on January 22, 2026.

- Under this program, the company may repurchase up to $4.0 million of its outstanding common stock.

- The repurchase program will continue until the earlier of its completion or 12 months after the effective date.

- The company's President and CEO, Nicole Sherman, stated that the program aims to enhance shareholder value and represents a disciplined approach to deploying excess capital.

- A Rule 10b5-1 trading plan has been authorized with Keefe, Bruyette & Woods, Inc. to facilitate these repurchases.

Jan 28, 2026, 9:22 PM

Riverview Bancorp Announces $4.0 Million Stock Repurchase Program

RVSB

Share Buyback

- Riverview Bancorp, Inc. announced on January 28, 2026, that its Board of Directors adopted a stock repurchase program on January 22, 2026.

- Under this program, the company may repurchase up to $4.0 million of its outstanding common stock.

- Repurchases can occur in the open market or through privately negotiated transactions.

- The program will continue until the earlier of its completion or 12 months after the effective date, depending on market conditions.

- The company's President and CEO, Nicole Sherman, stated that the program reflects a disciplined approach to deploying excess capital and aims to enhance shareholder value.

Jan 28, 2026, 9:00 PM

Riverview Bancorp Reports Fiscal Q3 2026 Earnings

RVSB

Earnings

Dividends

Share Buyback

- Riverview Bancorp reported net income of $1.4 million and diluted earnings per common share of $0.07 for the fiscal third quarter ended December 31, 2025. This is an increase from $1.1 million, or $0.05 per diluted share, in the preceding quarter.

- Net interest income for the quarter was $10.5 million, with a net interest margin of 2.96%. This compares to $9.4 million and 2.60% respectively in Fiscal Q3 2025.

- Tangible book value per share increased to $6.62 at December 31, 2025, up from $6.51 at September 30, 2025, and $6.20 at December 31, 2024.

- Credit quality metrics showed non-performing assets at 0.07% of total assets and 0.03% of total loans in Fiscal Q3 2026, with a $100,000 provision for credit losses and net charge-offs of $246,000 for the quarter.

Jan 27, 2026, 9:00 PM

Riverview Bancorp Reports Second Fiscal Quarter 2026 Financial Results

RVSB

Earnings

Dividends

Share Buyback

- Riverview Bancorp reported net income of $1.1 million and diluted earnings per common share of $0.05 for the second fiscal quarter ended September 30, 2025.

- Net interest income increased to $9.8 million in Q2 2026 compared to $8.9 million in Q2 2025, with the net interest margin expanding to 2.76% from 2.46% year-over-year.

- Non-interest expense increased to $12.2 million in Q2 2026 from $10.7 million in Q2 2025, resulting in an efficiency ratio of 89.8%.

- The company maintained strong credit quality with non-performing assets at 0.05% of total assets and reported a tangible book value per share of $6.51 at September 30, 2025.

- A cash dividend of $0.02 per share was paid on October 20, 2025, and the company continued its $2.0 million stock repurchase plan, having purchased $857,000 as of September 30, 2025.

Nov 3, 2025, 5:36 PM

Riverview Bancorp Reports Strong FY 2025 Performance and Key Updates

RVSB

Earnings

Proxy Vote Outcomes

Management Change

- Riverview Bancorp reported net income of $4,900,000 for fiscal year 2025, an increase from $3,800,000 in the previous year, with a loan portfolio exceeding $1,000,000,000 and deposits at $1,210,000,000 as of June 2025.

- The company maintains strong capital levels, with a total risk-based capital ratio of 16.56% and a leverage ratio of 11.16%, and nearly $800,000,000 in available liquidity as of June 30, 2025.

- Graham Clancy joined as Senior Vice President, Director of Finance, and Fung Lee was promoted to Senior Vice President, Controller. Additionally, Patricia W. Eby, Gerald Ilnis, and Valerie Moreno were elected as directors for three-year terms.

- Riverview Bancorp was added to the Russell 3000 Index and Russell 2000 Index on June 30, 2025.

Aug 28, 2025, 10:42 PM

Quarterly earnings call transcripts for RIVERVIEW BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more